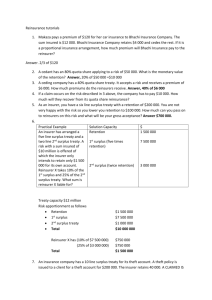

Facultative Reinsurance - Midlands State University

advertisement