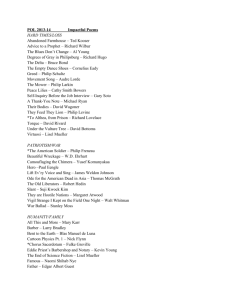

Examples of Fraud Investigations

advertisement

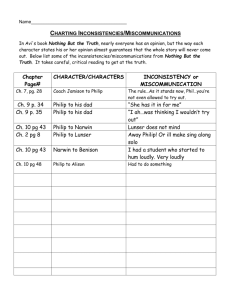

Financial Fraud Examples Georgia CTAE Resource Network Curriculum Office, February 2009 To accompany curriculum for the Georgia Peach State Career Pathways February 2009, Philip Ledford & Dr. Frank Flanders Enduring Understanding Financial fraud is the act of untruthfully taking financial assets that belong to another individual. There are many different types of financial fraud. The two most common types of fraud are making false statements on records and embezzlement. Fraud has been a battle in accounting for many years. Acts such as the Securities and Exchange Acts of 1933 and 1934 were passed to prevent and keep financial fraud at a minimum. Essential Questions Why is it important to be able to identify different types of financial fraud? How do you know if you have been a victim of financial fraud. What are some ways to avoid financial fraud. Objectives Know the types of fraud listed in the presentation. Be able to explain the types of fraud listed in the presentation. Illustrate your own story of a company committing a type of fraud listed in the presentation. Compare the fraud situations of Philip’s Peanut Company to real life events of financial fraud. Types of Financial Frauds Insider Trading – Trading of a corporations securities by individuals with access to non-public information pertaining the securities or the company. Money Laundering – Engaging in financial transactions to hide the identity, or source of illegally obtained money. Types of Financial Frauds (con’t) Embezzlement – The act of untruthfully, and secretly taking assets (usually financial) from whom ever said assets are entitled to. Making False Statements – When a company hides records of loss of money or other financial assets in order to keep the value of the company up. If a company records a larger gain of money than what was actually received is also considered making false statements. Types of Financial Frauds (con’t) Ponzi Scheme – A scheme used to entice investors with an extraordinary return rate on some sort of investment. The trick is to gather a large amount of investors and get them to reinvest their return, and investors that take the return are actually being paid from other investors money. All the while the individual running the scheme is keeping any investments not being returned. So in actuality no money is being invested and the only return to investors is money from other investors. Financial Fraud in Action • What is a CEO? A CEO is the head of a corporation. The CEO is in control of every aspect of the corporation, the budget, incoming and outgoing assets, as well as making sure all financial obligations are recorded and periodically updated with the Securities and Exchange Commission. Financial Fraud In Action (con’t) • Our Peanut Company. Imagine the CEO of a peanut company. We will call the peanut company Philip’s Peanut Company and the CEO is Philip. Philip over sees his company in everyway just like any CEO. Though, Philip has involved his peanut company in some fraudulent activities that are considered highly illegal in the United States. Let’s take a look at some of the activities that he has involved his peanut company in. Insider Trading • What is it? Insider Trading is trading of a corporations securities by individuals with access to non-public information pertaining the securities or the company. Insider Trading (con’t) • The Act Philip’s Peanut Company was doing very well. His company’s stock was worth $1400 a share. One day while Philip was inspecting his peanut supply he noticed salmonella organisms growing on his plants. Philip knew that the next time an inspector came to inspect his supply that the company would have to be temporarily shut down. That meant his companies value would decrease. Insider Trading (con’t) • The Act (con’t) Philip knew that his companies value would decrease as soon as the information became public. Before Philip’s company was required to release the information about the salmonella incident Philip sold all of his highly valuable securities. By doing this Philip had committed insider trading. Insider Trading •The Punishment The penalty for insider trading varies on the severity of the crime. The Department of Justice normally penalizes the offender with jail time and sever fines. As you already know due to the Securities and Exchange Act of 1933 and 1934 the Securities and Exchange Commission has the power to punish the offender as well. The SEC has several different ways of punishment one being reimbursement of all illegally gained assets. Another punishment is the offenders resignation of any and all executive positions presently occupied as well as future occupation of any type of executive positions. Money Laundering • What is it? Engaging in financial transactions to hide the identity, or source of illegally obtained money. Money Laundering (con’t) • The Act Philip’s Peanut Company is a high income earning company. Millions of dollars are profited by Philip’s Peanut Company as Philip sells peanuts and peanut products to thousands of different people, companies, and other businesses. Lately Philip has been selling illegally obtained merchandise for cash to hundreds of different people. Money Laundering (con’t) • The Act (con’t) Philip can not take his large amount of cash and deposit it directly to the bank, because that would leave a trail of untaxed money. What Philip does is takes his cash and deposits it as money his business has made. Now all that illegal cash is taxed and is recorded as money his business has profited. Philip has engaged himself in Money Laundering. Money Laundering (con’t) • The Punishment Punishment for Money Laundering