Chapter 14 Guided Reading 2013

Name ___________________________

Period ___________

Chapter 14 – The Congress, the President, and the Budget: The Politics of Taxing and Spending

Guided Reading Notes

1. Define Budget

2. Define Deficit

3. Define Expenditures

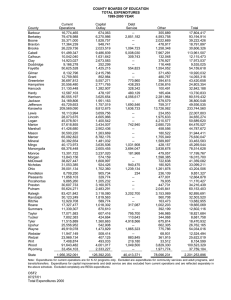

4. Define Revenues

5. Explain why a deficit occurs and the main reason why the government has accrued such a large deficit.

6. Identify the time period when most of today’s federal debt was run up by the government.

7. Define Income tax

8. Identify the four main sources of revenue for the government, and place them in order of most amount revenue to least amount of revenue based on Figure 14.1 on page 437. a. b. c. d.

9. Describe the details of the 16 th Amendment.

10. Identify the purpose and roles of the IRS.

11. Describe the difference between a progressive tax and a flat tax. Provide an example of each. a. Progressive: b. Flat:

12. Explain who pays Social Security Tax and the purpose of it.

13. Explain how the government “borrows money”.

14. Define Federal Debt.

15. Justify why the federal debt has continued to increase.

16. Explain capital budget and how it affects the federal deficit.

17. Define Tax Expenditures and provide at least three examples of tax expenditures in the current tax system. a. Definition: b. Examples:

18. Describe the THREE things that the government could do instead of allowing tax expenditures a. b. c.

19. Explain the characteristics of Reagan’s Tax Cuts in 1981.

20. Explain the characteristics of Reagan’s Tax Reforms in 1985.

21. By reading “How Much is Too Much”, compare the Untied States Tax to at least three other countries.

22. Identify the four main Federal Expenditures. Clarify the estimated costs and the proportions of the federal budget that goes to each Expenditure based on Figure 14.3. a. b. c. d.

23. After reading “How Big is Too Big?”, compare the United States spending to their GDP to at least three other countries.

24. How has the United States changed the budget of National Security throughout the years?

25. Define procurement in relation to National Security.

26. Describe the evolution of the Social Services provided in the Untied States.

27. Define Social Security Act

28. Define Medicare.

29. Define Incrementalism and describe the features of an incremental budgeting process. a. Definition: b. c. d. e.

30. Define uncontrollable expenditures and give examples. a. Definition b. Examples

31. Define entitlements and give examples. a. Definition b. Examples

32. Present an argument, with examples, in favor of the view that the rise of social services state and the rise of the national security state are the main causes of “big government” in America.

(Page 444-452)

33. List and describe, in brief, the various actors who influence the budgetary process. In total, are the interests of democratic government served? By whom and in what ways? (page 452-454

Hint: There are TEN players)

34. Outline the schedule of the President’s Budget.

35. Define and describe the provisions of the Congressional Budget and Impoundment Act of

1974. a. Definition b. c. d.

36. Define budget resolution

37. Define reconciliation

38. Define authorization bill

39. Define appropriations bill

40. Define continuing resolutions

41. Describe the continued reforms made in response to the budget.

42. Why do some economists attribute the growth in the scope of the government to the equality of the suffrage in America? Access the legitimacy of this claim and whether or not you think it is a positive or negative aspect of democracy. (page 460-462)

43. In what ways is the very size of the federal budget an inhibition on adding or dramatically expanding government programs? (page 463-465)