The Financial Crisis and Macroeconomic Policy: Four Years On

advertisement

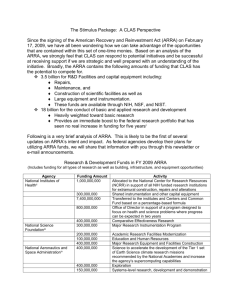

The Financial Crisis and Macroeconomic Policy: Four Years On John B. Taylor Stanford University MONFISPOL Conference September 19, 2011 The Revival of Keynesian Discretionary Fiscal Policy in the 2000s • Economic Growth and Tax Relief Reconciliation Act of 2001 – Refund checks; first installment of 2001 tax rate cuts • Economic Stimulus Act of 2008 (February) – Rebate checks and credits • American Recovery and Reinvestment Act of 2009 (February) – One-time payments, withholding change, refunds – More government spending too • Miscellaneous interventions in 2009-10 – Cash for clunkers program – First time home buyers program • Tax Relief , Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (December)) – Temporary cut in payroll tax • American Jobs Act of 2011? Keynesian Discretionary Fiscal Policy First Became Popular in the ‘60s & ‘70s • First in academia in the 1950s and 1960s – Arguments appeared in the major textbooks (Samuelson). – Keynesian econometric models • Then in practice: 1962 Economic Report of the President – “The task of economic stabilization cannot be left entirely to built-in stabilizers,” the report warned. “Discretionary budget policy, e.g. changes in tax rates or expenditure programs, is indispensible—sometimes to reinforce, sometimes to offset, the effects of the stabilizers.” – investment tax credit (1962), tax surcharge (1968) – tax rebates (1975) – countercyclical grants to states for infrastructure (1977-78) • Keynesian discretionary policy continued to the late 1970s. Keynesian Policy Fell Out of Favor in ‘80s & ‘90s • Research raised doubts about discretionary policy – Lucas and Sargent “After Keynesian Economics” – Gramlich “the general idea of stimulating the economy through state and local governments is probably not a very good one” • Soon automatic stabilizers dominated the budget cycle • Bush 41: proposed tiny stimulus package in 1992 – Shift $10 billion in G from future to the present – did not pass the Congress • Clinton: proposed tiny stimulus in 1993 – $16 billion more G – did not pass the Congress. • Eichenbaum (1997) “there is now widespread agreement that countercyclical discretionary fiscal policy is neither desirable nor politically feasible.” The Basic Model: A decline in I causes the aggregate expenditure line to shift down 25_10 SPENDING 45-degree line Original point of spending balance Original E line New E line I falls by this amount New point of spending balance Income or real GDP falls by this amount (more than by amount I falls ). New income level Original income level INCOME OR REAL GDP Countercyclical discretionary fiscal policy: Increase in G raises GDP depending on size of the multiplier and amount of crowding out 25_10 SPENDING 45-degree line G rises INCOME OR REAL GDP But Macro Models Differ Greatly • Romer and Bernstein (Jan 2009) used estimated old Keynesian models (without RE) to predict ARRA effect – Large multipliers, around 1.5. • Cogan, Cwik, Taylor and Wieland (Feb 2009) used estimated New Keynesian model to predict ARRA effect – Much smaller multipliers, around 0.5. • What not use these existing macro models for the evaluation of actual packages? – Because they simply repeat the same prediction story over again. • So you learn virtually nothing A Stylized Illustration Consider two models relating stimulus S to output Y. Model A is Y= αS +Z Model B is Y = Z where Z is a shock and α =1.5 Now, suppose that a stimulus is enacted: S = 2 and Y decreases by -1 According to Model A , Z = - 4 According to Model B, Z= -1 Now consider policy evaluation with counterfactual: S=0 Economists using Model A say: Just as we predicted, the stimulus package worked. Without it, Y would have fallen to -4 rather than -1. The decline in output would have been 4 times as deep, a Great Depression 2.0. Economists using Model B say Just as we predicted the stimulus package did not work. A Less