Part II

advertisement

Operations

Management

Linear Programming

Module B - Part 2

B-1

Problem B.23

1. Gross Distributors packages and distributes industrial

supplies. A standard shipment can be packaged in a class A

container, a class K container, or a class T container. The

profit from using each type of container is: $8 for each class

A container, $6 for each class K container, and $14 for each

class T container. The amount of packing material required

by each A, K and T container is 2, 1 and 3 lbs., respectively.

The amount of packing time required by each A, K, and T

container is 2, 6, and 4 hours, respectively. There is 120 lbs

of packing material available each week. Six packers must

be employed full time (40 hours per week each). Determine

how many containers to pack each week.

B-2

Problem B.23

Container

A

K

T

Profit

$8

$6

$14

Amount available

Packing

material (lbs.)

2

1

3

Packing

time (hrs.)

2

6

4

120

=240

B-3

Problem B.23

xi = Number of class i containers to pack each

week. i=A, K, T

Maximize: 8xA +

6xK + 14xT

2xA + xK +

2xA + 6xK +

3xT 120 (lbs.)

4xT = 240 (hours)

xA, xK, xT 0

B-4

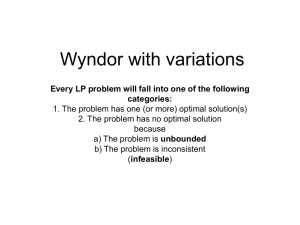

Linear Programming Solutions

Unique Optimal Solution.

Multiple Optimal Solutions.

Infeasible (no solution).

x + y 800

x

1000

x, y 0

Unbounded (infinite solution).

Maximize 3x + 2y

x + y 1000

B-5

Computer Solutions

Optimal values of decision variables and

objective function.

Sensitivity information for objective function

coefficients.

Sensitivity information for RHS (right-hand

side) of constraints and shadow price.

B-6

Computer Solutions

Enter data from formulation in Excel.

1 row for the coefficients of objective.

1 row for coefficients & RHS of each constraint.

1 final row for solution (decision variable) values.

Select Solver from the Tools Menu.

B-7

Computer Solutions - Spreadsheet

B-8

Computer Solutions - Spreadsheet

B-9

Computer Solutions - Spreadsheet

B-10

Computer Solutions - Solver

B-11

Computer Solutions - Solver

B-12

Computer Solutions - Solver Parameters

B-13

Computer Solutions

Set Target Cell: to value of objective function.

E3

Equal To: Max or Min

By Changing Cells: = Sol’n values (decision

variable values).

B7:D7

Subject to the Constraints:

Click Add to add each constraint:

LHS =, , RHS

B-14

Computer Solutions - Adding Constraints

Cell Reference: LHS location

Select sign : <=, =, >=

Constraint: RHS location

B-15

Computer Solutions - Adding Constraints

1st constraint.

Click Add.

Repeat for second constraint.

B-16

Computer Solutions

Click Options to set up Solver for LP.

B-17

Computer Solutions - Solver Options

Check ‘on’ Assume Linear Model and

Assume Non-Negative.

B-18

Computer Solutions

Click Solve to find the optimal solution.

B-19

Computer Solutions - Solver Results

B-20

Computer Solutions - Optimal Solution

Optimal solution is to use:

0 A containers

17.14 K containers

34.29 T containers

Maximum profit is $583 per week.

Actually $582.857… in Excel values are rounded.

B-21

Computer Solutions

Optimal solution is to use:

0 class A containers.

17.14 class K containers.

34.29 class T containers.

Maximum profit is $582.857 per week.

Select Answer and Sensitivity Reports and

click OK.

New pages appear in Excel.

B-22

Computer Solution - Answer Report

Microsoft Excel 8.0e Answer Report

Worksheet: [probb.23.xls]Sheet1

Report Created: 1/31/01 9:53:27 PM

Target Cell (Max)

Cell

Name

$E$3 Objective LHS

Original Value Final Value

28 582.8571429

Adjustable Cells

Cell

Name

Original Value Final Value

$B$7 Sol'n values A cont.

1

0

$C$7 Sol'n values K cont.

