“A bank is a place that will lend you money if you can prove that you

advertisement

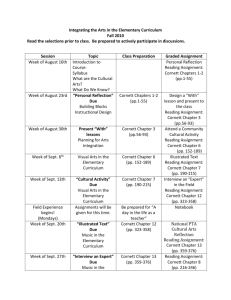

“A bank is a place that will lend you money if you can prove that you don’t need it.” Bob Hope Saunders & Cornett, Financial Institutions Management, 4th ed. 1 Why New Approaches to Credit Risk Measurement and Management? Why Now? Saunders & Cornett, Financial Institutions Management, 4th ed. 2 Structural Increase in Bankruptcy • Increase in probability of default – High yield default rates: 5.1% (2000), 4.3% (1999, 1.9% (1998). Source: Fitch 3/19/01 – Historical Default Rates: 6.92% (3Q2001), 5.065% (2000), 4.147% (1999), 1998 (1.603%), 1997 (1.252%), 10.273% (1991), 10.14% (1990). Source: Altman • Increase in Loss Given Default (LGD) – First half of 2001 defaulted telecom junk bonds recovered average 12 cents per $1 ($0.25 in 1999-2000) • Only 9 AAA Firms in US: Merck, Bristol-Myers, Squibb, GE, Exxon Mobil, Berkshire Hathaway, AIG, J&J, Pfizer, UPS. Late 70s: 58 firms. Early 90s: 22 firms. Saunders & Cornett, Financial Institutions Management, 4th ed. 3 Disintermediation • Direct Access to Credit Markets – 20,000 US companies have access to US commercial paper market. – Junk Bonds, Private Placements. • “Winner’s Curse” – Banks make loans to borrowers without access to credit markets. Saunders & Cornett, Financial Institutions Management, 4th ed. 4 More Competitive Margins • Worsening of the risk-return tradeoff – Interest Margins (Spreads) have declined • Ex: Secondary Loan Market: Largest mutual funds investing in bank loans (Eaton Vance Prime Rate Reserves, Van Kampen Prime Rate Income, Franklin Floating Rate, MSDW Prime Income Trust): 5-year average returns 5.45% and 6/30/00-6/30/01 returns of only 2.67% – Average Quality of Loans have deteriorated • The loan mutual funds have written down loan value Saunders & Cornett, Financial Institutions Management, 4th ed. 5 The Growth of Off-Balance Sheet Derivatives • Total on-balance sheet assets for all US banks = $5 trillion (Dec. 2000) and for all Euro banks = $13 trillion. • Value of non-government debt & bond markets worldwide = $12 trillion. • Global Derivatives Markets > $84 trillion. • All derivatives have credit exposure. • Credit Derivatives. Saunders & Cornett, Financial Institutions Management, 4th ed. 6 Declining and Volatile Values of Collateral • Worldwide deflation in real asset prices. – Ex: Japan and Switzerland – Lending based on intangibles – ex. Enron. Saunders & Cornett, Financial Institutions Management, 4th ed. 7 Technology • Computer Information Technology – Models use Monte Carlo Simulations that are computationally intensive • Databases – Commercial Databases such as Loan Pricing Corporation – ISDA/IIF Survey: internal databases exist to measure credit risk on commercial, retail, mortgage loans. Not emerging market debt. Saunders & Cornett, Financial Institutions Management, 4th ed. 8 BIS Risk-Based Capital Requirements • BIS I: Introduced risk-based capital using 8% “one size fits all” capital charge. • Market Risk Amendment: Allowed internal models to measure VAR for tradable instruments & portfolio correlations – the “1 bad day in 100” standard. • Proposed New Capital Accord BIS II – Links capital charges to external credit ratings or internal model of credit risk. To be implemented in 2005. Saunders & Cornett, Financial Institutions Management, 4th ed. 9 Traditional Approaches to Credit Risk Measurement 20 years of modeling history Saunders & Cornett, Financial Institutions Management, 4th ed. 10 Expert Systems – The 5 Cs • • • • Character – reputation, repayment history Capital – equity