Stylized Illustration New Keynesian Smets - ECB 6 Robert Barro Harvard 6 5 5 With stimulus With stimulus 4 4 3 3 2 2 If no stimulus 1 If no stimulus 1 0 0 -1 -1 2009 2010 2009 “The accumulation of hard data and real-life experience has allowed more dispassionate analysts to reach a consensus that the stimulus package, messy as it is, is working” New York Times November 12, 2009 2010 Use a Direct Approach • Micro data (used in 2001, 2008) – Shapiro and Slemrod (2003, 2009), – Johnson, Parker, Souleles (2006) – Parker, Souleles, Johnson, and McClelland (2009). • Macro data – Special BEA satellite account – “Personal Income and Output” (monthly to mid ’09) – “Effect of the ARRA on Selected Federal Government Sector Transactions” (quarterly) Monthly Data on Rebate Payments in 2001 and 2008 ($ billions, annual rates) April May June July August September October 2001 0 0 0 95.1 223.1 144.9 2.5 2008 23.3 577.1 334.4 164.1 12.4 0 0 Temporary stimulus meets permanent income hypothesis Temporary stimulus meets permanent income hypothesis again Cash for clunkers: incentives really matter Based on Mian and Sufi (2010) Quarterly Data Billions of dollars 320 2008 280 240 200 160 2001 2009 120 80 40 0 01 02 03 04 05 06 07 08 09 10 Effects of Three Stimulus Packages on Disposable Personal Income Billions of dollars 12,000 11,600 11,200 Disposable personal income with stimulus 10,800 and without stimulus 10,400 10,000 Personal consumption expenditures 9,600 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3 Quaterly disposable personal income, with and without stimulus, and personal consumption 11Q1 Quarterly PCE Regressions With and Without Stimulus Payments (1) (2) (3) Disposable Personal Income .817 (40.9) ---- ----- Disposable Personal Income--Without Stimulus ---- .857 (73.0) .851 (60.4) Stimulus Payments ----- ----- 0.128 (0.81) Oil Price ($/bbl lagged 2 quarters) -2.41 (-4.71) -2.55 (-4.14) -2.55 (-4.61) Net Worth (lagged 2 quarters) .021 (8.53) .017 (7.32) .018 (7.97) Standard error of regression 76.9 65.8 66.3 Billions of dollars (annual rates) 280 240 200 160 120 - Temporary transfers and tax credits to persons 80 - Grants to state and local governments 40 - Federal government consumption - Federal government investment 0 09Q1 09Q2 09Q3 09Q4 10Q1 10Q2 10Q3 10Q4 11Q1 Major Federal Budget Categories of ARRA Billions of dollars 1,300 With ARRA 1,200 Without ARRA 1,100 1,000 Federal Government Purchases 900 800 700 600 500 2000 2002 2004 2006 2008 Effect of ARRA on Federal Government Purchases 2010 Billions of dollars 2,400 With ARRA grants 2,200 Total Receipts of State and Local Governments 2,000 1,800 Without ARRA grants 1,600 1,400 1,200 2000 2002 2004 2006 2008 2010 Effect of ARRA on Receipts of State and Local Governments Billions of dollars 1,900 1,800 1,700 1,600 1,500 1,400 1,300 1,200 1,100 2000 2002 2004 2006 2008 2010 State and Local Government Purchases: 2000.1 - 2011.1 Billions of dollars 500 450 400 350 300 250 200 00 01 02 03 04 05 06 07 08 09 State and Local Government Expenditures Other Than for Purchases of Good and Services 10 Billions of dollars 180 160 140 120 100 80 60 40 20 2000 2002 2004 2006 2008 Net Borrowing By State and Local Governments 2010 Billions of dollars (annual rates) 150 ARRA Grants 100 Other expenditures 50 Government purchases 0 -50 Borrowing (net) -100 -150 2009Q1 2009Q3 2010Q1 2010Q3 2011Q1 ARRA Grants and State and Local Budgets (change from 2008.4 when ARRA grants were zero) State and local government budget constraint Gt + Et + Lt = Rt + At where G = Government purchases of goods and services E = Expenditures other than for the purchases L = Lending or borrowing (-), net A= ARRA grants (exogenous) R = Revenues excluding ARRA grants (exogenous) Estimated 3-equation system (1969Q1- 2011Q1) Gt = 3.86 + 0.864Gt-1 + 0.124Rt - 0.114At Et = -3.83+ 0.818Et-1 + 0.0398Rt + 0.113At Lt = .0321 - 0.864Gt-1 - 0.818Et-1 + .836Rt + 1.001At Billions of dollars 140 120 ARRA grants 100 80 60 40 20 Counterfactual 0 