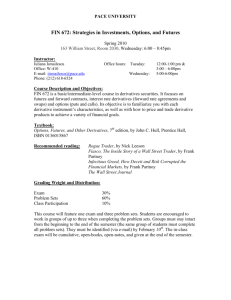

Chapter 15

advertisement

CHAPTER FIFTEEN THE ROLE OF DERIVATIVE ASSETS © 2001 South-Western College Publishing Outline Background The Rationale for Derivative Assets Uses of Derivatives The Options Market Options Terminology The Financial Page Listing The Origin of an Option The Role of the Options Clearing Corporation Standardized Option Characteristics 2 Outline The Futures Market Futures vs. Options Market Participants Keeping the Promise Categories of Futures Contracts Financial Futures Stock Index Futures Interest Rate Futures Foreign Currency Futures 3 Outline Derivative Assets and the News Current Events Risk of Derivative Assets Listed vs. Over-the-Counter Derivatives 4 Background : The Rationale for Derivative Assets The first organized derivatives exchange in the United States was developed in order to bring stability to agricultural prices, by enabling farmers to eliminate or reduce their price risk. 5 Background : Uses of Derivatives Risk management : The equity manager’s market risk or the bond manager’s interest rate risk is analogous to the farmer’s price risk. Risk transfer : Derivatives provide a means for risk to be transferred from one person to some other market participant who, for a price, is willing to bear it. Derivatives may provide financial leverage. 6 Background : Uses of Derivatives Income generation : Some people use derivatives as a means of generating additional income from their investment portfolio. Financial engineering : Derivatives can be stable or volatile depending on how they are combined with other assets. What’s next? 7 Options Terminology A call option gives its owner the right to buy a specified quantity of the underlying asset at a set price within a set time period. A put option gives its owner the right to sell a specified quantity of the underlying asset at a set price within a set time period. The set price is called the striking price or exercise price, and the last day the option is valid is called the expiration date. The price of the option is the premium. 8 Options Terminology Options trade in units called contracts, each of which normally covers 100 shares. An option’s volume indicates how many option contracts changed hands over some period of time. It measures trading activity. An option’s open interest indicates how many option contracts exist. Open interest goes up when someone creates an option and does down when two people trade and each close out an options position. 9 The Options Market : The Financial Page Listing Microsoft Option Prices, November 16, 1999 Microsoft Stock Price = 87 5/16 Calls Puts Striking Expiration Volume Last Open Volume Last Open Price Price Interest Price Interest 70 70 70 70 75 75 75 75 77 1 2 80 80 Nov Dec Jan Apr Nov Dec Jan Apr Jan Nov Dec 100 … 6 … 206 27 103 22 1 1325 248 17 5 8 … 17 7 8 … 12 1 2 12 14 3 4 17 11 5 8 7 58 9 18 1380 548 81584 2924 8740 512 98572 2416 9144 12724 … 3 203 10 … 299 74 1361 221 1121 … 3 13 8 16 3 2 8 … 11 1 3 2 1 16 1 3 1 16 2 8 8 26748 8408 78678 48596 20988 12464 111656 11604 51736 56556 10 The Origin of an Option Options can be created, or destroyed. The quantity of options in existence changes everyday. The first trade someone makes in a particular option is called an opening transaction. If an investor sells an option as an opening transaction, it is called writing the option. Options are fungible, meaning that, for a given company, all options of the same type with the same expiration and striking price are identical. 11 The Role of the Options Clearing Corporation The Options Clearing Corporation positions itself between every buyer and seller and acts as a guarantor of all option trades. OCC Buyer Trading Floor Seller 12 Standardized Option Characteristics Options have standardized expiration dates, striking prices, and lot size. option premium = intrinsic value + time value If an option has no intrinsic value, it is out-ofthe-money. Otherwise, it is either in-themoney or at-the-money. An American option can be exercised anytime prior to the expiration of the option. A European option, on the other hand, can only be exercised at expiration. 13 The Futures Market A futures contract is a promise. The initial seller of the contract promises to deliver a quantity of a standardized commodity to a designated delivery point during a certain delivery month. The other party to the trade promises to pay a predetermined price for the goods upon delivery. The person who promises to buy is said to be long, while the person who promises to deliver is said to be short. 14 The Futures Market Futures vs. options : Futures contracts do not expire unexercised. Market participants : Hedgers use futures to reduce price risk. Speculators assume risk in the hope of making a profit. Marketmakers provide liquidity for the marketplace. 15 The Futures Market Keeping the promise : Each exchange has a clearing corporation which ensures the integrity of the futures contract when a member is in financial distress. Categories of futures contracts : Agricultural e.g. wheat, cotton, cattle, eggs. Metals and petroleum e.g. platinum, copper, natural gas, crude oil. Financial e.g. foreign currency, stock index, interest rate. 16 Financial Futures : Stock Index Futures A stock index future is a promise to buy or sell the standardized units of a specific index at a fixed price at a predetermined future date. Unlike most other commodity contracts, there is no actual delivery mechanism when the contract expires. For practicality, all settlements are in cash. 17 Financial Futures : Interest Rate Futures Interest rate futures contracts are customarily grouped into short-term, intermediate-term, and long-term categories. The two principal short-term contracts are Eurodollars and U.S. Treasury bills. The Treasury bill futures contract calls for the delivery of $1 million par value of 90-day Tbills on the delivery date of the futures contract. 18 Financial Futures : Interest Rate Futures The contract on U.S. Treasury notes is the only intermediate-term contract, while Treasury bonds are the principal long-term contracts. The Treasury bond futures contract calls for the delivery of $100,000 face value of U.S. Treasury bonds with a minimum of 15 years until maturity (and, if callable, with a minimum of 15 years of call protection). Bonds that meet these criteria are said to be deliverable. 19 Financial Futures : Interest Rate Futures T-bonds are not all fungible. At any given time, several dozen bonds are usually eligible for delivery on a T-bond futures contract. Normally, only one of these bonds will be cheapest to deliver. Bonds are standardized as follows: invoice settlement conversion accrued x factor ] + interest price = [ price 20 Financial Futures : Foreign Currency Futures Foreign currency futures contracts call for delivery of the foreign currency in the country of issuance to a bank of the clearing house’s choosing. Most major corporations face at least some foreign exchange risk and quickly discovered the convenience of these futures as a hedging vehicle, while speculators saw the contracts as easy to understand and use. 21 Derivative Assets and the News Newspapers in recent months have been full of reports on various businesses that have lost billions “investing in derivatives.” Derivatives are neutral products. Their risk depends on what an investor does with them. Exchange-traded derivative assets and overthe-counter derivatives are markedly different. 22 Review Background The Rationale for Derivative Assets Uses of Derivatives The Options Market Options Terminology The Financial Page Listing The Origin of an Option The Role of the Options Clearing Corporation Standardized Option Characteristics 23 Review The Futures Market Futures vs. Options Market Participants Keeping the Promise Categories of Futures Contracts Financial Futures Stock Index Futures Interest Rate Futures Foreign Currency Futures 24 Review Derivative Assets and the News Current Events Risk of Derivative Assets Listed vs. Over-the-Counter Derivatives 25