Refineries (VLO, Provident, IPL)

advertisement

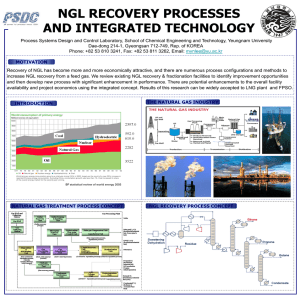

PETROLEUM REFINING AGENDA • Introduction • Industry Overview • Risk Analysis • Company Analysis • Valero Energy Corporation • Provident • Inter Pipeline •Conclusion •Recommendations INDUSTRY OVERVIEW Main Sector in Oil and Gas Industry Petroleum Refining • A refinery takes a raw material (crude oil) and transforms it into petrol and hundreds of other useful products. • What refining does: – Adjusts and reshapes molecules – Standardizes product – Removes contaminants to meet requirements for: • end-user performance • environmental regulations Major Products Light distillates Middle distillates Heavy fuel oil • LPG • Gasoline • Naphtha • Kerosene • Diesel • Heavy distillates and residuum • Lubricating oils • Wax • Asphalt Main Processes • All refineries perform three basic steps: Separation: fractional distillation) Conversion: cracking and rearranging the molecules Treatment: blending, purifying, fine-tuning and improving products to meet specific requirements Refinery System World’s Top Refineries Companies in 2011 1,400 Jamnagar Refinery (Reliance Industries Limited) Paraguana Refinery Complex (PDVSA) SK Energy Co., Ltd. Ulsan Refinery (SK Energy) GS-Caltex Yeosu Refinery (GS Caltex) Singapore (ExxonMobil) 1,240 Thousand barrel per day 1,200 1,000 940 850 800 600 400 200 0 730 605 572 550 503 446 Baytown Refinery (ExxonMobil) Ras Tanura Refinery (Saudi Aramco) Baton Rouge Refinery (ExxonMobil) Texas City Refinery (BP) Geographic distribution in U.S. U.S. Top Refineries Companies in 2011 600 500 561 502 500 464 428 400 300 EXXON MOBIL CORP (Taxes) EXXON MOBIL CORP-Louisiana HOVENSA LLC 407 405 362 345 MARATHON OIL CORP PDV AMERICA INC BP PLC-Taxes 200 BP PLC2-Indiana 100 0 WRB REFINING LLC EXXON MOBIL CORP3 Refineries in Canada Thousand of Cube Meters per day in 2007 Canada Top Refineries Companies 2010 Refining Capacity Changes for Integrated Majors Refining Capacity Changes for Integrated Majors IMPLICATIONS:DOWNSTREAM DIVESTMENTS • Integrated majors continuing to exit refining business – some through divestment of refining assets and some through spinning off of Downstream business as a separate corporate entity. • Result is that refinery ownership is moving away from integrated majors towards non-integrated companies. • To remain viable, refining businesses will need to be able to generate sufficient cash to provide an adequate return to their owners Evaluation of Refinery Capacity Future Capacity Forecast Factors Determining Gas Price 5% Crude oil costs 18% 47% Taxes and GST Refiner's margin 30% Marketing (or retail) margin Refinery Margin and Major Costs • Refining margin = total value of petroleum products the price of the raw material-other costs • Major Costs – Fixed operating costs: labour, maintenance, taxes and overhead costs – Variable operating costs: feed-dependent costs for power, water, chemicals, additives, catalyst and refinery fuels beyond own production – Transport costs – Marginal crude freight – Insurance and ocean loss – Applicable fees and duties Regional Refining Margins $/barrel REGULATION ENVIRONMENT Green House Gas Regulation • EPA has started to propose regulation of GHG’s under existing CAA programs such as Vehicle Emissions standards rule, Prevention of Significant Deterioration, and New Source Performance Standards • Under these regulations, permits will be required for projects that emit threshold levels of CO2 (regardless of emissions of other criteria pollutants such as SOx, NOx, etc. Implications • Significantly more permits will be required for refinery modifications • Require installation of BACT (Best Available Control Technology) for managing CO2 emissions. BACT to be determined on case-by-case basis. • EPA is currently working on approach for refinery GHG measures: Energy management Command and control (source specific emission limits) Benchmarking • In any case, greater focus on energy reduction projects will likely be required. Reformulated Fuel Standard (RFS2) – RFS program was created under the Energy Policy Act of 2005. Established first renewable fuel mandate – 7.5 billion gallons by 2012 – Established new categories of renewable fuel and mandates for each, and increased volumes of renewable fuel (9 billion gallons in 2008 to 36 billion gallons by 2022) Reformulated Fuel Standard (RFS2) Implications • Growth in biofuels exceeds overall growth in transportation fuels – increased pressure on refining • Significant expansion in facilities required to manufacture, store, transport, and blend biofuels • Impact of increasing biofuels volumes will result in changes to mix of fuel blending components – refinery configuration and/or new technologies Other Regulations • Clean Air Act – Dominant regulatory effect on refinery operations • Reformulated gasoline (RFG) standards – Affects operations indirectly through restrictions on product mix • • • • Clean Water Act RCRA State regulations Corporate Average Fuel Economy (CAFE) standards – Indirect effect through performance