Nominal GDP - WordPress.com

advertisement

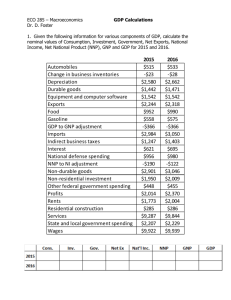

PowerPoint Presentation by Mehdi Arzandeh, University of Manitoba Measuring the Economy’s Output 7 LEARNING OBJECTIVES LO7.1 LO7.2 LO7.3 LO7.4 LO7.5 Explain how gross domestic product (GDP) is defined and measured. Describe how expenditures on goods and services can be summed to determine GDP. Explain how GDP can be determined by summing all of the incomes that were derived from producing the economy’s output of goods and services. Discuss the nature and function of a GDP price index, and describe the difference between nominal GDP and real GDP. List and explain the shortcomings of GDP as a measure of domestic output and well-being. © 2016 McGraw‐Hill Education Limited 7-2 7.1 Measuring the Economy’s Performance: GDP National Income Accounting measures economy’s overall performance • Statistics Canada compiles National Income and Product Accounts • Assess health of economy • Track the long-run course of the economy • Formulate policies LO1 © 2016 McGraw‐Hill Education Limited 7-3 7.1 Measuring the Economy’s Performance: GDP Gross Domestic Product The main measure of the economy’s performance • The total (aggregate) market value of all final goods and services produced within the borders of a country during a specific period of time A Monetary Measure LO1 © 2016 McGraw‐Hill Education Limited 7-4 TABLE 7-1 Year Comparing Heterogeneous Outputs by Using Money Prices Annual output Market value 1 3 sofas and 2 computers 3($500) + 2($2000) = $5500 2 2 sofas and 3 computers 2($500) + 3($2000) = $7000 Society is willing to pay $1500 more for the combination of goods produced in year 2 than for the combination of goods produced in year 1. LO1 © 2016 McGraw‐Hill Education Limited 7-5 7.1 Measuring the Economy’s Performance: GDP Avoiding Multiple Counting • To avoid multiple counting, only final goods and services are counted • Final goods: Goods and services purchased for final use and not for resale or further processing or manufacturing • Intermediate goods: Products purchased for resale or further processing or manufacturing • Value added LO1 © 2016 McGraw‐Hill Education Limited 7-6 TABLE 7-2 Value Added in a Five-Stage Production Process (1) Stage of production (2) Sales value of materials or product (3) Value added 0 Firm A, sheep ranch $ 120 Firm B, wool processor 180 60 (= 180 – 120) Firm C, suit manufacturer 220 40 (= 220 – 180) Firm D, clothing wholesaler 270 50 (= 270 – 220) Firm E, retail clothier 350 80 (= 350 – 270) Total sales value $1140 Value added (total income) LO1 $120 (= $120 – $0) $350 © 2016 McGraw‐Hill Education Limited 7-7 7.1 Measuring the Economy’s Performance: GDP GDP Excludes Nonproduction Transactions Two types of nonproduction transactions: • FINANCIAL TRANSACTIONS • • • Public Transfer Payments Private Transfer Payments Stock-Market Transactions • SECOND-HAND SALES LO1 © 2016 McGraw‐Hill Education Limited 7-8 7.1 Measuring the Economy’s Performance: GDP Two Ways of Calculating GDP: Expenditures and Income • The Expenditures Approach: • The sum of all the money spent in buying final goods and services • By households, businesses, government, and buyers abroad • The Income Approach • The income derived or created from producing final goods and services • Payments to the suppliers of factors of production as wages, rent, interest, and profit LO1 © 2016 McGraw‐Hill Education Limited 7-9 7.2 The Expenditure Approach •The Expenditures Approach: adds up all the expenditures made for final goods and services. • The Expenditures Approach adds up • personal consumption expenditures (C) • gross investment (Ig) • government purchases (G) • net exports (Xn) = exports (X) – imports (M) LO2 © 2016 McGraw‐Hill Education Limited 7-10 TABLE 7-3 Value Added in a Five-Stage Production Process GDP Percent of GDP Personal consumption expenditures (C) 1073 54.3 Gross investment (Ig ) 467 23.6 Government