Limited Liability Partnership (LLP)

advertisement

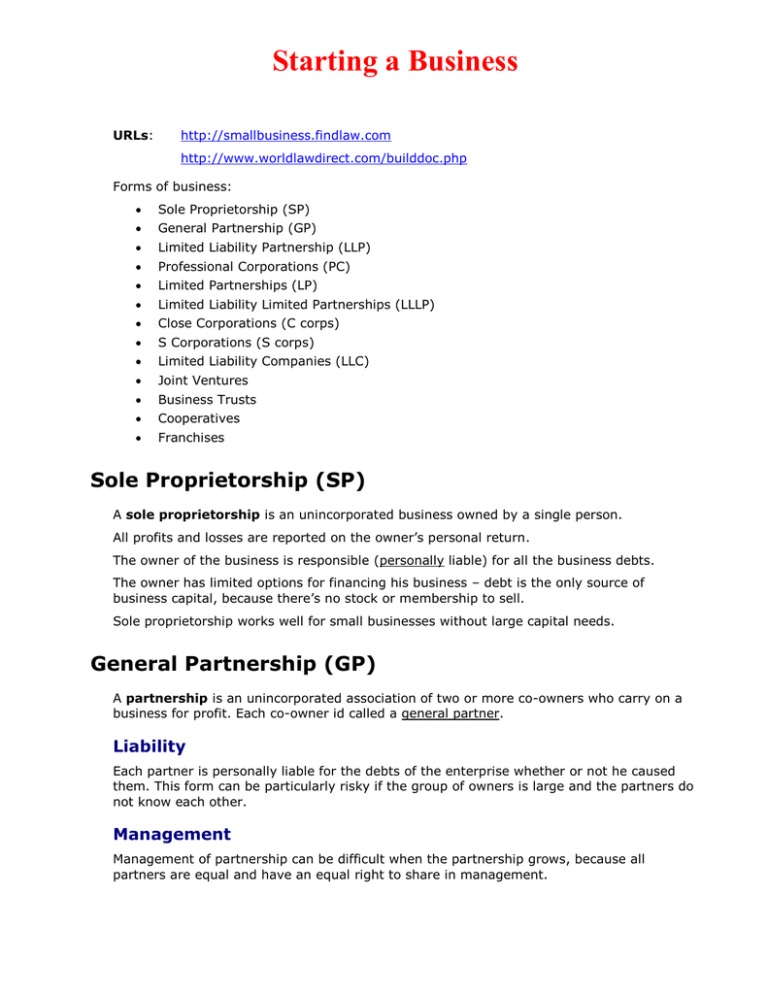

Starting a Business URLs: http://smallbusiness.findlaw.com http://www.worldlawdirect.com/builddoc.php Forms of business: Sole Proprietorship (SP) General Partnership (GP) Limited Liability Partnership (LLP) Professional Corporations (PC) Limited Partnerships (LP) Limited Liability Limited Partnerships (LLLP) Close Corporations (C corps) S Corporations (S corps) Limited Liability Companies (LLC) Joint Ventures Business Trusts Cooperatives Franchises Sole Proprietorship (SP) A sole proprietorship is an unincorporated business owned by a single person. All profits and losses are reported on the owner’s personal return. The owner of the business is responsible (personally liable) for all the business debts. The owner has limited options for financing his business – debt is the only source of business capital, because there’s no stock or membership to sell. Sole proprietorship works well for small businesses without large capital needs. General Partnership (GP) A partnership is an unincorporated association of two or more co-owners who carry on a business for profit. Each co-owner id called a general partner. Liability Each partner is personally liable for the debts of the enterprise whether or not he caused them. This form can be particularly risky if the group of owners is large and the partners do not know each other. Management Management of partnership can be difficult when the partnership grows, because all partners are equal and have an equal right to share in management. Transfer of Ownership Capital can be raised either by contributions from partners or by borrowing. Likewise, a partner can only transfer the value of his partnership interest, not the interest itself. For example, he cannot transfer the right to participate in the firm management. If a partner decides to leave the partnership, he’s entitled to the value of his share. But it is difficult to determine that value. The best thing is to initially negotiate the formula for calculating the values of partners’ shares. Dissociation When a partner leaves, the event is called dissociation. The partnership can choose between (a) buying out the departing partner or (b) terminating the partnership. Formation Partnerships are easy to form. A partnership should have a legal agreement, but is perfectly legal without one. Taxes A partnership is not a taxable entity. All income and losses are passed through to the partners and reported on their personal income tax returns. (Corporations, on the other hand are taxable entities and pay income tax on their profits. Shareholders pay tax on the dividends from the corporation.) Advantages Partnerships avoid the double taxation of the corporations and leave less money to the IRS. Unlike the owners of sole proprietorships, partners in a partnership can rely on their colleagues for help and capital supply. Partnerships have substantial laws and tradition behind them. Limited Liability Partnership (LLP) Limited Liability Partnership (LLP) is a form of general partnership where the partners are not personally liable for the debts of the partnership. Differences from general partnership: To form a LLP – file a statement of qualification with state officials. LLPs must file annual reports. Other attributes of a partnership remain the same: LLP are not taxable. LLP can choose its duration (terminate or continue existence after dissociation of a member). Risk: LLP law is still not well developed. It is not clear how much LLP protects the partners. Professional Corporations (PC) In many states PCs provide more liability protection than a partnership. Generally, members of PCs are not personally liable for a member’s malpractice, but the corporation is. Limitations All shareholders of the PC must be members of the same profession. Other valued employees can own stock. Expensive and time-consuming technicalities for forming and maintaining the PC (like other corporations). PCs pay taxes on their profits – the PC is a taxable entity, like the other corporations. Salaries, however, are deducted from the firm’s profits. Limited Partnerships (LP) and Limited Liability Limited Partnerships (LLLP) Structure Limited partnerships (LP) have two types of partners – limited partners and general partners. LP must have at least one of each. (General partnerships, in contrast, have only general partners.) Liability Limited partners in LP are not personally liable, only the general partners are. Limited partners are like corporation shareholders. They risk only their investment (called capital contribution) in the partnership. To avoid the liability of the general partners, most general partners are, in fact, corporations. Then, only the assets of the corporation are at risk, not the personal assets of the corporation owners. The revised version (not yet passed in any state) of the Uniform Liability Partnership Act permits a LP to declare itself a limited liability limited partnership (LLLP) in its certificate of formation. In a LLLP the general partner is not personally responsible for the debts of the partnership. This provision removes the major disadvantage of the LP. Taxes LPs, like GPs, are not taxable entities. Formation Unlike the GPs, LPs cannot be formed informally. The general partners must file a certificate of limited partnership with their Secretary of State. Management LPs are managed only by the general partners. Limited partners are passive investors and cannot manage the partnership. LP agreements can expand the rights of the limited partners. For example, an agreement can permit a substantial majority (i.e., two-thirds) of the limited partners to remove a general partner. Management of LPs is substantially easier compared to GPs because the limited partners are not allowed to manage. Transfer of Ownership As in the case of GP, limited partners have the right to transfer the value of their partnership interest. They can sell or give away the interest itself only if the partnership permits. Duration Unless stated otherwise in the partnership agreement, LP’s existence continues even as partners come and go. Corporations State laws regulate corporations, but federal statutes determine their tax status. In many states small corporations (called closed corporations) are treated differently than big corporations. Federal tax code also treats small corporations differently, more favorably, and calls them S corporations. The two sets of statuses are completely independent: C Corporation Regular Corporation IRS State S Corporation Close Corporation Corporations in General Advantages Corporations protect the managers and investors from personal liabilities for the debts of the corporation and the actions of others, but not against personal negligence. In contrast, the limited liability does not protect against all debts. Individuals are always responsible for their own acts. In addition to the limited liability, corporations offer another advantage – they are very flexible in transferring the ownership. While partnership interests are not transferable without the permission of the other partners, corporate stocks can be easily bought and sold. Disadvantages High expenses and efforts in forming and operating the corporations. Close Corporations Traditionally, close corporations (a.k.a. closely held corporations) were companies whose stocks were not publicly traded on a stock exchange. Nowadays, close corporations are privately held companies that have taken advantage of the close corporation provisions of their state code. Close corporation provisions vary from state to state, but they have common themes: Protection of Minority Shareholders – set of rules that prevent forming of alliances between shareholders to dominate other shareholders. Transfer Restrictions – shareholders can sell their shares only after first offering them to the other shareholders. Flexibility – close corporations can operate without a board of directors, a formal set of bylaws, or annual shareholder meetings. Dispute Resolution – shareholders can agree in advance on events that would dissolve the corporation. Even without such an agreement, a shareholder can ask the court to dissolve the corporation if the other shareholders behave “oppressively” or “unfairly”. The threat of such an action is a check. S Corporations (S corps) S corporations encourage the entrepreneurs by offering