requirements on products Risk Analysis Typical Risks in the Oil and Gas Industry Key drivers and Challenges in Refinery Risk Exposure • • • • • • • Operational Risk Environmental Consideration Economic and Political Risk Commodity Risk Financial Risk Regulatory Limitations Limitation on Capacity Environmental Impacts and Risks • Air Refinery emissions contain several major ozone precursors. The associated impacts would be most significant near and downwind of a given facility. • Water and soil Potential for contamination from leaks and spills • Carcinogens Benzene is a significant component of refinery air emissions • Global warming Future Regulation: Waxman-Markey Legislation • Market Environment Characterized by Rising Regulatory Costs and Excess Capacity Abroad – Rising costs of production from recently enacted environmental and regulatory requirements. – Rising competition from foreign competitors – 7.6 – 8.8 million barrels per day (mb/d) of new refining capacity is expected to come online by 2015 – 80% of which will be built outside of the OECD. Flat or declining demand for transportation fuels in the U.S. market. – Rising taxes, and biofuel mandates will further shrink margins and place 2.5 mb/d of the current 17.5 mb/d of domestic operable capacity at high risk of permanent closure early in the 2015-2030 forecast period. Future Regulation: Waxman-Markey Legislation Future Regulation: Waxman-Markey Legislation Implications Gasoline Prices • In the 2015-2030 gasoline prices could rise by an average of $0.20 to $0.40 per gallon under the carbon costs calculated by the U.S. Environmental Protection Agency (EPA). • Gasoline, and all other petroleum based transportation fuels, could rise by over $1/gallon under some CO2 allowance cost forecasts by the U.S. Energy Information Administration (EIA). Risk Measurement • Sensitivity analysis • Simulation Analysis • Probability Estimation • Value at Risk (VaR) Risk Management • Diversification and Insurance • OTC Forward Contracts • Exchange-Traded Energy Futures • Foreign Exchange Futures • Hedging through Options Valero Energy Corporation VLO - NYSE Overview Fortune 500 company based in San Antonio, Texas Incorporated in 1981 – Valero Refining & Marketing Company Changed name in 1997 to Valero Energy Corporation 22,000 employees Executives Bill Klesse Chairman of the Board, CEO and President • Started out as chemical engineer • BSci Chem Eng • MBA in Finance Jay Browning Senior Vice PresidentCorporate Law and Secretary • Responsible for Corporate Governance, Finance, Securities and Exchange Commission, and Information Systems Support. • BBA & MBA in Finance Mike Ciskowski Executive Vice President and Chief Financial Officer • Responsible for Treasury, Finance, Accounting, Internal Audit, Trading Controls and Insurance • BBA & MBA in Finance Donna Titzman Vice President and Treasurer • Responsible for the company’s banking, cash management, customer credit and investment management areas. • BBA Accounting, CPA Segments Refining Refining operations, wholesale marketing, product supply and distribution, and transportation operations Ethanol Sales of internally produced ethanol and distillers grains Our ethanol operations are geographically located in the central plains region of the U.S. Retail Company-operated convenience stores, Canadian dealers/jobbers, truckstop facilities, cardlock facilities, and home heating oil operations. Segregated into Retail-US and Retail-Canada Competitors 2010 Refining Capacity in USA Financial Statements Segment Revenues Gross margin: 9.2% Operating margin: 3% Operations - Petroleum 16 petroleum refineries are located in the United States (U.S.), Canada, the United Kingdom (U.K.), and Aruba Conventional gasolines Distillates Jet fuel Asphalt Petrochemicals Lubricants Premium products including CBOB and RBOB1 Gasoline meeting the specifications of the California Air Resources Board (CARB) CARB diesel fuel Low−sulfur and ultra−low−sulfur diesel fuel Refining Capacity Refining Yields Feedstock Supply • • Approximately 63 percent of our current crude oil feedstock requirements are purchased through term contracts while the remaining requirements are generally purchased on the spot market. The majority of the crude oil purchased under our term contracts is purchased at the producer’s official stated price (i.e., the “market” price established by the seller for all purchasers) and not at a negotiated price specific to us. Feedstock Supply • • Approximately 63 percent of our current crude oil feedstock requirements are purchased through term contracts while the remaining requirements are generally purchased on the spot market. The majority of the crude oil purchased under our term contracts is purchased at the producer’s official stated price (i.e., the “market” price established by the seller for all purchasers) and not at a negotiated price specific to us. Marketing We market our refined products through an extensive bulk and rack marketing network and we sell refined products through a network of approximately 6,800 