set by United States federal law states that the offender be fined now less that $500,000 and or imprisonment for no more than 20 years. Embezzlement • What is it? The act of untruthfully, and secretly taking assets (usually financial) from whom ever said assets are entitled to. Embezzlement (con’t) • The Act Philip’s Peanut Company makes millions of dollars in profits a year. Each year for the last 4 years Philip has been falsely recording his companies profits. One year his company actually made $4.5 million. Instead of properly recording that amount he recorded only $4 million. By doing this $500,000 had gone unaccounted for that year and Philip simply collected this money for himself. Philip has stolen assets that do not legally belong to him. He has engaged in embezzlement. Embezzlement (con’t) • The Punishment Punishment for embezzlement consists of prison time considering the severity of the crime and or severe fines and reimbursement of illegally obtained assets. If the offender is the CEO or the executive of a company then the offender must resign said position and forfeit any future position as CEO or executive of any type of business. Making False Statements What is it? When a company hides records of loss of money or other financial assets in order to keep the value of the company up. If a company records a larger gain of money than what was actually received is also considered making false statements. Making False Statements (con’t) The Act Philip’s Peanut Company hasn’t been doing well this year. At the end of the year Philip must record all the losses and gains his company has made. The value of Philip’s business will depend on the losses and gains made by his company. Since Philip does not want the value of his company to decrease he decides to record a gain of money much larger than what he actually gained. To do this Philip reported to the SEC that his company made $5 million last year. In actuality Philip’s Peanut Company only made $4 million last year. Philip falsely reported to the SEC his yearly gain much higher than it really is. This is Making False Statements Making False Statements (con’t) The Punishment Making false statements is considered a felony. The usual punishment for Making False Statements is a court ordered fine of no less than $2000 and no more than $10,000. The Ponzi Scheme What is it? A scheme named after Charles Ponzi used in the 1920’s to entice investors with an extraordinary return rate on some sort of investment. The trick is to gather a large amount of investors and get them to reinvest their return, and investors that take the return are actually being paid from other investors money. All the while the individual running the scheme is keeping any investments not being returned. So in actuality no money is being invested and the only return to investors is money from other investors. The Ponzi Scheme (con’t) The Act Philip has added a new securities and investment branch called Philip’s Investment Securities to his company allowing potential investors to invest money in his company. This branch allows investors to invest in a 20% annual return securities investment. This enticed investors to invest any amount of money with an annual return of 20% of whatever they invested. The Ponzi Scheme (con’t) The Act (con’t) Over a 5 year period Philip has taken thousands of investors money and had literally kept it. Philip pays out the annual returns to the people who want to collect their profit but keeps everything else as his own. No actual investments are made. No money is really being transferred. When the end of the year arrives Philip pays those who want their profit, and keeps the money of those who want to invest their profit. The Ponzi Scheme (con’t) The Act (con’t) Philip’s trick is to get as many investors to reinvest their profit instead of taking it. While Philip is trying to keep investors investing their profits Philip is signing on new investors keeping his scheme afloat. Ultimately Philip kept new investors coming and old investors investing. At the end of the 5 years Philip’s Securities Investment branch collapsed and investors lost their money leaving Philip with all the left over profit from his scheme. Philip has created complex pyramid scheme called The Ponzi Scheme. The Ponzi Scheme The Punishment The Punishment for a Ponzi Scheme is up to 20 years in prison and fine that is determined by the court. Though, the court can decide the prison sentence as well. Pyramid scheme punishment is often decided by the court depending on the severity of the case. Philip may only get 5 years in prison if convicted with a fine of only $500,000. Other people like Bernard Madoff who in 2008 was convicted of a $50 billion Ponzi scheme are facing up to 20 years in prison and a $5 million fine. The Ponzi Scheme (con’t) The Punishment (con’t) The offender, if being a CEO, must resign their position and any future position as executive CEO, or CFO of any company or corporation. Fraud Summary What are the basics of financial fraud? Untruthful acts of stealing assets belonging to some one else. Misrepresentation of information. Unlawful activities that go against the laws set by the 1933 and 1934 Securities and Exchange Acts. Fraud Summary (con’t) What are the punishments for financial fraud? Punishment for embezzlement, insider trading, and the Ponzi scheme all require the offender to resign their position and future positions as executives, CEO’s and CFO’s. Punishment for all fraud usually consist of a prison sentence up to 20 years and a fine designated by the court. The Securities and Exchange Commission have the power to punish financial fraud offenders as well as the Department Of Justice. These punishments by the SEC usually call for reimbursement of any stolen assets, and a fine.