tax breaks. S corps - the best of both worlds: the limited liability of corporations and the tax status of partnerships. Limitations Only one class of stock (although voting rights can vary within the class) No more than 75 shareholders. Shareholders can be individuals, estates, charities, pension funds, or trusts. Shareholders cannot be partnerships or corporations. Shareholders must be citizens or permanent residents of the US. All shareholders must agree that the company should be an S corporation. Some states treat S corps as C corps. In these states the S corps have to pay state corporate tax. Limited Liability Companies (LLC) An LLC offers the limited liability of a corporation and the tax status of a partnership, without the disadvantages of an S corporation. Complex interactions between IRS regulations and state laws make LLCs not as simple as they should be. Formation Two documents needed: a charter (containing the name and address, and filed with the secretary of the state), and an operating agreement (setting the rights and obligations of the owners, called members). Check www.tannedfeet.com/simple_operating_agreement_for_llc.doc Limited Liability Risk is limited to the member’s investment. Flexibility Unlike S corps, LLCs can have members that are corporations, partnerships, and nonresident aliens. LLCs can have different classes of stocks. Unlike corporations, LLCs are not required to hold annual meetings or maintain minute book. Standard Forms Unlike with corporations, standard forms for LLCs are not available. This may be good, considering the state law variations. Transferability of Interests Like in a partnership, members must obtain the unanimous permission of the remaining members before transferring their ownership rights, unless specified otherwise in the operating agreement. Duration Before, the LLCs were dissolved upon the withdrawal of a member (e.g., death, resignation, bankruptcy). Current trend in state laws is to permit the LLC operation even after withdrawal of a member. Unless the operating agreement provides otherwise, the LLC pays the departing member the value of his interest. Going Public Once going public, the LLC loses its favorable tax status and is taxed as a corporation. There’s no real advantage of using LLC form for public corporations. And there are some disadvantages – unlike corporations, LLCs do not enjoy well-established set of statutory and case law that is consistent across states. Changing Forms Switching from corporation to LLC is considered by IRS to be a sale of the corporate assets and would levy a tax on the value of these assets. Switching from a partnership to LLC or from LLC to a corporation is not a sale and is not taxable. Joint Ventures A joint venture is a partnership for a limited purpose. The purpose must include making a profit. In a joint venture only contracts relating to the limited purpose are binding. Other Forms of Organizations Business Trusts A business trust is an unincorporated association run by trustees for the benefit of investors (who are called beneficiaries). Investors buy certificates in the trust, like the shareholders buy stocks in a corporation, but they have fewer rights than the shareholders. Investors do not elect trustees. Trustees can take any action without the approval of the investors. Trustees can issue unlimited number of shares. The beneficiaries are not liable for the debts of the trust. Theoretically, the trusties are liable for the trust debts, but the trust agreement usually protects the trustees. Trusts are considered as a business form by mutual funds and other investment management companies. Cooperatives Cooperatives are groups of individuals or businesses that join together to gain the advantage of volume purchases or sales. Franchises Franchises are not a separate form of organization. In US, 1 in 12 small businesses is a franchise. Franchises generate sales of more than $1 trillion per year. Franchises provide jobs for more than 8 million people. Well known franchises – Dunkin’ Donuts, McDonald’s, Midas Muffler. Buying a franchise is a compromise between starting an own business and working for someone else. Disadvantages Upfront fee Annual fee that is