skoda - Tony Gauvin's Web Site

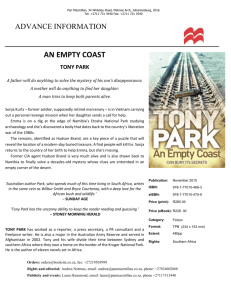

advertisement

SKODA A Strategic Management Case Study Tony Gauvin, UMFK, 2009 2 How do you double the value of a Skoda? Fill the gas tank What do you call a Skoda convertible? A dumpster What do you call a Skoda with twin exhaust pipes? A wheelbarrow. Why does a Skoda have a double rear window heater ? To keep your hands warm, while you push it. A guy goes into his local garage and asks "Do you have a windshield wiper for my Skoda???” "Sounds like a fair swap" replied the man in the garage. © 2009, Tony Gauvin, UMFK http://web.ukonline.co.uk/k.frost/czech/skoda_jokes.html 3/21/2016 3 Overview Company Overview A Brief history of Skoda Existing Mission and Vision Existing Objectives and Strategies Current Issues & Challenges New Mission and Vision External Assessment Industry analysis Porter’s Five Forces Opportunities and threats EFE Matrix Internal Assessment Strengths and weaknesses Financial Condition IFE Matrix Strategy Formulation SWOT Matrix Porter Generic Strgefics Space Matrix IE Matrix Grand Strategy Matrix Matrix Analysis QSPM Matrix Strategic Plan for the Future Objectives Strategies Implementation Issues Evaluation Skoda 2008 Update © Tony Gauvin, UMFK, 2009 3/30/2009 4 History • • • • • • • • • 1895 Vaclav Laurin and Vaclav Klemnet form bicycle company 1891 laurin and Kelemnt start making motorcycles 1905 The first car, called the “Voiturette A”, leaves the factory gates and thanks to its quality and attractive appearance soon gains a stable position in the emerging international automobile markets. 1907 Laurin & Klement set up a joint-stock company that goes on to export cars to markets the world over. 1925 The Laurin & Klement automobile factory merges with the Škoda machinery manufacturing company in Plzeň. 1939–1945 During the war years, the factory focuses on producing materials for the military. Just a few days before the war ends, the factory is bombed and sustains considerable damage. The enterprise is nationalized in the autumn of 1945. 1946 The enterprise’s reconstruction takes place under a new name, AZNP (“Automobilové závody, národní podnik” – Automotive Plants, National Enterprise). 1989 Czech republic formed 1991 April 16 marks the beginning of a new chapter in the Company’s history, when it is acquired by the strategic partner Volkswagen. Škoda becomes the Volkswagen Group’s fourth brand. 1996 Production commences of another milestone car model for the Company – the Škoda Octavia. © 2009, Tony Gauvin, UMFK 3/21/2016 5 Skoda History http://www.skoda-auto.com/moss/100/home/ © 2009, Tony Gauvin, UMFK 3/21/2016 6 (r) 2009, Tony Gauvin, UMFK 3/21/2016 7 Skoda key facts • Oldest Car Company in Central Europe • Largest employer in Czech Republic • Produced over half a million cars in 2006 & 630 million in 2007 ▫ Just behind Volkswagen and Audi in VAG • Skoda in the Czech language means “a shame” • Czech Republic largest exporter © 2009, Tony Gauvin, UMFK 3/21/2016 8 Skoda Mission Statement • Three basic values of the Skoda brand ▫ Intelligence We continuously seek technical solutions and new ways in which to care for and approach the customers that are the most important for us. Our conduct towards the customers is aboveboard, and we respect their desires and needs ▫ Attractivesness We develop automobiles that are aesthetically and technically of high standard and always constitute and attractive offer for our customers not only in terms of design or technical parameters but also the wide range of offered services ▫ Dedication We are following the steps of the founders of our company; Messrs. Laurin and Klement. We are enthusiastically working on the further development of our vehicles; we identify ourselves with out product © 2009, Tony Gauvin, UMFK 3/21/2016 9 Current Issues and Challenges • Challenges ▫ ▫ ▫ ▫ ▫ ▫ Companies in the former Soviet Union had not been forced to produce quality goods that can compete in world markets Employees in nationalized companies have been assured of “lifetime employment,” so they are not motivated to produce a high-quality product Banks are being privatized very slowly so infusions of capital normally Must come from outside the country. In addition, because all of the companies had been owned by the Soviets, there was no private money available to purchase companies offered by the state for sale Most companies have old and obsolete equipment that would take years to replace There is an insufficient infrastructure because the Soviets have never put money into such “public goods;” in their satellites (occupied states) Lack of development of managerial skills. • Issues ▫ Does Skoda become a Global brand or a European Brand ? Currently sold in Europe (>95%) and Asia (<5%) ▫ Where to position Skoda Within Volkswagen’s portfolio As a European only brand As a global brand ▫ Where to manufacture Sk0das? Czechoslovakia or seek cheaper labor (China?) (r) 2009, Tony Gauvin, UMFK 3/21/2016 10 New Vision A world leader in high-quality, value-priced automobiles for the 21st century consumer s © 2009, Tony Gauvin, UMFK 3/21/2016 11 New Mission Skoda Auto mission is to anticipate consumer needs and provide safe, quality, reliable, and innovative automotive products and services to consumers around the world (1, 2, 3). Meeting and exceeding customer’s expectations for exceptional quality, cutting-edge technology, and superior customer service will enable us to maximize returns to our shareholders. (4, 5). We are passionately committed to ensure we do the right thing for our customers, our employees, our environment, and our society (6, 9). Skoda is committed to leading all automotive firms in quality and safety in Europe and abroad. Along with our commitment to saving the environment, we can continue to add to our proud heritage (7, 8). © 2009, Tony Gauvin, UMFK 3/21/2016 12 © 2009, Tony Gauvin, UMFK 3/21/2016 13 Global Industry Analysis • • • • • • • • 5.2% growth in 2006 $1,176.5 Billion 65.7 million units sold in 2006 66.5% of sales are cars US accounts for 38.4 % of global market share Europe accounts for 29.3% Industry leader is GM with 17.3% Market Share CAGR from 2002 t0 2006 was 4.7% Projected CAGR of 4.5% in period from 20062011 © 2009, Tony Gauvin, UMFK 3/21/2016 14 © 2009, Tony Gauvin, UMFK 3/21/2016 15 © 2009, Tony Gauvin, UMFK 3/21/2016 16 © 2009, Tony Gauvin, UMFK 3/21/2016 17 Porter five forces models © 2009, Tony Gauvin, UMFK 3/21/2016 18 Five Forces Analysis • Threat of Entry Because of the increased buying power of consumers in former Soviet Union countries and in emerging countries, many firms may see this as an opportunity to move plants to Eastern Europe to reduce their costs and compete in that market. In addition, for the first time in 50 years, Eastern European consumers have access to a greater variety of cars than they have had. Both of these factors should heat up the competitive environment. • Bargaining Power of Buyers With increased competition worldwide in the automobile manufacturing industry, consumers have many more choices from which to select when purchasing a car. In addition, the movement to a global industry from one which had been formerly a monopoly or oligopoly within a country or region, has caused intense price competition to arise. Therefore, this industry could certainly be classified as a “buyer’smarket” today. In less developed countries, buyers are being wooed with lower prices; and in more developed countries, they are being wooed with product differentiation. © 2009, Tony Gauvin, UMFK 3/21/2016 19 Five Forces Analysis Bargaining Power of Suppliers With a movement toward just-in-time inventory systems worldwide in the automobile manufacturing industry, there has been greater pressure upon suppliers to move their plants to locations contiguous to the automobile plants they are supplying. Some automobile companies have