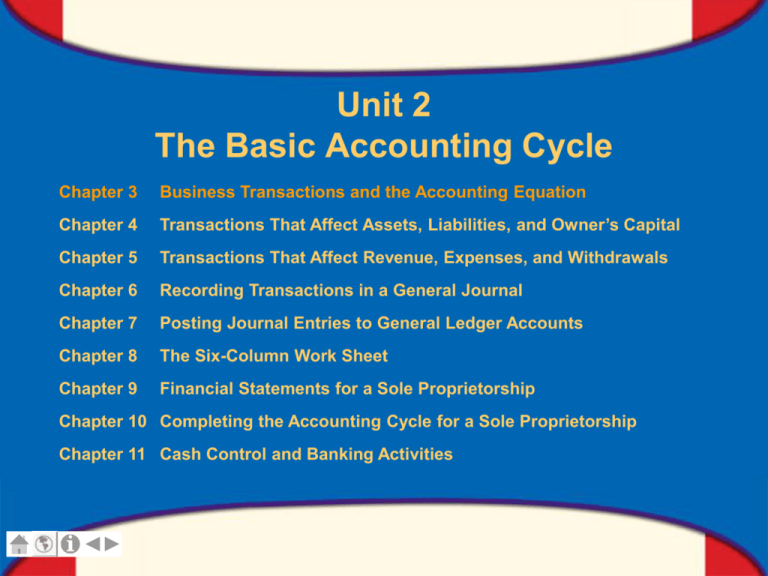

Unit 2

The Basic Accounting Cycle

Chapter 3

Business Transactions and the Accounting Equation

Chapter 4

Transactions That Affect Assets, Liabilities, and Owner’s Capital

Chapter 5

Transactions That Affect Revenue, Expenses, and Withdrawals

Chapter 6

Recording Transactions in a General Journal

Chapter 7

Posting Journal Entries to General Ledger Accounts

Chapter 8

The Six-Column Work Sheet

Chapter 9

Financial Statements for a Sole Proprietorship

Chapter 10 Completing the Accounting Cycle for a Sole Proprietorship

Chapter 11 Cash Control and Banking Activities

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

0

Chapter 3

Business Transactions and

the Accounting Equation

What You’ll Learn

Describe the relationship between property and

financial claims.

Explain the meaning of the term equities as it is

used in accounting.

List and define each part of the accounting

equation.

Demonstrate the effects of transactions on the

accounting equation.

Check the balance of the accounting equation after

a business transaction has been analyzed and

recorded.

Define the accounting terms introduced in this

chapter.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

1

Chapter 3, Section 1

Property and Financial Claims

What Do You Think?

Why is it important to keep track of financial claims?

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

2

SECTION 3.1

Property and Financial Claims

Main Idea

Any item of property has at least one financial claim

against it.

You Will Learn

what it means to own property.

the two types of financial claims to property.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

3

SECTION 3.1

Property and Financial Claims

Property

Property is anything of value that a person or business

owns. A purpose of accounting is to provide:

financial information about property.

financial claims (legal rights) to property.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

4

SECTION 3.1

Property and Financial Claims

Property

There is a relationship between property and financial

claims that can be expressed as an equation:

PROPERTY = FINANCIAL CLAIMS

When you buy something and agree to pay for it later,

you are buying it on credit, and you share the financial

claim with the creditor (the business or person selling

you the item on credit).

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

5

SECTION 3.1

Property and Financial Claims

Financial Claims in Accounting

A company can possess various property or items of

value, known as assets:

cash

office equipment

manufacturing equipment

buildings

land

Equities are financial claims to these assets. When a

business obtains a loan to help purchase an item, the

owner’s financial claims to the assets are called the

owner’s equity.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

6

SECTION 3.1

Property and Financial Claims

Financial Claims in Accounting

The creditor’s financial claims to the assets are called

liabilities. The relationship between assets, liabilities,

and owner’s equity are shown in the accounting

equation:

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

7

Property and Financial Claims

SECTION 3.1

Key Terms

property

financial claim

credit

creditor

assets

equities

owner’s equity

liabilities

accounting equation

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

8

Chapter 3, Section 2

Transactions That Affect Owner’s

Investment, Cash, and Credit

What Do You Think?

What do you think is meant by the term transaction?

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

9

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Main Idea

Accounts are used to analyze business transactions.

You Will Learn

how businesses use accounts.

the steps used to analyze a business transaction.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

10

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Business Transactions

A business transaction is an event that causes a

change in assets, liabilities, or owner’s equity. A

business records these changes in subdivisions called

accounts.

