Quantity of Output Price Level

advertisement

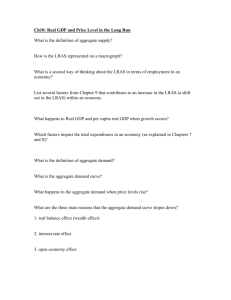

Chapter 33 – Aggregate Demand and Aggregate Supply Business Cycles • Business Cycles have consistent indicators, but are unpredictable in nature • Expansionary periods • Business is good, large amounts of customers, profits grow • Contractionary periods • Business is bad, GDP falls, declining sales, dwindling profits GDP Three Key Facts About Economic Fluctuations Real GDP • Real GDP is the most commonly used economic indicator to measure short-run changes in the economy •Fall in real GDP, fall in personal income, corporate profits, consumer spending, investment spending, retail sales, home sales, auto sales, etc. Three Key Facts About Economic Fluctuations GDP and Unemployment •Real GDP declines, unemployment rises •Contraction/Recession begins, unemployment rises •Recession ends, recovery/expansion, unemployment rates fall GDP Explaining Short-Run Economic Fluctuations Monetary Neutrality does not apply in the short run (6 months, 1 year) ◦ Real and nominal variables are highly intertwined in the short run ◦ Changes in the money supply can temporarily push real GDP away from its long-run trend “Economic Stimulus Package” Who Can Prevent A Recession From Becoming A Depression? Monetary Policy of the Fed Fiscal Policy of the Federal Government Model of aggregate demand & aggregate supply Model used to explain short-run fluctuations in economic activity around its long-run trend Aggregate – a sum, gross amount, of all supply and demand in an economy Two axes: Economy’s output of goods and services (Real GDP) Average level of prices (CPI or GDP Deflator) Price Level Aggregate supply (AS) Equilibrium price level (PL) Aggregate demand (AD) Equilibrium Output (Y) Real GDP 7 Aggregate Demand Aggregate demand curve ◦ Sum of C+I+G+NX (real GDP) at each price level ◦ Downward sloping ◦ Low price levels increase the quantity of goods and services demanded, vice versa Price Level P P2 1. A decrease in the price level . . . 0 Aggregate demand Y Y2 2. . . . increases the quantity of goods and services demanded. Quantity of Output Why the AD Curve Might Shift? C - Shifts arising from changes in consumption ◦ Increases in spending – people have more disposable income ◦ Decreases in spending – people become more concerned with saving for retirement I - Shifts arising from changes in investment ◦ Change in firm investing – tax policy, pessimism about the economy in future, high interest rates G - Shifts arising from changes in government purchases ◦ Congress increases/decreases spending NX - Shift arising from changes in net exports ◦ Global recessions would cause a decrease in demand for U.S. products What Shifts the Aggregate Demand Curve? Price Level A B C Quantity of Output Situation Change in AD New AD Curve Congress cuts taxes C Business spending decreases A Government spending increases; no new taxes C Survey shows consumer confidence jumps C Stock collapses; investors lose billions A President cuts defense spending by 20%; no increase in domestic spending A The Aggregate Supply Curve AS curve – total quantity of goods and services firms can produce and sell at any given price level Shape of AS curve depends on time horizon (short/long run) Short run - Aggregate-supply curve is upward sloping What shifts the curve? http://www.usatoday.com/story/news/nation/2013/10/19/us-oilimports-opec-embargo/2997499/ ◦ Temporary changes in Land, Labor, Capital ◦ 1973 Supply Shock 11 What Shifts the Aggregate Supply Curve? Price Level A B C Quantity of Output Situation Unions grow more aggressive; wage rates increase OPEC successfully increases oil prices Labor productivity increases dramatically Giant natural gas discovery decreases energy prices Computer technology brings new efficiency Research shows that improved schools have increased the skills of American workers Change in AS New AS Curve A A C C C C Aggregate Demand Consumer Spending Government Spending Investment Spending Foreign Spending (x-m) Corn Field Pizza Joint Aggregate Supply Factory Apple Store Aggregate Demand or Supply? Scenario 1. A factory 2. A printing press 3. A woman buys a hamburger for her child AD or AS AS AS 4. A U.S. company sells a jet to a foreign country AD AD 5. A company builds a new factory AD 6. Trees AS 7. A corn field AS 8. A coal mine AS 9. Students purchase tickets for a football game AD AD 10. Two newlyweds buy a house AD AS Scenarios 1. A significant increase in world oil prices 2. Government announces a large increase in spending on health and education 3. Average wage rises way above inflation for the third month running 4. Exchange rate appreciation knocks export hopes for manufacturing 5. US productivity levels at their highest level for 10 years 6. A booming stock market leads to highest rate of retail sales in a century Price Level AS1 AS Ple1 Ple AD Y1 Y Real GDP 16 AD AS Scenarios 1. A significant increase in world oil prices 2. Government announces a large increase in spending on health and education 3. Average wage rises way above inflation for the third month running 4. Exchange rate appreciation knocks export hopes for manufacturing 5. US productivity levels at their highest level for 10 years 6. A booming stock market leads to highest rate of retail sales in a century Price Level AS Ple1 Ple AD Y Y1 AD1 Real GDP 17 AD AS Scenarios 1. A significant increase in world oil prices 2. Government announces a large increase in spending on health and education 3. Average wage rises way above inflation for the third month running 4. Exchange rate appreciation knocks export hopes for manufacturing 5. US productivity levels at their highest level for 10 years 6. A booming stock market leads to highest rate of retail sales in a century Price Level AS1 AS Ple1 Ple AD Y1 Y Real GDP 18 AD AS Scenarios 1. A significant increase in world oil prices 2. Government announces a large increase in spending on health and education 3. Average wage rises way above inflation for the third month running 4. Exchange rate appreciation knocks export hopes for manufacturing 5. US productivity levels at their highest level for 10 years 6. A booming stock market leads to highest rate of retail sales in a century Price Level AS Pe Pe1 AD Y1 Y AD1 Real GDP 19 AD AS Scenarios 1. A significant increase in world oil prices 2. Government announces a large increase in spending on health and education 3. Average wage rises way above inflation for the third month running 4. Exchange rate appreciation knocks export hopes for manufacturing 5. US productivity levels at their highest level for 10 years 6. A booming stock market leads to highest rate of retail sales in a century Price Level AS AS1 Ple Ple1 AD Y Y1 Real GDP 20 AD AS Scenarios 1. A significant increase in world oil prices 2. Government announces a large increase in spending on health and education 3. Average wage rises way above inflation for the third month running 4. Exchange rate appreciation knocks export hopes for manufacturing 5. US productivity levels at their highest level for 10 years 6. A booming stock market leads to highest rate of retail sales in a century Price Level AS Ple1 Ple AD Y Y1 AD1 Real GDP 21 Videos 2010 AP® MACROECONOMICS FREE-RESPONSE 3. How does each of the following changes affect the real gross domestic product and price level of an open economy in the short run? Graph and explain each. (a) An increase in the price of crude oil, an important natural resource (b) A technological change that increases the productivity of labor (c) An increase in spending by consumers (d) A decrease in government spending to offset a deficit • a) GDP will fall and the price level will rise, because the increase in the price of oil raises input costs and causes the short-run aggregate supply curve to shift to the left. Price Level AS1 AS Ple1 Ple AD Y1 Y Real GDP 24 • b) Real GDP will rise and the price level will fall, because the increase in labor productivity reduces unit input costs and causes the short-run aggregate supply curve to shift to the right. Price Level AS AS1 Ple Ple1 AD Y Y1 Real GDP 25 • (c) Real GDP will rise and the price level will rise, because the increase in spending causes the aggregate demand curve to shift to the right. Price Level AS Ple1 Ple AD1 AD Y Y1 Real GDP 26 • (d) Real GDP will fall and the price level will fall, because the decrease in spending causes the aggregate demand curve to shift to