contribution, leverage. Capacity – Earnings volatility. Collateral – Seniority, market value & volatility of MV of collateral. • Cycle – Economic conditions. – 1990-91 recession default rates >10%, 1992-1999: < 3% p.a. Altman & Saunders (2001) – Non-monotonic relationship between interest rates & excess returns. Stiglitz-Weiss adverse selection & risk shifting. Saunders & Cornett, Financial 11 Institutions Management, 4th ed. Problems with Expert Systems • Consistency – Across borrower. “Good” customers are likely to be treated more leniently. “A rolling loan gathers no loss.” – Across expert loan officer. Loan review committees try to set standards, but still may vary. – Dispersion in accuracy across 43 loan officers evaluating 60 loans: accuracy rate ranged from 27-50. Libby (1975), Libby, Trotman & Zimmer (1987). • Subjectivity – What are the optimal weights to assign to each factor? Saunders & Cornett, Financial Institutions Management, 4th ed. 12 Credit Scoring Models • • • • • Linear Probability Model Logit Model Probit Model Discriminant Analysis Model 97% of banks use to approve credit card applications, 70% for small business lending, but only 8% of small banks (<$5 billion in assets) use for small business loans. Mester (1997). Saunders & Cornett, Financial Institutions Management, 4th ed. 13 Linear Discriminant Analysis – The Altman Z-Score Model • Z-score (probability of default) is a function of: – – – – – – Working capital/total assets ratio (1.2) Retained earnings/assets (1.4) EBIT/Assets ratio (3.3) Market Value of Equity/Book Value of Debt (0.6) Sales/Total Assets (1.0) Critical Value: 1.81 Saunders & Cornett, Financial Institutions Management, 4th ed. 14 Problems with Credit Scoring • Assumes linearity. • Based on historical accounting ratios, not market values (with exception of market to book ratio). – Not responsive to changing market conditions. – 56% of the 33 banks that used credit scoring for credit card applications failed to predict loan quality problems. Mester (1998). • Lack of grounding in economic theory. Saunders & Cornett, Financial Institutions Management, 4th ed. 15 The Option Theoretic Model of Credit Risk Measurement Based on Merton (1974) KMV Proprietary Model Saunders & Cornett, Financial Institutions Management, 4th ed. 16 The Link Between Loans and Optionality: Merton (1974) • Figure 4.1: Payoff on pure discount bank loan with face value=0B secured by firm asset value. – Firm owners repay loan if asset value (upon loan maturity) exceeds 0B (eg., 0A2). Bank receives full principal + interest payment. – If asset value < 0B then default. Bank receives assets. Saunders & Cornett, Financial Institutions Management, 4th ed. 17 Using Option Valuation Models to Value Loans • Figure 4.1 loan payoff = Figure 4.2 payoff to the writer of a put option on a stock. • Value of put option on stock = equation (4.1) = f(S, X, r, , ) where S=stock price, X=exercise price, r=risk-free rate, =equity volatility,=time to maturity. Value of default option on risky loan = equation (4.2) = f(A, B, r, A, ) where A=market value of assets, B=face value of debt, r=risk-free rate, A=asset volatility,=time to debt maturity. Saunders & Cornett, Financial Institutions Management, 4th ed. 18 Figure 4.1 The payoff to a bank lender $ Payoff 0 A1 B Saunders & Cornett, Financial Institutions Management, 4th ed. A2 Assets 19 Figure 4.2 The payoff to the w riter of a put option on a stock. $ Payoff 0 X Stock Price (S) Saunders & Cornett, Financial Institutions Management, 4th ed. 20 Problem with Equation (4.2) • A and A are not observable. • Model equity as a call option on a firm. (Figure 4.3) • Equity valuation = equation (4.3) = E = h(A, A, B, r, ) Need another equation to solve for A and A: E = g(A) Equation (4.4) Can solve for A and A with equations (4.3) and (4.4) to obtain a Distance to Default = (A-B)/ A Figure 4.4 Saunders & Cornett, Financial Institutions Management, 4th ed. 21 Figure 4.3 Equity as a call option on a firm. Value of Equity (E) ($) 0 A1 B A2 Value of Assets (A) L Saunders & Cornett, Financial Institutions Management, 4th ed. 22 Figure 4.4 Calculating the theoretical EDF A A $100m A B $80m Default Region t 0 t 1 Saunders & Cornett, Financial Institutions Management, 4th ed. Time (t) 23 Merton’s Theoretical PD • • • • Assumes assets are normally distributed. Example: Assets=$100m, Debt=$80m, A=$10m Distance to Default = (100-80)/10 = 2 std. dev. There is a 2.5% probability that normally distributed assets increase (fall) by more than 2 standard deviations from mean. So theoretical PD = 2.5%. • But, asset values are not normally distributed. Fat tails and skewed distribution (limited upside gain). Saunders & Cornett, Financial Institutions Management, 4th ed. 24 Merton’s Bond Valuation Model • B=$100,000, =1 year, =12%, r=5%, leverage ratio (d)=90% • Substituting in Merton’s option valuation expression: – The current market value of the risky loan is $93,866.18 – The required risk premium = 1.33% Saunders & Cornett, Financial Institutions Management, 4th ed. 25 KMV’s Empirical EDF • Utilize database of historical defaults to calculate empirical PD (called EDF): Empirical EDF = • Fig. 4.5 Empirical EDF percent = at the beginning of the year asset values of 2 from B Total population of firms with B at the beginning of the year a year with asset values of 2 from Number of firms that defaulted within 50 Defaults Firm population of 1, 000 Saunders & Cornett, Financial Institutions Management, 4th ed. = 5 26 Figure 4.5 Empirical EDF and the distance to default (DD): A hypothetical example. Empirical EDF 5% Proprietery Trade-Off 0 2 Saunders & Cornett, Financial Institutions Management, 4th ed. Distance to Default (DD ) 27 Accuracy of KMV EDFs Comparison to External Credit Ratings • • • • Enron (Figure 4.8) Comdisco (Figure 4.6) USG Corp. (Figure 4.7) Power Curve (Figure 4.9): Deny credit to the bottom 20% of all rankings: Type 1 error on KMV EDF = 16%; Type 1 error on S&P/Moody’s obligor-level ratings=22%; Type 1 error on issue-specific rating=35%. Saunders & Cornett, Financial Institutions Management, 4th ed. 28 Figure 4.6 KMV expected default frequency for Comdisco Inc. Source: TM and agency rating KMV. KMV EDF Credit Measure Agency Rating 20 CC 15 10 CCC 7 5 B 2 1.0 BB .5 BBB .20 .15 .10 .05 A AA .02 AAA 12/96 06/97 12/97 06/98 12/98 06/99 12/99 06/00 12/00 06/01 Figure 4.7 KMV expected default frequency for USG Corp. TM and agency rating Source: KMV. KMV EDF Credit Measure Agency Rating 20 CC 15 10 CCC 7 5 B 2 BB 1.0 .5 BBB .20 .15 .10 A .05 AA .02 AAA 12/96 06/97 12/97 06/98 12/98 06/99 12/99 06/00 12/00 06/01 Saunders & Cornett, Financial Institutions Management, 4th ed. 29 Monthly EDF™ credit measure Agency Rating Saunders & Cornett, Financial Institutions Management, 4th ed. 30 Figure 4.8 KMV EDF Credit Measure vs. agency ratings (1990-1999) for rated U.S. companies. Source: Kealhof er (2000). 100 90 80 70 60 50 40 30 EDF Power 20 S&P Company Power S&P Implied Power 10 Moody s Implied Power 0 0 10 20 30 40 50 60 70 80 90 100 Percent of Population Excluded Saunders & Cornett, Financial Institutions Management, 4th ed. 31 Problems with KMV EDF • Not risk-neutral PD: Understates PD since includes an asset expected return > risk-free rate. – Use CAPM to remove risk-adjusted rate of return. Derives risk-neutral EDF (denoted QDF). Bohn (2000). • Static model – assumes that leverage is unchanged. Mueller (2000) and Collin-Dufresne and Goldstein (2001) model leverage changes. • Does not distinguish between different types of debt – seniority, collateral, covenants, convertibility. Leland (1994), Anderson, Sundaresan and Tychon (1996) and Mella-Barral and Perraudin (1997) consider debt renegotiations and other frictions. • Suggests that credit spreads should tend to zero as time to maturity approaches zero. Duffie and Lando (2001) incomplete information model. Zhou (2001) jump diffusion model. Saunders & Cornett, Financial Institutions Management, 4th ed. 32 Term Structure Derivation of Credit Risk Measures Reduced Form Models: KPMG’s Loan Analysis System and Kamakura’s Risk Manager Saunders & Cornett, Financial Institutions Management, 4th ed. 33 Estimating PD: An Alternative Approach • Merton’s OPM took a structural approach to modeling default: default occurs when the market value of assets fall below debt value • Reduced form models: Decompose risky debt prices to estimate the stochastic default intensity function. No structural explanation of why default occurs. Saunders & Cornett, Financial Institutions Management, 4th ed. 34 A Discrete Example: Deriving Risk-Neutral Probabilities of Default • B rated $100 face value, zero-coupon debt security with 1 year until maturity and fixed LGD=100%. Risk-free spot rate = 8% p.a. • Security P = 87.96 = [100(1-PD)]/1.08 Solving (5.1), PD=5% p.a. • Alternatively, 87.96 = 100/(1+y) where y is the risk-adjusted rate of return. Solving (5.2), y=13.69% p.a. • (1+r) = (1-PD)(1+y) or 1.08=(1-.05)(1.1369) Saunders & Cornett, Financial Institutions Management, 4th ed. 35 Multiyear PD Using Forward Rates • Using the expectations hypothesis, the yield curves in Figure 5.1 can be decomposed: • (1+0y2)2 = (1+0y1)(1+1y1) or 1.162=1.1369(1+1y1) 1y1=18.36% p.a. • (1+0r2)2 = (1+0r1)(1+1r1) or 1.102=1.08(1+1r1) 1r1=12.04% p.a. • One year forward PD=5.34% p.a. from: (1+r) = (1- PD)(1+y) 1.1204=1.1836(1 – PD) • Cumulative PD = 1 – [(1 - PD1)(1 – PD2)] = 1 – [(1-.05)(1-.0534)] = 10.07% Saunders & Cornett, Financial Institutions Management, 4th ed. 36 Figure 5.1 Yield curves. Spot Yield 16% 13.69% 14% B Rated ZeroCoupon Bond A Rated ZeroCoupon Bond Zero-Coupon Treasury Bond 10% 11.5% 8% 1 Yr. 2 Yr. Saunders & Cornett, Financial Institutions Management, 4th ed. Time to Maturity 37 The Loss Intensity Process • Expected Losses (EL) = PD x LGD • If LGD is not fixed at 100% then: (1 + r) = [1 - (PDxLGD)](1 + y) Identification problem: cannot disentangle PD from LGD. Saunders & Cornett, Financial Institutions Management, 4th ed. 38 Disentangling PD from LGD • Intensity-based models specify stochastic functional form for PD. – Jarrow & Turnbull (1995): Fixed LGD, exponentially distributed default process. – Das & Tufano (1995): LGD proportional to bond values. – Jarrow, Lando & Turnbull (1997): LGD proportional to debt obligations. – Duffie & Singleton (1999): LGD and PD functions of economic conditions – Unal, Madan & Guntay (2001): LGD a function of debt seniority. – Jarrow (2001): LGD determined using equity prices. Saunders & Cornett, Financial Institutions Management, 4th ed. 39 KPMG’s Loan Analysis System • Uses risk-neutral pricing grid to mark-to-market • Backward recursive iterative solution – Figure 5.2. • Example: Consider a $100 2 year zero coupon loan with LGD=100% and yield curves from Figure 5.1. • Year 1 Node (Figure 5.3): – Valuation at B rating = $84.79 =.94(100/1.1204) + .01(100/1.1204) + .05(0) – Valuation at A rating = $88.95 = .94(100/1.1204) +.0566(100/1.1204) + .0034(0) • Year 0 Node = $74.62 = .94(84.79/1.08) + .01(88.95/1.08) • Calculating a credit spread: 74.62 = 100/[(1.08+CS)(1.1204+CS)] to get CS=5.8% p.a. Saunders & Cornett, Financial Institutions Management, 4th ed. 40 Figure 5.2 The multiperiod loan migrates over many periods. A B Risk Grade B C D 0 1 2 3 4 Time Saunders & Cornett, Financial Institutions Management, 4th ed. 41 Figure 5.3 Risky debt pricing. Period 0 Period 1 $85.43 Period 2 94% 5.66% 1% $67.14 94% $80.28 $100 A Rating 1% 94% $100 B Rating 0.34% 5% 5% $0 Default Saunders & Cornett, Financial Institutions Management, 4th ed. 42 Noisy Risky Debt Prices • US corporate bond market is much larger than equity market, but less transparent • Interdealer market not competitive – large spreads and infrequent trading: Saunders, Srinivasan & Walter (2002) • Noisy prices: Hancock & Kwast (2001) • More noise in senior than subordinated issues: Bohn (1999) • In addition to credit spreads, bond yields include: – Liquidity premium – Embedded options – Tax considerations and administrative costs of holding risky debt Saunders & Cornett, Financial 43 Institutions Management, 4th ed. Mortality Rate Derivation of Credit Risk Measures The Insurance Approach: Mortality Models and the CSFP Credit Risk Plus Model Saunders & Cornett, Financial Institutions Management, 4th ed. 44 Mortality Analysis • Marginal Mortality Rates = (total value of B-rated bonds defaulting in yr 1 of issue)/(total value of B-rated bonds in yr 1 of issue). • Do for each year of issue. • Weighted Average MMR = MMRi = tMMRt x w where w is the size weight for each year t. Saunders & Cornett, Financial Institutions Management, 4th ed. 45 Mortality Rates - Table 11.10 • Cumulative Mortality Rates (CMR) are calculated as: – MMRi = 1 – SRi where SRi is the survival rate defined as 1-MMRi in ith year of issue. – CMRT = 1 – (SR1 x SR2 x…x SRT) over the T years of calculation. – Standard deviation = [MMRi(1-MMRi)/n] As the number of bonds in the sample n increases, the standard error falls. Can calculate the number of observations needed to reduce error rate to say std. dev.= .001 – No. of obs. = MMRi(1-MMRi)/2 = (.01)(.99)/(.001)2 = 9,900 Saunders & Cornett, Financial Institutions Management, 4th ed. 46 CSFP Credit Risk Plus Appendix 11B • Default mode model • CreditMetrics: default probability is discrete (from transition matrix). In CreditRisk +, default is a continuous variable with a probability distribution. • Default probabilities are independent across loans. • Loan portfolio’s default probability follows a Poisson distribution. See Fig.8.1. • Variance of PD = mean default rate. • Loss severity (LGD) is also stochastic in Credit Risk +. Saunders & Cornett, Financial Institutions Management, 4th ed. 47 Figure 8.1 Comparison of credit risk plus and CreditMetrics. Credit Risk Plus Default Rate Possible Path of Default Rate BBB Loan Time Horizon Default Rate CreditMetrics Possible Path of Default Rate BBB Loan D BBB AAA Time Horizon Saunders & Cornett, Financial Institutions Management, 4th ed. 48 Figure 8.2 The CSFP credit risk plus model. Frequency of Defaults Severity of Losses Distribution of Default Losses Saunders & Cornett, Financial Institutions Management, 4th ed. 49 Distribution of Losses • Combine default frequency and loss severity to obtain a loss distribution. Figure 8.3. • Loss distribution is close to normal, but with fatter tails. • Mean default rate of loan portfolio equals its variance. (property of Poisson distrib.) Saunders & Cornett, Financial Institutions Management, 4th ed. 50 Figure 8.3 Distribution of losses w ith default rate uncertainty and severity uncertainty. Model 1 Probability Actual Distribution of Losses Losses Saunders & Cornett, Financial Institutions Management, 4th ed. 51 Figure 8.4 Capital requirement under the CSFP credit risk plus model. Expected Loss 99th Percentile Loss Level Probability Economic Capital 0 Loss Saunders & Cornett, Financial Institutions Management, 4th ed. 52 Pros and Cons • Pro: Simplicity and low data requirements – just need mean loss rates and loss severities. • Con: Inaccuracy if distributional assumptions are violated. Saunders & Cornett, Financial Institutions Management, 4th ed. 53 Divide Loan Portfolio Into Exposure Bands • In $20,000 increments. • Group all loans that have $20,000 of exposure (PDxLGD), $40,000 of exposure, etc. • Say 100 loans have $20,000 of exposure. • Historical default rate for this exposure class = 3%, distributed according to Poisson distrib. Saunders & Cornett, Financial Institutions Management, 4th ed. 54 Properties of Poisson Distribution • Prob.(n defaults in $20,000 severity band) = (e-mmn)/n! Where: m=mean number of defaults. So: if m=3, then prob(3defaults) = 22.4% and prob(8 defaults)=0.8%. • Table 8.2 shows the cumulative probability of defaults for different values of n. • Fig. 8.5 shows the distribution of the default probability for the $20,000 band. Saunders & Cornett, Financial Institutions Management, 4th ed. 55 Figure 8.5 Distribution of defaults: Band 1. .224 .168 .05 .008 0 1 2 3 4 8 Defaults Saunders & Cornett, Financial Institutions Management, 4th ed. 56 Loss Probabilities for $20,000 Severity Band Table 8.2 Calculation of the Probability of Default, Using the Poisson Distribution N Probability 0 1 2 3 . 7 8 Probability Cumulative 0.049787 0.149361 0.224042 0.224042 0.049789 0.199148 0.42319 0.647232 0.021604 0.008102 0.988095 0.996197 Saunders & Cornett, Financial Institutions Management, 4th ed. 57 Economic Capital Calculations • Expected losses in the $20,000 band are $60,000 (=3x$20,000) • Consider the 99.6% VaR: The probability that losses exceed this VaR = 0.4%. That is the probability that 8 loans or more default in the $20,000 band. VaR is the minimum loss in the 0.4% region = 8 x $20,000 = $160,000. • Unexpected Losses = $160,000 – 60,000 = $100,000 = economic capital. Saunders & Cornett, Financial Institutions Management, 4th ed. 58 Figure 8.6 Loss distribution for single loan portfolio severity rate = $20,000 per $100,000 loan. — 0.25 Expected Loss 0.2 Unexpected Loss 0.15 0.1 0.05 Economic Capital 0 0 60,000 100,000 160,000 200,000 250,000 300,000 350,000 400,000 Amount of Loss in $ Saunders & Cornett, Financial Institutions Management, 4th ed. 59 Figure 8.7 Single loan portfolio per $100,000 loan. —severity rate = $40,000 0.25 0.2 0.15 0.1 0.05 0 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 Amount of Loss in $ Saunders & Cornett, Financial Institutions Management, 4th ed. 60 Calculating the Loss Distribution of a Portfolio Consisting of 2 Bands: $20,000 and $40,000 Loss Severity Aggregate Portfolio Loss ($) 0 20,000 40,000 60,000 80,000 (Loss on v = 1, Loss on v = 2) in $20,000 units Probability (0,0) (.0497 x .0497) (1,0) (.1493 x .0497) [(2, 0) (0,1)] [(.224 x .0497) + (.0497 x.1493)] [(3, 0) (1, 1)] [(.224 x .0497) + (.1493)2] [(4, 0) (2,l) (0, 2)] [(.168 x.0497) + (.224 x.1493) + (.0497x.224)] Saunders & Cornett, Financial Institutions Management, 4th ed. 61 Add Another Severity Band • • • • Assume average loss exposure of $40,000 100 loans in the $40,000 band Assume a historic default rate of 3% Combining the $20,000 and the $40,000 loss severity bands makes the loss distribution more “normal.” Fig. 8.8. Saunders & Cornett, Financial Institutions Management, 4th ed. 62 Figure 8.8 Loss distribution for tw o loan portfolios w ith severity rates of $20,000 and $40,000. 