Business Office 16th Annual How to* Session

advertisement

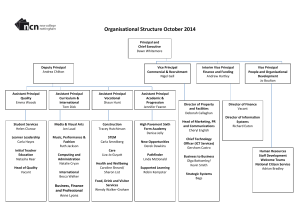

Business Office th 16 Annual How to ….. Session Summer “Fiscal” Tips 2015 Business Office Organizational Chart Fiscal Year 2014-2015 Myriam Lopez Comptroller 700214 Vacant Administrative Assistant 700228 Vacant Associate Comptroller 745184 Jose Salinas System Analyst 2 714184 Irene Zavala Secretary 720184 Norma Jimenez Director of Student Accounts/Bursar 707184 Vacant System Analyst 1 - FAS 739184 Dalinda Gamboa Accounting Group Manager Grants/Contracts & AP 700059 Concepcion Lira Accounting Assistant 725184 Maria de Jesus Palomo Accounting Group Supervisor, Student Payments 730184 Maria E. Treviño Accounting Group Supervisor, Cashiers 735184 Marittza Adame Accounting Group Supervisor, Accounts Receivable 700130 Soledad Ortiz Accounting Specialist 744184 Bertha Villarreal Cashier Customer Service Specialist 740184 Yvette Ortiz Accounting Specialist AP 734184 Iris Urrutia Collection Specialist 722184 Patricia Jackson Vanessa Limon Accounting Assistant Travel 709184 / 798184 Georgina Betancourt Accounting Assistant (Temp-Contracted) Bertha Espinoza Elizabeth Gomez Rodolfo Madrigal Carlet Mokom Robin Nguyen Fabian Rodriguez Jessalyn Salinas Linda Gomez Ruben Martinez Jorge Saucedo Call Agent 731184 / 712184 / 742184 Vacant Norma Zavala Luis Flores Cashier II 731184 / 712184 / 742184 Eutiquio Vela Marco Velasquez Cashier III 741184 / 700122 Raquel Cantu Cynthia Lopez Erika Garcia David Gaytan Kaleb Guzman Rachel G. Marr Vacant Cashier 700050 / 794184 / 715184 / 711184 / 700160 / 732184 / 727184 Ashley Garza Daisy Ybarra Monica Zavala Yesenia Gutierrez Jimena Olivarez Cashier (Direct Wage) Alma Church Accounting Group Manager General Accounting, Construction & Debt Management 700104 Marcy Gonzalez Accounting Assistant (Direct Wage) 840185 Nancy Martinez Cashier (Temp-Contracted) Vanessa Sifuentes Accounting Group Manager Payroll, Fed/State Tax, Risk Assessment and Process Review 718184 Cynthia Villarreal Accounting Group Manager Cash Management, Special Projects, Training & Office Support 733184 Vacant Accounting Group Supervisor, Payroll 728184 Maricarmen Ramirez Accounting Group Supervisor, Accounts Payable 700108 Myra Ochoa Vacant Vacant Accounting Assistant 799184 / 700018 / 704184 Yadira Ramirez Ted Trujillo Accounting Assistant 721184 / 796184 Nicole Perez Accounting Group Manager Property Taxes, Budget, Information and Analysis 700054 Norma Reyna Accountant Grants & Contracts 729184 Vacant Accountant Budget Control 736184 Jacinta Garcia Esmer Palomo Accounting Specialist Grants & Contracts 716184 / 743184 Elena Jimenez Accounting Specialist Budget Control 713184 Jeanette Villarreal Bertha Arriaga Beatriz Saldaña Maria G. Gonzalez Kelly Lara Rachel Reyes Accounting Assistant 795184 / 703184 / 723184 / 738184 / 737184 / 700077 Celeste Avendano Accounting Assistant (Temp-Contracted) Vacant Accountant Property Tax 746184 Alex Cespedes Accountant Construction 791184 Nereida Sanchez Accountant Construction 710184 Ana Maria Hodgson Accounting Specialist Payroll 717184 Vacant Accounting Specialist General Accounting 702184 Anabel Garza Accounting Assistant General Ledger 719184 Vacant Accountant Budget Control Payroll 701184 Brenda Lopez Blanca Cantu Accounting Assistant 708184 / 700148 Monica Garza Accounting Assistant (Temp-Contracted) Rachel Jaramillo Blanca Sanchez Anna Gonzalez (Direct Wage) Payroll Assistant 706184 / 726184 / 705184 Lucia Chavez Accountant Special Projects 724184 Carlos Quintanilla Accounting Assistant 792184 Isabel V. Ramirez Accounting Assistant (Direct Wage) 700145 Glenda de Anda Accounting Assistant (Temp-Contracted) Agenda • Welcome & Summer “Fiscal” Tips • Fraud & Abuse Awareness, Internal Controls & Ethics Myriam Lopez, Comptroller Breakout Session Topics 1 Budget Rm J1.306 2 Position Control Rm J1.210 3 Accounts Payable Rm J1.406 4 Travel Rm J1.504 5 Banner Finance Access Rm J1.410 Nicole Perez, Accounting Group Manager Ana Maria Hodgson, Accountant Maricarmen Ramirez, Accounting Group Supervisor Vanessa Limon, Accounting Assistant Jose Salinas, System Analyst II - FAS Breakout Session Topics 6 Accounting Transactions, Donations & IDT’s Rm J1.414 7 Time Force & Travel Working Hours Rm J1.214 8 Cashiers Rm J1.412 9 Student Accounts & Other Receivables Rm J1.208 Alma Church, Accounting Group Manager Alejandro (Alex) Cespedes, Accountant Maria A. Garza, Accounting Assistant Vanessa Sifuentes, Accounting Group Manager Ana Gonzalez, Payroll Assistant Maria (Sussy) Palomo, Accounting Group Supervisor Erika Garcia, Cashier Marittza M. Adame, Accounting Group Supervisor 2015 - 2016 Healthy Tips for New “Fiscal” Year Exercise Drink Plenty of Water Get More Sleep Change Lifestyle De-Stress Get Energized with Vitamin