Output - Taskin

advertisement

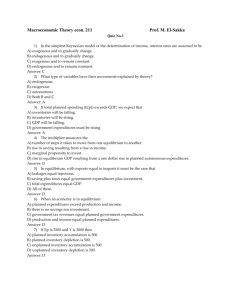

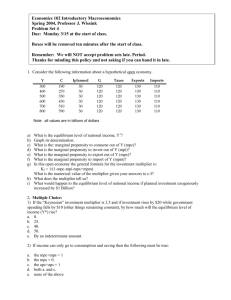

Output, growth and business cycles Econ 102 GDP Growth Countries: High savings rate have higher GDP/ cap. high population growth rates have low GDP/ cap. Solow model: GDP and Per capita GDP Output grows over time: SR and LR Aggregate Supply LR Aggregate Supply SR Aggregate Supply Very long run Aggregate Supply Potential Output Ideal level of income What is an ideal level of Real GDP? POTENTIAL INCOME (Full employment level of income) The income level that corresponds to the output that will be produced if all resources are employed at a ‘normal’ rate. Here, the output level at the Natural Rate of Unemployment, (U% is equal to only frictional + structural U% rate, and cyclical U% is zero.). SR and LR Aggregate Supply There are constraints on Price changes and Output changes. Very long run: capacity is growing, shifts in the LRAS curve. Long run AS: capacity of production is constant, an increase in demand increases prices but not quantity. Short run AS : price pressures are less, there are unemployed resources and if demand increases output increase without price increase. Which output level is produced: Demand and Supply Aggregate Demand and Aggregate Supply Business Cycles Boom Y potential Recession Depression Trough AS and AD Equilibrium at different Y levels Business Cycles: Cyclical fluctuations in real GDP, Contractionary period: output is declines, unemployment rises, price pressures are low, pessimistic outlook, investment is declining Recession (depression): Output is low, Unemployment is high, wages are low, prices are not increasing, interest rates are low. Expansionary period: Output is increasing, unemployment is declining, wages and prices are increasing, optimistic outlook, investment is increasing, Boom: Prices are high, interest rates are high, unemployment is low, (good times but not clear how long this will last...) Aggregate Demand Total of desired aggregate expenditures Which type expenditures? Desired Consumption Expenditures: Desired Investment Expenditures: Government Expenditures: Net Exports: WHY ‘DESIRED’ EXPENDITURES? WHY ‘DESIRED’ EXPENDITURES? Agents may want to purchase, may plan to buy but Are there enough goods there? If not ? What happens? What type adjustment occur will happen? ‘Desired’ Aggregate Expenditures Buyers in the Goods and Services Market: Desired Consumption Expenditures + Desired Investment Expenditures + Desired Government Expenditures + Desired Net Exports ___________________________________________________ Desired Aggregate Expenditures (AEd) Closer look at the components of desired AE? AEd= Cd + Id + Gd + Xd – Md Household: Cd depends on Disposable Income, after tax income. Firms: Id depends on cost of borrowing; interest rate. External Sector: Xd and Md depends on exchange rate and Income of domestic and foreign income. Government: determines its own expenditure level Gd (it is a policy tool). When will there be an equilibrium? When aggregate desired expenditures are equal to total output produced AEd = Y (Equilibrium) If Aggregate Expenditure is less than output AEd < Y, stocks of unsold good will pile up. If Aggregate Expenditure is more than output AEd > Y stocks of unsold good will decline. Equilibrium in a Macroeconomy (Keynesian Model) Graphical Presentation and Equilibrium: Disequilibrium adjustment If the economy starts at a point where AE≠Y; what happens? The forces in the economy will bring the economy to the equilibrium output level. (Stable equilibrium) If for example AE<Y… then inventories will pile up, the firms will cancel orders, firms will cut back production, fire workers, employment and production will decline until AE=Y. (Reverse is also true for AE>Y ) Equilibrium in a Macroeconomy Keynesian Model: (emphasizes the demand side, assumes constant prices and unemployed resources) If AEd > Y , then there is unplanned decline in the inventory levels of the firms, firms start to increase production. If AEd = Y , then there is no unplanned change in inventory levels, no