percentage of gross sales, not of profit. Contributions to co-op advertising Chapter Review Forms of Business Definition Separate Taxable Entity Personal Liability for Owners Ease of formation Transferable Interests (easily bought and sold) Perpetual Existence Sole Proprietorship (SP) An unincorporated business owned by a single person. No Yes Very Easy No, can only sell entire business No General Partnership (GP) An unincorporated association of two or more co-owners who carry on a business for profit. Each co-owner is called a general partner. No Yes Easy No Depends on the partnership agreement Management can be difficult. Supported by law and tradition. Limited Liability Partnership (LLP) A form of general partnership where the partners are not personally liable for the debts of the partnership. No No Difficult No Depends on the partnership agreement LLP law is still not well developed. It is not clear how much LLP protects the partners. Professional Corporation (PC) A special way for some professional organization to incorporate – PCs provide more liability protection than a partnership in many states Yes No – for PC debts or malpractice of others. Yes – for own malpractice. Difficult Shareholders must all be members of same profession Yes, as long as it has shareholders Complex tax issues. Limited Partnership (LP) Similar to GP, but with 2 types of partners – limited partners and general partners. No Yes – for general partner. No – for limited partners. Difficult Yes (for limited partners), if partnership agreement permits Yes Must have at least one partner of each type. Usually, the general partner is a corporation. Managed only by the general partners. Limited Liability Limited Partnership (LLLP) Like LP but the general partner is not personally liable for the debts of the partnership No No Difficult Yes (for limited partners), if partnership agreement permits Yes Must have at least one partner of each type. Managed only by the general partners. Yes No Difficult Yes Yes Yes No Difficult Transfer Restrictions Yes Corporation Close Corporation (C corp) Privately held corporation that have taken advantage of the close corporation provisions of their state code. Other Features Protection of minority shareholders. No board of directors required. Stalemates may develop. Forms of Business Definition Separate Taxable Entity Personal Liability for Owners Ease of formation Transferable Interests (easily bought and sold) Perpetual Existence Other Features S Corporation (S corp) S-corps – the best of both worlds: the limited liability of corporations and the tax status of partnerships. No No Difficult Transfer Restrictions Yes Only 75 shareholders. Only one class of stock. Shareholders must be individuals, estates, trusts, charities or pension funds and be citizens or residents of the US. All shareholders must agree to S status. Limited Liability Company (LLC) An LLC offers the limited liability of a corporation and the tax status of a partnership, without the disadvantages of an S corporation. No No Difficult Yes, if the operating agreement permits Yes, generally (varies by state) No limit on the number of shareholders, the number of classes of stock or the type of shareholder. Joint Venture (JV) Partnership for a limited purpose. No Yes Easy No No The purpose must include making a profit. Business Trust Unincorporated associations run by trustees for the benefit of investors (beneficiaries). Yes No Difficult Yes Yes Most commonly used by mutual funds and other investment companies. Cooperative Groups of individuals or businesses that join together to gain the advantages of volume purchases or sales. All these issues depend on the chosen form of organization. Franchise Not a separate form of organization. A franchise is a compromise between starting an own business and working for someone else. All these issues depend on the chosen form of organization. Established business. Name recognition. Management assistance. Loss of control. Upfront and annual fees may be high. Annual fee is percentage of revenue, not of profit. The Federal Trade Commission (FTC) requires that at least 10 business days prior to sale franchisors must give prospective franchisees an offering circular.