current purchases of goods and services (G) 417 21.1 Net exports (Xn) +18 +1.0 Gross domestic product at market prices* 1975 100.0 *Includes adjustments and statistical discrepancy. Source: Statistics Canada Gross Domestic Product, expenditure-based. LO2 © 2016 McGraw‐Hill Education Limited 7-11 7.2 The Expenditure Approach • Gross investment (Ig) includes • All final purchases of machinery, equipment, and tools by firms • All construction • Changes in inventories • Intellectual property products (R&D) • Net investment = Gross investment - depreciation LO2 © 2016 McGraw‐Hill Education Limited 7-12 FIGURE 7-1 Gross Investment, Depreciation, Net Investment, and the Stock of Capital Gross Investment Stock of capital Net investment Stock Depreciation of capital January 1 LO2 December 31 © 2016 McGraw‐Hill Education Limited 7-13 7.2 The Expenditure Approach • GDP as the sum of all the money spent in buying final goods and services. GDP = C + Ig + G + Xn • For Canada in 2014 (in billions, from Table 7-3): GDP = $1073 + $467 + $417 + $18 = $1975 LO2 © 2016 McGraw‐Hill Education Limited 7-14 7.1 GLOBAL PERSPECTIVE Comparative GDPs of Selected Nations, 2013 (trillions of dollars) LO2 © 2016 McGraw‐Hill Education Limited 7-15 7.3 The Income Approach • The Income Approach: adds up expenditures that are allocated as income to those producing the output • Wages, salaries, and supplementary labour income • Profits of corporations and government enterprises before taxes • Interest and investment income • Net income of farm and unincorporated businesses • Indirect taxes less subsidies on products • Depreciation: Capital consumption allowances LO3 © 2016 McGraw‐Hill Education Limited 7-16 7.3 The Income Approach • Net domestic income at factor cost • All the income earned by Canadian-supplied factors of production as wages, interest, rent, and profit. • Personal income (PI) • The earned and unearned income available to resource suppliers and others before the payment of personal income taxes. • Disposable income (DI) • Personal income less personal taxes. LO3 © 2016 McGraw‐Hill Education Limited 7-17 TABLE 7-4 Calculating GDP in 2014: 1: The Income Approach (billions of dollars) GDP Percent of GDP Wages, salaries, and supplementary labour income $994 50.3 Profits of corporations and government enterprises before taxes 278 14.0 Interest and investment income 169 8.5 Net income of farm and unincorporated businesses 55 2.8 Taxes less subsidies on factors of production 77 3.9 Indirect taxes less subsidies on products* 121 6.1 Capital consumption allowances 280 14.1 1 0.3 1975 100 Statistical discrepancy Gross domestic product at market prices *Includes inventory valuation adjustment. Source: Statistics Canada Gross Domestic Product, expenditure-based. LO3 © 2016 McGraw‐Hill Education Limited 7-18 7.4 Nominal GDP versus Real GDP •Nominal GDP • GDP measured in terms of the price level at the time of measurement (unadjusted for inflation) •Real GDP • Nominal GDP adjusted for inflation. LO4 © 2016 McGraw‐Hill Education Limited 7-19 TABLE 7-5 LO4 Calculating Real GDP (base year = year 1) (2) Price of pizza per unit (P) (3) Price index (year 1 = 100) Year (1) Units of output (Q) (4) Unadjusted, or nominal, GDP (Q) x (P) (5) Adjusted, or real, GDP 1 5 $10 100 $50 $50 2 7 20 200 140 70 3 8 25 250 200 80 4 10 30 ? ? ? 5 11 28 ? ? ? © 2016 McGraw‐Hill Education Limited 7-20 7.4 Nominal GDP versus Real GDP PRICE INDEX • A measure of the price of a specified collection of goods and services, called a “market basket,” in a specific year as compared to the price of an identical (or highly similar) collection of goods and services in a reference year LO4 © 2016 McGraw‐Hill Education Limited 7-21 7.4 Nominal GDP versus Real GDP PRICE INDEX Price index in specific year = price of market basket in specific year x 100 price of same market basket in base year For example, if in year 2, price of basket is $20 Price of same basket in