R 0 - University of Queensland

advertisement

BENEFIT-COST ANALYSIS

Financial and Economic

Appraisal using Spreadsheets

Chapter 10: The Social Discount Rate,

Cost of Public Funds, and the Value of

Information

© Harry Campbell & Richard Brown

School of Economics

The University of Queensland

Three reasons why NPV>0 may not be the appropriate rule to

identify projects which are efficient from a social viewpoint:

• the social discount rate may be lower than the market rate

of interest;

• the marginal cost of public funds may exceed unity (ie. $1 of

public funds costs more than $1);

• undertaking an irreversible investment involves a loss of

option value.

The Social Discount Rate

Why does the market discount future benefits and costs?

• impatience: people value utility today more highly than

utility tomorrow. In making choices, future utility is

discounted in comparison with utility in the present;

• diminishing marginal utility of consumption: people expect

to be wealthier in the future. An extra dollar in the future will

add less to utility than an extra dollar today.

The observed market rate of interest is the sum of the utility

discount factor (reflecting impatience) and the utility growth

factor (reflecting diminishing marginal utility of consumption).

Example:

economic growth rate: 2%

elasticity of marginal utility of income: 1.5

utility growth factor: 1.5 x 2% = 3%

utility discount factor: 1%

real market rate of interest: 3% + 1% = 4%

Why do people argue that a social discount rate, lower than the

market rate of interest, should be used to discount public

projects?

We should not be discounting the utility of future generations who

are not able to participate in markets which determine levels of

current investment, and, hence, future utility levels.

It is argued that there is, in effect, a ‘missing market’ and we need

to use non-market methods to determine the appropriate price (in

this case an inter-temporal price in the form of a discount factor).

What is the appropriate discount rate for public projects?

It is reasonable to employ a utility growth factor in discounting

public projects: if future generations are going to be wealthier than

us, we should take this into account in sacrificing present

consumption to make provision for the future.

It is not reasonable to employ a utility discount factor in

discounting public projects: we should not treat the utility of future

generations as any less important than that of the present

generation.

Developing our simple example: instead of using the real market

rate of interest of 4% as the discount rate for public projects, we

would adjust it downwards by the amount of the utility discount

factor (1%) to get a social discount rate equal to the utility growth

factor (3%).

Using a social discount rate would tend to make investment

projects more attractive, but the 1% difference in discount rate

would be crucial in only a few cases.

The Marginal Cost of Public Funds

Raising public funds to undertake investment projects involves

three types of costs:

• collection costs: costs of running the tax office;

• compliance costs: costs incurred by taxpayers;

• deadweight loss: costs of misallocation of resources as people

respond to prices distorted by taxes.

Compliance and collection costs are largely fixed costs: they do

not change when the amount of tax collected changes by a small

amount. Since any given project will involve relatively small

changes in the flow of public funds, compliance and collection

costs can be ignored in social benefit-cost analysis.

The amount of deadweight loss tends to rise (fall) as the amount of

public funds raised rises (falls).

A project which requires additional public funds imposes an

additional deadweight loss on the economy; and a project which

contributes to public funds reduces the amount of deadweight loss.

When the additional deadweight loss is taken into account, the

NPV rule becomes:

NPV = B - C - D > 0

where: B is the PV of project benefits

C is the PV of project costs

D is the additional deadweight loss

The NPV rule could also be written as:

B - C[(C+D)/C] >0, or

B/C > (C+D)/C

where (C+D)/C is the marginal cost of public funds.

There are three main ways of raising additional public funds:

• borrowing from the public i.e. selling government bonds

in the market;

• borrowing from the central bank i.e. printing money;

• raising tax rates.

If the required quantity of public funds is raised at minimum cost,

the marginal cost of public funds from each source will be the same.

The deadweight loss resulting from selling bonds to the public.

Suppose $100 worth of government bonds is sold on the market,

and that $50 is diverted from private consumption spending, and

$50 from private investment spending.

The tax rate on the returns to private investment is around 1/3.

Since the after-corporation tax rate of return on private investment

must equal the government bond rate r, the before-tax rate of

return on private investment must be r* = 1.5r.

(Why? Because r*(1 - 1/3) = r )

Now we can work out the cost to the economy of displacing $50

worth of private consumption and $50 worth of private investment:

• the loss of $50 worth of private consumption costs $50

• the $50 worth of private investment would have yielded an

annual before-tax return of $50r*. The present value of this return

(at the market rate of interest) is $50(r*/r) = $50*1.5 = $75.

The cost to the economy of raising $100 of public funds by

borrowing from the public is $125. The deadweight loss is $25

and the marginal cost of public funds is $1.25 per dollar i.e. 1.25.

The deadweight loss resulting from collecting additional tax revenues.

There is a wide range of taxes in our economy:

• personal and business income taxes

• goods and services tax

• excise duties on petrol, tobacco, alcohol etc.

It can be argued that eventually all these taxes are borne by

households.

We can consolidate all these taxes into a single tax which can be

regarded as a tax on the labour supply of households.

When the government wishes to raise additional tax revenue, it

has a wide range of choice as to which tax rates to increase.

However, we can argue that the effect is simply to increase the

consolidated rate of tax on labour supply by households.

Assuming that the aggregate labour supply curve of households

is upward sloping, an increase in the rate of tax will cause a

reduction in labour supply.

