McGraw-Hill/Irwin

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

Chapter 6

Defining the Organization's

Strategic Direction

6-2

Genzyme’s Focus on

“Orphan Drugs”

• Genzyme was founded in 1981 by scientists studying

genetically inherited enzyme diseases

• Adopted a very unusual strategy of developing drugs for rare

diseases rather than “blockbuster” drugs.

• Smaller markets, but fewer competitors

• Requires less advertising, smaller sales force

• In 1983, the FDA established the “Orphan Drug Act,” giving

seven years market exclusivity to developers of drugs for rare

(<200,000 patients) diseases.

• Also chose unusual strategy of doing its own manufacturing

and sales rather than licensing to a pharmaceutical company.

• Diversified into side businesses to fund its R&D.

• By 2012, the company (now a fully-owned subsidiary of

Sanofi) was one of the world’s leading biotech companies with

25 products sold in 90 countries.

6-3

Genzyme’s Focus on

“Orphan Drugs”

Discussion Questions:

1. How does Genzyme’s focus on orphan drugs affect the

degree of competition it faces? How does it affect the

bargaining power of customers?

2. How does focusing on orphan drugs affect the types of

resources and capabilities a biotech firm needs to be

successful?

3. Does Genzyme’s focus on orphan drugs make sense?

Do you think Genzyme has a long-term strategic intent?

4. Why do you think Genzyme has diversified into other

areas of medicine? What are the advantages and

disadvantages of this?

5. What recommendations would you offer Genzyme for

the future?

6-4

Overview

• A coherent technological innovation

strategy leverages the firm’s existing

competitive position and provides

direction for future development of the

firm.

• Formulating this strategy requires:

• Appraising the firm’s environment,

• Appraising the firm’s strengths, weaknesses,

competitive advantages, and core

competencies,

• Articulating an ambitious strategic intent.

6-5

Assessing the Firm’s Current

Position

• External Analysis

•

•

Two common methods are Porter’s Five-Force

Model and Stakeholder Analysis.

Porter’s Five-Force Model

1. Degree of existing rivalry. Determined by number of

firms, relative size, degree of differentiation between

firms, demand conditions, exit barriers.

2. Threat of potential entrants. Determined by

attractiveness of industry, height of entry barriers (e.g.,

start-up costs, brand loyalty, regulation, etc.)

3. Bargaining power of suppliers. Determined by

number of suppliers and their degree of differentiation,

the portion of a firm’s inputs obtained from a particular

supplier, the portion of a supplier’s sales sold to a

particular firm, switching costs, and potential for

vertical integration.

6-6

Assessing the Firm’s Current

Position

4.

5.

Bargaining power of buyers. Determined by number of

buyers, the firm’s degree of differentiation, the portion of

a firm’s inputs sold to a particular buyer, the portion of a

buyer’s purchases bought from a particular firm,

switching costs, and potential for vertical integration.

Threat of substitutes. Determined by number of

potential substitutes, their closeness in function and

relative price.

Recently Porter has acknowledged the role of complements.

Must consider:

a) how important complements are in the industry,

b) whether complements are differentially available

for the products of various rivals (impacting the

attractiveness of their goods), and

c) who captures the value offered by the

complements.

6-7

Assessing the Firm’s Current

Position

• Five-Force Model

6-8

Assessing the Firm’s Current

Position

Stakeholder Analysis

1. Who are the stakeholders.

2. What does each stakeholder want.

3. What resources do they contribute to

the organization.

4. What claims are they likely to make

on the organization.

6-9

Assessing the Firm’s Current

Position

• Internal Analysis

1. Identify the firm’s strengths and

weaknesses. Helpful to consider each

element of value chain.

6-10

Assessing the Firm’s Current

Position

2. Assess which strengths have potential to be

sustainable competitive advantage

•

•

•

•

Rare

Valuable

Durable

Inimitable

Competitive

Advantage

Sustainable

Competitive

Advantage

• Resources are difficult (or impossible) to

imitate when they are:

•

•

•

•

6-11

Tacit

Path dependent

Socially complex

Causally ambiguous

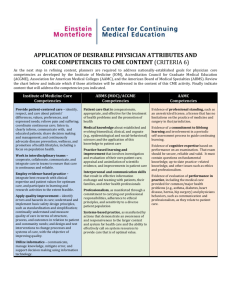

Identifying Core

Competencies and Capabilities

• Core Competencies: A set of integrated

and harmonized abilities that distinguish

the firm in the marketplace.

• Competencies typically combine multiple kinds of

abilities.

• Several core competencies may underlie a business

unit.

• Several business units may draw from same

competency.

• Core competencies should:

• Be a significant source of competitive differentiation

• Cover a range of businesses

• Be hard for competitors to imitate

6-12

Identifying Core

Competencies and Capabilities

6-13

Research Brief

Identifying the Firm’s Core Competencies

• Gallon, Stillman and Coates offer a step-by-step

program for identifying core competencies.

• Module 1 -- Assemble a steering committee, appoint a

program manager, and communicate the overall goals of the

project to all members of the firm.

• Module 2 -- Constructing an inventory of capabilities

categorized by type. Assess their strength, importance, and

criticality.

• Module 3 – Organize capabilities by both their criticality and

the current level of expertise within the firm for each.

• Module 4 – Distill competencies into possible candidates for

the firm to focus on. No options should be thrown out yet.

• Module 5 -- Testing the candidate core competencies against

Prahalad and Hamel's original criteria.

• Module 6 -- Evaluate the firm’s position in the core

competency.

6-14

Risk of Core Rigidities

• When firms excel at an activity, they can

become over committed to it and rigid.

• Incentives and culture may reward current

competencies while thwarting development

of new competencies.

• Dynamic capabilities are competencies that

enable the firm to quickly respond to change.

• E.g., firm may develop a set of abilities that enable

it to rapidly deploy new product development

teams for a new opportunity; firm may develop

competency in working with alliance partners to

gain needed resources quickly.

6-15

Strategic Intent

• Strategic Intent

• A long-term goal that is ambitious, builds upon and

stretches firm’s core competencies, and draws from all

levels of the organization.

• Typically looks 10-20 years ahead, establishes clear milestones

• Firm should identify resources and capabilities needed to close

gap between strategic intent and current position.

6-16

Theory In Action

The Balanced Scorecard

Kaplan and Norton argue

that effective performance

measurement should

incorporate:

• Financial perspective

• Customer perspective

• Internal perspective

• Innovation and learning

6-17

Discussion Questions

1.

2.

3.

4.

5.

6.

6-18

What is the difference between a strength, a competitive

advantage, and a sustainable competitive advantage?

What makes an ability (or set of abilities) a core competency?

Why is it necessary to perform an external and internal

analysis before the firm can identify its true core

competencies?

Pick a company you are familiar with. Can you identify some

of its core competencies?

How is the idea of “strategic intent” different from models of

strategy that emphasize achieving a fit between the firm’s

strategies and its current strengths, weaknesses, opportunities

and threats (SWOT)?

Can a strategic intent be too ambitious?