also begun supplying their own parts and thereby eliminating many of the suppliers they formerly used. Therefore, the bargaining power of suppliers has been greatly weakened. Pressure from Substitute Products There appears to be very little pressure from substitute products in this market because automobiles have actually become the substitute product for other forms of transportation such as bicycles in developing countries. The only true threat of a substitute product in more developed, heavily populated countries is public transportation. This supplies a cheaper, faster means of transportation into large cities where parking is at a premium. This is often a product of choice in many European countries where public transportation has been greatly refined. Rivalry Among Existing Competitors The global automobile manufacturing industry is one of the most competitive in the world. In addition, new car companies are emerging in the developing countries of Asia and Central and Eastern Europe. These companies are all trying to reduce costs by moving to low-cost countries, so Skoda’s location in such a country will not be a competitive advantage for long. © 2009, Tony Gauvin, UMFK 3/21/2016 20 Opportunities 1. Growing automobile market in Eastern Europe, China, Africa, India and other emerging economies. 2. Possibility of moving manufacturing and assembly plants to low-cost countries. 3. First mover advantage to those companies using alternative fuels 4. American Markets favor Europeanmanufactured cars (r) 2009, Tony Gauvin, UMFK 3/21/2016 21 Threats 1. 2. 3. 4. 5. Movement of the global automobile manufacturing industry to a monopolistically-competitive structure with increased competition. Costliness of non-renewable energy sources. Higher wage rates in some countries are making it difficult for automobile manufacturers to remain competitive. Decline in sales in Eastern European countries that have become a part of the European Union because of the increased availability of used vehicles from other European countries. There is an insufficient infrastructure because the Soviets have never put money into such “public goods;” in their satellites (occupied states) (r) 2009, Tony Gauvin, UMFK 3/21/2016 22 EFE External Factor Evaluation Matrix Key External Factors Opportunities Growing automobile market in Eastern Europe, China, Africa, India and other emerging economies. Possibility of moving manufacturing and assembly plants to low-cost countries. First mover advantage to those companies using alternative fuels American Markets favor European-manufactured cars Threats Movement of the global automobile manufacturing industry to a monopolisticallycompetitive structure with increased competition. Costliness of non-renewable energy sources. Higher wage rates in some countries are making it difficult for automobile manufacturers to remain competitive. Decline in sales in Eastern European countries that have become a part of the European Union because of the increased availability of used vehicles from other European countries. There is an insufficient infrastructure because the Soviets have never put money into such “public goods;” in their satellites (occupied states) Totals Weights 0.0 to 1.0 Rating 1 to 4 Weighted Score 0.15 0.1 0.15 0.13 4 4 2 2 0.6 0.4 0.3 0.26 0 0.08 0.11 3 2 0.24 0.22 0.15 4 0.6 0.08 3 0.24 0.05 2 0.1 1 2.96 © 2009, Tony Gauvin, UMFK 3/21/2016 23 © 2009, Tony Gauvin, UMFK 3/21/2016 24 Financial Data 1 USD = 0.6790 Euro = 18.11 CZK Dec , 31, 2007 © 2009, Tony Gauvin, UMFK 3/21/2016 25 Financial Data © 2009, Tony Gauvin, UMFK 3/21/2016 26 Financial Data 1 USD = 0.6790 Euro = 18.11 CZK Dec , 31, 2007 © 2009, Tony Gauvin, UMFK 3/21/2016 27 Financial Ratios Industry Comparison D&B Top Quartile D&B median D&B Bottom Quartile Current Ratio 2.2 1.5 1.1 1.478 Quick ratio 1.0 0.6 0.3 1.124 Liabilities To equity 103.3 167.2 345.4 1.804 Assets to sales 27.6 48.1 78.0 0.516 Return on Sales 5.1 