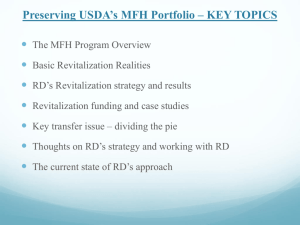

RD*s Revitalization Strategy

advertisement

RD’s Revitalization Strategy • • • Components of all deals – Project is needed in market – Post transaction Owner is eligible Basic Feasibility Thresholds – CNA to determine capital needs, timing and funding – Underwriting to determine feasibility and tools • SUSTAINABLE RENTS = SUSTAINABLE PROPERTIES! • CNA needs/3 year data/O&M cushion/vacancy/accounts current – Seller payments and increased RTO is market based • Market value for equity loan • CRCU limit for equity payment and increased RTO • CRCU test before any MPR tools – Consider and mitigate impact on tenants Long Term Commitment – RD’s RA funding/Owner’s RUP Rural Housing Preservation Associates, LLC - contact Larry Anderson at landerson@rhpallc.com Access to Preservation Resources • MPR (MFH Preservation and Revitalization Demo) – – • Transfer – – • Access RA, RTO increase and equity loan incentives (stay in owners or transfers) Apply thru RD Office – Incentives and S2NP process strictly regulated by Statute Substitution of GP’s or "no funds” transfers – – • Access 3rd party funding – only source of seller payment outside prepayment process Apply thru RD Office, Low rents = tight deals and “Pie split” issues common Prepayment process – – • Apply thru NOFA – only access RD rehab funds – key tool: deferrals (pre-92 only) Simple (stay in owners)/Complex (transfers)Portfolio (transfers and stay in owners) Access to project control - no RD resources available Apply thru RD Office, beware of internal and RD related “pottery barn” affect Internal Rehab – – Access to existing RA and rent proceeds Work with RD Office – get a CNA and prepare a plan Rural Housing Preservation Associates, LLC - contact Larry Anderson at landerson@rhpallc.com Preservation Strategies – Lost Resources • • • • • MPR (MFH Preservation and Revitalization Demo) – Last MPR NOFA FY 2013 – Annual funding for about a 100 projects Transfer – FY 12 started to retire RA and FY 13 stopped States from re-using RA – Tighter appraisals - new debt rarely works, esp. if RUPs in place – New underwriting UNL discourages rent increases and 3rd party funders Prepayment process – No USDA NP advance request since FY 2010 budget – No USDA Incentive RA request since FY 2010 budget – Current arbitrary freeze on new incentive offers or funding of sale to nonprofits since July 30, 2012. Cloud on all prepayments. Sales of Inventory Projects – No credit sale funding requested since FY 12 and selling fixed up program properties as “non-program.” Ended all New Construction in FY 2012 – Avg. of 2,000 units lost each year Rural Housing Preservation Associates, LLC - contact Larry Anderson at landerson@rhpallc.com Some advice on a preservation strategy: • Look for deals that work – the four “R” analysis – – – – RENTS - What’s the gap between current basic rents and market rents? RA - How many RA units and what is the percentage? RUPS – Find out about RUPs and prepayment restrictions (pre or post 89) REHAB – How much (CNA & SOW)? Rehab or Transfer/Rehab? • Line up third party money – – – – – Lots of competition for 9% LIHTC 4% LIHTC with tax exempt bonds are less utilized, but need more units Combine with MPR – usually only deferral is needed (only pre-92 loans) 538 may be an option Consider partnership with NP to score well for AHP or LIHTC – Line up green money • Long term operational savings • Look at energy generation • Work with all to keep process simple and open – Meet early and often! Rural Housing Preservation Associates, LLC - contact Larry Anderson at landerson@rhpallc.com Successful strategies to coordinate and cooperate • Agree to a Scope of Work – – – – • First CNA – full review of needs. Walk the property together! Add third party requirements – to get tax credits what must you do Agree to a Scope of Work Revised CNA to reflect post rehab per Scope of Work Expect and schedule a series of meetings with all parties – Issues will rise throughout the process – Establish a positive effective working relationship • Establish realistic underwriting expectations – Equity and RTO increase must fit within CRCU – The gap between current rents and CRCU is a pivotal feasibility measure – Some projects may not have the market position to satisfy all expectations • • Is the MPR Team Leader available for fast tracked help advice and solutions? Big Deals need big time team work – Coordinate developer, financial and RD resources (loan/servicing and technical) – Focus on critical times – application, underwriting, obligation, closing, and construction Rural Housing Preservation Associates, LLC - contact Larry Anderson at landerson@rhpallc.com