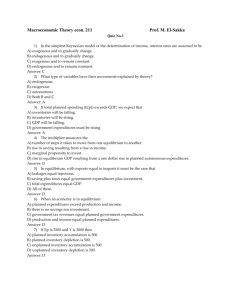

Aggregate Production/Aggregate Expenditures Model

advertisement

Aggregate Production/Aggregate Expenditures Model And the Macro Policy Debate Textbook Keynesian Model • Keynesians said govt action could help shift aggregate equilibrium demand…but exactly how? • Fills gap in macro policy model by determining the size of the multiplier effects • Knowing how much could increase their impact on policy – Know the multiplier effects due to an autonomous shock to aggregate equilibrium – Autonomous shift – changes outside the AE/AP model Aggregate Production/Aggregate Expenditures Model (AP/AE) • Aggregate Production = Aggregate Supply • Aggregate Expenditures = everyone’s planned spending • Focuses on total production changes, not changes in output caused by price-level changes – What do you notice about this model already? Hint: price-level • Focuses on induced effects of changes in AP and AE Aggregate Production (AP) • What is AP? AP and Expectations AP Curve • If businesses expect high expenditures, they produce a lot – If expect low expenditures, produce little – Planned investment • AP represented by 45° • Model only relevant when output is below its potential (Keynesian Range or A range of AS path) – Exhibit 1 pg 282 At all points, income = production Keynesian View of Production • Income = aggregate production • Planned expenditures need not equal production • If expenditures and production not in equilibrium, some adjustment necessary to move back to equilibrium – Inventory: expand or contract it Aggregate Expenditures Look familiar? • E = C + I + G + (X-M) • In AP/AE model, as production changes expenditures change, but not by as much – Why not? AE: Autonomous and Induced Expend. • Even if 0 income, there is still spending – Autonomous expenditures • Expenditures function represents relationship between E and Y: E = E˳ + mpeY E = expenditures E˳ = autonomous expenditures mpe = marginal propensity to spend Y = income AE: mpe • mpe is the ratio of a ΔE/ΔY – mpe is fraction spent from additional dollar of Y – Remember: largest component of expenditures is __________ and that the propensity for individuals to spend out of their income is a key determinant of mpe Determining Aggregate Income • Bringing AE and AP together – Economy is in Range A – Price level is constant (horizontal line) – AP curve is 45° line up until economy reaches potential income – E shown on AE line not necess. = AP – To determine income graphically, find where AE = planned AP Determining Aggregate Income with Keynesian Equation • Y = E˳ + mpeY • Multiplier, or induced effects, is key aspect that differentiates it from Classical model – How? • Multiplier is a number that reveals how much income will change in response to a change in autonomous expenditures • Multiplier = 1/(1-mpe) • Multiplier explains downward spirals in economy • As mpe increases, the multiplier increases (the larger the effect on change in income) • Induced effects = (multiplier) (E˳) Income Adjustment Mechanism • Multiplier process works b/c when E do not equal AP, people change planned production, which changes income, which changes expenditures… Multiplier and Circular Flow Injections & Withdrawals • The mpe measures the percentage of injection • But there is withdrawal from the flow, too – money leaving the circular flow (e.g., save $) – Marginal propensity to withdraw (mpw) is % of income flow that leaks out of the economy for each round of the circular flow – Mpe + mpw = 1 – Mpw = 1-mpe – Multiplier = 1/mpw – [Remember multiplier for mpe is 1/(1-mpe)] • Equilibrium occurs when withdrawals = E˳ Shifts in Autonomous Expenditures • How much would a change in autonomous expenditures change the equilibrium level of income? • Remember: E = C + I + G + (X-M) – Changes in consumer taste affect __ – Changes in exchange rates affect __ – Major tech breakthroughs affect __ Japan: Shifts Explained 1. 2. 3. 4. 5. 6. 7. A dramatic rise in the Japanese exchange rate cuts Japanese exports AE falls so that AP is greater than AE Suppliers cannot sell all they produce If all producers lay off workers and decrease output, investment, and hence AE, will also fall As laid off workers cut consumption, total AE will decrease further Producers will lay off still more workers and cut back production even more Keynes argued that the downward spiral will finally stop 1. 2. 3. Fired workers will dip into saving and not cut back expenditures by the full amount of their decrease in income So as income falls, AP and AE will move closer together At some level of income, AP will equal AE *Income Adjustment Process: Exhibit 7, pg. 293 • Paradox of thrift – individuals attempting to save more, spent less, and caused income to decrease. ended up saving less! Keynesian Model when Price Isn’t Fixed • AP/AE model depends on economy in Range A – The relative split is determine by the degree of pricelevel flexibility determine by the AS path • If Range A, change reflected in shift in Y • If in Range B part of the shift of AE curve would be offset by a change in price level • The greater the slope of the AS path, the greater the shift back in AE as change in P offsets any would be change in Y • Real income increases by smaller amount when prices are flexible than when they are fixed; Exhibit 10a, pg. 295 • If in Range C, AS curve is vertical and price-level offset is complete – In Range C, all changes nominal (inflation) not real; Exhibit 10b Classical Response to Keynes • Keynesian model is not a complete model of the economy – Doesn’t tell us where the autonomous expenditures comes from in real life – Doesn’t tell us how we go about measuring them – At best, model allows estimate direction and rough sizes of autonomous demand and supply shocks Classical Response • Shifts not as great as Ks suggest – Model leads people to overemphasize the shifts that occur in AE in response to a shift in E˳ – If one takes a broad view of AE, many of the shifts in E are simply rearrangements from one group of expenditures to another (C to I; G to C) • Price level changes in response to shifts in demand – AP not always at 45° line – Economy is in range B, where price level change equilibrium Classical Response • People’s forward-looking expectations make adjustment much more complicated – Keynesians assume people respond to current prices – Most people act on expectations for the future • Firms may not automatically cut back on production and lay off workers if they see the fall as temporary • They would begin to build up their inventories or give workers other tasks (e.g., Garrett’s dad at Boeing) Classical Response • Expenditures depend on much more than current income – Permanent income hypothesis – expenditures are determined by permanent or lifetime income The Keynesian Cross • Khan: https://www.khanacademy.org/economicsfinance-domain/macroeconomics/incomeand-expenditure-topic/keynesian-crosstutorial/v/keynesian-cross (6:33 min) AP/AE Model and Macro Policy Model • Using them together – Equivalent when the P is fixed (range A on AS path) – Show the affect of adjustments in equilibrium AP/AE on AED curve and AS path – Example: Exhibit 12a and b, pg. 301 AP/AE & Macro Policy Models • When P partially flexible – Changes in both P and output and additional adjustments to AE – Exhibit 12c and d, pg. 301 AP/AE & Macro Policy Models • What will happen with P is flexible (range C)? IS-LM Model • Describes the aggregate demand of the economy using the relationship between output and interest rates. • IS = Investment and Saving equilibrium – Inverse relationship between interest rate and output • LM = Liquidity preference Money supply – quantity of money demanded increases with aggregate income and decreases with the interest rate • Explains decisions made by investors when it comes to investments – with the amount of money available and – the interest they will receive. – Equilibrium is achieved when the amount invested equals the amount available to invest. • • • • Investment and real interest rates (2:11 min) Keynesian Cross and the IS curve (7:36 min) Loanable Funds (6:06 min) Govt spending and the IS-LM model (6:05 min)