UPlan Benefit Changes for 2012 - University of Minnesota Twin Cities

advertisement

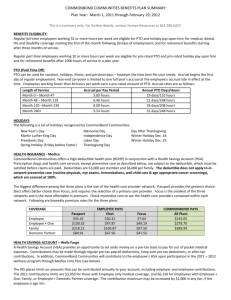

2011 Open Enrollment Update & UPlan Changes For Calendar Year 2012 What’s in this presentation? Benefit Changes for 2012 2012 Medical and Dental Plan Options Open Enrollment Basics Disability Program Changes Open Enrollment Resources Flexible Spending Accounts Other Open Enrollment Information HealthPartners Information Wellness Program Highlights for 2012 UPlan Benefit Changes for 2012 What are the UPlan Benefit Changes for 2012? UPlan Cost Increases Change to Single Medical Plan Administrator – Medica Changes for U Classic Plus by HealthPartners members Medical and Pharmacy Changes University Contribution Changes Relief for Lower Paid Employees Disability Program Changes New Wellness Program Points Bank Program 4 Why are Changes Being Made to the UPlan for 2012? UPlan cost increase requirement due to Minnesota State funding reductions for University: 5% of UPlan Medical Program expense $12.7 million first year, $11.4 million ongoing, plus savings from the RFP process Shift to employees necessary Premium/copays 5 How will the Medical Contribution Rates Change? Cost share for employee-only coverage 2011: Employee 10% / University 90% 2012: Employee 13% / University 87% Cost share for family coverage 2011: Employee 15% / University 85% 2012: Employee 19.5% / University 80.5% Medical trend (inflation) increase: 6.5% Premium increase due to University contribution shift + trend: Insights by Medica – 25.0% Base Plans, National & HSA – 34.6% 6 What about the Dental Contributions? Cost share for employee-only coverage 2011: Employee 10% / University 90% 2012: Employee 12% / University 88% Cost share for family coverage 2011: Employee 40% / University 60% 2012: Employee 48% / University 52% Dental trend (inflation) increase: 2.9% Premium increase due to University contribution shift + trend: 19% for all plan options 7 Who will administer the UPlan medical plans for 2012? Selecting a single administrator: MEDICA Saves more than $14 million over six years Gains uniformity of important variables across UPlan offerings Streamlines internal administration HealthPartners Medical Group (HPMG) clinics will continue to be available in UPlan All HPMG clinics are Tier 1 in Insights by Medica Como, Riverside, etc. Limited HPMG clinics in Medica Elect/Essential, Medica Choice and Medica HSA Other U Classic Plus by HealthPartners Providers (Allina, Park Nicollet, Boynton, UMP, etc.) are available in other Medica Plans Will our Copays Change? Copay / Deductible Changes Increase in Pharmacy Copays (Generic Plus from $8 to $10; Formulary Brand from $25 to $30; Non-Formulary from $50 to $60) Increase in Office Visit Copays (Base Plans from $11 to $15; Insights – No change; National from $25 to $30) Increase in ER Copay ($75 to $90) Increase in Walk-In Clinic Copay ($5 to $10) Increase in MRI/CT Scan Copay ($25 to $30) Increase in Out-of-Network Deductible (Individual from $500 to $600; Family from $1,000 to $1,200). Some benefit & contribution changes are subject to collective bargaining. 9 What if I need help paying the increased premiums for 2012? • • • • New, one-year grant program to help lower income employees offset 2012 medical premium increases Premium relief amounts based on medical plan coverage tier & total household income Amounts available range from $200 to $450 – Paid as bi-weekly credits on paycheck Employees apply by submitting application form & 2010 federal tax form to Employee Benefits 10 2012 Medical Plan Options What Medical Plans are available in 2012? Medica Elect/Essential – Twin Cities & Duluth (Base Plan in Twin Cities and Duluth) Medica Choice Regional – Greater Minnesota (Base Plan for Greater MN) Insights by Medica (tiered network) Medica Choice National (open network) Medica Health Savings Account Plan (HSA) 12 How are rates determined for UPlan Medical options? UPlan: self-insured program Actuarial consultant: helps set rates Costs reflect actual cost of care: for employees, early retirees, and dependents Costs include: Medical and pharmacy claims, external administrative fees, special insurance for high claims, internal costs, FrontierMEDEX, wellness