the left. Price Level AS Pe Pe1 AD Y1 Y AD1 Real GDP 27 The Aggregate Supply Curve In the Long-Run (LRAS) the supply is vertical ◦ Conceptually, the same as the Production Possibilities Curve ◦ An economy’s production of goods and services (real GDP) is based on the factors of production not on price levels Land, Labor, Capital determine what is possible to produce ◦ LRAS – shows potential output/full employment/natural rate of output ◦ Shows what the economy produces when unemployment is at its natural/normal rate (5-6%) Price Level Long-run Aggregate Supply (LRAS) Capital Goods Natural rate Quantity of Output of output (GDP) (GDP) Full Employment 5-6% Consumer Goods Why the LRAS Curve Might Shift Permanent changes in the following: Changes in Labor ◦ Immigration increase quantity of labor, shift right ◦ Emigration, workers leave for jobs abroad, shift left Changes in Capital ◦ Increase capital stock (machinery, factories, operating equipment), shift right ◦ Decrease productivity (generational trend to bypass college education), shift left Changes in Natural Resources ◦ Discovery of oil, shift to right ◦ Cold weather destroys crops, shift to left Changes in Technological Knowledge ◦ Innovations (computer, internet, handheld devices), shift right ◦ Government policies (environmental concerns, patents, workers safety), shift to left Why The Short Run Aggregate-Supply Curve Slopes Upward Key difference in the economy in the short and long run is behavior of AS ◦ Long run, price level does not affect economic output ◦ Short run, price level does affect economic output Period of a year or two, an increase in price levels raises output Price levels increase, suppliers want to supply more, vice versa Price Level Short-run aggregate supply P1 1. A decrease in the price P2 level . . . Y2 Y1 Quantity of Output 2. . . . reduces the quantity of goods and 30 short run services supplied in the Why The Short Run Aggregate-Supply Curve Slopes Upward Key difference in the economy in the short and long run is behavior of AS ◦ Long run, price level does not affect economic output ◦ Short run, price level does affect economic output Period of a year or two, an increase in price levels raises output Price levels increase, suppliers want to supply more, vice versa Price Level Short-run aggregate supply P1 1. An increase in the price P2 level . . . Y2 Y1 Quantity of Output 2. . . . increases the quantity of goods 31 in the short run and services supplied Why the AS curve slopes upward in short-run Sticky-wage theory - nominal wages are slow to adjust to changing economic conditions Wages are “sticky” in short run Can affect long-term contracts: workers and firms (up to 3 years) Nominal wages are based on expected prices Don’t respond immediately when actual price level is different from what was expected, causing input costs for the firm to increase 32 Why the AS curve slopes upward in short-run Sticky-price theory - prices of some goods & services slow to adjust to changing economic conditions Menu costs, firms’ costs of adjusting prices 33 Why the AS curve slopes upward in short-run Misperceptions theory - changes in the overall price level can temporarily mislead suppliers about changes in individual markets Suppliers respond to changes in level of prices change quantity supplied of goods and services 34 The Long-Run Equilibrium Long-run aggregate Supply (LRAS) Price Level Equilibrium Price (Ple) Short-run aggregate Supply (SRAS) A Aggregate Demand (AD) Natural rate of output (Qfe, Y) 5-6% Unemployment • Quantity of Output Long-Run-Equilibrium • AD intersects with SRAS and LRAS(point A). • Expected price level has adjusted to equal the actual price level. • Full Employment (natural rate of output), wage Equilibrium The Economy Compared to a Car The economy is like a car… You can drive 120mph but is not sustainable ◦ Extremely low unemployment, 2% Driving 20mph is too slow; the car can go faster ◦ High unemployment, 10% Some cars have the capacity to drive faster than others ◦ Industrial nations vs. 3rd world nations If the engine (technology) or gas mileage (productivity) increase then the car can move at even higher speeds ◦ Increase in LRAS/PPC The government/Fed’s job is to brake