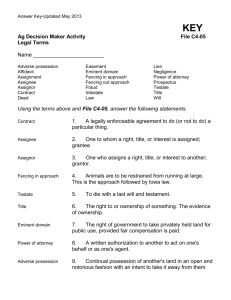

ICOA, Feb. 10, 2010 - Iowa State University Extension and Outreach

advertisement

Pro-Ag CALT Legal Update: Fall 2010 Erin C. Herbold Staff Attorney ISU Center for Agricultural Law and Taxation Presented at Pro-Ag Meeting- Fort Dodge, Iowa; Nov. 10, 2010 Our website • www.calt.iastate.edu • 515-294-6365 • eherbold@iastate.edu Handling wet grain… • IDALS has issued a press release and Q & A fact sheet regarding flood-damaged grain • Keep flood-impacted grain separate • Iowa Code 198.7 deals with adulterated grain • Grain used for commercial feed is adulterated if it bears of contains poisons, pesticides, additives that are injurious to health • Two areas of concern (mycotoxins and pathogenic bacteria) Damaged Grain • IDALS reviewed the publication on our website. • If grain is not contaminated, can be used in animal feed- IDALS • FDA and CVM issuing letter on the process • Will be posted on website when it comes out • Update: There will be no letter, follow above protocol Tax • Health Care Tax Article New and Improved • BAPCPA Does Not Apply to Post-Petition Claims- 9th Circuit rejected the holding of Knudsen case. Holds that taxes arising post-petition remain entitled to priority treatment. • IRS announces tax relief for select Iowa Counties for June flooding and tornadoes- Look to website for list. Disaster declaration allows IRS to postpone specified filing deadlines for taxpayers that reside or operate a business in these counties. • Does not apply to recent Central Iowa flooding. IRS may issue relief for this area in future Tax • Banking Bill with tax provisions signed into law • http://www.calt.iastate.edu/taxbill.html • TARP like bailout of banking system, to give incentives to lend to small businesses • Creates small business lending fundauthorizes U.S. Treasury to make up to $30 billion in credit available to small community banks at various interest rates Banking Bill • Bonus Depreciation: Act renews bonus depreciation for 2010 (2011 for certain long-lived assets) retroactive to Jan. 1, 2010 at the 50% level. To be eligible, qualified property must be purchased and placed in service before Jan. 1, 2011. • Expense Method Depreciations: Raises expense method limit to $500,000 for tax years beginning in 2010 and 2011 and changes phase out from $800,000 to $2,000,000. Without legislation, method limit drops to $25,000 for tax years after 2011- Certain real property may be eligible up to $250,000. Banking Bill • Health Insurance Deduction: Beginning in 2010 taxpayers with self-employment tax can reduce self-employment income by their deductible self-employed health insurance • Expanded 1099 reporting: Act subjects taxpayers that receive rental income from real estate to file information returns just like taxpayers that are engaged in a trade or business • $600 or more, there are some exceptions • Taxpayers with land enrolled in CRP will have to file information returns for payments made to farmers who, for example, provide mid-contract maintenance services on land worth $600 or more. FSA Adjusted Gross Income • Verification Process – 2008 Farm Bill implemented new AGI qualifications for some programs (notably ACRE and direct payments) – Limits: $500,000 for non-farm average AGI; $750,000 for farm AGI, and $1 million for non-farm AGI for Cons. Programs – Producers required to declare AGI on Form CCC-926 with FSAproducer agrees to provide additional info to FSA to assist in verifying income – USDA and IRS recently announced joint program for verification purposes, intended to strengthen integrity of FSA programs and reduce fraud – Beginning of 2010, producers must complete consent forms CCC-927 for individuals and CCC-928 for entities – Supposed to be sent directly to IRS by June 15, 2010 The problem • This fall, FSA offices received lists of people who didn’t send in consent forms • Believed that it is not producer’s faults, its just that IRS is not familiar with how to process the forms • Problem: producers who don’t submit consent forms will become ineligible for future payments and could be required to pay back all 2009 payments • If you have this problem, get 3rd party verification from an accountant or attorney • Will this function in a workable manner? Round-Up Ready Alfalfa Issue • U.S. Supreme Court reverses-injunction