retail and wholesale branded outlets in the United States (U.S.), Canada, the United Kingdom (U.K.), Aruba, and Ireland under various brand names including Valero®, Diamond Shamrock®, Shamrock®, Ultramar®, Beacon®, and Texaco® Operations - Ethanol • 10 ethanol plants in the Midwest Operations - Retail Retail – U.S. Sales of transportation fuels Average 119,780 BPD Fuels sold under Valero brand Convenience store merchandise and services 998 company-operated sites under Corner Store brand name Retail – Canada Sales of transportation fuels Average 76,100 BPD Fuels sold under Ultramar brand 791 outlets 381 owned 410 independent dealers and jobbers Sales of home heating oil to residential customers Growth Strategy “leads in shareholder value growth through innovative, efficient upgrading of low cost feedstocks into high value, high quality products.” Aggressive “growth through acquisitions” strategy Since 1997 1,000 to 22,000 employees 1 to 16 refineries 0.2 to 3 million BPD capacity Risk Oversight The Board considers oversight of Valero’s risk management efforts to be a responsibility of the full board Risk management is an integral part of Valero’s annual strategic planning process, which addresses, among other things, the risks and opportunities facing Valero Risk Management Policies “The Board had a Finance Committee in 2010. The Finance Committee reviewed and monitored the investment policies and performance of our Thrift Plan and pension plans, insurance and risk management policies and programs, and finance matters and policies as needed. During 2010, the members of the Finance Committee were Irl F. Engelhardt (Chairman), Ruben M. Escobedo, Bob Marbut, Susan Kaufman Purcell, and Stephen M. Waters. The Finance Committee met three times in 2010. The Board has determined that it will not have a separately appointed Finance Committee in 2011.” Risk Factors 1. Volatility of refining margins & global economic activity • Primarily affected by the relationship, or margin, between refined product prices and the prices for crude oil and other feedstocks • Affected by regional/global supply & demand for crude oil and refined products, US & global economies, US relationships with foreign governments, governmental regulation Risk Factors 2. Uncertainty and illiquidity in credit and capital markets • Can impair our ability to obtain credit and financing on acceptable terms, and can adversely affect the financial strength of our business partners Risk Factors 3. Compliance with and changes in environmental laws • Emissions into the air and releases into the soil, surface water, or groundwater • Level of expenditures required for environmental matters could increase in the future due to more stringent and new environment laws and regulations Risk Factors 4. Disruption of our ability to obtain crude oil could adversely affect our operations • Supplies originating in Middle East, Africa, Asia, North America & South America •Political, geographic and economic risks • Possibility for unavailability of alternative sources or volumes at unfavourable prices Risk Factors 5. Reliance on third-party transportation of crude oil and refined products • Subject to interruptions in supply and increased costs •Weather events, accidents, governmental regulations, or third-party actions Risk Factors 6. Competitors that produce their own supply of feedstocks, have more extensive retail outlets, or have greater financial resources may have a competitive advantage • Do not produce any of our crude oil feedstocks •Many competitors obtain significant portion of feedstocks from company-owned production Risk Factors 7. A significant interruption in one or more of our refineries could adversely affect our business • Refineries are principal operating assets • Interruption: lost production and repair costs Risk Factors 8. Insurance may not cover all potential losses from operating hazards • We maintain insurance against many, but not all, potential losses arising from operating hazards •For example, coverage for hurricane damage is very limited, and coverage for terrorism risks includes very broad exclusions • Failure by one or more insurers to honor its coverage commitments for an insured event Risk Factors 9. Compliance with and changes in tax laws could adversely affect our performance •Extensive tax liabilities imposed by multiple jurisdictions, including • income taxes, • transactional taxes (excise/duty, sales/use, and value-added taxes), • payroll taxes, • franchise taxes, • withholdingtaxes, and • ad valorem taxes. Risk Factors 10. Losses as a result of our forward-contract activities and derivative transactions • Currently use derivative instruments • Expect to continue their use in the future • If these instruments we use to hedge are not effective, we may incur losses Item 7A Commodity Price Risk Interest Rate Risk Foreign Currency Risk Compliance Program Price Risk Commodity Price Risk • Future markets for liquidity • Swaps for price exposure • Certain commodity derivative instruments for trading purposes to take advantage