or speed up when needed; promote things that will improve the engine ◦ Shift the LRAS/PPC left/outward Recessionary and Inflationary Gaps Price Level Price Level LRAS LRAS SRAS SRAS AD Q1 (7.9%) • Qfe (5-6%) Recessionary Gap • • • • Underperforming economy (contraction/recession) Not at full employment Unused resources Falling Prices Quantity of Output (GDP) AD • Qfe Q1 (5-6%) (2%) Inflationary Gap • • • Overperforming economy (expansion) Above full employment Quickly Rising Prices Quantity of Output (GDP) Four Step Process For Modeling AS&AD First, determine whether the event affects AD or AS Second, determine which way the curve shifts Third, use AD & AS to compare initial & new equilibrium Fourth, examine the transition between SRAS and LRAS The Aggregate Demand and Aggregate Supply Model at Long-Run Equilibrium Effects of a Shift in AD Scenario: The economy is experiencing a recession *Assume long-run equilibrium* ◦ Step 1 – AD or AS affected? AD ◦ Step 2 – Which direction will the curve shift? Left ◦ Step 3 – Plot the new EP (B) ◦ Step 4 – Examine transition between SRAS and LRAS (C) Price Level LRAS 3. . . . Over time, nominal wages come down, price levels decrease(cost of doing business), and the short-run aggregate-supply curve shifts, bringing us back to long-run equilibrium. . . SRAS1 SRAS2 Ple1 A B Ple2 C 4. . . . and output returns to its natural rate. Ple3 1. A decrease in aggregate demand . . . AD2 Y2 Y1 AD1 Quantity of Output 2. . . . causes output to fall in the short run, companies lay off workers, unemployment will rise, cut back on production. . . Effects of a Shift in Demand Scenario: The economy experiences a boom in the stock market, people have more disposable income to spend *Assume long-run equilibrium* ◦ Step 1 – AD or AS affected? AD ◦ Step 2 – Which direction will the curve shift? Right ◦ Step 3 – Plot the new EP (B) ◦ Step 4 – Examine transition between SRAS and LRAS (C) Price Level LRAS SRAS2 SRAS1 Ple3 C B Ple2 A Ple1 AD1 Y1 Y2 AD2 Quantity of Output Important points about AD Short run, shifts in AD cause fluctuations in short run output (real GDP) Long run, shifts in AD affect overall price level, but output returns to long run equilibrium Policymakers can affect AD/AS and reduce the short-run impact of economic fluctuations Effects of a Shift in AS Scenario: A hurricane hits and reduces the availability of refineries to produce oil *Assume long-run equilibrium* ◦ Step 1 – AD or AS affected? AS ◦ Step 2 – Which direction will the curve shift? Left ◦ Step 3 – Plot the new EP (B) ◦ Step 4 – Examine transition between SRAS and LRAS (C) Price Level LRAS SRAS2 1. An adverse shift in the short-run AS curve. . . SRAS1 Ple3 3. . . . and the Ple 2 price level Ple1 to rise (stagflation). . . B C A Policymakers affect AD through monetary/fiscal policy. . . AD2 AD1 Y2 Y1 2. . . . causes output to fall. . . Quantity of Output 4. . . . but keeps output at its natural rate. Important points about AS Short run, shifts in AS can cause stagflation Long run, shifts in AS affect overall price level, but not output Policymakers can reduce the impact of economic fluctuations, but risk increasing price levels Binder Check Chapter 33 An Introduction to Aggregate Supply and Demand 2. Short Run AD and AS 3. Youtube video - (Macro) Episode 24: AD & AS 4. Youtube video - (Macro) Episode 25: Macroeconomic Viewpoints 5. Youtube video - (Macro) Episode 26: Macroeconomic Viewpoints 6. Chapter 33 Mankiw Practice 7. Free Response 8. Daily Tens 9. Notes Chapter 33 10. Terms 1. Extra Credit 1. 2. 3. 4. How are the LRAS model and the PPC model similar? Draw a properly labeled graph of each of the above models to show an underperforming (below full employment) economy. Identify each of the following as being either AS or AD. a. Oil refineries b. China imports US soybeans c. A baseball stadium d. A customer buys a hotdog at a baseball game Each of the following are current event headlines in the news today. List which of the following will most likely to be affected, AD, SRAS, or LRAS. a. b. US drought affects wheat and soybean yields Despite No Fed Action, Interest Rates For Mortgages Drop To Record Lows c. Stock Market Hit Hard By Lack Of QE3 (quantitative easing 3)