Lex: G7 and currencies 2006 21:13

advertisement

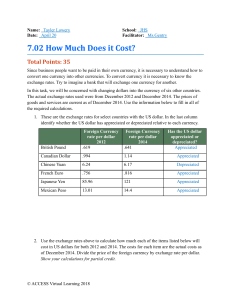

EMAIL THIS | Close Lex: G7 and currencies >Published: April 24 2006 14:17 | Last updated: April 24 2006 21:13 >> >In recent years, G7 communiqués have been more notable for finely nuanced language than clear intent. Last weekend’s meeting marked a return to a more direct enunciation of the world’s problems, but also an admission that the G7 is no longer able to deal with them. The world economy is more globalised than when the G7 agreed to weaken the dollar in the 1985 Plaza Accord. The communiqué recognizes this by including, unusually, an annex on global imbalances. Reaching agreement between the US and European members on responsibility for trade gaps is difficult enough. Making China accept the need for currency appreciation, mentioned specifically for the first time, is beyond the scope of a small group of rich, industrialised nations. The stakes have been raised: emphasising imbalances also highlights the inadequacies of current policy in dealing with them. The G7 endorsement of a wider role for the International Monetary Fund is a step forward – even if, perhaps, it may have been prompted by a lack of progress in US/Chinese bilateral talks. The US has pressured China to revalue the renminbi. A more broad-based forum may be more effective in forcing China’s hand than these counterproductive attempts. Unlike Plaza, the meeting was not a defining moment for currency markets. There is no agreement on the pace of necessary change, and the People’s Bank of China is committed to a gradualist approach. The dollar, however, is already under threat from other directions. Central bank reserve diversification in favour of the euro and waning yield support have both undermined dollar sentiment. Currency traders have been hurt in the pursuit of a weaker dollar – not least by backing a stronger yen after last year’s renminbi revaluation. But, this year, the consensus may finally be proved right. - Click here to add your comments >- Get Lex by email > > > Find this article at: http://news.ft.com/cms/s/737aa1e0-d380-11da-b2f3-0000779e2340,s01=1.html EMAIL THIS | Close Check the box to include the list of links referenced in the article.