1 17.14285714

$D$7 Sol'n values T cont

1 34.28571429

Constraints

Cell

Name

$E$4 lbs. LHS

$E$5 hours LHS

Cell Value

Formula

Status Slack

120 $E$4<=$F$4 Binding

0

240 $E$5=$F$5 Binding

0

B-23

Sensitivity Analysis

Projects how much a solution will change if

there are changes in variables or input data.

Shadow price (dual) - Value of one additional

unit of a resource.

B-24

Computer Solution - Sensitivity Report

Microsoft Excel 8.0e Sensitivity Report

Worksheet: [probb.23.xls]Sheet1

Report Created: 1/31/01 9:53:27 PM

Adjustable Cells

Cell

$B$7

$C$7

$D$7

Final

Value

Reduced

Objective

Allowable Allowable

Name

Cost

Coefficient

Increase

Decrease

Sol'n values A cont.

0 -1.142857143

8 1.142857143

1E+30

Sol'n values K cont. 17.14285714

0

6

8

1E+30

Sol'n values T cont 34.28571429

0

14

1E+30

1.6

Constraints

Cell

Name

$E$4 lbs. LHS

$E$5 hours LHS

Final

Value

120

240

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

B-25

Allowable Allowable

Increase

Decrease

60

80

480

80

Computer Solution - Sensitivity Report

Microsoft Excel 8.0e Sensitivity Report

Worksheet: [probb.23.xls]Sheet1

Report Created: 1/31/01 9:53:27 PM

Adjustable Cells

Cell

$B$7

$C$7

$D$7

Final

Value

Reduced

Objective

Allowable Allowable

Name

Cost

Coefficient

Increase

Decrease

Sol'n values A cont.

0 -1.142857143

8 1.142857143

1E+30

Sol'n values K cont. 17.14285714

0

6

8

1E+30

Sol'n values T cont 34.28571429

0

14

1E+30

1.6

Optimal solution:

0

class A containers

17.14285… class K containers

34.28571… class T containers

Profit = 0(8) + 17.14285(6) + 34.28571(14) = $582.857

B-26

Computer Solution - Sensitivity Report

Microsoft Excel 8.0e Sensitivity Report

Worksheet: [probb.23.xls]Sheet1

Report Created: 1/31/01 9:53:27 PM

Adjustable Cells

Cell

$B$7

$C$7

$D$7

Final

Value

Reduced

Objective

Allowable Allowable

Name

Cost

Coefficient

Increase

Decrease

Sol'n values A cont.

0 -1.142857143

8 1.142857143

1E+30

Sol'n values K cont. 17.14285714

0

6

8

1E+30

Sol'n values T cont 34.28571429

0

14

1E+30

1.6

Constraints

Cell

Name

$E$4 lbs. LHS

$E$5 hours LHS

Final

Value

120

240

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

B-27

Allowable Allowable

Increase

Decrease

60

80

480

80

Sensitivity for Objective Coefficients

Objective

Allowable Allowable

Coefficient

Increase

Decrease

8 1.142857143

1E+30

6

8

1E+30

14

1E+30

1.6

As long as coefficients are in range indicated, then

current solution is still optimal, but profit may

change!

Current solution is optimal as long as:

Coefficient of xA is between -infinity and 9.142857

Coefficient of xK is between -infinity and 14

Coefficient of xT is between 12.4 and infinity

B-28

Sensitivity for Objective Coefficients

Objective

Allowable Allowable

Coefficient

Increase

Decrease

8 1.142857143

1E+30

6

8

1E+30

14

1E+30

1.6

If profit for class K container was 12 (not 6), what

is optimal solution?

B-29

Sensitivity for Objective Coefficients

Objective

Allowable Allowable

Coefficient

Increase

Decrease

8 1.142857143

1E+30

6

8

1E+30

14

1E+30

1.6

If profit for class K container was 12 (not 6), what

is optimal solution?

xA=0, xK=17.14, xT=34.29 (same as before)

profit = 685.71 (more than before!)

B-30

Sensitivity for Objective Coefficients

Objective

Allowable Allowable

Coefficient

Increase

Decrease

8 1.142857143

1E+30

6

8

1E+30

14

1E+30

1.6

If profit for class K container was 16 (not 6), what

is optimal solution?

B-31

Sensitivity for Objective Coefficients

Objective

Allowable Allowable

Coefficient

Increase

Decrease

8 1.142857143

1E+30

6

8

1E+30

14

1E+30

1.6

If profit for class K container was 16 (not 6), what

is optimal solution?

