Internal Analysis

advertisement

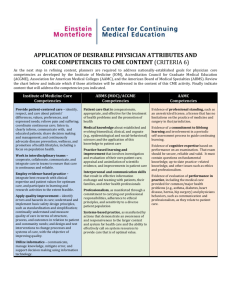

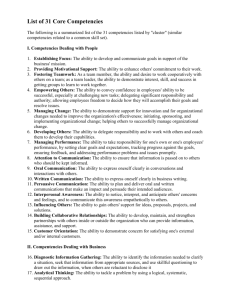

Internal Analysis 1 Internal Analysis • Strategic Managers must evaluate the Internal Environment of the organization. • What is the process? – Identify and classify variables within an organization as strengths or weaknesses. 2 • STRENGTH = factor that is better than: – past performance – key competitors – industry as a whole • WEAKNESS = factor that is worse than: – past performance – key competitors – industry as a whole 3 Approaches for scanning and analyzing Internal Variables • Functional Analysis • Value Chain Analysis • Core Competencies Analysis 4 Functional Analysis 5 Management 1. General Management 2. Human Resource Management 6 General Management Factors • • • • Structure of the organization Organizational Culture Record in Achieving Objectives Top management skills, capabilities, & interests. • Reputation of the Organization and Top Management • Social Responsibility record 7 Human Resource Management • • • • Number of employees Unionization Employee skills and morale Quality of Work/Life Issues – Recent downsizings • Recognition/promotion/reward systems • Training programs; educational reimbursement 8 Operations (Manufacturing or Service Firms) • Quality Initiatives – Quality certifications – Policies and procedures for quality • Six sigma quality = 3.4 manufacturing defects per million items • • • • Location of facilities Outsourcing Flexible manufacturing Raw material costs and availability 9 Operations - Continued (Manufacturing or Service) • Economies of scale – decreasing fixed costs/ unit when producing more • Economies of scope – common parts of different products manufactured together. • Re-engineering • Percentage of cost of goods sold to sales 10 Information Systems • • • • • Chief Information Officer Network Capabilities Hardware and software upgrades Y2K compliance & costs Internet page – quality; features 11 Research and Development • Expenditures – Over time – In relation to competitors/industry – Percentage of sales • Product to market time • Own labs/facilities or lease? 12 Finance • Currency risk management – Global impact • Financing decisions 13 Financial Ratios 1995 1996 1997 Industry Trend Type of ratio Avg Liquidity Current Quick Leverage Debt-tototal assets Debt-to14 equity Value Chain Analysis 15 Firm Infrastructure general management,accounting finance Support Human Resource Management Activities recruiting, training, development Technology Development R&D, product and process improvement Procurement purchasing raw materials; machines, supplies Inbound OperationsOutbound Marketing Service Logistics machining Logistics and Sales instalraw matl assembling wareadvertising lation, handling testing housing promotion repair, replacewarepackaging distripricing ment housing bution channel relations PRIMARY ACTIVITIES 16 Core Competencies 17 Core Competencies of the Corporation • Real sources of advantage - not based on businesses. – management’s ability to consolidate corporatewide technologies and production into competencies. • Core competencies are collective learning in the organization, especially: – how to coordinate diverse production skills by integrating multiple streams of technologies. 18 Three tests to identify core competencies • Provide potential access to a wide variety of markets. • Make a significant contribution to the perceived customer benefits of the end product. • Are difficult to imitate. 19 examples Core Competencies Products/businesses • Engines • Powertrains • Cars; motorcycles; lawn mowers; generators • Optics • Imaging • Microprocessor controls • Copiers; laser printers; cameras; image scanners; medical imaging 20 More kinds of core competencies: • • • • Systems Integration Virtual reality Bioengineering Delighting the customer 21 Purpose of Internal Analysis • Identify and evaluate what’s going on inside the firm. • The goal is to assess what are strengths and what are weaknesses. • Critical in making decisions about the future of the organization. 22