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3 Actual and Counterfactual ARRA grants to State and Local Governments 11Q1 Billions of dollars 240 Counterfactual simulation 200 160 120 Dynamic simulation 80 Historical data 40 0 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3 11Q1 Borrowing (net) by State and Local Governments: Historical and Counterfactual without ARRA Billions of dollars 2,350 2,300 Counterfactual simulation Dynamic simulation Historical data 2,250 2,200 2,150 2,100 2,050 2,000 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3 11Q1 Total Expenditures by State and Local Governments: Historical and Counterfactual without ARRA Billions of dollars 500 480 460 Dynamic simulation 440 Historical data 420 Counterfactual simulation 400 380 360 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3 11Q1 Other Expenditures by State and Local Governments: Historical and Counterfactual without ARRA Billions of dollars 1,880 Counterfactual simulation 1,840 1,800 Dynamic simulation Historical data 1,760 1,720 1,680 1,640 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3 11Q1 Purchases of Goods and Services by State and Local Governments: Historical and Counterfactual without ARRA The Plausibility of the Counterfactual • Weren’t many states borrowing constrained after the crisis? • Not clear but in any case Fed’s Flow of Funds data show that that net borrowing would have increased even with such borrowing constraints. • Net borrowing = net increase in liabilities - net acquisition of financial assets • Net borrowing = - $118 billion from 2008 to 2010. Net increase in liabilities = $53 billion Net acquisition of financial assets = $171 billion. • Thus state and local government added significantly to their financial assets as ARRA grants came in. • With no ARRA they would not have done so. Why the Negative Effect on Purchases? • “Other expenditures” consist largely of Medicaid, TANF, and other transfer programs • ARRA conditioned states’ receipt of additional Medicaid grants on their not reducing benefits or restricting eligibility rules • In some states, this meant undoing benefit reductions or eligibility restrictions that were implemented in the previous 6 months – July 1, 2008 is the date in Section 5001 of ARRA • This “hold-harmless” provision, may have forced states to reallocate funds that would have been used for purchases Test By Splitting ARRA Grants into Medicaid and Other Billions of dollars 140 120 Total ARRA grants 100 80 Other 60 40 Medicaid 20 0 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3 11Q1 Regressions with ARRA grants split into Medicaid (M) and other (N) Constant G 3.356 (3.5) Dependent Variables E L -2.471 2.691 (-2.1) (1.3) G(-1) 0.882 (17.8) ------- -0.877 (-12.8) E(-1) ------ 0.875 (20.2) -0.734 (-11.0) R 0.108 (2.6) 0.028 (3.2) 0.829 (13.8) M -0.318 (-2.3) 0.129 (2.6) 1.200 (6.7) N -0.002 (-0.03) 0.076 (1.6) 0.851 (13.0) Net Effect on Federal, State& Local Government Purchases • If government purchases have a greater impact on GDP than temporary transfers—which the permanent income theory predicts—then ARRA could have had a negative effect • According to the simulations the cumulative negative effect on state and local government purchases was $85 billion (341/4). Larger than the $30 billion (119/4) cumulative positive effect of ARRA on federal government purchases. Cross check on GDP growth and G-contribution Percent, annual rate 6 Growth rate of real GDP 4 2 0 Contribution of government purchases -2 -4 -6 -8 07Q1 07Q3 08Q1 08Q3 09Q1 09Q3 10Q1 10Q3 Parrallel Developments in Monetary Policy Toward Discretion: ‘60s & ‘70s • Fed did not follow Milton Friedman’s rules message “of setting itself a steady course and sticking to it.” (AEA 1968) • 1965-1970s saw a series of boom-bust cycles in monetary policy with inflation rising steadily higher at each cycle. • The wage and price controls of the 1970s – Epitome of interventionist policy – Defended by Fed Chair Burns: “wage rates and prices no longer respond as they