Different!

Resolve problem to get solution.

B-32

Computer Solution - Sensitivity Report

Microsoft Excel 8.0e Sensitivity Report

Worksheet: [probb.23.xls]Sheet1

Report Created: 1/31/01 9:53:27 PM

Adjustable Cells

Cell

$B$7

$C$7

$D$7

Final

Value

Reduced

Objective

Allowable Allowable

Name

Cost

Coefficient

Increase

Decrease

Sol'n values A cont.

0 -1.142857143

8 1.142857143

1E+30

Sol'n values K cont. 17.14285714

0

6

8

1E+30

Sol'n values T cont 34.28571429

0

14

1E+30

1.6

Constraints

Cell

Name

$E$4 lbs. LHS

$E$5 hours LHS

Final

Value

120

240

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

B-33

Allowable Allowable

Increase

Decrease

60

80

480

80

Sensitivity for RHS values

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

Allowable Allowable

Increase

Decrease

60

80

480

80

Shadow price is change in objective value for each unit

change in RHS as long as change in RHS is within range.

Each additional lb. of packing material will increase profit

by $4.2857... for up to 60 additional lbs.

Each additional hour of packing time will increase profit

by $0.2857... for up to 480 additional hours.

B-34

Sensitivity for RHS values

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

Allowable Allowable

Increase

Decrease

60

80

480

80

Suppose you can buy 50 more lbs. of packing

material for $250. Should you buy it?

B-35

Sensitivity for RHS values

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

Allowable Allowable

Increase

Decrease

60

80

480

80

Suppose you can buy 50 more lbs. of packing

material for $250. Should you buy it?

NO. $250 for 50 lbs. is $5 per lb.

Profit increase is only $4.2857 per lb.

B-36

Sensitivity for RHS values

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

Allowable Allowable

Increase

Decrease

60

80

480

80

How much would you pay for 50 more lbs. of

packing material?

B-37

Sensitivity for RHS values

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

Allowable Allowable

Increase

Decrease

60

80

480

80

How much would you pay for 50 more lbs. of

packing material?

$214.28

50 lbs. $4.2857/lb. = $214.2857...

B-38

Sensitivity for RHS values

Shadow

Constraint

Price

R.H. Side

4.285714286

120

0.285714286

240

Allowable Allowable

Increase

Decrease

60

80

480

80

If change in RHS is outside range (from allowable

increase or decrease), then we can not tell how the

objective value will change.

B-39

Extensions of Linear Programming

Integer programming (IP): Some or all variables are

restricted to integer values.

Allows “if…then” constraints.

Much harder to solve (more computer time).

Nonlinear programming: Some constraints or

objective are nonlinear functions.

Allows wider range of situations to be modeled.

Much harder to solve (more computer time).

B-40

Integer Programming

{

1

{

0

x1

x2

1 if we build a factory in St. Louis

0 otherwise.

if we build a factory in Chicago

otherwise.

We will build one factory in Chicago or St. Louis.

x1 + x 2 1

We will build one factory in either Chicago or St. Louis.

x1 + x 2 = 1

If we build in Chicago, then we will not build in St. Louis.

x2 1 - x1

B-41

Harder Formulation Example

You are creating an investment portfolio from 4

investment options: stocks, real estate, T-bills

(Treasury-bills), and cash. Stocks have an annual rate

of return of 12% and a risk measure of 5. Real estate

has an annual rate of return of 10% and a risk measure

of 8. T-bills have an annual rate of return of 5% and a

risk measure of 1. Cash has an annual rate of return of

0% and a risk measure of 0. The average risk of the

portfolio can not exceed 5. At least 15% of the portfolio

must be in cash. Formulate an LP to maximize the

annual rate of return of the portfolio.

B-42

Another Formulation Example

A business operates 24 hours a day and employees

work 8 hour shifts. Shifts may begin at midnight, 4 am,

8 am, noon, 4 pm or 8 pm. The number of employees

needed in each 4 hour period of the day to serve

demand is in the table below. Formulate an LP to

minimize the number of employees to satisfy the

demand.

Midnight

- 4 am

3

4 am 8 am

6

8 am noon

13

Noon 4 pm

15

B-43

4 pm - 8 pm 8 pm midnight

12

9