of existing market conditions related to future results of operations and cash flows Commodity Price Risk “Our positions in commodity derivative instruments are monitored and managed on a daily basis by a risk control group to ensure compliance with our stated risk management policy that has been approved by our board of directors.” Commodity Price Risk Sensitivity Analysis Commodity Price Risk For risk management, we use: • Fair Value Hedges • Cash Flow Hedges • Economic Hedges • Trading Derivatives Commodity Price Risk Fair Value Hedges Hedge price volatility in certain refining inventories and firm commitments to purchase inventories Level of activity for our fair value hedges is based on the level of our operating inventories, and generally represents the amount by which our inventories differ from our previous year-end LIFO inventory levels Commodity Price Risk Cash Flow Hedges • Price volatility in certain forecasted feedstock, refined product purchases, refined product sales & natural gas purchases Commodity Price Risk Economic Hedges • Manage price volatility in certain (i) refinery feedstock, refined product, and corn inventories, (ii) forecasted refinery feedstock, refined product, and corn purchases, and refined product sales, and (iii) fixed-price corn purchase contracts Commodity Price Risk Trading Derivatives • Take advantage of existing market conditions related to future results of operations and cash flows Interest Rate Risk No outstanding interest rate derivatives as of Dec 31, 2011 & 2010 Foreign Currency Risk As of December 31, 2011, we had commitments to purchase $751 million of U.S. dollars Our market risk was minimal on the contracts, as they matured on or before January 26, 2012, resulting in a $3 million loss Compliance Program Price Risk Exposed to volatility in the price of financial instruments associated with various governmental and regulatory compliance programs that we must purchase in the open market to comply with these programs. As of December 31, 2011, we had purchased futures contracts – long for 68,000 metric tons of EU emission allowances that were entered into as economic hedges. Fair Value Measurements Fair Values of Derivative Instruments Corporate Overview Calgary based corporation that owns and operates NGL midstream services Provides natural gas liquids midstream processing and marketing in western and central Canada and the United States 4th largest integrated oil and gas company in Canada Energy products include: ethane, butane, propane, condensate Non energy products: storage, processing, terminalling and transportation Corporate Overview The Midstream business unit extracts, processes, stores, transports and markets natural gas liquids (NGLs) for Provident and offers these services to third party customers Three operations: Empress East Redwater West Commercial Services Map of Operations Empress East Extracts NGLs from natural gas at the Empress straddle plants and sells finished products into markets in central Canada and the eastern United States. The margin in this business is determined primarily by the “frac spread ratio”, which is the ratio between crude oil prices and natural gas prices Demand for propane is seasonal and results in inventory that generally builds over the second and third quarters of the year and is sold in the fourth quarter and the first quarter of the following year . Redwater West Purchases an NGL mix from various producers and fractionates it into finished products at the Redwater fractionation facility, the feedstock for this business line is primarily NGL mix rather than natural gas, the frac spread ratio has a smaller impact on margin than in the Empress East business line Captures supply from northeast British Columbia and northwest Alberta and generates revenues through extraction, gathering, transportation, storage and fractionation of NGL into finished products Has several significant competitive advantages including the ability to process sour NGL and is one of only two fractionation facilities in the Fort Saskatchewan area capable of processing ethane-plus Located at the Redwater facility is rail-based condensate terminal, which serves the heavy oil industry and its need for diluent Commercial services Commercial Services - generates income from relatively stable fee-forservice contracts to provide fractionation, storage, loading, and marketing services to upstream producers. Income from pipeline tariffs from Provident's ownership in NGL pipelines is also included in this business line Redwater facility has a rail unloading capacity of 110 rail cars per day or 75,000 bpd Storage facilities at both Empress East and Redwater West facilities seven million gross barrels at Empress East 50% ownership of 2.5 mm-bbl storage cavern and 100% ownership of 1000 acre 12 million barrel storage cavern at Redwater West Stock Details Financial Statements Provident Midstream business performance Risk Factors 1. Frac Spread and Commodity Price Exposed to possible price declines between the time Provident purchases NGL