base year is $10, then price index, year 2 = ($20/$10) x 100 = 200. LO4 © 2016 McGraw‐Hill Education Limited 7-22 7.4 Nominal GDP versus Real GDP DIVIDING NOMINAL GDP BY THE PRICE INDEX Nominal GDP Real GDP 100 Price Index For example, if in year 2, nominal GDP is $140 and price index is 200, then Real GDP = ($140/200) x 100 = $70. LO4 © 2016 McGraw‐Hill Education Limited 7-23 TABLE 7-5 LO4 Calculating Real GDP (base year = year 1) (2) Price of pizza per unit (P) (3) Price index (year 1 = 100) Year (1) Units of output (Q) (4) Unadjusted, or nominal, GDP (Q) x (P) (5) Adjusted, or real, GDP 1 5 $10 100 $50 $50 2 7 20 200 140 70 3 8 25 250 200 80 4 10 30 300 300 100 5 11 28 280 308 110 © 2016 McGraw‐Hill Education Limited 7-24 7.4 Nominal GDP versus Real GDP An Alternative Method Nominal GDP GDP Deflator 100 Real GDP For example, if in year 2, nominal GDP is $140 and real GDP is $70, then GDP Deflator = ($140/$70) x 100 = 200. LO4 © 2016 McGraw‐Hill Education Limited 7-25 TABLE 7-6 Steps for Deriving Real GDP from Nominal GDP Method 1 1. Find nominal GDP for each year. 2. Compute a price index. 3. Divide each year’s nominal GDP by that year’s price index, then multiply by 100 to determine real GDP. Method 2 1. Break down nominal GDP into physical quantities of output and prices for each year. 2. Find real GDP for each year by determining the dollar amount that each year’s physical output would have sold for if base-year prices had prevailed. LO4 © 2016 McGraw‐Hill Education Limited 7-26 7.4 Nominal GDP versus Real GDP Real-World Considerations and Data Chain-type annual-weights price index • Links each year to the previous year through the use of both the prior-year prices and current-year prices. • For example, the calculation of the chain-weighted index would use both 2011 and 2012 prices to calculate real GDP growth in 2012. Since the 2011 chain-weighted index was arrived at using both 2010 and 2011 prices, the year 2010 is linked back - as the links of a chain are - to 2009, 2008 and previous years as well. LO4 © 2016 McGraw‐Hill Education Limited 7-27 TABLE 7-7 Nominal GDP, Real GDP, and the GDP Deflator*, Selected Years (1) Year (2) Nominal GDP (3) Real GDP (4) GDP deflator 2002 = 100 1981 366.6 778.8 - 1985 495.6 859.0 57.7 1990 690.8 989.5 69.8 1995 826.2 - 76.6 2000 1098.2 - 82.9 2007 1565.9 1565.9 100.0 2010 1662.8 1593.4 - 2014 1974.8 1747.2 113.0 *Chain-type annual-weights price index. Source: Statistics Canada. Gross GDP. LO4 © 2016 McGraw‐Hill Education Limited 7-28 7.5 Shortcomings of GDP Measurement Shortcomings • NONMARKET ACTIVITIES • THE UNDERGROUND ECONOMY • IMPROVED QUALITY LO5 © 2016 McGraw‐Hill Education Limited 7-29 7.2 GLOBAL PERSPECTIVE The Underground Economy as a Percentage of GDP, Selected Nations LO5 © 2016 McGraw‐Hill Education Limited 7-30 7.5 Shortcomings of GDP Shortcomings of the Well-Being Measure • GDP AND THE ENVIRONMENT • LEISURE • COMPOSITION AND DISTRIBUTAION OF OUTPUT • NONMATERIAL SOURCES OF WELL-BEING LO5 © 2016 McGraw‐Hill Education Limited 7-31 The LAST WORD Value Added and GDP • The value added approach sums up the value of total output less the value of intermediate goods and services. • The expenditure approach sums up the expenditure on final goods and services. • The income approach tallies earnings of all factors of productions. © 2016 McGraw‐Hill Education Limited 7-32 Chapter Summary LO7.1 Explain how gross domestic product (GDP) is defined and measured. LO7.2 Describe how expenditures on goods and services can be summed to determine GDP. LO7.3 Explain how GDP can be determined by summing all of the incomes that were derived from producing the economy’s output of goods and services. LO7.4 Discuss the nature and function of a GDP price index, and describe the difference between nominal GDP and real GDP. LO7.5 List and explain the shortcomings of GDP as a measure of domestic output and well-being. © 2016 McGraw‐Hill Education Limited 7-33