Macro

advertisement

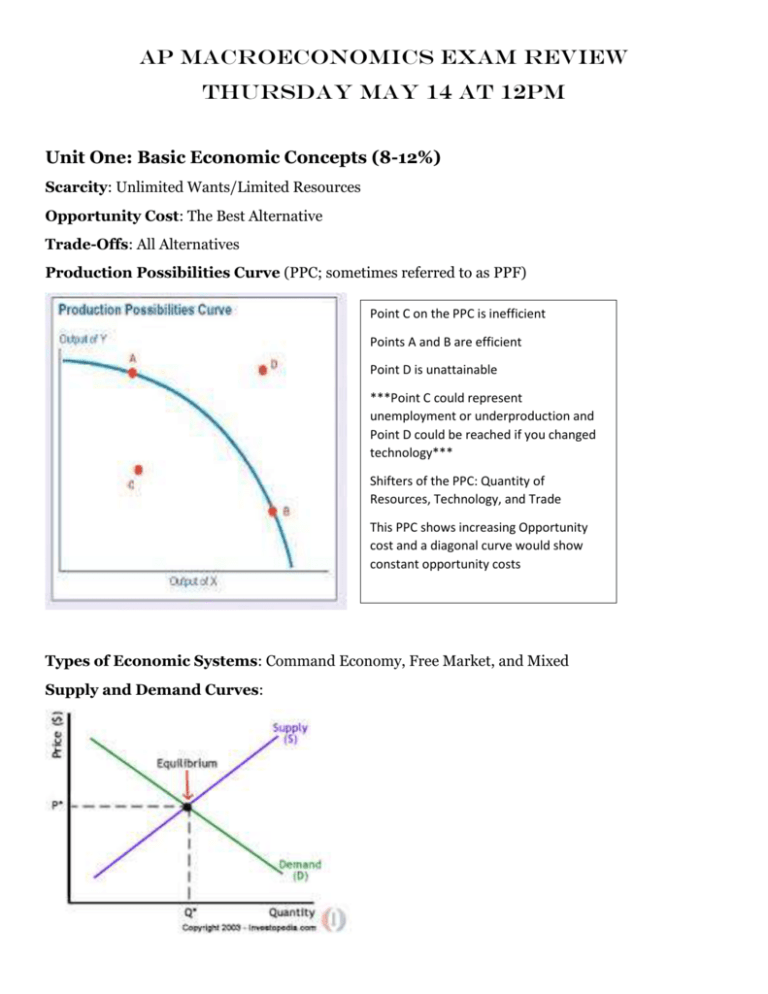

AP Macroeconomics Exam Review Thursday May 14 at 12pm Unit One: Basic Economic Concepts (8-12%) Scarcity: Unlimited Wants/Limited Resources Opportunity Cost: The Best Alternative Trade-Offs: All Alternatives Production Possibilities Curve (PPC; sometimes referred to as PPF) Point C on the PPC is inefficient Points A and B are efficient Point D is unattainable ***Point C could represent unemployment or underproduction and Point D could be reached if you changed technology*** Shifters of the PPC: Quantity of Resources, Technology, and Trade This PPC shows increasing Opportunity cost and a diagonal curve would show constant opportunity costs Types of Economic Systems: Command Economy, Free Market, and Mixed Supply and Demand Curves: Comparative Advantage: Lower Opportunity Cost to produce a particular good ***Understand the Circular Flow Model and make sure to label EVERYTHING!!!*** Unit Two: Measurement of Economic Performance (12-16%) Gross Domestic Product: GDP is the market value of all final goods and services produced within a country in a given period of time. Consumer Spending+Investments from Businesses+Government Spending+Net Exports(Exports-Imports). C+I+G+X-M. ***Memorize this because it is essential for how the economy increases and decreases!!!*** Real GDP: GDP adjusted for inflation Nominal GDP: Not adjusted for inflation Categories of Unemployment: Structural (Wrong Skills), Frictional (Between Jobs), and Cyclical (Recession/Bad Economy) To Calculate Natural Rate of Unemployment, you add Frictional and Structural together Labor Force: Number of Employed + Number of Unemployed Unemployment Rate= Number of Unemployed/Labor Force X 100 Labor Force Participation Rate= Labor Force/Adult Population X 100 ***The problems of the Unemployment Rate is that it does not include Discouraged Workers.*** Calculate Inflation= Price of Basket/Price of Basket in Base Year (this shows how prices have changed since the base year) GDP Deflator= Nominal GDP/Real GDP X 100 Business Cycle: Unit Three: National Income and Price Determination (10-15%) Shifters of AD: Consumer Spending, Investments, Government Spending, and Net Exports When AD Shifts, there will be movement ALONG the Phillips Curve Shifters of AS: Price of Resources Change, Taxes and Subsidies to Businesses, and Productivity When AS Shifts, this will in return move the entire Short Run Phillips Curve ***Make sure when labeling this graph to write PRICE LEVEL and NOT PRICE*** Fiscal Policy: The Setting of the level of government spending and taxation by government policymakers Multiplier Effect: Additional shifts in AD that result when expansionary fiscal policy increases income and thereby increases consumer spending Expansionary Policy: To Increase AD; You either Increase Government Spending or Decrease Taxes which would Decrease Consumer Spending which would then Increase AD Contractionary Policy: To Decrease AD; You either Decrease Government Spending or Increase Taxes which would Decrease Consumer Spending which would then Decrease AD ***The Graph on the left is an example of a Recessionary Gap. To fix a Recessionary Gap, you would use Expansionary Policy. The Graph on the Rights is an example of an Inflationary Gap. To fix an Inflationary Gap, you would us Contractionary Policy. GOVERNMENT SPENDING HAS MORE OF AN EFFECT THAN CUTTING TAXES!!! Phillips Curve: Shows the relationship between Inflation and Unemployment Unit Four: Money and Monetary Policy (15-25%) Types of Money: Fiat Money has no intrinsic value and Commodity Money is like Gold and Silver. Functions of Money: Shifters of Money Supply: Reserve Requirement (RR): Percentage of Money that Banks don’t use. When RR increases, Supply of Money (Sm) Decreases and when RR Decreases Sm Increases Money Multiplier= 1/RR Discount Rate (DR): Rate FED Charges Banks. When DR Decreases, Sm Increases and when DR Increases, Sm Decreases Open Market Operations: FED Buys and Sells Bonds. FED Buys=Sm Increase. FED Sells=Sm Decreases “Buy Big, Sell Small” The Federal Reserve (FED): Controls the Central Banks’ Monetary Policy Monetary Policy: The setting of the money supply by policymakers in the central bank Expansionary Monetary Policy: Sm Increases= Interest Rates Decrease= Investments Increase= AD Increases Contractionary Monetary Policy: Sm Decreases= Interest Rates Increase= Investments Decrease= AD Decreases Loanable Funds Graph: Bank Balance Sheet: Make sure you know the types of Liabilities and Assets. Also remember that the two should equal each other out! Nominal Interest Rate: Real Rate + Inflation Real Interest Rate: Nominal Rate- Inflation Unit Five: Trade and Foreign Exchange (10-15%) Balance of Payments: Measures ALL international Transactions. There are two sub accounts (Current and Capital). Current Account: Goods and Services Capital/Financial Account: Financial Assets like bonds, stocks, real estate ***If there is a deficit in the current account, then there is a surplus in the capital account. The USA has a deficit in the capital account. Trade Deficit= Exports < Imports Trade Surplus= Exports> Imports Exchange Rates and Trade: If Currency Appreciates, then Net Exports will Decrease. If Currency Depreciates, then Net Exports will Increase Foreign Exchange Graph: