Overview of fundraising laws

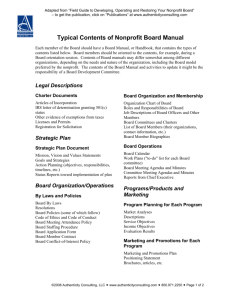

advertisement

Legal Implications of Fundraising via Social Media Bob Carlson Missouri Attorney General’s Office Jeremy Sher President, Grassroots Giving Group, Inc. We ♥ Questions Attorney General’s Powers Attorney General oversees charitable solicitations 1. As Guardian of Charitable Assets, and 2. Under State consumer fraud laws. Aggressively pursue fraudulent solicitations and other deceptive practices. Maintain registration of nonprofits and professional fundraisers who solicit donations. Attorneys General are active States are more active than most realize Cases go unreported AGO’s exercise discretion so to preserve nonprofits fundraising ability Ex: Missouri is a mid-sized state with mid-sized staff. 80 to 100 cases or investigations per year. Everything under nonprofit authority Follow up on more complaints too Interested and active in online solicitations, too Remember: we can see these from our desks 4 About Grassroots Giving Group Consulting on Internet fundraising issues Focus on ethics/transparency, public policy Potential new fundraising websites in beta testing Informed by political fundraising experience -- Tightly regulated sector (nonprofit space does not need regulations that tight) -- A system that basically works; can inform nonprofit “conduit” policy 5 Where we’re going today 1. Attorney General and/or Secretary of State powers for registration and fraud laws 2. Legal bounds of our jurisdiction over online solicitations 3. Who needs to register? 4. Who is a professional fundraiser? 5. Other, new considerations 6 Overview of fundraising laws 1. Failure to register If you solicit donations, you may need to register in the states in which you solicit Consequences may be severe. On September 2, 2008 Pennsylvania obtained a judgment of over $1,290,000 for failure to register 2. Misrepresentations or fraud Obviously, fraud and misrepresentations in soliciting donations are forbidden But…. Overview of fundraising laws Registration with states In General, 1. If a nonprofit solicits donations, it must register with the AGO or SOS o Some exceptions 2. All Professional Fundraisers must register with the AGO or SOS Few exceptions here 3. Fundraising Counsel/Consultant may have to register Overview of fundraising laws Who Must Register? 1. Charitable organization, any person or entity who solicits funds for any charitable purpose.§ 407.453(2), RSMo 2. Professional fund-raiser,any person or entity who is retained under contract or otherwise compensated by a charitable organization primarily for the purpose of soliciting funds.§ 407.453(4), RSMo “Professional fund-raiser” doesn’t include bona fide employees of charitable organizations who receive regular compensation. Salaried development directors are usually exempt 3. Fundraising Counsel/Consultant Definitions do vary by state but concepts are similar Overview of fundraising laws Common registration exceptions • Who Doesn’t have to Register? (Missouri list) • Religious organizations (breadth of definition varies) • Educational institutions and their related foundations; An institution with a defined curriculum, student body and faculty, and which conducts classes on a regular basis; Bob’s Fantasy Football Institute does not count • Fraternal, benevolent, social, educational, alumni, and historical organizations, when solicitation is confined to the membership of such organizations or auxiliaries; • Hospitals and auxiliaries of hospitals, Exceptions vary by state, these are the most common Overview of fundraising laws Misrepresentations in Solicitations Missouri example: The use by any person of any deception, fraud, false pretense, false promise, misrepresentation…. in connection with the solicitation of any funds for any charitable purpose, is declared to be an unlawful practice. Penalties can be severe In Missouri: $1,000 per action In Arkansas: $10,000 per violation Expectation of aggressive enforcement Obviously, misrepresentations in soliciting donations are forbidden. But social media and online soliciting have created more opportunities for inadvertent (or intentional) violations The Questions we get about online fundraising 1. How do I know what states I need to register in? 2. How do I assure that I don’t violate laws forbidding misrepresentations and other malarkey in online solicitations? And if my nonprofit does mess up, who is going to take action? Please don’t mess up. We have a whole sector to protect and don’t need good organizations doing stupid things while we’re trying to protect them. 3. What else has changed? Going to try to provide the tools to find the answers 12 New Issues for Conduit Fundraisers Reasonable User Expectations No current vendor is in trouble. These are just questions and potential complications to watch out for as the market evolves. Regulators can help the sector grow in a healthy way. Disbursement of Donated Funds Regardless of fine print, the donor expects their designated organization to receive their funds. Donor expects their funds to be forwarded timely. Donor expects to be credited for the full amount of their gift, even if a transaction fee is deducted. Donor will be shocked if their funds are commingled with somebody else’s operating budget. They did not consent to make a zero-interest loan to a portal operator. (e.g. PipeVine) Ownership of Data Regardless of conduit ownership, nonprofits need their data. What the courts say about jurisdiction A state (and its AG) have jurisdiction if the organization has “minimum contacts” with state, and “purposefully avails itself of the privilege of conducting activities within that forum state, thus invoking the benefits and protections of its laws.” The Zippo test (952 F. Supp. 1119 (W.D. Pa. 1997)). If a Web site is passive andmerely posts information, there is no jurisdiction. If a Web site is interactive, there may be jurisdiction If “clearly doing business” online, there is jurisdiction. Accepting donations could be “doing business.” 