against Monsanto’s RoundUp Ready Alfalfa should not have been entered – 9th Cir. COA’s issued a temporary ban on genetically modified alfalfa – Key issues- whether producers of organic alfalfa seeds are exempt from being required to show a likelihood of irreparable harm to get an injunction under the National Environmental Policy Act (NEPA) – Should there be a nation-wide injunction based on a remote possibility of irreparable harm? – S.C. says no – Justice Scalia, “This isn’t the contamination of the New York City water supply. It’s the creation of plants of genetically engineered alfalfa… doesn’t even destroy current plantings of non-genetically engineered alfalfa. This isn’t the end of the world.” Update on VeraSun • Sept. 30, attorneys for New York law firms notified corn producers that they withdraw demands for preference claims in the bankruptcy proceeding • “Sufficient information” to determine that the VeraSun estate will not pursue relief against corn producers • Letter with names to be released “soon” • Withdraw claims against “normal preference defendants” How do we respond in the wake of VeraSun? • Keep all information regarding grain sales (and livestock sales- remember Agriprocessors) • Keep any contracts • Read any contracts • Suspect of premium payments? • What is the fall-out for elevators? • Make sure to ask questions • Be familiar with protecting yourself through ag liens Livestock Production Legal Issues • • • • • • • Landlords’s Lien Ag Supply Dealer’s Lien Harvester’s Lien Custom Cattle Feedlot Lien Commodity Production Lien Lien for Services of Animals Veterinarian’s Lien Perfecting an Ag Lien • Iowa Code requires filing to perfect • If secured party assigns a perfected security interest or ag lien, a filing under this Article is not required- perfected status continues • Maintaining an ag lien- Farm products are located in jurisdiction, then local law of that jurisdiction governs. If not, then go to that state to perfect. Priority • Generally, priority dates from the earlier of time a filing covering the collateral is first made or the security interest is perfected. • However, statute may say otherwise. Landlord’s Lien • Most common Ag Lien in Iowa • Must file! • Lien continues for one year after rent is due or six months after end of lease, whichever is earlier • Lien must state that it is filed with purpose of perfecting landlord’s lien • Lien must be perfected when tenant takes possession or within 20 days after tenant takes possession • Probably need to file every year- safest Custom Cattle Feedlot Lien and Commodity Production Contract Lien • Lien is effective when livestock arrive at the farm • Must perfect Custom Cattle Feedlot lien within 20 days, Comm. Prod. Contract Lien within 45 days or 180 for continuous arrival Ag Supply Dealer’s Lien • Guidance on Iowa Ag Supply Dealer’s Lien – Consensus is that the courts are split on the issue of priority- Consensus is no consensus – Will the Iowa Supreme Court address the issue? – This lien is effective when the farmer purchases the ag supply, perfected if filed within 31 days after date of purchase – Lien on crops produced and livestock consuming feed – Issue centers around whether a certified letter needs to be issued for lien on livestock feed. Courts are split. Death (for the moment) of the Federal Estate Tax? • Congress has failed in its attempts to extend FET for deaths in 2010. No new legislation for 2010 • What does that mean? Revert back to $1 million exemption Law governing deaths in 2010 • Modified Carryover Basis, No Estate Tax • Property’s basis (if sold in 2010) is the lesser of the decedent’s adjusted basis in the property or the property’s fair market value at the time of death • No basis step-up allowed • Two exceptions: – 1. Executor can increase basis by $3 million for assets passing to surviving spouse – 2. Allocate an additional $1.3 million of aggregate basis to other assets What does this mean? Heirs would have to pay capital gain tax on excess amounts not covered by the basis increase rules. But, cap gains rates are lower this year. Federal Estate Tax: My best guess… • Divide into three windows: – Pre-election- little to no chance – Post-election- lame duck- maybe in the second part of lame duck session – After first of year- retroactive legislation What planning steps need