1.8 0.4 0.054 Return on Assets 9.5 4.2 0.7 0.105 © 2009, Tony Gauvin, UMFK 3/21/2016 28 Volkswagen Financial Data ŠKODA BRAND Deliveries (thousand units) Vehicle sales Production Sales revenue (€ million) Operating profit as % of sales revenue 2007 630 620 661 8,004 712 8.9 2006 550 562 556 7,186 515 7.2 + + + + + % 14.6 10.2 18.8 11.4 38.4 1 USD = 0.6790 Euro = 18.11 CZK Dec , 31, 2007 © 2009, Tony Gauvin, UMFK 3/21/2016 29 Volkswagen Financial Data KEY FIGURES BY BRAND AND BUSINESS FIELD Vehicle sales thousand vehicles/€ million Volkswagen Passenger Cars Audi Škoda SEAT Bentley Commercial Vehicles VW China1 Other Automotive Division Financial Services Division Group before special items Special items Volkswagen Group 2007 3,664 1,200 620 411 10 427 930 -1,070 6,192 6,192 2006 3,451 1,139 562 419 10 388 694 -943 5,720 5,720 Sales revenue 2007 73,944 33,617 8,004 5,899 1,376 9,297 2006 70,710 31,720 7,186 5,874 1,340 8,092 Sales to third parties 2007 2006 60,201 58,839 21,078 20,521 5,925 5,378 4,375 4,433 1,294 1,251 6,548 5,732 Operating result 2007 2006 1,940 918 2,705 2,054 712 515 8 -159 155 137 305 138 -33,385 98,752 -28,918 750 96,004 100,171 743 96,897 0-6312 5,194 0-632 3,540 10,145 108,897 8,871 8,726 104,875 108,897 7,978 104,875 108,897 104,875 108,897 104,875 957 6,151 6,151 843 4,383 -2,374 2,009 1 USD = 0.6790 Euro = 18.11 CZK Dec , 31, 2007 © 2009, Tony Gauvin, UMFK 3/21/2016 30 Production Markets © 2009, Tony Gauvin, UMFK 3/21/2016 31 Strengths 1. 100-year history as a vehicle manufacturer. 2. Capital infusions from Volkswagen. 3. Emphasis on research and development from Volkswagen. 4. Strength of Volkswagen’s reputation. 5. Highly-skilled work force available in the Czech Republic. 6. Relatively low wages in Czech Republic. 7. Largest employer in the Czech Republic. 8. Synergy with other Volkswagen products. (r) 2009, Tony Gauvin, UMFK 3/21/2016 32 Weaknesses 1. Location in a country that must deal with outdated infrastructure. 2. Perception from the past that Skoda produces a low-quality product. 3. Perception by some that their new 4-door limousine is not a limousine at all. 4. Growing unrest of Skoda’s employees in seeking higher wages which decrease profit margins. 5. Reputation of Skoda may spill over to the Bentley and frighten off buyers. (r) 2009, Tony Gauvin, UMFK 3/21/2016 33 IFE Key Internal Factors Internal Strengths 100-year history as a vehicle manufacturer. Capital infusions from Volkswagen. Emphasis on research and development from Volkswagen. Strength of Volkswagen’s reputation. Highly-skilled work force available in the Czech Republic. Relatively low wages in Czech Republic. Largest employer in the Czech Republic. Synergy with other Volkswagen products. Internal Weaknesses Location in a country that must deal with outdated infrastructure. Perception from the past that Skoda produces a low-quality product. Perception by some that their new 4-door limousine is not a limousine at all. Growing unrest of Skoda’s employees in seeking higher wages which decrease profit margins. Reputation of Skoda may spill over to the Bentley and frighten off buyers. Totals Weights Rating 0.0 to 1.0 1, 2, 3 or 4 Weighted Score 0.06 0.1 0.08 0.1 0.07 0.06 0.04 0.06 3 4 4 4 3 3 3 4 0.18 0.4 0.32 0.4 0.21 0.18 0.12 0.24 0.1 1 0.1 0.07 2 0.14 0.08 2 0.16 0.1 1 0.1 0.08 1 2 0.16 2.71 © 2009, Tony Gauvin, UMFK 3/21/2016 34 © 2009, Tony Gauvin, UMFK 3/21/2016 35 SWOT MATRIX SO Strategies ST Strategies • Develop a new car line to use Alternative Fuels for global market (O3, O4, S2, S3, S5) • Expand Sales in emerging counties in Eastern Europe, (Near & Far) Asia & Africa (O1, S2, S4, S8) • Develop a low cost and economical to operate SUV for American Markets (O4, S1, S2, S3, S4, S5) • Expand collaboration and innovation with other VAG brands (T1, S1, S2, S3, S4, S5, S6, S8 ) • Move manufacturing to countries with low wages and demand for value priced automobiles (T3, T4, S1, S2) © 2009, Tony