Special Purpose Vehicle (SPV) Act (2002)

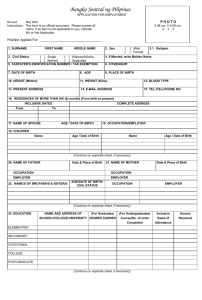

advertisement

The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Experience of the Philippines in Securitization Zeno Ronald R. Abenoja Department of Economic Research MoF-APFDC-WB Workshop on The Rise of Securitization in East Asia 7-9 Nov 2005 Shanghai, China The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Local Currency Bond Market as Percent of GDP, 2004 Source: AsianBondsOnline The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Capital Market Financing 100 Percent 75 50 25 0 1999 Initial Public Offerings (IPOs) 2000 2001 Loans granted 2002 2003 2004 New Government bond issuances The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Outstanding Domestic Bonds 2500 In billion pesos 2000 1500 1000 500 0 1996 1997 Public 1998 1999 2000 2001 2002 Private 2003 2004 The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Secondary Market Liquidity for T-Bonds 3500 4.0 3000 3.5 3.0 In billion pesos 2500 2.5 2000 2.0 1500 1.5 1000 1.0 500 0.5 0 0.0 1997 1998 1999 2000 Volume of secondary market transactions-LHS 2001 2002 2003 2004 Turnover ratio-RHS The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Holders of Government Securities, 2004 Others , 20% Govt, 5% Banks, 49% CB, 6% Private, 8% TEI, 12% Source: Bureau of the Treasury The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Role of Securitization • Enrich menu of credit instruments • Incentive for banks to help develop credit markets • Diversify risk • Helps to overcome initial problem of size/quality by bundling many underlying assets The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Special Purpose Vehicle (SPV) Act (2002) Main purpose Through the creation of SPVs or AMCs: · help banks dispose of their non-performing assets (NPAs) and replenish their loan portfolios with fresh capital. · encourage private sector investments in NPAs, eliminate existing barriers to the acquisition of NPAs, and improve the liquidity of the financial system The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Special Purpose Vehicle (SPV) Act (2002) SPV Stock corporation organized under Corporation Code 60% Filipino owned, if acquiring land Min authorized capital : P 500 M min paid-up capital : P 31.25 M Must be formed within 18 months from IRR Selling financial institution may not invest Another SPAV may not invest The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Special Purpose Vehicle (SPV) Act (2002) Powers of SPV Primary: to invest in or acquire NPAs of fin institutions Secondary: Engage 3rd parties to manage, operate, collect and dispose NPAs Rent, lease, hire, pledge, mortgage, transfer sell, securitize, collect rents and profits concerning NPAs The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Special Purpose Vehicle (SPV) Act (2002) Transfer Condition True Sale • no effective or indirect control • bankruptcy remote • transferee can freely dispose • no recourse The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Special Purpose Vehicle (SPV) Act (2002) Financial incentives: On transfer Tax exemption on transfer from FI to SPAV to third party Documentary stamp tax (DST) Capital gains tax Value added tax (VAT) Reduced transfer fees Mortgage registration Filing fees on foreclosure Land registration fees The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Special Purpose Vehicle (SPV) Act (2002) Financial incentives: On recapitalization •5- year NOLCO Financial incentives: On work-out Debtor exempt from income tax if extended financial assistance by SPAV SPAV financial assistance to debtor exempt from credit-related taxes and fees The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Special Purpose Vehicle (SPV) Act (2002) Eligibility for the incentives: Transferred within 2 years from IRR Disposed within 5 years from acquisition The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Securitization Act (2004) Purpose: improve the legal standing of securitized issues; promote securitization to the development of the capital market; and to pursue the development of the secondary market for asset-backed securities and other related financial instruments The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Securitization Act (2004) Powers of SPV: Accept the sale or transfer of assets Issue and offer the ABS for sale to investors Create any indebtedness or encumberance to defray administrative or other necessary expenses as specified in the securitization plan The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Securitization Act (2004) Elimination of friction costs: exemption from VAT and DST of the sale or transfer of assets from the financial institutions (FIs) to the SPEs (Special Purpose Entities); exemption from the payment of capital gains tax (CGT) of transfer of assets by dation in payment (dacion en pago) by the obligor in favor of an SPE; The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Securitization Act (2004) Elimination of friction costs: (con’t) exemption from VAT of the original issuance of asset-backed securities (ABS) and other securities related solely to securitization transactions; exemption from VAT and DST of all secondary trading and subsequent transfers of ABS, including all forms of credit enhancement in such instruments; The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment Securitization Act (2004) Elimination of friction costs: (con’t) exemption of the SPE, which is not considered an FI, from the payment of gross receipts (GRT); exemption from VAT and DST on re-transfer of assets and collateral from the SPE to the Originator or Seller; and exemption from income tax on the yield of the investor from any low-cost or socialized housingrelated ABS. The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment BSP Regulations on banks’ securitization activities Overall purpose to foster the development of a market for new financial products but at the same time ensure that banks hold sufficient capital