Closing Entries

advertisement

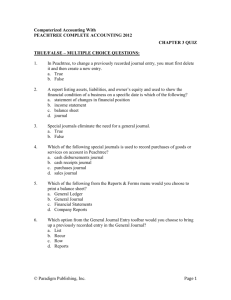

Completing the Accounting Cycle for a Service Business: Closing Entries and the Post-Closing Trial Balance Chapter 5 © Paradigm Publishing, Inc. 1 Learning Objectives 1. Explain the purpose of the closing process. 2. Journalize and post closing entries. 3. Prepare a post-closing trial balance. © Paradigm Publishing, Inc. 2 Learning Objective 1 Explain the purpose of the closing process © Paradigm Publishing, Inc. 3 Temporary Accounts Revenue and expense accounts and the owner’s drawing account Used to show changes in owner’s equity during a single accounting period Closing Process: The process of transferring the balances of the temporary accounts to the owner’s capital account Closing Entries: Entries necessary to accomplish the closing process © Paradigm Publishing, Inc. 4 1. To reduce the balance of temporary owner’s equity accounts to zero and thus make the accounts ready for entries in the next accounting period. 2. To update the balance of the owner’s capital account. © Paradigm Publishing, Inc. 5 Learning Objective 2 Journalize and post closing entries © Paradigm Publishing, Inc. 6 1. Close the balance of each revenue account to the Income Summary account. 2. Close the balance of each expense account to Income Summary. 3. Close the balance of Income Summary to the owner’s capital account. 4. Close the balance of the owner’s drawing account directly to the owner’s capital account. © Paradigm Publishing, Inc. 7 A clearing account used to summarize the balances of revenue and expense accounts Used only at the end of an accounting period Opened and closed during the closing process Does not have a normal balance as do other accounts Will never appear on the financial statements © Paradigm Publishing, Inc. 8 Quick Check The balance in the Income Summary account a. appears on the income statement. b. appears on the balance sheet. c. appears on the income statement and the statement of owner’s equity. d. does not appear on any financial statement. e. appears on the balance sheet and the statement of owner’s equity. © Paradigm Publishing, Inc. 9 We’ll use the numbers on the work sheet to demonstrate the closing entries. © Paradigm Publishing, Inc. 10 © Paradigm Publishing, Inc. 11 To close an account, we must make an entry that will reduce the balance of the account the zero. Thus, a revenue account must be debited for the amount of its credit balance. The credit will be to the Income Summary account. © Paradigm Publishing, Inc. 12 Quick Check When closing a revenue account, the a. revenue account is credited for its balance. b. owner’s capital account is credited for the balance of the revenue account. c. owner’s drawing account is credited for the balance of the revenue account. d. Income Summary account is credited for the balance of the revenue account. e. Income Summary account is debited for the balance of the revenue account. © Paradigm Publishing, Inc. 13 An expense account must be credited for the amount of its debit balance. The debit will be to the Income Summary account. © Paradigm Publishing, Inc. 14 Quick Check When closing an expense account the a. expense account is credited for its balance. b. owner’s capital account is credited for the balance of the expense account. c. owner’s drawing account is credited for the balance of the expense account. d. Income Summary account is credited for the balance of the expense account. e. owner’s capital account is debited for the balance of the expense account. © Paradigm Publishing, Inc. 15 Compute the balance in the Income Summary account. The balance in the Income Summary account will always reflect the amount of net income or net loss. Assuming a net income, it is transferred to the credit side of the owner’s capital account. © Paradigm Publishing, Inc. 16 The Income Summary account is debited for its balance to close it. © Paradigm Publishing, Inc. 17 Quick Check When closing the Income Summary account, assuming a net income the a. Income Summary account is credited for its balance. b. owner’s capital account is credited for the amount of the net income. c. owner’s capital account is debited for the amount of the net income. d. owner’s drawing account is credited for the amount of the net income. e. owner’s drawing account is debited for the amount of the net income. © Paradigm Publishing, Inc. 18 The balance of the owner’s drawing account does not enter into the determination of net income or net loss. Therefore, the drawing account is not closed to the Income Summary account. Instead, it is closing directly into the owner’s capital account. The drawing account has a debit balance and is credited to close it. © Paradigm Publishing, Inc. 19 The owner’s capital account is debited since drawing decreases the owner’s capital. © Paradigm Publishing, Inc. 20 Quick Check When closing the owner’s drawing account, the a. owner’s capital account is debited for the amount of net income. b. owner’s capital account is credited for the balance of the owner’s drawing account. c. owner’s drawing account is credited for its balance. d. Income Summary account is credited for the balance of the owner’s drawing account. e. Income Summary account is debited for the balance of the owner’s drawing account. © Paradigm Publishing, Inc. 21 The balance in the owner’s capital account after all closing entries have been prepared will be the updated balance appearing on the balance sheet and the postclosing balance. © Paradigm Publishing, Inc. 22 Quick Check The owner’s capital account is a. increased by the balance in the