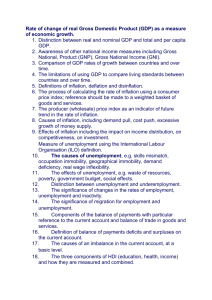

unit 4 book

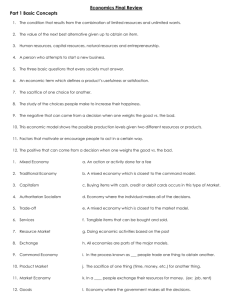

advertisement