feedstock and sells NGL products, and to narrowing frac spreads Also a differential between NGL product prices and crude oil prices which can change prices received and margins realized for midstream products separate from frac spread ratio changes Risk Factors 2.Facilities Throughput and Product Demand Volumes of natural gas processed through Provident's natural gas liquids midstream processing and marketing business and of NGLs and other products transported in the pipelines depend on production of natural gas in the areas serviced by the business and pipelines Without reserve additions, production will decline over time as reserves are depleted and production costs may rise Producers may shut in production at lower product prices or higher production costs Producers in the areas serviced by the business may not be successful in exploring for and developing additional reserves, and the gas plants and the pipelines may not be able to maintain existing volumes of throughput Risk Factors 3.Operating and Capital Costs Operating and Capital Costs may vary considerably from current and forecast values and rates and represent significant components of the cost of providing service Risk Factors 4.Reliance on Principal Customers and Operators Rely on several significant customers to purchase product from the Midstream Business If for any reason these parties were unable to perform their obligations under the various agreements with Provident, the revenue and dividends of Provident, and the operations of the Midstream Business could be negatively impacted Risk Factors 5.Operational Matters and Hazards Subject to common hazards of the natural gas processing and pipeline transportation business The operation of Provident's natural gas liquids midstream processing and marketing business could be disrupted by natural disasters or other events beyond the control of Provident Risk Factors 6.Competition Subject to competition from other gas processing plants which are either in the general vicinity of the gas plants or have gathering systems that are or could potentially extend into areas served by the gas plants Producers in Western Canada compete with producers in other regions to supply natural gas and gas products to customers in North America and the natural gas and gas products industry also competes with other industries to supply the fuel, feedstock and other needs of consumers Risk Factors 7.Regulatory Intervention Pipelines and facilities can be subject to common carrier and common processor applications and to rate setting by regulatory authorities in the event agreement on fees or tariffs cannot be reached with producers Risk Factors 8.Environmental Considerations Major equipment failure, release of toxic substances or pipeline rupture could result in damage to the environment and Provident's natural gas liquids midstream processing and marketing business, death or injury and substantial costs and liabilities to third parties The gas processing and gathering industry is regulated by federal and provincial environmental legislation Risk Factors 9.Variations in Interest Rates and Foreign Exchange Rates Variations in interest rates could result in a significant change in the amount Provident pays to service debt, potentially impacting dividends to Shareholders. Variations in the exchange rate for the Canadian dollar versus the U.S. dollar could affect future dividends Risk Management Philosophy Provident has an Enterprise Risk Management program that is designed to identify and manage risks that could negatively impact the business, operations, or results Utilizes a hedging program that protects a portion of the company's cash flow and supports continued unitholder distributions, capital programs, and bank financing Has an insurance program in place to mitigate the economic costs associated with risks to the business, its assets, and its people Manages counterparty exposure with a credit policy that establishes limits by counterparty based on an analysis of financial information and other business factors Risk Management overview Enterprise Risk Management program that is designed to identify and manage risks that could negatively affect its business, operations or results. The program’s activities include risk identification, assessment, response, control, monitoring and communication of derivative instruments Provident uses include put and call options, costless collars, participating swaps, and fixed price products that settle against indexed referenced pricing Provident’s commodity price risk management program utilizes derivative instruments to provide for protection against lower commodity prices and product margins, as well as fluctuating interest and foreign exchange rates. Provident may also use derivative instruments to protect acquisition economics. The program is designed to stabilize cash flows in order to support cash distributions, capital programs and bank financing Fair Values Fair value measurement of assets and liabilities recognized on the consolidated statement of financial position