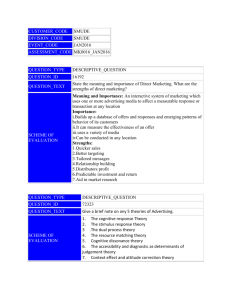

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE

advertisement

CUSTOMER_CODE SMUDE DIVISION_CODE SMUDE EVENT_CODE OCTOBER15 ASSESSMENT_CODE MF0010_OCTOBER15 QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 17767 QUESTION_TEXT Explain the various steps involved in Investment Process. Steps involved in Investment Process: 1.Setting investment policy Asset allocation a. time horizon b. Risk tolerance Portfolio management style a. Active management SCHEME OF EVALUATION b. Passive management. (3 marks, with explanation) 2.Performing security analysis a. Fundamental analysis b. Technical analysis.(2 marks, with explanation) 3.Portfolio construction 4.Portfolio revision 5. Portfolio performance evaluation. (1 mark each=3 marks, with explanation) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 17769 QUESTION_TEXT Briefly explain Dow Theory. SCHEME OF EVALUATION Dow Theory– Introduction. (1 mark, with explanation) Assumption: a.The averages discount everything.(1 mark, with explanation) b. The market is comprised of three trends. i. Primary trends. ii. secondary trends iii. minor trends(3 marks, with explanation) c. Primary trends have three phases i. First phase ii. Second phase iii. Third phase(3 marks, with explanation) d. The volume confirms the trends (1 mark, with explanation) e. A trend remains intact until it gives a definite reversal signal. (1 mark, with explanation) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 126188 Differentiate between CML and SML. QUESTION_TEXT 1. SCHEME OF EVALUATION 2. CML: is a straight line on a plot of absolute returns versus risk that begins at the point of the risk–free asset and extends to its point of tangency with the efficient frontier for risky assets that we call the market portfolio and beyond. SML: allows us to represent the risk and return characteristics of every asset in a market portfolio. SML disaggregates the market portfolio into its individual risky assets and plots return against the only meaningful aspect of total risk for each asset that is rewarded (its beta). CML: shows the relation between the expected return from a portfolio and its standard deviation and helps investors in their capital allocation. While SML shows the relation between expected return and beta and helps investors in security selection and individual asset pricing. (Any two differences to be explained) (10 marks) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 126191 QUESTION_TEXT SCHEME OF EVALUATION a. What is EMH? b. Write notes on prospects theory c. What are convertible bonds? a. Efficient Market Hypothesis (EMH) asserts that financial markets are ’efficient’, meaning the prices of traded assets (Example stocks and bonds) reflect all known information. The prices of assets reflect the collective beliefs of all investors about future prospects. EMH implies that it is not possible to consistently outperform the market, appropriately adjusted for risk, by using any information that the market already knows, except through luck. Only new information affects price of assets b. The prospect theory was propounded by Kahneman and Tversky. It describes how people frame and value a decision involving uncertainty. According to this theory, people look at choices in terms of potential gains or losses in relation to a specific reference point, which is often the purchase price. The decision attempts to maximise utility, keeping in mind the following features of the utility function. The utility function is concave for gains. This means that people feel good when they gain, but twice the gain does not make them feel twice as good. It is convex for losses. This means that people experience pain when they lose, but twice the loss does not mean twice the pain. The utility function is steeper for losses than for gains. This means that people feel stronger about the pain from a loss than the pleasure from an equal gain-about two and half times as stronger and this phenomenon is referred as loss aversion. c. Convertible bonds give the bondholders an option to exchange each bond for a specified number of shares of common stocks of the firm. The conversion ratio gives the number of shares for which each bond may be exchanged. Suppose a convertible bond that is issued at par value of $1,000 is convertible into 40 shares of a firm's stock. The current stock price is $20 per share, so the option to convert is not profitable now. However, should the stock price later rise to $30, each bond may be converted profitably into $1,200 worth of stock. The market conversion value is the current value of the shares for which the bonds may be exchanged. At the $20 stock price, the bond’s conversion value is $800. The conversion premium is the excess of the bond value over its conversion value. If the bond is selling currently at $950, its premium will be $150. QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 126193 QUESTION_TEXT What are the four crucial criteria of financial performance measure by Financial Ratios? SCHEME OF EVALUATION 1. Profitability 2. Liquidity 3. Efficiency 4. Solvency (2.5 marks each, explanation required) QUESTION_TYPE DESCRIPTIVE_QUESTION QUESTION_ID 126195 QUESTION_TEXT Discuss the Risks and returns from foreign investing. Returns: International investing provides superior return adjusted for risks. International equities also offer access to a broader spectrum of economies and opportunities that can provide for further diversification benefits. – (3 marks) Risks: SCHEME OF EVALUATION (7 marks) i. Changes in currency exchange rates ii. Dramatic changes in market value iii. Political, economic and social events iv. Lack of liquidity v. Less information vi. Reliance on foreign legal remedies vii. Different market operations