Plan Sponsors - Mutual of Omaha

advertisement

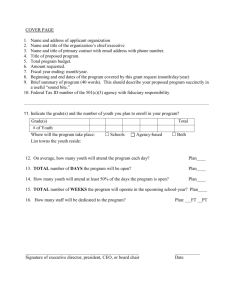

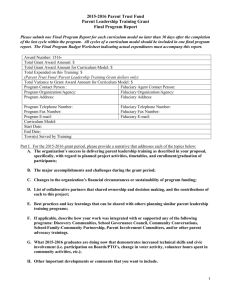

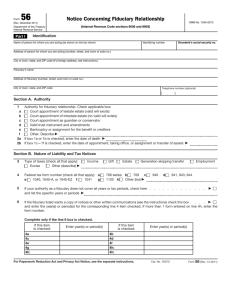

401(k) Admin Advantage W h o l e s a l e r Tr a i n i n g June 2, 2014 Agenda • Introduction – Pat Bello • 3(16) Overview / Fiduciary Role – Janis Winterhof • Product and Pricing Overview / FAQs – Tim Bormann – Rachel Peterson • Sales Positioning – Diane Kolvek • Marketing Materials / Communication Plan – Matt Ord • Questions? 3(16) Overview/Fiduciary Role Presented By: Janis Winterhof Overview • • • • ERISA’s Fiduciary Roles 3(16), 3(21) and 3(38) Fiduciary Duties and Liability Legal Aspects of Delegating Plan Administration ERISA’s Fiduciary Roles • • • • • • Trustee Investment Manager Investment Advisor Named Fiduciary Plan Administrator Delegated Fiduciary ERISA’s Fiduciary Roles Trustee Investment Manager Investment Advisor Named Fiduciary Plan Administrator Delegated Fiduciary Basis in ERISA 403 3(38) None 402(a) 3(16), 101-103 405(c) Scope of Authority Limited Limited Limited Full Limited Limited ERISA Fiduciary Type 3(21) 3(38) 3(21) 3(21) 3(16) 3(21) What is 3(16)? A. B. C. D. The day before St. Patrick’s Day The area code for Wichita, Kansas John Corrieri’s personalized license plate A section of ERISA relating to plan administration What is 3(16)? • Defines “administrator” • Includes: – person designated by the plan, – plan sponsor, if the plan does not designate the administrator, or – person designated by the DOL • Places responsibility for ERISA’s reporting and disclosure requirements What is 3(21)? • Defines “fiduciary” • Includes someone who: – has discretionary authority or control over plan management or control over plan assets, – gives investment advice, or – has discretionary authority or control over plan administration What is 3(38)? • Defines “investment manager” • Includes anyone who: – has the power to manage, acquire or dispose of plan assets, – is registered under law as an investment adviser or is a bank or insurance company, and – acknowledges fiduciary status in writing Fiduciary Duties • Be loyal – Act solely for in the interests of providing benefits to participants and beneficiaries – Defray the reasonable expenses of plan administration • Take care: be a prudent expert – Carry out duties “with the care, skill, prudence and diligence under the circumstance…that a prudent [person] acting in like capacity and familiar with such matters would use” • Diversify investments • Exercise obedience – Follow the plan documents Fiduciary Liability • Personal liability • DOL penalties – “EBSA Achieves Over $1.6 Billion in Total Monetary Results in Fiscal Year 2013”* – FY13 EBSA closed 3,677 civil investigations with 2,677 (72.8%) resulting in monetary results or corrective action* • IRS penalties** – Top ten failure #4: not satisfying loan provisions – Top ten failure #5: impermissible in-service distributions – Top ten failure #6: missing RMDs *www.dol.gov/ebsa.newsroom.fsfyagencyresults.html **www.irs.gov/retirement-plans/top-ten-failures-found-in-voluntary-correction-program Delegation=Fiduciary Protection • Limited Fiduciary Exposure – Delegated fiduciary retains all legal responsibility for administrative role – Plan sponsor’s sole fiduciary role for delegated duties is hiring and monitoring the delegated fiduciary • Limited ≠ Eliminated – Delegation creates co-fiduciary relationship – Plan sponsor cannot avoid fiduciary role 401(k) Admin Advantage Overview and FAQ’s Presented By: Tim Bormann & Rachel Peterson Product Overview Participant Notice Distribution Services (Level 1) – – – – – – – – – Participant Statements Participant Fee Disclosures Blackout Notices Safe Harbor Notice ACA, QACA, EACA Notices Summary Plan Description Summary Annual Report QDIA Notice Missing Participant Services Product Overview Transaction Processing Services (Level 2) − − − − − − − − RMD Notices and Payouts Termination Packet Delivery Involuntary Force-outs Separation of Service Distributions Loan Distributions and Monitoring Hardship Distributions and Monitoring In-Service Distribution Requests Management of Unclaimed checks Product Overview • Full Service options – Level 1 – Notice Distribution – Level 2 – Transaction Processing – Both Level 1 and Level 2 • TPA options – Level 1 Only • Additional Services – Qualified Domestic Relations Orders (QDRO) Review – Enrollment Book Delivery to Participant Homes Client Pricing Strategy • Fully Electronic – 85% or greater of participants have electronic delivery – Reduced Cost • Partially Electronic/ Paper – Less than 85% of participants have electronic delivery – Higher Cost 3(16) Fee Schedule - Billed Services Provided Base Fee Per Participant Fee Per Participant Fee (Fully Electronic Delivery) (Partial Electronic Delivery) Notice Distribution $500 $3.00 $8.00 Transaction Processing $600 $1.00 $4.00 $1,100 $4.00 $12.00 Both Participants are defined as Eligible Participants plus former employees with balances. Requirement for electronic delivery rates: A minimum of 85% of participants must receive information electronically and email addresses must be provided. 