are categorized into levels within a fair value hierarchy based on the nature of valuation inputs Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities; Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly; and Level 3 – Inputs that are not based on observable market data Provident’s financial derivative instruments have been classified as Level 2 instruments Financial Derivative Sensitivity Analysis Market Environment Market Risk Market risk is the risk that the fair value of a financial instrument will fluctuate because of changes in market prices Price risk Currency risk Interest risk Market Risk Management Program Utilizes financial derivative instruments to provide protection against commodity price volatility and protect a base level of operating cash flow Protect the relationship between the purchase cost of natural gas and the sales price of propane, butane and condensate and to protect the relationship between NGLs and crude oil in physical sales contracts Reduces foreign exchange risk due to the exposure arising from the conversion of U.S. dollars into Canadian dollars, interest rate risk and fixes a portion of Provident’s input costs Risk Management Contracts Settlement of Contracts Liquidity Risk Credit Risk Net Financial Derivative Instruments Commodity Price Risk Program Provident's commodity price risk management program utilizes commodity hedges to protect against adverse price movements Provident's intention is to routinely hedge approximately 50 percent of its natural gas and NGL volumes on a rolling 12 month basis. Subject to market conditions, Provident may add additional hedges as appropriate for up to 24 months Frac Spread Volumes Contracts In Place Contracts In Place Historical Stock Price Corporate Profile – IPL Petroleum transportation, storage and natural gas liquids extraction business Operating approximately 6,100 kilometres of petroleum pipelines and 4.8 million barrels of storage in western Canada Made the 100 Venture’s list Executives CEO: David W. Fesyk President since 1997 Senior executive and general partner at Koch from 1991 to 2002 Director of South Saskatchewan Pipeline Company Operation Overview Conventional Pipelines Oil Sands Transportation NGL Extraction Bulk Liquid Storage Operation Overview Conventional Pipelines Through a total of approximately 3,700 kilometres (almost 2,300 miles) of pipeline and over 975,000 barrels of storage, the conventional gathering business transported approximately 170,000 b/d of crude in 2011 Crude for the conventional systems is gathered from approximately 160 producer owned batteries and 20 truck terminals throughout southern Alberta and southwest Saskatchewan for delivery to key market hubs in Alberta and Saskatchewan. Conventional Pipelines Oil Sands Transportation The Oil Sands Transportation business is the largest oil sands gathering business in Canada - transporting in 2011 roughly 786,000 b/d of bitumen blend or approximately 35% of Canada’s oil sands production Consisting of the Cold Lake, Corridor and Polaris pipeline systems, this business segment has nearly 2,500 km of pipeline and 3.8 million barrels of storage Oil Sands Transportation NGL Extraction Facilities process pipeline quality natural gas to remove natural gas liquids (NGL) comprised of ethane, propane, butanes and pentanes-plus The NGL stream is then partially fractionated to produce a specification ethane product and a mix of propane, butane, and pentanes-plus NGL Extraction Bulk Liquid Storage Inter Pipeline's bulk liquid storage business segment is the fourth largest independent storage business in Europe Operating under two wholly owned entities, the bulk liquid storage business operates 12 deep-water terminals and approximately 19 million barrels of storage Bulk Liquid Storage Financial Statements Performance Overview Fourth quarter FFO* increased to $90 million, 12% higher than fourth quarter 2010 levels Payout ratio before sustaining capital* of 72% for the quarter Cash distributions to unitholders were $65 million or $0.2475 per unit Inter Pipeline’s oil sands and conventional oil pipelines systems transported 945,100 b/d Performance Overview Performance Overview Cont’ Risk Factors 1. Demand risk Inter Pipeline’s business will depend, in part, on the level of demand for petroleum in the geographic areas in which deliveries are made by the pipelines and the ability and willingness of shippers having access or rights to utilize the pipelines to supply such demand Risk Factors 2. Supply Risk Future throughput on the pipelines and replacement of petroleum reserves in the pipelines’ service areas is dependent upon the success of producers operating in those areas in exploiting their existing reserve bases and exploring for and developing additional reserves Reserve bases necessary to maintain long term supply cannot be assured, and petroleum price declines, without corresponding reductions in costs of production, may reduce or eliminate the profitability of production and therefore the supply of petroleum for the pipelines Risk Factors 