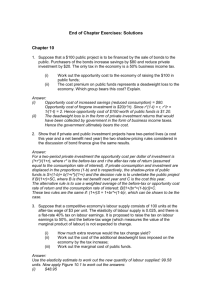

Figure 10.1 Taxation and Labour Supply

$

W

F

W0 A

B

S

G

C

W1

D

E

L1

L0

Quantity of Labour (Hours)

In Figure 10.1:

• the after-tax wage falls from W0 to W1 as a result of the

increase in tax rate;

• the quantity of labour supplied falls from L0 to L1 because

of the upward sloping supply curve.

The cost to households of the tax increase is the loss of producer

surplus: ABDE + BCD

The extra tax revenue to government is measured by: ABDE - FGCB

The cost per dollar of additional revenue is the ratio of the cost to

households to the extra tax revenue.

Summary:

• Cost to the economy of additional public funds:

Area ABDE + BCD;

• Quantity of additional public funds:

Area ABDE - FGCB

• Cost per additional dollar of public funds:

MC = ABDE + BCD

ABDE - FGCB

MC = (ABDE - FGCB) + (BCD + FGCB)

(ABDE - FGCB)

= 1 + FGCD

(ABDE - FGCB)

How to interpret the formula for the marginal cost of public funds:

MC = 1 +

FGCD

(ABDE - FGCB)

The cost of an extra dollar of public funds is: $1 plus the additional

deadweight loss per dollar of extra funds.

Why does area FGCD represent an additional deadweight loss?

The effect of the tax rate increase is to divert a quantity of labour

(L0 - L1) from work to leisure.

In work that quantity of labour would have produced output with

a value measured by area FGL0L1.

The value of the corresponding extra leisure time is measured by

area DCL0L1.

The difference between these two measures is a loss to the

economy, termed a deadweight loss.

The marginal cost of public funds is:

1+

additional deadweight loss

additional quantity of funds

Two complications:

1. When household labour supply falls, household earned income falls.

When earned income falls, the household’s eligibility for social security

payments rises. Some of the extra tax revenue raised will have to be

used to fund increased social security payments rather than the public

project the extra tax revenues are intended to fund.

2. Some public projects will, by their nature, cause a shift of the

labour supply curve, and this may tend to increase or decrease the

effects of the tax rate increase on the quantity of labour supplied and

the quantity of leisure demanded.

Estimates of the marginal cost of public funds:

In Australia and other OECD countries most estimates of the

marginal cost of public funds are in the 1.2 - 1.3 range. In other

words, there is an additional deadweight loss of around 25 cents

per dollar of extra tax revenue raised.

Implications of the marginal cost of public funds for social benefitcost analysis:

All flows of public funds resulting from a project should be

shadow-priced (at around 1.25 in Australia). This increases the cost

of outflows and increases the benefits of inflows of funds as a

result of a project.

The Value of Information

Suppose that you have undertaken a social benefit-cost analysis

and find that NPV>0. Is there any reason (other than a budget

constraint) why you would recommend that the project should

not go ahead immediately?

There might be uncertainty about the values of some of the

variables used to calculate the NPV e.g. future prices. Delaying

the project might resolve these uncertainties.

To investigate the value of delaying the project we compare the

NPV (at time 0) of undertaking the project immediately (at time 0)

with the NPV (at time 0) of delaying the start of the project until

time 1.

In the example considered, it is assumed that, while we know the

present price of output (at time 0), we don’t know whether the price

of the project output is going to be high or low from time period 1

onwards. If we delay the project until time 1 we will get this

information prior to deciding on whether to undertake the project.

In the example:

K is the project cost

R0 is net benefit in year 0 (known with certainty)

RH is net benefit from year 1 onwards if the high

price prevails

RL is net benefit from year 1 onwards if the low

price prevails

q is the probability of the high price prevailing

(1-q) is the probability of the low price prevailing

r is the rate of interest

The expected value of information is:

The expected project NPV (at time 0) if we delay the project for

1 year minus the expected project NPV (at time 0) if we

undertake the project at time 0.

Figure 10.2 illustrates the expected NPVs of the two options.

Figure 10.2 The benefit and cost of delaying an investment

Wait

q

RH/r – K/(1+r)

Invest

(1-q)

0

[since {RI/r) – K/(1+r)}<0]

R0+(qRH/r + (1-q)RI/r) - K

When we subtract the expected NPV of undertaking the project

immediately from the expected NPV if the project is delayed for one

year, we get an estimate of the value of information.

The value of information rises as:

• the initial capital cost, K, rises;

• the return in the low price environment, RL, falls;

• the probability of a low price, (1-q), rises;

• the return in the current period, R0, falls;

• the interest rate falls.

The ‘bad news principle’ - the level of the return in the high price

environment, RH, does not affect the value of information.

The NPV Rule

If there is no additional information to be obtained by delaying the

project, the NPV rule is to undertake the project immediately if:

NPV = E(R) + R0 - K > 0,

r

where E(R) = q RH + (1-q) RL.

If additional information can be obtained by delay, the NPV rule is to

undertake the project immediately only if:

E(R) + R0 - K > b, where b > 0.

r

The NPV rule when additional information can be obtained says

that the project should be undertaken only when the option of delay

is worthless.

The condition which makes the option of delay (the value of

waiting) worthless is the revised NPV rule:

NPV = E(R) + R0 - K > b,

r

where b = q{RH - K }

r

(1+r)