Gauvin, UMFK 3/21/2016 36 SWOT MATRIX WO Strategies WT Strategies • Move manufacturing to countries with low wages and demand for value priced automobiles (W1,W2, O1, O2) • Rebrand Skoda as a value priced quality built Europe made automobile (W1, W2, O1, O4) • Brand Skoda as a subdivision of VAG, a well know German brand (W2, W1, T1) • Develop a new car line to use Alternative Fuels for global market leveraging the VAG brand (T1, T2, T3, W1, W4, W5) © 2009, Tony Gauvin, UMFK 3/21/2016 37 Porter’s Generic Strategies © 2009, Tony Gauvin, UMFK 3/21/2016 38 Alternative Cost leadership Strategies 1. Move production facilities to countries that have a skilled yet relatively inexpensive work force and a stable economic and political environment. 2. Produce automobiles that meet the needs of that particular region. For example, an SUV or truck would be inappropriate in the former Soviet Union countries or developing countries where petroleum prices are high and wages relatively low. 3. In constructing new plants in countries hitherto not utilized, consider such additional factors as energy costs, access to the necessary infrastructure and closeness to important world markets. 4. Consider mergers with other appropriate companies in the target market to achieve economies of scale. © 2009, Tony Gauvin, UMFK 3/21/2016 39 Space Matrix Data Financial Strength rating is 1 (worst) to 6 (best) 1 Rerturn on Assets 2 Leverage 3 Net Income growth 4 Income/employee 5 Cash Reserves Industry Strength rating is 1 (worst) to 6 (best) 1 Growth Potential 2 Finacila Stabiliy 3 Ease of Entry in Market 4 Resource Utilazation 5 Profit Potential Environmental Stability rating is -1 (best) to -6 (worst) 1 Rate of Infaltion 2 Technologocal Changes 3 Preice Elasticity of Demand 4 Competiove Pressure 5 Barriers to Entry 6 Globalization Competitive advantage rating is -1 (best) to -6 (worst) 1 Market Share (Czech Republic) 2 Market Share Europe 3 Product Quality 4 Customer Loyally 5 Technological Know How 6 Control over suppliers 7 Market Share Global Ratings 4.0 2.0 4.0 5.0 6.0 FS Total 21.0 5.0 3.0 6.0 4.0 5.0 IS Total 23.0 -3.0 -4.0 -3.0 -6.0 -2.0 ES Total CS total -18.0 -1.0 -4.0 -5.0 -5.0 -1.0 -1.0 -6.0 -23.0 © 2009, Tony Gauvin, UMFK 3/21/2016 SPACE Matrix FS Conservative ES average CA average IS average FS average X Coordinate Y Coordinate Aggressive +6 +5 +4 +3 -3.60 -3.29 4.60 4.20 +2 1.31 0.60 +1 CA IS -6 -5 -4 -3 -2 -1 +1 -1 +2 +3 +4 +5 +6 -2 -3 -4 Defensive -5 Competitive -6 ES GSM 1. 2. 3. 4. 5. 6. WEAK COMPETITIVE POSITION 1. 2. 3. 4. 5. RAPID MARKET GROWTH Quadrant II Market development Market penetration Product development Horizontal integration Divestiture Liquidation 1. 2. 3. 4. 5. 6. 7. Quadrant I Market development Market penetration Product development Forward integration Backward integration Horizontal integration Concentric diversification STRONG COMPETITIVE POSITION Quadrant III Quadrant IV Retrenchment 1. Concentric diversification Concentric diversification 2. Horizontal diversification Horizontal diversification 3. Conglomerate diversification Conglomerate diversification 4. Joint ventures Liquidation SLOW MARKET GROWTH 2009 Hold and Maintain IE Matrix IFE Scores Average 2-2.99 Strong 3-4 EFE Scores High 3-4 Weak 1-1.99 I II III IV V VI VII VIII IX Medium 2-2.99 Low 1-1.99 42 3/30/2009 43 © 2009, Tony Gauvin, UMFK 3/21/2016 44 Matrix analysis SPACE GRAND (Europe) Porter’s COUNT Forward Integration X X X 3 Backward Integration X X X 3 Horizontal Integration X X 2 X X 3 X X X 2 X X X 4 Concentric Diversification X X Conglomerate Diversification X 1 Horizontal Diversification X 1 Alternative Strategies Market Penetration IE X Market Development Product Development Joint Venture X 2 X 1 Retrenchment Divestiture Liquidation 7-Apr-08 45 Possible Strategies • Develop an alterative fuel car for global marketplace ▫ Product Development, Market development and Market penetration, Porter’s Type 3 • Move Manufacturing