3. Competition and Contracts While Inter Pipeline attempts to renew contracts on the same or similar terms and conditions, there can be no assurance that such contracts will continue to be renewed or, if renewed, will be renewed upon favourable terms to Inter Pipeline Inter Pipeline's supply contracts with producers in the areas serviced by the conventional oil pipelines business are based on market-based toll structures negotiated from time to time with individual producers The pipelines are subject to competition for volumes transported by trucking or by other pipelines near the areas serviced by the pipelines Risk Factors 4. Operational Factors The pipelines are connected to various third party mainline systems such as the Enbridge system, Express pipeline, the Trans Mountain pipeline, and the Plains Milk River system, as well as refineries in the Edmonton area Operational disruptions or apportionment on third party systems or refineries may prevent the full utilization of the pipelines Risk Factors 5. Multi-Jurisdictional Regulation The pipelines are subject to intra-provincial and multijurisdictional regulation, including regulation by the Energy Resources Conservation Board in Alberta, and the Ministry of Energy and Resources in Saskatchewan Risk Factors 6. Natural Gas Availability and Composition The volumes of natural gas processed by the NGL extraction business depend on the throughput of the Foothills and TransCanada Alberta systems from which the NGL extraction facilities source their natural gas supply The production of NGL from the NGL extraction facilities is largely dependent on the quantity and composition of the NGL within the natural gas streams that supply the NGL extraction business Risk Factors 7. Competition The NGL extraction facilities are subject to natural gas markets and, as such, are subject to competition for gas supply from all natural gas markets served by the TransCanada Alberta System or the Foothills System The NGL extraction facilities are subject to competition from other extraction plants that are in the general vicinity of the NGL extraction facilities or that may be constructed upstream of or in parallel to the NGL extraction facilities Risk Factors 8. Execution Risk and Reputational Risk Inter Pipeline’s ability to successfully execute the development of its growth projects may be influenced by capital constraints, third party opposition, changes in customer support over time, delays in or changes to government and regulatory approvals, cost escalations, construction delays, shortages and in-service delays Reputational risk is the potential for negative impacts that could result from the deterioration of Inter Pipeline’s reputation with key stakeholders. The potential for harming Inter Pipeline’s reputation exists in every business decision and all risks can have an impact on reputation Hedging Philosophy Inter Pipeline utilizes derivative financial instruments to manage liquidity and market risk exposure to changes in commodity prices, foreign currencies and interest rates Risk management policies are intended to minimize the volatility of Inter Pipeline’s exposure to commodity price, foreign exchange and interest rate risk to assist with stabilizing FFO* Derivative financial instruments: •commodity price swap agreements •foreign currency exchange contracts •power price hedges •heat rate and interest rate swap agreements Frac-Spread Risk Management Frac-spread risk : The difference between the weighted average propane-plus price and the Monthly index price of AECO natural gas Frac-Spread Risk Management Power Price Risk Management Inter Pipeline uses derivative financial instruments to manage power price risk in its NGL extraction and conventional oil pipelines business segments Inter Pipeline enters into financial heat rate swap and power price swap contracts to manage power price risk exposure in these businesses. Foreign Exchange Risk Management Inter Pipeline uses derivative financial instruments to manage power price risk in its NGL extraction and conventional oil pipelines business segments. Inter Pipeline enters into financial heat rate swap and power price swap contracts to manage power price risk exposure in these businesses. Interest Rate Risk Management Based on the variable rate obligations outstanding at December 31, 2011, a 1% change in interest rates at this date could affect interest expense on credit facilities by approximately $14.7 million, assuming all other variables remain constant The entire $14.7 million relates to the $1.55 billion Corridor credit facility and is recoverable through the terms of the Corridor FSA, therefore there would be no after-tax income impact Fair Value Through Profit or Loss Fair Value Through Profit or Loss Credit Risk Inter Pipeline’s credit risk exposure relates primarily to customers and financial counter-parties holding cash and derivative financial instruments, with a maximum exposure equal to the carrying amount of these instruments Credit risk is managed through credit approval and monitoring procedures