Atlanta presentation

advertisement

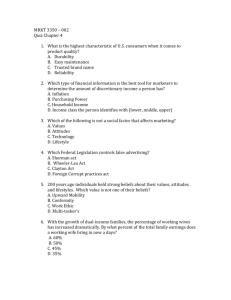

Convergence and Anchoring of Yield Curves in the Euro Area Michael Ehrmann Marcel Fratzscher European Central Bank European Central Bank Refet Gürkaynak Eric T. Swanson Bilkent University Federal Reserve Bank of San Francisco Conference on International Financial Integration Federal Reserve Bank of Atlanta November 30, 2007 Note: The views expressed in this presentation are the authors’ and do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or the European Central Bank. European Monetary Union: Background Feb 1992: Maastricht Treaty signed Sep 1992: ERM crisis, several countries abandon exchange rate pegs May 1998: Countries eligible for EMU are announced Jan 1, 1999: Exchange rates irrevocably fixed, European Central Bank established, financial institutions adopt euro Jan 1, 2002: Euro adoption completed, currency issued Overview of the Paper Two related issues: • Convergence of sovereign bond yields (market integration) • Convergence and anchoring of inflation expectations Despite unified monetary policy, convergence in these respects is not clear: • Bond market unification: • Default risk varies across sovereign governments • Liquidity varies across bond issues • Long-term inflation expectations: • There may be probability of exit from EMU Overview of the Paper Three metrics for assessing convergence: • Yield levels • Yield volatility • Yield sensitivity to news (conditional volatility) Focus on daily frequency bond market data • More stringent test of convergence/unification/anchoring Two types of yields: • Medium- and long-term yields (bond market integration) • Far-ahead forward interest rates (inflation expectations) Related Literature Studies of EMU on financial markets using monthly data: • Beale, Ferrando, Hördahl, Krylova, and Monnet (2004) • Manganelli and Wolswijk (2007) Analysis of EMU on macroeconomic convergence: • Canova, Ciccarelli, Ortega (2006) • Rogers (2007) Analyses using high-frequency data: • long-term inflation expectations: Gürkaynak, Sack, and Swanson (2005), Gürkaynak, Levin, and Swanson (2007) • effects of U.S. announcements on euro yields: Ehrmann and Fratzscher (2006), Ehrmann, Fratzscher, and Rigobon (2006), Goldberg and Klein (2007) Data Daily bond yields for four largest euro area countries: • Germany • France • Italy • Spain Also consider one “control” (non-euro area) country: • United Kingdom Sample periods: • pre-EMU: 1993-1998 • post-EMU: 2002-2006 For comparability across countries, use zero-coupon yields Data: Yield Curve Estimation Convergence of Yields: Levels • Convergence takes place even before EMU • UK exhibits little convergence relative to EMU countries Convergence of Yields: Volatility Table 4: Principal Components Analysis of 2-year Yields across Countries sample contribution of: pre-EMU post-EMU first PC .895 .998 second PC .097 .001 Convergence of Yields: Sensitivity Convergence of Yields: Sensitivity Convergence of Yields: Sensitivity Figure 3: Response of 2-year Yield to Macroeconomic Surprises ISM - NAPM US inflation 3 2 1 0 0 -1 .5 -2 -1 1 0 1.5 1 2 2 2.5 Non-farm payroll employment 1994 1996 1998 2000 2002 2004 2006 1994199619982000200220042006 1994199619982000200220042006 . . . France inflation Germany inflation 4 2 1 0 0 -1.5 1 -1 -.5 2 3 0 3 .5 IFO confidence 1994199619982000200220042006 . . Italy inflation Spain inflation Euro area M3 1994199619982000200220042006 . .5 0 -.5 -2 -1 0 0 .5 1 1 1 2 1.5 1994199619982000200220042006 . 1.5 1994199619982000200220042006 1994199619982000200220042006 . 1994199619982000200220042006 . Convergence of Yields: Sensitivity Figure 4: Heterogeneity in the Effects of Macroeconomic Surprises 1 .5 0 .5 1 1.5 .2 .4 .6 .8 1.5 2 US inflation 1 ISM - NAPM 2 Non-farm payroll employment 1994 1996 1998 2000 2002 2004 2006 1994199619982000200220042006 1994199619982000200220042006 . . . France inflation Germany inflation 2 1.5 0 0 .5 .5 1 1 1.5 .2 .4 .6 .8 2 1 2.5 IFO confidence 1994199619982000200220042006 1994199619982000200220042006 . . . Italy inflation Spain inflation Euro area M3 1994199619982000200220042006 . 1 .2 .4 .6 .8 0 0 0 .5 1 .2 .4 .6 .8 1.5 1994199619982000200220042006 1994199619982000200220042006 . 1994199619982000200220042006 . Long-Term Yields and Inflation Expectations Long-term bond yields not necessarily a good measure of inflation expectations: • In response to a shock, short-term interest rates move • Long-term yields are an average of the short-term rates over the life of the bond • Long-term yields should exhibit some sensitivity to news Long-Term Yields and Inflation Expectations Far-Ahead Forward Rates To study anchoring of inflation expectations, it is better to use forward interest rates rather than long-term rates: For N large enough, we have: Far-Ahead Forward Rates Far-Ahead Forward Rates Figure 5: Response of 9-year-ahead 1-year Forward Rate to Macroeconomic Surprises 2 0 0 -2 -4 0 -2 -5 -10 US inflation 4 ISM - NAPM 2 5 Non-farm payroll employment 1994199619982000200220042006 1994199619982000200220042006 . . . France inflation Germany inflation 0 2 4 6 8 -1 -1 0 1 2 3 0 1 2 3 4 IFO confidence 10 1994 1996 1998 2000 2002 2004 2006 1994199619982000200220042006 . . Italy inflation Spain inflation Euro area M3 1994199619982000200220042006 . 1 0 -2 -1 -1 0 -3 -2 -1 1 0 1 2 2 1994199619982000200220042006 . 2 3 1994199619982000200220042006 1994199619982000200220042006 . 1994199619982000200220042006 . Far-Ahead Forward Rates Figure 6: Heterogeneity in the Effects of Macroeconomic Surprises on the 9-year-ahead 1-year Forward Rate 2 2 . .5 .5 1 1 2 1 . 1.5 1.5 4 3 . US inflation 2.5 ISM - NAPM 5 Non-farm payroll employment 1994199619982000200220042006 1994199619982000200220042006 . . . France inflation Germany inflation 0 0 .5 . 1. 1.5 2 2 IFO confidence 0 1 2. 3 4 5 1994 1996 1998 2000 2002 2004 2006 1994199619982000200220042006 . . Italy inflation Spain inflation Euro area M3 1994199619982000200220042006 . . .5 0 0 .6 .8 .5 1. . 1 1 1.5 2 1.5 1994199619982000200220042006 . 1.21.41.6 1994199619982000200220042006 1994199619982000200220042006 . 1994199619982000200220042006 . Conclusions • European Monetary Union appears to have led to a unified sovereign bond market, despite differences in liquidity and default probabilities across member countries • Convergence in yield levels, volatility, and sensitivity to news • Convergence in daily data as well as at lower frequency • Evidence that EMU has led to convergence in long-term inflation expectations • Inflation expectations in Italy and Spain seem to have benefited the most