15 years after Zippo, very few websites are “passive.” 14 What the courts say, part 2 Calder v. Jones 465 U.S. 783, 789 (1984) Intend to direct activities into a certain state A/k/a “purposeful availment” Intent has two interpretations 1. Grokster/Kazaa purposefully availed themselves of doings business in California because they knew significant number of users were from California. Actual intent to go to CA was not necessary MGM Studios, Inc. v. Grokster 243 F.Supp.2d 1073, 1087 (C.D. Cal. 2003). 2. Other jurisdictions require actual intent. Tamburo v. Dworkin, 601 F.3d 693, 704 (7th Cir. 2010). 15 What that means 1. Misrepresentations and deceptive acts If a donor in a state is the victim of a deceptive act, there is jurisdiction. Transaction = “Doing business” Courts will allow AG’s and SOS’s to protect their citizens 2. Registration Jurisdiction to require registration is based on “purposeful availment” and “intent to direct” Means: One Big Grey Area Charleston Principles Recommended guidelines from NASCO Adopted 2001 – technologically rather behind the times In general, not enacted into law; just ethical guidelines 16 The Charleston Principles Written in 2001, i.e. well before Mark Zuckerberg got shot down on a date, went back to his dorm, and created Facebook while drinking away his sorrows Thus, language only addresses websites but based on same law as outlined above Principles are still good, need to register if: 1. In State where the nonprofit is domiciled (HQ, etc.) 2. In other states if: A. Specifically targets persons physically located in the state for solicitation, or B. Receives contributions from the state on a repeated and ongoing basis or a substantial basis 17 The Charleston Principles in 2011 Registration examples: What is “specifically target”? Posts on Twitter, Facebook, etc. Software platform, i.e. First Giving, Crowdrise, changethepresent.org Platform (aka conduit) Those who use platform Matching services Note actions of all involved matter, but not all may need to register. 18 Part II, Who & What 1. Who is making the solicitation? And thus needs to register 2. Who is considered a pro fundraiser? And thus needs to register 3. Who is considered responsible when deceptive acts happen? And what you should do to protect yourself 4. What could be considered deceptive in 2011? The issues we’re seeing and are concerned about 5. What is Charitable? 19 Part II, Who & What 1. Who is making the solicitation? Need a solicitation before any of these laws kick in Missouri defines solicitation as: any request, either oral or written,….for funds, property, financial assistance or other thing of value But who is soliciting? Example 1: doGoodr.com, probably not Example 2: changethepresent, it could be Note: all examples are good sites (if they were in trouble, they would NOT be listed). 20 21 Part II, Who & What 2. Who is making the solicitation? If you are making a solicitation, you must register Missouri defines solicitation as: any request, either oral or written,….for funds, property, financial assistance or other thing of value But who is soliciting? Example 1: doGoodr.com, probably not Not compensated by the nonprofits who are listed Content is supplied by nonprofits, not doGoodr.com Donation button goes to nonprofit’s website Example 2: changethepresent, it could be 22 23 Part II, Who & What Who is making the solicitation? If you are making a solicitation, you must register Missouri defines solicitation as: any request, either oral or written,….for funds, property, financial assistance or other thing of value But who is soliciting? Example 2: changethepresent, it could be 1. Has cart for donations 2. Fees are based on amount donated Above and beyond the credit card fees 3. Creates its own content 4. Advisors give impression of vetting and recommendations Taken together, could be a “request for funds” 24 Part II, Who & What 2. Who is considered a pro fundraiser? If you’re a pro fundraiser, you need to register Missouri definition: anyone who is retained under contract or otherwise compensated by or on behalf of a charitable organization primarily for the purpose of soliciting funds. Example1: The platform that somehow endorses Many sites provide online platform for charities to build online presence. My fave: First Giving When could they be considered a pro fundraiser: Place nonprofit into an issue portfolio, higher search rank, “featured” nonprofit – all for higher fee (or a fee) All original content that requests funds, for a fee see definition 25 26 Who is considered a pro fundraiser? Examples 2 and 3: Crowdrise Example 2: A pro fundraiser is someone is compensated by or on behalf of a charitable organization If create online presence to ask for funds and are not compensated, not a pro fundraiser Like Will Ferrell in example Example 3: Many entities in one place Although Will does not have to register, that does not necessarily mean Crowdrise and the recipient nonprofit are off the hook. 27 3. Who is responsible when deceptive acts happen? I assume none of you intend to defraud folks Example: Mr. Scam and Ripoff Foundation create a page on an otherwise legit online platform and collect $50,000 by claiming to help lemurs, but use funds for Mr. Scam’s Corvette When is the platform responsible? Actual knowledge of fraudulent misuse = in trouble FTC v. Neovi , Defendant engaged in an unfair practice thru its online services when it "engaged in a practice that facilitated and provided substantial assistance to a multitude of deceptive schemes.“ 604 F. 3d 1150 Means you must take some action to prevent being used as a facilitator for deceptive schemes. 28 Who is considered responsible when deceptive acts happen And what you should do to protect yourself Need to do something The specific actions depend on the services you offer, but would suggest these four guideposts, you need a system that: 1. Stops basic misuse automatically Common examples 2. Detects more sophisticated attempts at fraud 3. Requires some active effort by you no head in the sand 4. Fixes flaws as they become known Please cooperate with law enforcement 29 4. What could be considered deceptive in 2011 Reasonable consumer standard Not a jaded, cynical nonprofit expert standard Issues regulators have seen that cause concern: 1. Failure to adequately disclose ALL fees As stated: Disclose. All. Fees. Upfront. Stating 100% goes to nonprofit when PayPal gets 3% is not 100% honest 2. Holding money meant for another organization or cause for longer than reasonable. 3. Profile hi-jacking on platforms and other forms of ID theft Platforms should aggressively watch for this 4. Charging unnecessary fees Saw one website that listed nonprofits then demanded joining 30 fee to tweak address information. Remember: We ♥ Questions 5. What is charitable? (c)(3) v. L3C v. LLC For now, only actual nonprofits are… Check back next week though But… Can you have a charitable solicitation for a for-profit or low-profit entity? Many of our definitions only say “charitable purpose” No distinction on recipient entity classification Where does Social Enterprise fall See example 32 33 Part III, Wait, there’s more 1.The Communications Decency Act 2.Older statutes that are still good law 3.Privacy issues (the sleeping giant) 34 The Communications Decency Act Section 230 of the Communications Decency Act (CDA), 47 U.S.C. § 230(e)(3) Gives providers of interactive computer services immunity from some state law claims. The immunity is provided to service providers but not content providers. A service provider is completely passive and displays content that is wholly provided by third-parties while a content provider displays content for which it is wholly or partly responsible. A website can be both Can be immune for some content on its website and not immune for other content. Could have immunity as long as the website isn’t encouraging or facilitating unlawful conduct. 35 Communications Decency Act Case examples 1. Roommates.com ran a website designed to match people renting out spare rooms with people looking for a place to live. Then it asked about gender, sexual orientation, and children. Sued for Fair Housing Act violations, 521 F.3d 1157 (9th Cir. 2008). Not immune because CDA provides immunity only if the interactive computer service does not ‘create or develop the information in whole or in part. By mandating information in violation of the FHA, Roommates.com was ‘developing’ that information rather than just passively allowing it to be posted. 2. Carafano v. Metrosplash.com, Inc., 339 F.3d 1119 (9th Cir. 2003). Anonymous person created a profile for Carafano, an actress, on an internet dating site. Website was immune because the libelous content was created “entirely by the user without prompting or help from the website” 36 Older statutes that are still good law Laws created for good purposes years ago Obviously not in every state But, as I’ve been saying, you need to be aware of these issues and respond to them. 1. Some states require that if you are going to solicit for a nonprofit, you need its written permission 2. Some states require that funds solicited be placed into a bank account controlled by the nonprofit. 3. Others? 37 Privacy issues Well beyond the scope of this presentation Will be important in the coming years Some general concepts: 1. Must protect data against theft 2. Also, must disclose when will use or sell data Data is an asset Donor lists, etc. 3. Remember what your donors and constituents expectations are. If they believe you violated their privacy they won’t give and will tell their friends Even if you violated no laws. 38 Contact Information Bob Carlson Missouri Attorney General’s Office 815 Olive St., St. Louis, MO 63101 314-340-6816 / 314-340-7957 (fax) bob.carlson@ago.mo.gov Jeremy Sher Grassroots Giving Group, Inc. 16 Union Park St., #7, Boston, MA 02118 617-477-5825 / 617-249-0335 (fax) jeremy@grassrootsgivinggroup.com