File - Jamie Creason, MPH

advertisement

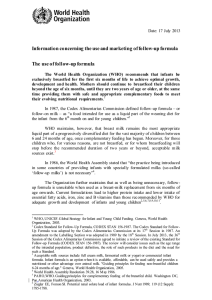

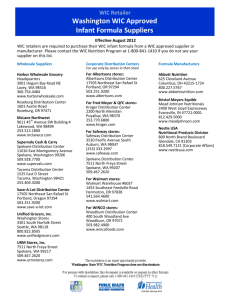

Holding the Formula Industry Accountable Jamie Creason MPH Nutrition Capstone 2014 The Plan -Create a document for CA WIC Assoc. that includes: ▪ Current violations of the WHO code ▪ UC Davis Human Lactation Center study results -Provide document to CA WIC Association -Collaborate with CA WIC, BMSG, Advocacy Initiative Benefits of Breast-feeding Infant Mother Protective against: Protective against: ▪ ▪ ▪ ▪ ▪ ▪ Diabetes ▪ Type 2 diabetes Sudden infant death syndrome ▪ Obesity Childhood leukemia Obesity Asthma Various infections ▪ Breast and ovarian cancers Breast-feeding Rates Factors Influencing the Choice to Breast-feed Media Institutional Social Choice to BF Strategies to Increase Breast-feeding ▪ Hospital support ▪ Workplace support ▪ Community support, resources ▪ Training for all medical providers ▪ National campaign to promote breast-feeding ▪ Research and surveillance ……But what about regulating formula marketing? WHO Code of Marketing of Breast-milk Substitutes Aims: ▪ Contribute to provision of safe, adequate nutrition for infants ▪ Protection and promotion of breast-feeding ▪ Ensuring proper use of breast-milk substitutes when necessary Ratified by more than 100 nations 65 countries adopted regulations and restrictions on marketing based on the code. But NOT the United States WHO Code of Marketing of Breast-milk Substitutes Formula Companies SHOULD NOT: ▪ Advertise to general public ▪ Seek contact with pregnant women, mothers WHO Code of Marketing of Breast-milk Substitutes Formula Companies SHOULD NOT: ▪ Promote mixed feeding/supplementation WHO Code of Marketing of Breast-milk Substitutes Formula Companies SHOULD NOT: ▪ Make Nutrition and Health Claims WHO Code of Marketing of Breast-milk Substitutes Formula Companies SHOULD NOT: ▪ Idealize formula ▪ Draw similarities with breast-milk ▪ Insinuate superiority WHO Code of Marketing of Breast-milk Substitutes Formula Companies SHOULD NOT: ▪ Provide samples, coupons ▪ (to consumers or medical providers) Market share: Infant Formula Oligopoly Company Strategy Mead Johnson Medical Detailing Branded Product Enfamil Nestle Competitive pricing; Consumer marketing Good Start PBM Nutritionals Competitive pricing; Consumer marketing (private label) Walmart/Target Medical Detailing (private label) Similac/Costco Abbott Nutrition Major Trends in the Formula Industry 1 Growth of Private Label 2 Increasing share of organic product 3 Movement to supplemented formula 4 Increase in BF Rates..but Exclusive Rates Remain Low National WIC Association (NWA) ▪ 60% of formula market=WIC How they Increase Profits ▪ $3.2B Infant formula market ▪ Growth driven by price increases 4 3 Dollars ($B) 2 1 0 Infant Formula Market Dollar Split by Type of Formula (2002 – 2011) $pecialty Products ▪ Lutein ▪ DHA ▪ Probiotics Exposure to Marketing Media Medical Social Consumer Marketing: Medical ▪ Relationships with medical providers ▪ Using WIC name ▪ Discharge packs Marketing: Media Magazines Public Displays • Advertisements • Coupons • Demos in public • Billboards Television Internet • Commercials • • • • • Smartphones • Coupons • Trackers • “Expert” advice Coupons Advertisements Blogs Forums “Expert” advice Marketing: Media EXAMPLES Marketing: Social “Mommy Parties” UC Davis Human Lactation Center and WIC qualitative research study Perceptions of Infant Formula Additives from Moms Participating in the CA WIC Program (2010-2013) ▪ Purpose: Characterize understanding of formula marketing claims Determine impact of infant formula marketing What Can We Do ▪ Align with advocacy groups (IBFAN, LLL, NABA, NWA, USBC) ▪ Engage lawmakers ▪ Apply pressure on: FDA, FTC, Formula Industry Thank You! ▪ Laurie True for the idea for my capstone ▪ Lia Fernald for your guidance ▪ My classmates (especially Will, the breast editor around) ▪ My mom friends who provided me with anecdotes and wisdom ▪ My family and friends for their support