program 13 How is the Base Plan the Key to Employee Cost? For Medical, employees pay: 13% of Base Plan rates for Employee Only 19.5% of Base Plan rates for Family Coverage Everything above the U’s Base Plan rate contribution for “buy-up” (higher cost) plans Costs vary by Employee/Family tier Rate Information: U & Your Benefits Newsletter — October & November 2011 www.umn.edu/ohr/benefits/openenroll 2011 Dental Plan Options Are the same Dental Plans available in 2012? All Dental options remain the same for 2012 The base plan choices are: Delta Dental PPO for the Twin Cities and Duluth Delta Dental Premier for Greater Minnesota www.umn.edu/ohr/benefits/openenroll 16 What other Dental Plan options are available in 2012? All other plans also remain the same: Delta Dental Premier HealthPartners Dental HealthPartners Dental Choice University Choice Check with Delta Dental or HealthPartners to see whether your dentist is in the plan you are considering Note: HealthPartners Dental Plans will continue to be available! 2011 Open Enrollment Basics for January 1, 2012 What are the Dates for Open Enrollment? Your annual opportunity to review your benefit elections: November 1–30, 2011 Employees make changes online at: http://hrss.umn.edu/ Additional information on Employee Benefits Website at: www.umn.edu/ohr/benefits/openenroll 19 What Changes Can I Make During Open Enrollment? Add or cancel Medical and Dental coverage or elect a different plan option U Classic Plus by HealthPartners members must elect one of the Medica plans to have coverage in 2012 Add, change, or cancel your dependents Elect to participate in the Health Care or Dependent Daycare Flexible Spending Accounts 20 What Other Changes Can Be Made? Enroll or increase the amount of Voluntary Short-term disability coverage without evidence of insurability Elect to participate in Voluntary Long-term Disability coverage (Civil Service and Represented Staff employees), or Increase or decrease your Long-term Disability benefit amount 21 Do I have to make changes during Open Enrollment ? You need to go online and change your elections: If you are a U Classic Plus by HealthPartners member and want to have medical coverage in 2012 If you are an FSA participant and want to have an account for 2012 If you want to change your Medical or Dental Plan, or coverage level Otherwise, no changes are necessary To change your clinic election only, call Medica health plan directly at 952-992-1814 or 1-877-252-5558 22 Who can I cover on my UPlan Medical & Dental Plans? Yourself Your spouse or registered same-sex domestic partner Your dependent child or children to age 26 Unmarried or married But not the spouse of a married child Review detailed Dependent Eligibility Definition: www.umn.edu/ohr/benefits/eligibility/index.html 23 Will I get new cards for 1/1/2012? All members will receive a new card from Medica and from the HealthPartners Dental Plans Only new enrollees will receive cards from the Prime Therapeutics Pharmacy Program and Delta Dental Plans If you need a new or additional card any time during the year, contact the health plan directly and they will issue a new one 24 Will flu shots be available this year? Seasonal Flu Shots will be available this year Flu shots will be available at campus flu clinics and the Employee Health & Benefits Fairs Seasonal Flu shots available at all Walk-in Clinics No copay for flu shots at your own medical clinic Flu shots at retail locations are full price and will often not be billed to your medical plan On the Twin Cities campus: schedule appointment for flu shot online at: www.bhs.umn.edu/public-health/flu.htm What is the Medication Therapy Management (MTM) Program? You are eligible for MTM if you take Four or more medications for chronic conditions UPlan-paid consultations with MTM Pharmacist $10 copay reductions for all Generic Plus and Brand medications for six months Note: HSA members pay full cost of MTM consultations www.umn.edu/ohr/benefits/ 26 Disability Coverage What are the Disability Program Changes? New Disability Administrator - CIGNA During the 2011 Open Enrollment, for plan year 2012 only, you can enroll in or increase your existing amount of short-term disability coverage without evidence