commensurate to the risks inherent in these products to encourage banks to diversify their investment portfolio as a means to stabilize earnings, control maturity mismatches and minimize over concentration of exposures The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment BSP Regulations on banks’ securitization activities Securitization structures Traditional Securitization - cash flow from an underlying pool of exposures is used to service at least two different stratified risk positions or tranches Synthetic Securitization - with at least two different stratified risk positions or tranches that reflect different credit risk, where credit risk of an underlying pool of exposures is transferred through the use of credit derivatives or guarantees The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment BSP Regulations on banks’ securitization activities Approval all securitization of receivables of banks and other financial institutions are subject to the approval of the BSP Investments by banks all U/KBs with expanded derivatives authority may invest in securities overlying any tranche of securitization structures. U/KBs without expanded derivatives authority may also invest but only in securities overlying tranches of securitization structures that are rated at least A, or its equivalent, by a BSPrecognized credit rating agency. The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment BSP Regulations on banks’ securitization activities Disclosure to prospective investors (a) the ABS do not represent deposits or liabilities of the originator, servicer or trustee; (b) that they are not insured with the PDIC; (c) the investor has an investment risk; (d) the trustee does not guarantee capital value of the ABS; (e) that only loans existing in the books of the originator may be the subject of securitization; The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment BSP Regulations on banks’ securitization activities Disclosure to prospective investors (con’t) (f) that credit enhancements in the form of standby letters of credit, surety bonds, guarantees are allowed to support the ABS; and (g) only the Trust Department of a bank may act as trustee of a securitization scheme The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Legal and Regulatory Environment BSP Regulations on banks’ securitization activities Capital treatment Capital charge for investments in securitization structures held in the banking book shall be based on the latest rating given by any of the BSPrecognized credit rating agencies. Risk weight 20% 50% 100% Deduction from total of Tier 1 and Tier 2 capital Moody’ s Aaa to Aa3 A1 to A3 Baa1 to Baa3 Below Baa3 Unrated Standar d and Poor’s AAA to AAA+ to ABBB+ to BBBBelow BBB- Fitch IBCA Phil Ratings AAA to AAA+ to ABBB+ to BBBBelow BBB- Aaa to Aa A Baa Below Baa The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Asset-Backed Securities 96100 P M i l l i on 97400 2000 1500 1000 500 0 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Securitization deals The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines 1992, 1995 - Citibank issued mortgage backed securities 1996 - BPI issued asset-backed securities without recourse secured by a pool of real estate mortgages 1997 - the Solid Bank issued without recourse, mortgage loans selected from its mortgage portfolio to Mortgage-Backed Security Trust 1997 - Philippine Airlines securitized its US ticket receivables 2003 - the Metro Rail Transit Corporation (MRTC), completed the largest securitization in the Philippines through the issuance of receivable-backed notes to local institutional investors. The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Mortgage Credit and Bank Loans 2,500 14.0 12.0 2,000 1,500 8.0 6.0 1,000 4.0 500 2.0 0 0.0 2000 Mortgage credit (REL)-LHS 2001 2002 Outstanding bank loans (TLP)-LHS 2003 REL/TLP-RHS 2004 REL/GDP-RHS Percent In billion pesos 10.0 The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Real Estate Lending by Purpose 100% PhP204.8B PhP182.9B Dec-97 June-05 Percent 75% 50% 25% 0% Acquisition of Residential Property Acquisition of Commercial Property Development of Subd. for Housing Development of Industrial Park Development of Commercial Property Dev. of Recreational & Amusement Park Development of Memorial Park Construction of Office Condominium Const. of Residential Condominium Construction of Infrastructure Project Other Purpose The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Impediments in the ABS industry Inadequate infrastructure Burdensome legal infrastructure and procedures particularly on foreclosures Inadequate external credit rating capacity Custodianship, clearing and settlement systems Trading conventions for ABS The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Impediments in the ABS industry Financial taxes, and high transactions cost Concerns about the quality and risks of asset-backed securities as financial instruments Limited understanding of asset-backed securities (ABS) as a fund-raising tool The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Some capital market reform initiatives PhilPaSS -- RTGS Fixed Income Exchange 3rd party custodianship Credit Information Bureau Encourage entry of more credit rating agencies Financial Sector Forum – BSP, SEC, IC, PDIC, Encourage new instruments – UITF, CDOs Legislative agenda -Corporate Reform Act, Revised Investment Company Act, Personal Equity and Retirement Act, Pre-need Code Act, Corporate Recover Act The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Concluding remarks A series of structural and legal reforms are continuously being pursued to create an enabling environment for securitization. The Securitization Law is a key element of this reform process: - as it provides the favorable regulatory framework; and - is expected to bring local practices consistent with international norms The Government of the BangkoRepublic Sentral ng Pilipinas of the Philippines Thank you www.bsp.gov.ph zabenoja@bsp.gov.ph