owner’s drawing account. b. increased by the amount of net loss. c. decreased by the balance in the owner’s drawing account. d. closed at the end of each accounting period. e. decreased by the amount of net income. © Paradigm Publishing, Inc. 23 Temporary Accounts All revenue accounts All expense accounts All drawing accounts Close at the end of the accounting period © Paradigm Publishing, Inc. 24 Permanent Accounts All balance sheet accounts Do not close at the end of the accounting period © Paradigm Publishing, Inc. 25 © Paradigm Publishing, Inc. 26 Quick Check Select the correct statement: a. Revenues, assets, and expenses are permanent accounts. b. Liabilities and the owner’s capital account are temporary accounts. c. Revenues, expenses, and the owner’s drawing account are temporary accounts. d. Assets, liabilities, and the owner’s drawing account are temporary accounts. e. Expenses and liabilities are permanent accounts. © Paradigm Publishing, Inc. 27 © Paradigm Publishing, Inc. 28 Example Assume the Service Revenue account has an ending balance of $3,000. Prepare the closing entry. General Journal Date 20X1 Dec. Account Title 31 Service Revenue Income Summary © Paradigm Publishing, Inc. P.R. Debit Credit 3,000 3,000 29 Example Assume Salaries Expense has an ending balance of $1,200. Prepare the closing entry. General Journal Date 20X1 Dec. Account Title 31 Income Summary Salaries Expense © Paradigm Publishing, Inc. P.R. Debit Credit 1,200 1,200 30 Example Assume net income for the current period is $1,800 for June Delugas Interiors. Prepare the closing entry. General Journal Date 20X1 Dec. Account Title 31 Income Summary June Delugas, Capital © Paradigm Publishing, Inc. P.R. Debit Credit 1,800 1,800 31 Example Assume June Delugas, Drawing, has an ending balance of $500. Prepare the closing entry. General Journal Date 20X1 Dec. Account Title 31 June Delugas, Capital June Delugas, Drawing © Paradigm Publishing, Inc. P.R. Debit Credit 500 500 32 1. Close the balance of revenue accounts to Income Summary. 2. Close the balance of expense accounts to Income Summary. 3. Close the balance of Income Summary to the owner’s capital account. 4. Close the balance of the owner’s drawing account to the owner’s capital account. © Paradigm Publishing, Inc. 33 © Paradigm Publishing, Inc. 34 Review Quiz 5-1 Close the temporary accounts. © Paradigm Publishing, Inc. 35 Review Quiz 5-1 © Paradigm Publishing, Inc. 36 Review Quiz 5-1 The closing entries are journalized. © Paradigm Publishing, Inc. 37 Review Quiz 5-1 © Paradigm Publishing, Inc. 38 After closing entries have been journalized, the next step in the accounting cycle is to post these entries from the general ledger to the general journal After posting has occurred The permanent accounts will have up-to-date balances The temporary accounts will have zero balances © Paradigm Publishing, Inc. 39 Review Quiz 5-2 T-Account Balances © Paradigm Publishing, Inc. 40 Review Quiz 5-2 The temporary accounts are journalized. © Paradigm Publishing, Inc. 41 Learning Objective 3 Prepare a post-closing trial balance © Paradigm Publishing, Inc. 42 The final step in the accounting cycle Ensures the ledger will be in balance at the start of the next account period Only permanent accounts appear on the post-closing trial balance, since the balances of all temporary accounts have been reduced to zero © Paradigm Publishing, Inc. 43 © Paradigm Publishing, Inc. 44 Quick Check Select the correct statement: a. The post-closing trial balance will list revenues and assets. b. The post-closing trial balance will list assets and the owner’s capital account. c. The post-closing trial balance will list expenses and assets. d. The post-closing trial balance will list the owner’s drawing account and the owner’s capital account. e. The post-closing trial balance will list expenses, revenues, and liabilities. © Paradigm Publishing, Inc. 45 1. Analyze transactions from source documents During the accounting period 2. Record transactions in a journal 3. Post from the journal to the ledger 4. Prepare a trial balance of the ledger © Paradigm Publishing, Inc. 46 5. Determine needed adjustments 6. Prepare a work sheet At the end of the accounting period 7. Prepare financial statements from a completed work sheet 8. Journalize and post adjusting entries 9. Journalize and post closing entries 10.Prepare a post-closing trial balance © Paradigm Publishing, Inc. 47 Any period of time covering the complete accounting cycle, from the analysis of transactions to the post-closing trial balance. A fiscal period consisting of 12 consecutive months is a fiscal year. A fiscal year does not necessarily coincide with the calendar year. A fiscal year ending at a business’s lowest point of activity is referred to as a natural business year. © Paradigm Publishing, Inc. 48 Accrual Basis of Accounting The basis of accounting that requires that revenue is recorded when earned, no matter when cash is received, and that expenses are recorded when incurred, no matter when cash is paid. Cash Basis of Accounting The basis of accounting where revenue is recorded only when cash is received, and expenses are recorded only when cash is paid. The cash basis of accounting is not in accordance with GAAP. © Paradigm Publishing, Inc. 49 © Paradigm Publishing, Inc. 50 Focus on Ethics Refer to the Focus on Ethics box on pages 191-192 in your text. What pressures might lead executives to try to illegally manipulate a company’s earnings? © Paradigm Publishing, Inc. 51 Joining the Pieces Steps in the Accounting Cycle for a Service Business © Paradigm Publishing, Inc. 52