of good health Enroll or make your changes online in Employee Self-Service by November 30 In future years, open enrollment amounts will be limited When Can I Enroll in Short-term Disability? You can enroll or increase your short-term disability coverage during this Open Enrollment period without proof of good health You can elect coverage any time during the year but would be required to submit evidence of good health You can elect an amount to replace up to 66-2/3 percent of your salary but no more than $5,000 per month (Calculation = Annual Salary times 66.67%; divided by 12; rounded down to nearest $100) See website for details on how to apply: www.umn.edu/ohr/benefits/disability/shortterm Who can enroll in Long-term Disability during Open Enrollment? Civil Service and Represented Staff Employees May enroll in or change the amount of Long-term Disability during Open Enrollment. Maximum Benefit: 60% of salary up to $5,000 per month. (Calculation = Annual Salary times 60%; divided by 12; rounded down to nearest $100) Pre-existing Condition Limit: Disabilities related to medical issues during previous 12 months will not be covered for 24 months. www.umn.edu/ohr/benefits/openenroll 30 Open Enrollment Resources What if I need help with open enrollment? Telephone: 612-624-9090 or 1-800-756-2363 Option 2 ̶ General benefits questions Option 3 ̶ FSA questions E-mail: benefits@umn.edu Benefit Fairs: Computer help, Plan representatives, and Employee Benefits staff available to answer questions Computer Labs (Twin Cities): Room 315 Donhowe Bldg. November 23, 28, 29, and 30: 8 a.m. to 4:30 p.m. 32 What if I want to talk to Employee Benefits? Employee Benefits Service Center 612-624-9090 or 1-800-756-2363 Option 2 ̶ General benefits questions Option 3 ̶ FSA questions Telephone Language Interpretation service available through Employee Benefits Employee Benefits Website www.umn.edu/ohr/benefits/openenroll 33 What if I want to talk to the Health Plans? Medica: 952-992-1814 or 1-877-252-5558 Prime Therapeutics: 1-800-727-6181 Fairview Specialty Pharmacy: 1-877-509-5115 and 612-672-5289 HealthPartners Dental: 952-883-5000 or 1-800-883-2177 Delta Dental: 651-406-5916 or 1-800-448-3815 34 When are the Employee Health & Benefits Fairs? Duluth: November 2: Kirby Student Center – Ballroom – 10 a.m. to 2:30 p.m. Morris: November 4: Oyate Hall, UMM Student Center – 11 a.m. to 1 p.m. St. Paul: November 8: St. Paul Student Center – North Star Ballroom – 10 a.m. to 4:30 p.m. Minneapolis: November 9: Coffman Memorial Union – Great Hall – 10 a.m. to 4:30 p.m. 35 Links to U of M Resources www.bhs.umn.edu/public-health/flu.htm (Slide 1, 13) www.umn.edu/ohr/benefits/openenroll/ (Slide 6, 23, 34, 47, 51) http://hrss.umn.edu (Slide 6, 54) www.umn.edu/ohr/benefits/eligibility/index.html (Slide 10) www.wellness.umn.edu (Slide 41) well@umn.edu to e-mail Wellness (Slide 42) www.umn.edu/ohr/benefits/ (Slide 45) www.umn.edu/ohr/benefits/disability/shortterm/ (Slide 48) benefits@umn.edu to e-mail Employee Benefits (Slide 50) 3 Flexible Spending Accounts 37 What are Flexible Spending Accounts? The UPlan includes: Health Care Flexible Spending Account Dependent Daycare Flexible Spending Account Your contributions to both accounts are made with pre-tax dollars No Federal, state, or Social Security taxes are taken No FSA Enrollment = No FSA for 2012 38 How much can I contribute to a Flexible Spending Account? Health Care FSA Minimum: $100 Maximum: $5,000 Dependent Daycare FSA $5,000 maximum per family www.umn.edu/ohr/benefits/openenroll 39 What else do I need to know about Flexible Spending Accounts for 2012? 2012 contributions are made during the calendar year 2012 claims can be incurred between January 1, 2012, and March 15, 2013 “Use it or lose it” Any amount remaining after March 15, 2013, is forfeited Note: 2011 claims can be incurred through March 15, 2012 40 Are there any recent changes for Flexible Spending Accounts? Reminder: Section 9003 of the Affordable Care Act has a new uniform definition of qualified medical expenses Reimbursement will be made only if the medicine or drug (1) requires a prescription, (2) is available over the counter (OTC) and individual obtains prescription, or (3) is insulin Note: Insulin does not require a prescription 41 What else do I need to know about Flexible Spending Accounts for 2012? Over the Counter (OTC) supplies and devices (such as contact lenses and lens cleaning solutions), eyeglasses, Rx and office copays, bandages, blood sugar test kits, and out-of-pocket dental charges continue to be eligible for reimbursement. Be conservative in estimating your health care account contributions for 2012: do not include amounts for OTC medications unless you will have a prescription from your physician RFP in process for outsourced FSA services Debit card option 42 Other UPlan Information Enrolling Online If hired before December 1, new employees may make two elections to participate in FSA for 2011 and 2012 Multiple elections can be made online, but not at the same time; wait a day between enrollments Benefits will send an e-mail to affected employees Employees with appointments ending prior to January 1, 2012, cannot enroll online they are not anticipated to be active employees in 2012 44 Open Enrollment Communications Employees with enrolled same-sex domestic partners will receive a letter and instructions for Open Enrollment. Elections can be made online if currently enrolled, or on paper, if not. Materials are sent to employees on LOA & to those without computer access An e-mail will be sent in November to announce the start of Open Enrollment A final reminder will be sent near the end of November 45 Benefit Materials for 2012 U & Your Benefits newsletters Guide for UPlan Benefits Open Enrollment Online for all employees Paper copies for new employees, retirees, other former employees, and those without computer access COBRA instructions & rates Benefit summaries for prospective employees Summary of Benefits for Medical & Dental Plans Managers Toolkit on OHR website http://www.umn.edu/ohr/debcp/index.html 46 Applying for the Medical Premium Relief Program Application on Employee Benefits website UPlan participants submit application & 2010 tax forms to Employee Benefits Premium relief amounts range from $200 to $450 annually Paid as biweekly Medical Premium credits Applications received by December 15, 2011 Full year of Medical premium credit Applications received during 2012 Amounts are pro-rated Must be covered on January 1, 2012 47 Applying for the Medical Premium Relief Program Employee Benefits will contact those with incomplete applications Costs are considered taxable income Per University budget office, costs will be charged to departments, since income to the employee First payment on January 25, 2012 paycheck; last payment on December 26, 2012 paycheck 48 Information for Current Members of U Classic Plus by HealthPartners What are the Guidelines for Current U Classic Plus by HealthPartners Members? All U Classic Plus by HealthPartners members will need to re-enroll in a Medica plan option during Open Enrollment Elections are made online in Employee Self-Service A new election must be made in order to have coverage for 2012 50 Will HPMG Clinics be Available in Medica for 2012? All HealthPartners Medical Group Clinics (HPMG) will be available in Tier 1 of Medica Insights Lowest cost tier - $15 copay Includes Como & Riverside Clinics & Regions Hospital Tiers for Specialists and Hospitals can vary Example: University of MN Physicians (UMP) is in Tier 3 of Medica Insights Limited HPMG clinics are available in Medica Elect/ Essential and Medica Choice & Medica HSA 51 How does Insights by Medica work? Providers submit bids to Medica Providers are placed in three tiers based on cost/quality Insights Copays also vary by tier Tier 1 - $15 copay Tier 2 - $30 copay Tier 3 - $50 copay HealthPartners Medical Group clinics & Regions Hospital are in Tier 1 of Insights by Medica Specialists and hospitals are also tiered. Example: UMP is in Tier 3 52 How does Insights by Medica work? Members do not need to elect a Primary Care Clinic No referrals required Copays are based on the tier for the clinic / hospital from which you receive services If you want to stay with HealthPartners Medical Group clinics, they are all available only in Insights by Medica 53 What if I use a different provider within U Classic Plus? Other U Classic Plus by HealthPartners Clinics (Example: Park Nicollet, Allina, UMP) are available in other Medica products Medica Elect/Essential (base plan for Twin Cities & Duluth – lowest copays at $15) Insights by Medica (plan with tiered providers & copays) Medica Choice National (broad network plan with $30 copays) Medica HSA (high deductible plan with an HSA account) Use Medica’s Find a Physician/Hospital feature to locate the plan with your providers http://www.medica.com/uofm 54 What if I choose to change my plan and providers? You can change your Medical plan and providers, if you elect to do so. If you are in the midst of care for a serious medical condition (care received in the past 90 days) A short-term continuation of care with your current provider may be available. Medica’s care coordinators will work with you if you have An acute or life-threatening, A disabling, or chronic condition in an acute phase A confirmed pregnancy A physical or mental disability Culturally appropriate care or care in a certain language that Medica doesn’t have available Use the transition of care form to submit your request http://www.medica.com/uofm 55 Will I need a referral to see a specialist with Medica? You may want to have a recommendation from your primary care doctor before you see a specialist However, these Medica Plans do not require referrals to see an in-network specialist: Insights by Medica (the plan with tiered providers & copays) Medica Choice National (the broad network plan) Medica HSA (the high deductible plan with an HSA account) There are special guidelines for Medica Elect/Essential (the base plan) You do not need a referral to see a specialist in your care system You will need a referral approved by your care system’s referral coordinator to see an in-network provider who is not in your care system For all plans, you’ll need a referral from your care system and Medica to receive in-network benefits from an out-of-network provider 56 Will I still have access to my online HPMG medical record? If you remain a HealthPartners Medical Group patient, you will still have access to your online medical record This is a clinic/patient record, not a health plan record 57 If I decide to change to a new provider, can I ask my old provider to transfer my medical records? Yes, contact your new clinic’s Medical Records Department They will give you a form to use Send that to your old provider The old provider will transfer your records 58 2012 Wellness Program What Wellness Programs will continue in 2012? Wellness Assessment: January through March 2012 Earn $65 Wellness Reward for Employee & Spouse/SSDP Health Improvement Programs Phone-based Health Coaching In-person Health Coaching – Twin Cities, Duluth, and Morris Online Healthy Living Programs and Step It Up!® walking program Earn $65 Wellness Reward for Employee & Spouse/SSDP Fit Choices Program $20 monthly subsidy for health club participants Farmers Market: Minneapolis and Duluth 60 What’s new in the Wellness Program in 2012? New Wellness Points Bank program UPlan Members & Spouse/SSDPs can earn wellness points in 2012 to reduce their UPlan Medical Program premiums in 2013 through the new Wellness Points Bank program Wellness points are earned by participating in a wide range of Wellness Program-sponsored wellness activities Spouse participation completely voluntary Also includes Early Retirees, COBRA, etc. 61 How Does the New Wellness Points Bank Work? Employee-Only and Employee Plus Child(ren) coverage levels must earn 300 points by August 31, 2012, to qualify for a $300 premium reduction in 2013 Employee Plus Spouse/SSDP and Employee Plus Family coverage levels must earn 400 points by August 31, 2012, to qualify for a $400 premium reduction in 2013 $65 Wellness Rewards continue for 2012 but stop in 2013 62 What points can I earn for my Wellness Points Bank? Wellness Program Option Reward Points Preventive Care Wellness Assessment Annual flu shot Tobacco-free pledge Biometric Health Screening participation 100 25 25 100 Health Improvement Programs On campus Weight Management Program Tobacco-cessation Program NextSteps Telephonic Health Coaching On-site Health Coaching Fit Choices if Credits Earned in 5 Months Healthy Pregnancy Program Disease Management Telephonic Health Coaching 150 150 150 150 50 50 150 Health Action Campaigns Step It Up! Walking & Pedometer Program (available April 1, 2012) Online Healthy Living Program Bike Commuter Program 50 50 50 63 What Weight Management Programs are offered for 2012? Create your Weight — offered through Fairview on Twin Cities Campus and Weight Watchers at Work — offered on The Twin Cities and coordinate campuses You pay up front, Wellness Program will reimburse you in full if you attend 80% of sessions (Costs: $186 to $235) You can be reimbursed for up to three sessions per year; six total lifetime reimbursements New this year: Complete a weight management session by August 31, 2012, and earn 150 points in your Wellness Points Bank HIP (Health Improvement Program) available at UMD - no cost-Weight Management Focused Program Details available at: www.wellness.umn.edu 64 Would you like to be a Wellness Advocate for your Department? Wellness Advocates Program: Looking for Wellness Advocates from each College, Department Lead departmental Wellness initiatives Wellness Program to provide support, materials, and training Plus special programs for wellness advocates Interested? Email to well@umn.edu 65 Wellness Program Metrics Return on Investment Analysis Annual Return on investment (ROI) analysis assesses effectiveness of wellness programs in helping to control health care costs Overall study led by Professor John Nyman (School of Public Health), and research assistant Nathan Barleen Study on ROI for Fitness Rewards led by Jean Abraham 67 Programs Evaluated for Savings Evaluated Phone-based Disease & Lifestyle Management, Wellness Assessment, 10000 Steps Not Evaluated Nurseline, flu shot clinics, Farmers Market, Health Action Programs, Online Healthy Living Programs 68 Costs Evaluated for Savings De-identified costs evaluated for changes based on: – Health care claims costs from U of M claims data warehouse – Sick leave use by civil service and bargaining unit employees as a proxy for absenteeism 69 Brief Methodology Statement Tracked “difference in differences” in costs between participants and those eligible to participate who did not. Used claims and absence data from 2004 – 2007 to reflect pre- and post-implementation data Evaluated wellness program participation as one of many factors (age, gender, etc.) that could influence health care cost changes to isolate just the difference associated with participation. 70 2006-2008 ROI Analysis Disease management shows positive, statistically significant return on investment. Continued smaller return on absenteeism. Claims: $8,064,960 Absenteeism: $480,988 Total Savings - $8,545,948 Total Program Costs - $7,809,984 Disease Management Claims Savings covered $1.09 for every $1.00 of program costs – First positive ROI 71 2006-2008 ROI Analysis Also evaluated participation by year since many Wellness Program analyses indicate 3 years necessary for positive return DM participation in any one year generated savings of $960 over all three years DM participation in 2006 and 2007 or 2008 generated savings of $1,200 per year Participation in all three years didn’t add significant savings 72 2006-2008 ROI Analysis No significant return on Lifestyle Management or 10,000 Steps Did not put dollar impact on participant health and include that in calculations – have included improved measure of participant health in most recent Wellness Assessments to make that calculation possible Portion of the effectiveness is durable. Study does not include gains that would occur if program were stopped but effectiveness continued 73 Fitness Rewards ROI Analysis “Fragile Evidence” Persistent Exercisers show Some Evidence of Medical Claims Savings Exercise 5-9 of 12 Months 923 people – each saved $1,032 per year Estimated Return on Investment $952,536 Total Savings $406,246 Incentives & Administrative Expense $2.34 for Each $1 spent 74 Weight Management Programs Metric Create Your Weight Weight Watchers at Work Totals Participants 391 550 per session 941 Total Weight Lost 2,665.4 lbs. 12,555 lbs. 15,220.4 lbs. Average Loss Per Participant Per Session 6.8 lbs. 10.8 lbs. 9.8 lbs. 1-35 lbs. 1-70 lbs. 1-70 lbs. Weight Loss Range 75 Remember to enroll online for 2012! http://hrss.umn.edu