INTEGRATION IN THE PEARL RIVER DELTA AND IMPLICATIONS

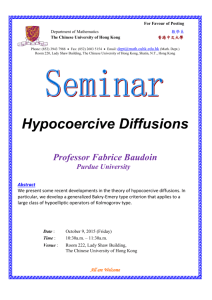

advertisement