to be taken? • Inform clients that have not had estate plans reviewed to get into their attorney’s office. • Even if reviewed, if they are bumping up against $1 million exclusion amount, perhaps have a codicil drafted. Or new wills or trusts… • Drafts of Legislation • Grassley’s Senate Floor Speech (Sept.) – Watch on C-Span New Case Law • Minnesota Swampbuster Case Goes Against Farmer – Swampbuster resulted out of the conservation compliance provisions of the 1985 Farm Bill – Wetlands- have the presence of hydric soil – If drained before Dec. 23, 1985, it is a “farmed wetland”only original drainage can be maintained (prior converted wetland) – Here, MN farmer disputed that he violated Swampbuster by “filling” a two-acre wetland. Farmer exceeded scope of original drainage – Presence of undecomposed stalks in top-soil, indicated a filling of a wetland area- changed the size and scope Another wetlands case • Florida District Court issued an order blocking an attempt by US COE to expand its powers over prior converted wetlands under the Clean Water Act – This court invalidated the COE’s adoption of the Stockton Rules because they improperly expanded the COE’s authority. – Here, dry lands maintained by using continuous pumping – What is NRCS and Army Corps of Engineers stand on prior converted wetlands? What is use of land? – Problem- the plaintiff was operating a renewable energy plant, land no longer being used for farming purposes – Court sides with power company- COE went outside of their authority. New Case Law • Kansas cases- involving habendum clause on oil and gas lease – Frequently utilized in deeds that transfer ownership interests in real estate – Question: whether without express language to the contrary the continuing payment to property owners of an annual minimum royalty that was not derived from actual production of oil and gas extends the lease into the secondary term – No, the lease terminated New Kansas Case • Partition case (implications for wind energy) – “interested parties” are not always entitled to notice – Partition is an action that divides up a co-tenancy into separate portions (co-tenants who own undivided portions) – Case involved sub-surface and surface rights- more common on Kansas, Oklahoma, Texas – Kansas Supreme Court – all parties are not necessary to a partition action; only the parties who stand to be adversely affected are entitled to notification IRS gets “beat” by Common-law Marriage • New Kansas case • Minority of states recognize common-law marriage (not enough to simply live together for a certain amount of time) • Must hold yourselves out to the public as married persons, have the capacity to marry • Kansas courts: Facts: “Husband” dies, she claims they were married for 20 years- should be exempt from FET and Kansas Inheritance Tax • KDR and IRS do not agree Common-law marriage • Court examines affidavit of “uncontroverted facts” • Not enough evidence to establish the marriage at trial court level • Appellate court says there was • Later tax refund action in federal court- court’s unimpressed with “widow’s” arguments- relationship was concealed from family and friends- denies refund. • Later jury trial- jury determines common-law marriage existed. • IRS claimed she owed $1.4 million in estate tax, another $1 million for fraud and interest on top of thatIf jury’s decision holds, she won’t have to pay Iowa Case • Assignment of income doctrine nabs Iowa farmer – Income taxed to party that earns it – However, when ongoing business changes form, income may end up being reported by wrong taxpayer (common in farming and livestock operations) – Example: when sole proprietorship incorporates, farmer may have incurred expenses for putting in crop and then have income from the sale post-incorporation – If income reported as corporate income, could end up being taxed at lower corporate rates and minimize SE tax. IRS may challenge. Thus, IRS may use the assignment of income doctrine to fight farmer – Doctrine provides that taxpayer can’t escape tax liability for income taxpayer earned by transferring income to another entity – Doctrine utilized against farm couple here Assignment of Income Doctrine • Facts: Farm family had sole proprietorship corn and soybean farm; after crop is put in ground, they incorporate. Essentially, nothing was transferred to the corp. After incorporation, balance of government payments is transferred to corporate account. Income earned before transfer, thus IRS argues that its not corporate income • Outcome: Farmers taxed at personal level and assessed accuracy-related penalty Wind Energy Update • Wind Power Stations must pay millions for not meeting minimum generation requirements – Failure to deliver sufficient electricity to the grid – Increase in nuisance suits Iowa Appellate Cases Fall 20092010 (p. 35) • Dillenburg v. Campbell (Iowa Ct. App. Mar. 10, 2010) • Farm Lease: Death of Landlord and Option to Purchase by Tenants • Deals with Iowa Code Section 633.304 notice of will probate • Executor must notify those people they know have claims against property by mail • Children failed to give notice to “reasonably ascertainable claimant” Gaede v. Stansberry (Iowa 2010) • (P. 36) Recovery of Attorney’s Fees for Defending Title to Property – Typically fees incurred defending title to property are awarded if “necessary and reasonable” – Trial court ordered sellers to pay damages for removal of retaining wall, loss of property to city, costs incurred in defending title – Iowa COA’s agreed – Supreme Court invalidated damages award for attorney’s fees – Holding: Buyer who must defend title to property may not recover expenses of that defense unless buyer has given seller notice of title challenge and opportunity to defend Allamakee County v. Schaumberg Living Trust (ICOA, Feb. 24, 2010) • P. 37- Constitutionality of Subdivision Zoning Ordinance • Under Iowa Code Ch. 335, Iowa counties have authority to adopt zoning regs for land and structures in county, but not within city limits • Ordinance contained proper definitions • Ordinance not unconstitutionally vague • Common understanding or practice • Land subject to ordinance Cooper v. Iowa Realty, Co. (ICOA, Feb. 24, 2010) • P. 38-Fiduciary Duty of Real Estate Agent – Does real estate agent owe seller notice of buyer’s financial situation? – The buyers moved out of the home and the seller subsequently had the first home foreclosed on and defaulted in her payments for the second home. The seller filed suit against the real estate agent, claiming that the agent had breached her fiduciary duty by not disclosing the buyers’ financial situation. – Trial court found that the real estate agent did not owe any duty to the seller, and that the buyer’s finances were confidential. The court determined that if a fiduciary duty was present, the seller had waived it by accepting payments from the buyers. The seller appealed. – On appeal, the appellate court affirmed. Kersey v. Babich (ICOA, Feb. 10, 2010) • P. 40- Driveway Easement Construed – Appellate court reiterated that overarching goal of contract interpretation (easement is real estate contract) is to determine intent of parties at the time they entered contract – Court agreed that height and width requirements set by trial court were sufficient and consistent with driveways prior use Guthrie v. Jones (ICOA, Feb. 10, 2010) • P. 40-41- No Boundary by Acquiescence – Battle over proper location of boundary line – Both trial court and appellate court reached same conclusion- no consent to use shrub line as boundary – No boundary by acquiescence Mitchell v. Holliday (ICOA Dec. 30, 2009) • P. 43- Plaintiff barred from bringing suit – Plaintiffs participated in conspiracy to defraud a bank by entering into farm leases that were never disclosed to the bank- below market value leases – In pari delicto doctrine- Plaintiffs’ recovery barred where illegal or fraudulent conduct or plaintiff was equally or more culpable than defendant – Also, issue preclusion In re Estate of Battle (ICOA Dec. 17, 2009) • P. 45- Homestead Mortgage Issues – Subsequent Marriage and refinancing – Mortgage void without signature of both spouses even if it was a refinance of a mortgage taken out prior to marriage – Homestead rights jealously guarded Lynch v. Lennon (ICOA Nov. 12, 2009) • P. 47- Another fenceline boundary dispute • “Mere discrepancy in the amount of land conveyed by deed is not, in itself, sufficient to constitute a breach of warranty of title.” • However, fence was openly placed, obvious, accepted as boundary, no breach of title and no recovery for alleged loss of land. • Attorney’s fees awarded Van Sickle Construction v. Wachovia (Iowa 2010) • P. 49- Mortgage company negligent, but not deceitful in failure to transfer truck titles • Iowa Code Section 321.45(3) requires every seller of motor vehicle to transfer title in commercially reasonable time • What was reasonable here? • Claims of fraudulent and negligent misrepresentation, punitive damages • Buyer awarded damages only for his economic loss Jensen v. City Council of Cambridge (ICOA Jun. 16, 2010) • P. 50- Noxious weeds – Organic garden not exempt from mowing ordinance – City and counties attempt to eradicate noxious weeds – What constitutes a conservation area? – Unconstitutionally vague? No – Statute’s meaning was fairly ascertainable – Conservation area must be compatible with the environment Roger’s organic home garden- How will the City of Ankeny deal with this? Cases from other state and federal jurisdictions… • Scheele v. Dustin (Sup. Ct. Vt. 2010) – Noneconomic damages were not allowed for intentional killing of family pet Scheele v. Dustin • Intentional infliction of emotional distress or loss of companionship for intentional killing of family pets? – Not in Vermont – Court adhered to longstanding precedent – Pets are personal property of their owners – Some states (Hawaii and Florida) do allow these claims – Pet owners could have gone after punitive damages, but dropped claim at trial court level To get prior image out of your head… U.S. v. Andrus • P. 53- Court finds violation of MBTA for “Baiting” birds – MBTA is strict liability statute- liability imposed regardless of intent – Act prohibits “taking” of migratory birds by the aid of “baiting” – Milo planted, harvested by use of stripper headercourt found that this was not an acceptable ag practice – Guilty of violating MBTA Stenehjem v. Crossland (N.D. Sup. Ct. May 13, 2010) • P. 55- Anti-corporate farming law violation – Corporation’s acquisition of farmland to protect waterfowl violates statute – Statutory prohibition against corporations engaging in farming – Farming and ranching defined broadly – Exception for family held farm and ranch operations with 15 or fewer shareholders – Entire tract violated statute- court should not have to engage in piecemeal analysis LDT Keller Farms v. Holmes Livestock (U.S. Dist. Ct. N.D. Ind. Jun. 25, 2010) • What constitutes defamation to business? – Ohio dairy farmers sue livestock company alleging they knowingly sold them 284 freemartins, seller countered that cows sold as-is – Litigation continued- ad placed seeking dairymen who bought replacement heifers that turned out to be freemartins from seller – Defamation- did this injure reputation or diminish confidence, good will? • Party alleging defamatory conduct must prove publication with defamatory imputation with malice and prove damages • Truth is an absolute defense to a defamation claim • Trial Terry v. Sperry (Ohio Ct. App., Mar. 23, 2010) • P. 61- Winery found to be in violation of zoning regulation – What is agricultural and what is commercial? • Property owners use of property was properly enjoined because they did not obtain correct permits • Plant vines and not begin processing activities until primary source of grapes for processing and marketing is from on-site production EDM Corp. v. Hastings State Bank • Court says security interest seriously misleading even though filed financing statement contained debtor’s correct name – How do you file an effective financing statement? – Neb. Court ruled that bank’s lien not properly filed – Look to debtor’s official name on record – Search logic regulations – Strict compliance with requirements of revised Art. 9 New Iowa Legislation • HR 2380 Tenant’s Right to Above Ground Crop Residue • Corn Stover • Creates Iowa Code § 562.5A. In a farm tenancy, the tenant has the right to take part of a harvested crop’s aboveground plant, such as corn stover and other crop residue. • Tenant may take aboveground residue at the time of harvest or after harvest, until the termination of tenancy. • It is important to remember that if the landlord and tenant specify another use or non use for the residue, in writing, then the writing will trump this new code section. Thank you! • • • • • • • • Questions? Issues? Erin Herbold Staff Attorney ISU Center for Ag Law and Tax www.calt.iastate.edu 515-294-6365 eherbold@iastate.edu If you are in Ames, stop by