change in production (Equilibrium). If AEd < Y , then there is unplanned increase in the inventory levels of the firms, firms start to decrease production. More of a closer look at the components of Aggregate Expenditures Desired Consumption Expenditures: Cd C d = C + mpcYD What is Disposable Income? DI DI =Y -T +TR Therefore desired consumption expenditures are increasing function of DI and hence Y. A Model for Desired Aggregate Expenditures d Desired Investment I =Expenditures: f (cost of borrowing) Id The model assumes interest rates to be constant, hence wed can write: I =I A Model for Desired Aggregate Expenditures Desired Government Expenditures: Gd G = Government's Policy Tool d Therefore we can write as: G =G d A Model for Desired Aggregate Expenditures = constant Net Exports NX Desired Net Exports: NXd d In the simple model the exchange rate and foreign income are held constant, hence we can write: NX d = NX Mathematical Example Steps to find the Equilibrium Income (Output): 1. Find Desired Aggregate Expenditure Function as a function of Y. 2. Use equilibrium condition: AEd= Y 3. Solve for Y, which will be the level of output which is equal to the level of AEd. Example… Economic Models Economic models are the use of simple (often mathematical) relationships in order to represent the complex of economic processes. We make assumptions and use the necessary variables we are interested in. We domnot explicitly mention the other factors that might have relatively less important effect on the outcome. Example: Consumption Function and d C C mpcYD YD =Y -T +TR Why does the Equilibrium Income change? If any of the autonomous spending increase then equilibrium income will increase from YE to YE NEW. Possible causes of autonomous income increase are: C, I , G, NX (Graphically all of these are vertical (upward) shift of the AE function) How does the Equilibrium Income change? I =I d I <I I =I d Example: If Investment increases from to (where AEd=Y Then AE ) AEd new AEd Δ Id 45o YE YE NEW Δ YE Y How does Eq. Income respond to a change in AEd? What is the change in equilibrium income if Id increases? Multiplier: DY E 1 = d DI 1- slope of AE function Numeric example… Why is there a ‘multiplier effect’? Initial increase in autonomous spending sets off a series of increase in AE and in real GDP. First increases, which means firms want to purchase more new machines, the AE in the economy increases, the factories which makes these machines will hire workers. This will increase their salary payments, the workers will increase their desired consumption and hence the economy will move to a higher Y level along the new AE function. I How does the multiplier work? Change in Autonomous Expenditure Round 1 Round 2 Round 3 Round 4 Round ∞ 200 0 0 0 . . 0 Change in Induced Expenditure 0 (0.7)* 200 (0.7)*140= (0.7)2*200 (07)*98=(0.7)3*200 . . (0.7) ∞*200 200 140 98 68.6 0 DY E = (1+ 0.71 + 0.72 + 0.73 +... + 0.7¥ )DI æ 1 ö E DY = ç ÷ DI è 1- 0.7 ø Change in Aggregate Expenditure= Change in Real GDP 200 340 438 506.6 . . 666.67 Multiplier For one unit increase in the autonomous desired expenditures the equilibrium income increases by a multiple amount. The formula for the multiplier: The steeper the slope of AE function, the larger will be the multiplier. DY E 1 = d DI 1- slope of AE function Why do we need the multiplier information? If Desired Government Expenditure increase by 1 billion TL, we can tell what will be the change in the equilibrium income. (Multiplier x 1 billion TL) Hence we will be able to tell how much increase in desired government expenditure is necessary to bring the economy to Potential Real GDP level. Output Gap = Y – Y Graphically Output Gap AEd=Y AE AEd new AEd Δ Id 45o YE YE NEW Δ YE Y Necessary change in G to close the Output Gap ∆Y= multiplier*∆G Hence you may compute the necessary change in change in G from the above equation, as ∆G= ∆Y/ multiplier What if the government increases taxes by 1 Billion TL Is the effect on Real GDP ( Equilibrium income) expansionary or contractionary? ??? How much will be the change in Real GDP? ???