0.120 0.100 0.080 0.060 0.040 0.020 0.000 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 Amount of Loss in $ Saunders & Cornett, Financial Institutions Management, 4th ed. 63 Oversimplifications • The mean default rate was assumed constant in each severity band. Should be a function of macroeconomic conditions. • Ignores default correlations – particularly during business cycles. Saunders & Cornett, Financial Institutions Management, 4th ed. 64 Loan Portfolio Selection and Risk Measurement Chapter 12 Saunders & Cornett, Financial Institutions Management, 4th ed. 65 The Paradox of Credit • Lending is not a “buy and hold”process. • To move to the efficient frontier, maximize return for any given level of risk or equivalently, minimize risk for any given level of return. • This may entail the selling of loans from the portfolio. “Paradox of Credit” – Fig. 10.1. Saunders & Cornett, Financial Institutions Management, 4th ed. 66 Figure 10.1 The paradox of credit. B The Efficient Frontier Return C 0 A Risk Saunders & Cornett, Financial Institutions Management, 4th ed. 67 Managing the Loan Portfolio According to the Tenets of Modern Portfolio Theory • Improve the risk-return tradeoff by: – Calculating default correlations across assets. – Trade the loans in the portfolio (as conditions change) rather than hold the loans to maturity. – This requires the existence of a low transaction cost, liquid loan market. – Inputs to MPT model: Expected return, Risk (standard deviation) and correlations Saunders & Cornett, Financial Institutions Management, 4th ed. 68 The Optimum Risky Loan Portfolio – Fig. 10.2 • Choose the point on the efficient frontier with the highest Sharpe ratio: – The Sharpe ratio is the excess return to risk ratio calculated as: r R p f p Saunders & Cornett, Financial Institutions Management, 4th ed. 69 Figure 10.2 The optimum risky loan portfolio B D Return (Rp ) rf A C Risk (p ) Saunders & Cornett, Financial Institutions Management, 4th ed. 70 Problems in Applying MPT to Untraded Loan Portfolios • Mean-variance world only relevant if security returns are normal or if investors have quadratic utility functions. – Need 3rd moment (skewness) and 4th moment (kurtosis) to represent loan return distributions. • Unobservable returns – No historical price data. • Unobservable correlations Saunders & Cornett, Financial Institutions Management, 4th ed. 71 KMV’s Portfolio Manager • Returns for each loan I: – Rit = Spreadi + Feesi – (EDFi x LGDi) – rf • Loan Risks=variability around EL=EGF x LGD = UL – LGD assumed fixed: ULi = EDF (1 EDF ) – LGD variable, but independent across borrowers: ULi = EDFi(1 EDFi) LGDi2 EDFiVOL2i – VOL is the standard deviation of LGD. VVOL is valuation volatility of loan value under MTM model. – MTM model with variable, indep LGD (mean LGD): ULi = EDFi(1 EDFi) LGDi2 EDFiVVOL2i (1 EDFi)VVOL2i Saunders & Cornett, Financial Institutions Management, 4th ed. 72 Correlations • Figure 11.2 – joint PD is the shaded area. • GF = GF/GF • GF = JDFGF ( EDFG EDFF ) EDFG (1 EDFG ) EDFF (1 EDFF ) • Correlations higher (lower) if isocircles are more elliptical (circular). • If JDFGF = EDFGEDFF then correlation=0. Saunders & Cornett, Financial Institutions Management, 4th ed. 73 Figure 11.2 Value correlation. Market Value of Assets - Firm G Firm G Market Value of Assets - Firm F Firm F 100(1-LGD) Face Value of Debt 100 Firm F ’s Debt Payoff Saunders & Cornett, Financial Institutions Management, 4th ed. 74