once did to the play of market forces.” • Insider reports showed little strategy or systematic thinking • Econometric studies show that Fed’s responses to inflation were unstable over time in the 1970s – Rising implicit inflation target • Not rule-like as it would become in the 1980s and 1990s. U.S. Inflation and Expected Inflation 1965-1980 14 CPI Inflation Livingston Survey 12 10 8 6 4 2 0 56 58 60 62 64 66 68 70 72 74 76 78 80 82 84 1965-1980: monetary policy not well described by a rules-based price stability objective 1965-79 From “Has the Fed Gotten Tougher on Inflation?” The FRBSF Weekly Letter, March 31, 1995, by John P Judd and Bharat Trehan of the San Francisco Fed Toward Rules in the ‘80s –’90s • Dramatic shift of policy under Volcker in 1979-87. – Volcker (1983) “We have…gone a long way toward changing the trends of the past decade and more.” • Policy continued in ‘80s and ‘90s under Greenspan. • Additional evidence of more rules-based policy – more predictable and transparent decision-making process – focus on expectations of future policy actions. – announcing interest rate decisions when making them. • Transcripts of the FOMC in the 1990s, many references to rules. • Actual monetary policy closer to simple policy rule Monetary policy gets more predictable, inflation targets, rules-based 1965-79 From “Has the Fed Gotten Tougher on Inflation?” The FRBSF Weekly Letter, March 31, 1995, by John P Judd and Bharat Trehan of the San Francisco Fed 1987-92 1993-94 Illustrative monetary policy chart from St Louis Fed February 2007, Bill Poole The Swing Away from Rules in Recent Years • Interest rates too low for too long in 2003-05 • On-again, off-again bailouts financed by central bank’s balance sheet – on for BSC creditors’ bailout, off for Lehman creditors’ bailout, on for AIG creditors’ bailout, off for TARP role out • Government regulators and supervisors deviated from sound regulatory rules, especially at large banks Illustrative monetary policy chart from St Louis Fed February 2007, Bill Poole Illustrative monetary policy chart from St Louis Fed February 2007, Bill Poole Chart from Kansas City Fed, 2009, Tom Hoenig (2000-2009) Percent 10 Real GDP growth 2009Q3 - 2011Q1 1983Q1 - 1984Q3 8 6 4 2 0 1 2 3 5 4 Quarter since recession ended The Recovery in Historical Context 6 7 Percent 11 10 9 8 7 6 5 4 3 2 50 55 60 65 70 75 The Unemployment Rate 80 85 90 95 00 05 10 More intervention, Percent 11 10 9 8 7 6 5 4 3 2 50 55 60 65 70 75 The Unemployment Rate 80 85 90 95 00 05 10 More intervention, more unemployment Percent 11 10 9 8 7 6 5 4 3 2 50 55 60 65 70 75 The Unemployment Rate 80 85 90 95 00 05 10 More intervention, more unemployment Percent 11 10 Less Intervention, 9 8 7 6 5 4 3 2 50 55 60 65 70 75 The Unemployment Rate 80 85 90 95 00 05 10 More intervention, more unemployment Percent 11 10 Less intervention, less unemployment 9 8 7 6 5 4 3 2 50 55 60 65 70 75 The Unemployment Rate 80 85 90 95 00 05 10 More intervention, more unemployment Percent 11 10 More intervention, Less intervention, less unemployment 9 8 7 6 5 4 3 2 50 55 60 65 70 75 The Unemployment Rate 80 85 90 95 00 05 10 More intervention, more unemployment Percent 11 10 More intervention, more unemployment Less intervention, less unemployment 9 8 7 6 5 4 3 2 50 55 60 65 70 75 80 85 90 95 00 05 10 The Unemployment Rate and Unintended Consequences Conclusion • Revival of discretionary policy has been ineffective • Fiscal stimulus packages – People largely saved the transfers and tax rebates – Federal government increased purchases by a tiny amount – State and local governments used stimulus grants to reduce borrowing rather than increase expenditures, and they shifted expenditures away from purchases – The results do not support the view that things would have been worse • Provide evidence against “Model A” • Plus counterfactual simulations • Parallel developments for monetary policy • Results are consistent with consensus prior to the revival, based on experience of 30 years ago