The number of accounts will vary from business to

business. Two possible business accounts are

accounts receivable, an asset account, and

accounts payable, a liability account.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

11

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Effects of Transactions on the

Accounting Equation

To analyze a business transaction, follow these steps:

Identify the accounts affected.

Classify the accounts affected.

Determine the amount of increase or decrease for

each account affected.

Make sure the accounting equation remains in

balance.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

12

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Investments by the Owner

Money or other property paid out in order to produce

profit is an investment. Analyze a cash investment

transaction:

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

13

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Investments by the Owner

Money or other property paid out in order to produce

profit is an investment. Analyze a cash investment

transaction:

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

14

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

15

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

16

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Cash Payment Transaction

Analyze a cash purchase business transaction:

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

17

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Cash Payment Transaction

Analyze a cash purchase business transaction:

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

18

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Credit Transaction

Purchasing an item on credit is also called buying on account.

Analyze a purchase on account business transaction:

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

19

SECTION 3.2

Transactions That Affect Owner’s

Investment, Cash, and Credit

Credit Transaction

Purchasing an item on credit is also called buying on account.

Analyze a purchase on account business transaction:

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

20

Transactions That Affect Owner’s

Investment, Cash, and Credit

SECTION 3.2

Key Terms

business transaction

account

accounts receivable

accounts payable

investment

on account

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

21

Chapter 3, Section 3

Transactions That Affect Revenue,

Expense, and Withdrawals by the Owner

What Do You Think?

How do you think revenue, expenses, investments and

withdrawals affect owner’s equity?

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

22

SECTION 3.3

Transactions That Affect

Revenue, Expense, and

Withdrawals by the Owner

Main Idea

Owner’s equity is changed by revenue, expenses,

investments, and withdrawals.

You Will Learn

how revenue and expenses affect owner’s equity.

how withdrawals affect owner’s equity.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

23

SECTION 3.3

Transactions That Affect

Revenue, Expense, and

Withdrawals by the Owner

Revenue and Expense Transactions

Examples of revenue, income earned from the sales of

goods and services, are

fees earned for services performed, and

cash received from the sale of merchandise.

To generate revenue, a business may also incur

expenses, or costs. Examples of expenses are

rent,

utilities, and

advertising.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

24

SECTION 3.3

Transactions That Affect

Revenue, Expense, and

Withdrawals by the Owner

Revenue and Expense Transactions

Revenues increase owner’s equity and expenses

decrease owner’s equity.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

25

SECTION 3.3

Transactions That Affect

Revenue, Expense, and

Withdrawals by the Owner

Withdrawals by the Owner

An owner can make a withdrawal of cash or other

assets from the business assets if revenue is earned.

A withdrawal has the opposite effect on owner’s equity

than investments:

Withdrawals decrease assets and owner’s equity.

Investments increase assets and owner’s equity.

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

26

SECTION 3.3

Transactions That Affect

Revenue, Expense, and

Withdrawals by the Owner

Key Terms

revenue

expense

withdrawal

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

27

CHAPTER 3

Chapter 3 Review

Question 1

O’Donnell’s Car Wash has the following assets and

liabilities.

Assets: Cash in Bank $9,500; Accounts Receivable

$500; Computer Equipment $3,500; Car Wash

Equipment $75,000; Building $450,000

Liabilities: Alto’s Equipment Service $2,500;

First National Bank (mortgage on building) $200,000

What is the owner’s equity for O’Donnell’s?

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

28

Chapter 3 Review

CHAPTER 3

Answer 1

Step 1: Calculate total assets.

$9,500 + $500 + $3,500 + $75,000 + $450,000 = $538,500

Step 2: Calculate total liabilities.

$2,500 + $200,000 = $205,500

Step 3: Calculate owner’s equity.

$538,500 - $202,500 = $336,000

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

29

CHAPTER 3

Chapter 3 Review

Question 2

A business owner invests $12,000 cash in the business.

How would you analyze this transaction?

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

30

CHAPTER 3

Chapter 3 Review

Answer 2

1. Identify the accounts affected.

a. Cash in Bank is affected.

b. Owner’s Capital is affected.

2. Classify the accounts affected

a. Cash in Bank is an asset account.

b. Owner’s Capital is an owner’s equity account.

3. Determine the amount of increase or decrease for

each account affected.

a. Cash in Bank is increased by $12,000.

b. Owner’s Capital is increased by $12,000.

4. Make sure the accounting equation remains in

balance.

Assets = Liabilities + Owner’s Equity

$12,000 =

0

+ $12,000

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

31

Resources

Glencoe Accounting Online Learning Center

English Glossary

Spanish Glossary

Glencoe Accounting Unit 2 Chapter 3 Copyright © by The McGraw-Hill Companies, Inc. All rights reserved.

32