3(16) Fee Schedule - Wrapped Plan Size Notice Delivery Transaction Processing Both Less than $500,000 Billed Billed Billed $500,000 - $1M 10 bps 5 bps 15 bps $1M - $2M 5 bps 5 bps 10 bps Over $2M Custom Custom Custom Rates shown above are for electronic delivery. If partial electronic delivery is required, the costs shown above will increase by 5 bps. If both services are selected, the total cost will increase by 5 bps rather than 10 bps. Custom pricing requires a minimum increase of 5 bps. Additional Services We offer these services for additional fees. They will be billed as indicated below: • QDRO Fees - $500.00 for review and approval services – Charged to Participant account • Enrollment Books mailed to participant homes will be charged an additional $1.00 per book. – Billed to Sponsor unless over $2M in assets then can be wrapped FAQ – What else should I know? What is available as of 7/1/14: – Proposal will include Product Materials and Fully Electronic Pricing – New RSA Addendum (Recordkeeping Service Agreement) – Co-Fiduciary Coverage FAQ – What else should I know? What is not available: – Plans with outside assets – 457 plans and I(k) plans – Notices are only available in English – Transaction Services (Level 2) for TPA plans – No A’La Carte pricing – Not currently available to Existing clients – EPIC clients – service is not offered FAQ – Setting Expectations Requirements upon signing up for service: – Participant Email addresses – Payroll Information – Plan Documents/Loan Policy – Force-out Agreement with Frontier Trust – Vesting Validation – TPA clients – Amendments, Eligibility and Notices are critical Sales Positioning Presented By: Diane Kolvek Consultative Solutions • • • • Limited competition New conversations with advisors Allows for strengthened TPA relationships Two tiers of service for unique needs and flexibility • Extremely affordable solution Advisor Value Positioning • Give a compelling reason to move a plan • Offers differentiator for new prospects • Advisor can focus on growing practice Plan Sponsor Value Positioning • Simplicity – takes function off plate • Peace of mind – solve regulatory compliance worries • Ease of doing business – one source • Cost savings – outsourcing vs employee TPA Value Positioning • Creates partnership recognizing mutual strengths • Addresses TPA limitations to offer 3(16) due to cost of liability insurance • Positions TPAs to do what they do best See how happy this advisor is? 401(k) Admin Advantage Campaign Messaging Presented By: Matt Ord Overall Campaign Message “401(k) Admin Advantage brings Simplicity, Ease of Doing Business and Peace of Mind to Plan Sponsors by taking on the burdens of day-to-day plan administration and minimizing plan risk while enhancing Advisor and TPA relationships.” Plan Sponsor Messaging “Mutual of Omaha will act as a co-fiduciary with plan sponsors by taking on the burden of certain day-to-day administrative duties, making it easier for them to focus on building their business” TPA Messaging “Mutual of Omaha will work with TPAs to offer complementary services that fill in the gaps in the TPA offering, so that together we can provide the best possible retirement solution for the customer. Mutual can provide notice distributions while TPAs provide transaction services, creating a complete service offering for plan sponsors” Marketing Materials Marketing Materials (continued) Marketing Campaign Timeline • • • • • • 6/4: 6/12 : 6/12: 6/13: 6/16: 6/16: • Tier One Advisor Mailing (top 25): TPA Announcement Advisor Teaser Email: http://mooitg.mutualofomaha.com/esp/e2328/ Public Relations Outreach (exclusive meeting with 401(K) Wire) Sellretirementright.com promotional content goes live Press release disseminated to all 401(k) trade publications 401(k) Admin Advantage Ad published in NAPA Net Magazine’s Summer Issue – 6/12- Wooden In-box mailing First Flight – 6/16- Wooden In-box Mailing Second Flight • Tier Two Advisor Mailing (following 50): – 6/23-Envelope Mailing First Flight – 6/30- Envelope Mailing Second Flight Marketing Resources • The Internal Navigator Blog: http://blogs.mutualofomaha.com/rms/messageplaybooks/401k-admin-advantage-playbook/ • RP Marketing: RP_Marketing@mutualofomaha.com Questions For more information contact your Regional Sales Director