D Physical Activity Helps To: • Maintain Weight • Reduce High Blood Pressure • Reduce arthritis for osteoporosis and falls • Reduce risk for Type 2 Diabetes, Heart Attack, Stroke & several forms of cancer • Reduce symptoms of depression and anxiety Sleep Deprivation Can Prematurely Age Your Skin & Deter Your Weight Loss Efforts 6-8 Hours of Sleep Stay Positive (Salmon, Tuna, Mackerel, Fish Liver Oil, Beef Liver, Cheese and Egg Yolks) Don’t skip breakfast. Studies show that eating a proper breakfast is one of the most positive things you can do if you are trying to lose weight. Get smelly. Garlic, onions, spring onions and leeks all contain stuff that’s good for you. A study at the Child’s Health Institute in Cape Town found that eating raw garlic helped fight serious childhood infections. Heat destroys these properties, so eat yours raw, wash it down with fruit juice or have it in tablet form. Bone up daily. Get your daily calcium by popping a tab, chugging milk or eating yoghurt. It’ll keep your bones strong. Remember that your bone density declines after the age of 30. You need at least 200 milligrams daily, which you should combine with magnesium, or it simply won’t be absorbed. Eat your stress away. Prevent low blood sugar as it stresses you out. Eat regular and small healthy meals and keep fruit and veggies handy. Herbal teas will also soothe your frazzled nerves. Eating unrefined carbohydrates, nuts and bananas boosts the formation of serotonin, another feel-good drug. Small amounts of protein containing the amino acid tryptamine can give you a boost when stress tires you out. Trade Supplements for Tea. Drinking all-natural green tea is an excellent way to boost your weight loss and your health. Helps with metabolism, contains high concentration of catechins, antioxidants found in plants that help protect against heart disease and some cancers. Bring on the Broccoli. Broccoli is the best produce option because it cleanses the liver and helps to fight cancer. Load up on vitamin C. We need at least 90 mg of vitamin C per day and the best way to get this is by eating at least five servings of fresh fruit and vegetables every day. So hit the oranges and guavas I say tomato. Tomato is a superstar in the fruit and veggie pantheon. Tomatoes contain lycopene, a powerful cancer fighter. They’re also rich in vitamin C. The good news is that cooked tomatoes are also nutritious, so use them in pasta, soups and casseroles, as well as in salads. Berries for your belly. Blueberries, strawberries and raspberries contain plant nutrients known as anthocyanidins, which are powerful antioxidants. Blueberries rival grapes in concentrations of resveratrol – the antioxidant compound found in red wine that has assumed near mythological proportions. Resveratrol is believed to help protect against heart disease and cancer. The Budget breakout session will discuss helpful Banner screens for organization balances and year-todate activity, data extraction steps, budget transfer rules, and the budget development process. Fiscal Tips: • Expenses must be charged to the appropriate organization and not to any other organization due to funds availability. • Don’t submit several budget transfers in order to circumvent the requirement for the President’s approval. • Regularly review the accounts in each organization and reconcile. Open POs should be closed when they are no longer needed in order to increase an organization’s budget availability. Nicole Perez, Accounting Group Manager Email: mnperez@southtexascollege.edu Phone: (956) 872-4640 The Position Control department is part of the Business Office performing such functions as assisting the college's departments in maintaining their salary funds throughout the fiscal year. The department assigns budgeted sources to positions and performs non-sufficient fund checking. Fiscal Tips: When preparing NOEs (Regular or Direct Wage) make sure to provide the following information: Under “Employee” section, state the correct Division, Department Title and Organization code of the employee (FTMORGN Banner form) Under “Funding Source Information” section, provide the position number, organization code, percentage and the approval of the Financial Manager funding the assignment, if assignment is split funding then the mentioned information of the departments funding the assignment. Review the organization’s remaining Balance at the beginning of each month to make sure your organization has a positive balance, by accessing Banner form FGIBDST. The balance is updated once a month the last working day of the month. When Departments have a salary deficit or they are running out of salary funds, Financial Managers must request a Position Control Transfer form from the Business Office Accountant Ana M. Hodgson to replenish their pool positions. Make sure to provide the following information: An email or memorandum from the Financial Manager requesting a position control transfer fund Indicate the Organization’s code and department title to where the money is going to Indicate the Organization’s code and department title where the money is coming from Indicate the dollar amount Ana Maria Hodgson, Accountant Email: amhodgson@southtexascollege.edu Phone: (956) 872-4608 The mission of the Payroll Department is to provide accurate and quality payroll operations for all South Texas College Faculty, Staff, and Administration. Fiscal Tips: • As an employee, always review your timecard weekly to confirm its accuracy and always verify timecard at the end of pay period. • As Designee or Supervisor, regularly review your employees’ timecards to ensure all leaves are entered and there are no errors and verify the timecard after your employee. • Always respond to emails or phone calls from Payroll staff as soon as possible so ensure accurate payroll processing for yourself and your staff. Vanessa Sifuentes, Accounting Group Manager Email: vsifuentes@southtexascollege.edu Phone: (956) 872-4674 Ana Gonzalez, Payroll Assistant agonza53@southtexascollege.edu Phone: (956) 872-4629 The goal of the Accounts Payable Department is to ensure accurate, efficient and timely payments to our vendors, employees and students, with excellent customer service and a commitment to continuous process improvement. The Accounts Payable department is responsible for payment of goods and services purchased by the college, employee tuition reimbursements and travel as well as student refunds. Fiscal Tips: • Please remember that all items received, services rendered and travel occurring on 08/31/15 or prior must be processed for payment with FY2015 budget. • Any items received, services rendered and travel occurring after 09/1/15 will be processed with FY2016 budget. Maricarmen Ramirez, Accounting Group Supervisor Email: mramirez@southtexascollege.edu Phone: (956) 872-4609 The Travel Office, under the Accounts Payable Department, audits business related travel authorizations, travel vouchers and mileage reimbursement vouchers as well as student travel forms to ensure accuracy, completeness and compliance with the college’s policies and procedures. The goal of the Travel Office is to ensure dependable and timely services to South Texas College faculty, staff and students, with excellent customer service and a commitment to continuous process improvement. Fiscal Tips: • All reimbursement requests for travel that occurred on August 31st or prior must be submitted to the Business Office by September 8th. • Any travel documents received for travel occurring after 09/1/15 will be processed with FY2016 budget. Vanessa Limon, Accounting Assistant Email: vlimon2@southtexascollege.edu Phone: (956) 872-4618 Some of the accounting transactions are used to update and to maintain the chart of accounts in the Banner System after required documentation is received. Others accounting transactions serve as a journal entry to record and recognize revenue and expenditures in the correct FOAP. Donation transactions are used to record and to recognize gifts as authorized in Policy #5910. Interdepartmental Transfers (IDTs) transactions are used to record services and materials provided to other departments within the College. Fiscal Tips: • Submit completed documentation no later than Friday, September 18, 2015. Alma Church, Accounting Group Manager - General Accounting Email: achurch@southtexascollege.edu Phone: (956) 872-4616 Alex Cespedes, Accountant – Interdepartmental Transfers (IDT ) Email: acespedes_5228@southtexascollege.edu Phone: (956) 872-4665 Anabel Garza, Accounting Assistant - Donations Email: magarza@southtexascollege.edu Phone: (956) 872-4662 The Accounts Receivable department serves as a centralized invoicing area for the College to collect from third party agencies, student delinquent accounts, and other receivables such as Inter-Library lost books, and Departmental Travel Reimbursements. The Accounts Receivable department also maintains the College’s various Restricted Scholarship funds and collaborates with Student Financial Services personnel to provide customer service to our students. This session will provide steps to follow: • When approached with a Scholarship opportunity or a Third Party Agency who would like to financially assist our students. • If STC personnel participates in a seminar requiring travel expenditures and the seminar host would like to reimburse the College. Fiscal Tips: • Restricted Scholarships requirements • Third Party Agency Student Sponsors • Departmental Travel Reimbursements Marittza M. Adame, Accounting Group Supervisor Email: mmadame@southtexascollege.edu (956)872-4612 The Cashier’s department receives payments, posts charges, credits and maintains the integrity of the student accounts. In an effort to provide excellent customer service to our students, this session will provide tools available to staff in assisting our # 1 priority, the student. Navigating the Cashier website Payment Options and Deadlines Refund schedules JagCard Quick Links $60 registration after deadline Cashier “fiscal” tips: Avoid - $60.00 Student Registration Fee After Deadline Student must be registered and paid or financial aid processed before August 1st, January 1st, May 15th and June 15th . Departments registering their students should allow the student enough time to pay or make payment arrangements prior to the deadlines. Take Advantage of Payment Options Payment Options are available from the beginning of the semester until census. Enrolling early will guarantee availability and cover minimester tuition and fees. Plans are not available after census Collections – timely deposit Departments collecting monies should deposit funds no later than the close of business on the next day following the date of collection. At year end, August 31st, collections should be deposited by the end of the day. Maria (Sussy) Palomo, Accounting Group Supervisor Email: mdpalomo1@southtexascollege.edu Phone: (956) 872-6451 Erika Garcia, Cashier Email: egarcia3@southtexascollege.edu Phone: (956) 872-3456 Banner Finance Overview What's the access needed for? How to request access? Queries and Wildcards Extracting Data to Excel Jose Leon Salinas, Systems Analyst II Email: jsalinas_8202@southtexascollege.edu Phone: (956) 872-4663 Business Office “Count on Satisfaction” South Texas College Fraud Awareness and Internal Controls South Texas College Guidelines for Reporting and Investigating Suspected or Known Fraud, Abuse and Other Improprieties http://hr.southtexascollege.edu/forms/policies/policies_reporting_fraud_procedures.pdf 1. Examples of Acts of Fraud, Abuse and Other Improprieties ACFE – The use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization’s resources or assets Encompasses wide variety of conduct, such as pilferage to sophisticated investment swindles Common violations – asset misappropriation, corruption, false statements, false overtime, petty theft and pilferage, use of common property for personal benefits and payroll and sick time abuses 2. Employee Responsibilities Report the act to your immediate supervisor If the supervisor has participated in or condoned the act, report the matter to the next highest level of supervisor or management Director of Human Resources Anonymous Fraud Hotline State Auditor’s Hotline 3. Doing What’s Right THE NETWORK 1-800-482-5158 This toll-free number is staffed by The Network, an independent organization operating 24 hours a day, 7 days a week. You do not have to give your name. An Interview Specialist documents your concern, assigns you a personal reference number, and relays your concerns to the company. Fraud Survey http://finance.southtexascollege.edu/businessoffice/survey.html Got Internal Controls? The COSO* Definition of Internal Control Definition of I/C: “Internal control is a process - effected by an entity’s board of directors, management, and other personnel - designed to provide reasonable assurance regarding the achievement of objectives in the following categories: a) reliability of financial reporting b) effectiveness and efficiency of operations, c) compliance with applicable laws and regulations. * Committee of Sponsoring Organizations of the Treadway Commission Simple Definition Internal control is what we do to see that the things we want to happen will happen … And the things we don’t want to happen won’t happen. The Integrated Framework of Enterprise Risk Management/Internal Controls 8 Components 4 Entity Objectives 4 Activities Components of I/C: 1) Internal environment 2) Risk assessment 3) Control activities 4) Information and Communication 5) Monitoring Strong Internal Controls Benefits • Reducing and preventing errors in a cost- effective manner. • Ensuring priority issues are identified and addressed. • Protecting employees & resources. • Providing appropriate checks and balances. • Having more efficient audits, resulting in shorter timelines, less testing, and fewer demands on staff. Fraud Triangle When these three sides of the triangle are present, there is a much higher than normal chance of an individual committing a fraud. Ethics Manual of Policy • Policy 4000, Code of Ethics Policy Statement • Policy 4001, Code of Professional Ethics for the Administration, Faculty and Staff • Policy 4002, Standards of Conduct • Policy 4204, Reporting Suspected or Known Fraud, Abuse and Other Improprieties Policy 4000 Policy 4001 Policy 4002 Policy 4204