to low-cost labor countries with high demand for value priced automobiles (China and India) ▫ Product development, Forward & backwards integrations. Porter’s type 1 • Leverage Volkswagen Auto Groups brand to create a global market for Skoda Cars ▫ Market development, Market Penetration, Joint venture, Porter’s type 2 © 2009, Tony Gauvin, UMFK 3/21/2016 46 QSPM Key factors External O1 O2 O3 O4 T1 T2 T3 T4 T5 Internal S1 S2 S3 S4 S5 S6 S7 S8 W1 W2 W3 W4 W5 Move to China/India Alternative Fuel VAG Global Brand AS TAS AS TAS AS TAS 1 to 4 1 to 4 1 to 4 0.15 4 0.6 2 0.3 1 0.15 0.1 4 0.4 2 0.2 1 0.1 0.15 1 0.15 4 0.6 2 0.3 0.13 0 0 0 0 0 0 0.08 2 0.16 1 0.08 4 0.32 0.11 4 0.44 1 0.11 3 0.33 0.15 4 0.6 1 0.15 3 0.45 0.08 4 0.32 1 0.08 2 0.16 0.05 4 0.2 1 0.05 2 0.1 1 1 to 4 1 to 4 1 to 4 0.06 0 0 0 0.1 4 0.4 3 0.3 3 0.3 0.08 2 0.16 4 0.32 4 0.32 0.1 0 0 0 0.07 2 0.14 4 0.28 4 0.28 0.06 1 0.06 2 0.12 3 0.18 0.04 0 0 0 0.06 1 0.06 2 0.12 4 0.24 0 0 0 0.1 4 0.4 1 0.1 1 0.1 0.07 0 0 0 0.08 0 0 0 0.1 3 0.3 1 0.1 1 0.1 0.08 4 0.32 1 0.08 1 0.08 0 0 0 1 4.71 2.99 3.51 Weight © 2009, Tony Gauvin, UMFK 3/21/2016 47 Recommendations • Next 3 years ▫ Move Manufacturing to low-cost labor countries with high demand for value priced automobiles (China and India) • Next 5 to 7 years ▫ Develop an alterative fuel car for global marketplace • Continuing ▫ Leverage Volkswagen Auto Groups brand to create a global market for Skoda Cars © 2009, Tony Gauvin, UMFK 3/21/2016 48 Annual Objectives • Year one ▫ Get plants up and running in China and India • Year two ▫ Increase Production& Sales ~ 100,000 units in China, 25% export ~ 30,000 units in India, 0% export • Year three ▫ Increase Production& Sales > 150,000 units in China, 35% export ~ 45,000 units in India, 10% export © 2009, Tony Gauvin, UMFK 3/21/2016 49 © 2009, Tony Gauvin, UMFK 3/21/2016 50 Financial • Cost ▫ 2 factories in China @ 30,000,000 each ▫ 1 factory in India @ 50,0000,000 • Skoda is wholly owned by Volkswagen AG ▫ No stock … so EPS/EBIT is not important • The Financing decision is to borrow money or fund from extensive cash reserves ▫ Czech national bank is listing a 1.5% Prime rate making this a “nobrainer” ---Borrow the cash! © 2009, Tony Gauvin, UMFK 3/21/2016 51 © 2009, Tony Gauvin, UMFK 3/21/2016 Management Skoda Automobile followed the German model of utilizing the members of the Board of Directors as the top management of the company. This is very different from the composition of the top management of large corporations in this country. Boards in the United States are typically composed of more outside directors (those employed by a company other than the company on which they are serving as board members) than inside directors. Most U.S. institutional investors and watchdog groups would prefer a majority of outside directors because it is believed that they can be more objective in making decisions than inside directors. OrganisationStructure.pdf 52 (r) 2009, Tony Gauvin, UMFK 3/21/2016 IT Skoda Auto employs a best of Breed Enterprise Resource Planning infrastructure, SAP/R3, allowing for digital optimization across the company. The difficulty comes in integrating other acquisitions and partner firms in the vale chain. 53 Marketing Product Positioning within VAG Sporty Value Priced Luxury Consevative © 2009, Tony Gauvin, UMFK 3/21/2016 54 © 2009, Tony Gauvin, UMFK 3/21/2016 55 © 2009, Tony Gauvin, UMFK 3/21/2016 56 © 2009, Tony Gauvin, UMFK 3/21/2016 57 © 2009, Tony Gauvin, UMFK 3/21/2016 58 Data Sources • Skoda Auto – 2007 Case Notes Marlene M. Reed: Baylor University • http://new.skoda-auto.com • http://en.wikipedia.org/wiki/%C5%A0koda_Auto#Hist ory • Datamonitor ▫ Global Automobile Manufacturers March 2007 ▫ Volkswagen AG 2008 • Automotive Forecast December 2005, Czech republic, The Economist Intelligence Unit Limited • Skoda 2007 Annual Report • Skoda 2006 Annual Report • Volkswagen 2007 Annual Report © 2009, Tony Gauvin, UMFK 3/21/2016