Disinflation, Crisis, and Global Imbalances, 1980

advertisement

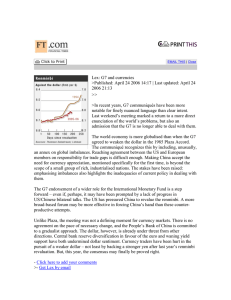

Disinflation, Crisis, and Global Imbalances, 1980 - 2008 Thomas Wheat Disinflation and the 1981-1983 Recession • Late 1979 Fed Chairman Volcker announces change in U.S. monetary policy • 1980 – Ronald Reagan elected on antiinflation platform • U.S. Interest Rates Doubled between 1978 and 1981 Dollar appreciation • Higher US Interest Rates lead to appreciating US Dollar • Appreciation not welcome abroad • Second Oil Shock in throws World Economy in Recession Fiscal Policies, the Current Account, and the Resurgence of Protectionism • President Reagan lowers taxes and raised defense spending • By 1987 US a net debtor • Strong US dollar leads to more imports and increased unemployment in some sectors Global Slump, Recovery, Crisis, and Deficits • Inflation in 1985 and 1986 leads to high in inflation in 1987 and 1988 leading to economic downturn in 1990 • US recovers in 1992 and grows through 1990’s • Japan growth in 1996 and Government response The Plaza Accord • Agreement between France, West Germany, Japan, US, and UK to deflate USD vs. Yen • Exchange Rate fell 51% between 1985 and 1987 • Reason’s for Plaza Accord: Reduce US account deficit and help US economy emerge from Depression Global Imbalances and Real Interest Rates in 2000’s • US Real Interest Rates drop from 1997 – 2006 • US tax cuts in early 2000’s lead to larger deficit • Interest Rate drops leading to more American’s buying homes • Change in investment behavior outside US

![Sculptures [slide] by Cynthia Dianne Barnes](http://s2.studylib.net/store/data/013509397_1-945353041bb2dd0aabb8a3013516adb2-300x300.png)