ACSR 4 – Agency E&O Part 1 Timed Outline

advertisement

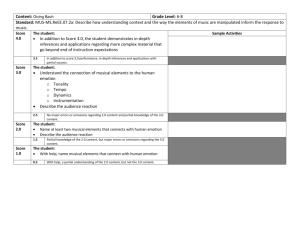

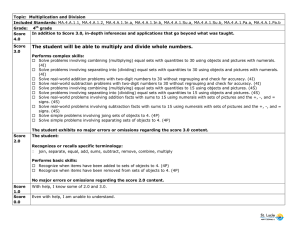

Agency Errors and Omissions – ACSR 4 – Part 1 This course is part of the ACSR (Accredited Customer Service Representative) national designation. Educational Objectives: Explain the purpose of transferring potential errors and omissions agency losses by means of an insurance policy. Identify the legal sources for the agent’s authority in transacting insurance business. Describe the major regulations at the federal level that have an impact on agency operations. Explain the purpose for state regulations on an agency’s operations under the following: • Licensing of agents • Unfair trade practices • Unfair claim settlement practices • Handling of premiums • Selecting proper insurers Prepare and present client proposals and quotes that comply with appropriate standards to minimize agency errors and omissions. Place new business by completing the application with the insurer submission that properly fulfills the client’s insurance requirements. Deliver the client the policy that is verified to be correct and in compliance with the client’s requirements. CE Outline: I. Transferring Agency Errors and Omissions (E&O) Losses A. B. C. Defining Errors and Omissions Agent E&O Policy Overview 1. Insuring Agreement and Coverage 2. Limits and Defense Costs 3. Exclusions Agent E&O Policy Considerations 1. The Deductible 2. Consent to Settle II. Agency Law A. B. C. 15 minutes Defining Agency Law Sellers of Insurance Products 1. Agent 2. Broker 3. Producer Legal Sources for Agent Authority 1. Express Authority 2. Implied Authority 3. Apparent Authority III. Federal Regulations That Have an Impact on the Agency A. B. 15 minutes Insurance Regulation at the Federal Level Federal Regulations That Have an Impact on the Agency 1. Federal Emergency Management Agency (FEMA) 2. Department of Transportation (DOT) 15 minutes 3. 4. 5. 6. 7. 8. 9. Drivers Privacy Protection Act (DPPA) Fair Credit Reporting Act (FCRA) Gramm-Leach-Bliley Act (GLB) Sarbanes-Oxley Act CAN-SPAM Act Telemarketing and Consumer Fraud and Abuse Prevention Act Telephone Consumer Protection Act (TCPA) IV. Application of States’ Regulations and Unfair Trade Practices Statutes A. B. C. D. E. V. Presenting Proposals and Quotes to Minimize Agency Errors and Omissions (E&O) A. B. C. D. B. C. 15 minutes Application Insurer Placement Binder Premium Financing VII. Effectively Delivering the Policy to the Client A. 15 minutes Account Reviews Preparing the Proposal or Quote Coverage Options and Quotes Advising of Preconditions to Obtain Coverage VI. Placing the Business Once the Proposal or Quote Has Been Accepted A. B. C. D. 15 minutes Licensing Laws Unfair Trade Practices Acts Unfair Claims Settlement Practices Acts Handling Premium Payments Selecting Proper Insurers Verify That the Policy Matches the Proposal, Application, and Binder 1. Names, Locations, and Amounts 2. Coverages, Endorsements, Exclusions, and Conditions Deliver the Policy Client Review 10 minutes