Bank

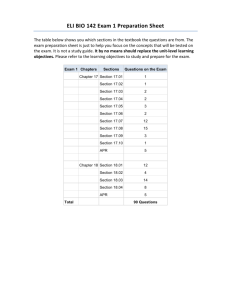

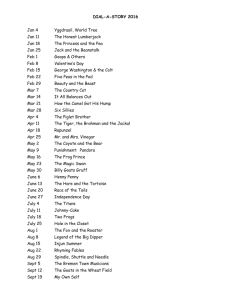

advertisement

FINANCIAL INDUSTRY STRUCTURE Chapter 9 & Chapter 13 & Chapter 17 450-454 Shadow Banking System • Over the last 30 years, competitors to banks in providing traditional banking services. The competitors include • Investment/Merchant Banks • Mutual Funds • Hedge Funds • GSE’s • Pension Funds/Insurance Companies • Finance Companies • The FSB defines shadow banking as “credit intermediation involving entities and activities (fully or partially) outside the regular banking system”. In the Global Shadow Banking Monitoring Report 20121, the term “Other Financial Intermediaries” (OFIs) which include NBFIs except insurance companies, pension funds or public sector financial entities, was used as a conservative proxy for the size of shadow banking. Decline of Glass-Steagal Act • In 1927, interstate banking eliminated. • In 1933, Glass-Steagal act created FDIC and separated banking business from securities business. During 1990’s, these regulations were eliminated and US banks had a wave of consolidation and concentration. Bank Holding Companies • Bank holding companies have a corporate structure in which a parent company owns many subsidiaries in different financial industries. 1. 2. 3. 4. Subsidiaries engage in banking, securities, real estate and insurance business. Subsidiaries are separate legal entities so the bankruptcy of one does not mean losses for the other. Losses at one subsidiary do result in losses for shareholders of the holding company. Banks mostly protected from risk of sister companies. Advantages: Protects depositors & bank capital from market risk. One stop shopping can help build relationships. Financial Innovation and The Decline of Traditional Banking • Banking is traditionally the business of accepting short-term retail deposits and making long-term loans. • A number of financial innovations have led to changes in the financial industry and financial regulation. • Due to reductions in information & transaction costs, the banking industry in US, Japan, and Europe faces competition for both deposits and credit. IMF Global Financial Stability Report - Chapter 2: Global Shadow Banking Decline in Advantage in Providing Liquidity • New Competition: Money Market Mutual Funds – Mutual funds that are redeemable at a fixed price by writing checks. Mutual funds invest in money markets. These are essentially checking accounts issued by non-financial institutions that pay interest. Decline in Advantage in Providing Credit • Another of banks comparative advantage is their ability to provide loans quickly and provide credit to small or new firms. • New Competition • Commercial Paper: Short-term corporate bonds. Many firms that relied on banks for short-term loans now issue commercial paper. • Junk Bonds: Bonds issued by firms with noninvestment grade credit ratings. Many firms that relied on banks for credit now issue junk bonds. Jan, 1991 Aug, 1991 Mar, 1992 Oct, 1992 May, 1993 Dec, 1993 Jul, 1994 Feb, 1995 Sep, 1995 Apr, 1996 Nov, 1996 Jun, 1997 Jan, 1998 Aug, 1998 Mar, 1999 Oct, 1999 May, 2000 Dec, 2000 Jul, 2001 Feb, 2002 Sep, 2002 Apr, 2003 Nov, 2003 Jun, 2004 Jan, 2005 Aug, 2005 Mar, 2006 Oct, 2006 May, 2007 Dec, 2007 Jul, 2008 Feb, 2009 Sep, 2009 Apr, 2010 Nov, 2010 Jun, 2011 Jan, 2012 Aug, 2012 Mar, 2013 Oct, 2013 May, 2014 Millions US$ Commercial Paper Outstanding: sa: Total 2500000 2000000 1500000 1000000 500000 0 US Corporate Bond Issuance US$ Billions 1,600.0 1,400.0 1,200.0 1,000.0 800.0 600.0 400.0 200.0 0.0 1996 1997 1998 1999 2000 2001 2002 2003 2004 Investment Grade 2005 2006 High Yield 2007 2008 2009 2010 2011 2012 2013 Loan Commitments & Letters of Credit Banks collect fees for additional off balance sheet activities 1. Loan Commitment: A line of credit giving company ability to borrow when desired. 2. Letter of Credit: Promise by a bank to make good on customer’s credit from another party. Commercial LOC: Customer buys goods on credit. If they get LOC from bank, the bank promises to pay trade bill if the customer does not. B. Standby LOC: If issuers of commercial paper, get LOC from bank, the bank promises to pay bond investors if issuer defaults. A. Loan Commitments 5,000,000,000 4,500,000,000 4,000,000,000 3,500,000,000 3,000,000,000 2,500,000,000 2,000,000,000 1,500,000,000 1,000,000,000 500,000,000 0 2014 2009 2004 Credit Card & Home Equity Line of Credit 1999 Loan Commitments 1994 Loan Securitization • Banks make loans in a certain class, bundle the loans into a portfolio, sell securities, and dedicate the principal and interest payments on the loans to making coupon and face value payments on the securities. • Banks profits come as fee for setting up loan back securities. • Banks reduce the maturity mismatch between assets and liabilities by raising funds this way instead of deposits reducing interest rate and liquidity risk. • Primarily mortgage loans are securitized but also securitization of credit card receivables, auto loans and even leasing payments by rental companies. Securitization Banks collect fees for making loans and collecting repayment Borrower Borrower Borrower Borrower Borrower Loans Bank Will bundle loans And sell to 3rd party Bundle 3rd Party Securitization Company (typically GSE) Bonds Bond Market Mortgage Debt by Owners 16000000 14000000 12000000 Millions US$ 10000000 8000000 6000000 4000000 2000000 0 Axis Title Mortgage Debt: Mortgage or Pool Trusts Mortgage Debt: Federal & Related Agencies Mortgage Debt: Major Financial Institutions Individuals & Others Other Tyes of Securitization, Billions USD 900.0 800.0 700.0 600.0 500.0 400.0 300.0 200.0 100.0 0.0 19851986198719881989199019911992199319941995199619971998199920002001200220032004200520062007200820092010201120122013 Automobile Credit Card Equipment Student Loans Shadow Banking and Asia • FSB uses OFI’s (non-bank financial institutions less insurance, pension funds & public institutions) as indicator of shadow banking (Unit Trusts/Mutual Funds, Finance Companies, Credit Unions, Brokerage Companies, Structured Finance). • Shadow banking in Asia generally: • Small relative to banking sector but growing • Mostly not financed through financial markets. • Mostly finances simple loans or vanilla securities. Chinese Banking System 1. 2. 3. 4. 5. 6. Major Commercial Bank (BoC, ICBC, CCB, ABC) Joint-Stock Commercial Bank (CITIC Industrial Bank, Bank of Communications, Everbright) City Commercial Bank (Bank of Shanghai, Bank of Beijing, Bank of Tianjian) Credit Cooperatives (Collective Banks – Urban and Rural) Policy Banks (Export Import Bank, China Development Bank) Trust Companies 2014 Q1 China Banking Regulatory Commission RMB Billion Total Other (NBFI & Public) Rural FI City Joint Stock Major Commercial 0 20000 40000 60000 CBRC 80000 100000 120000 140000 160000 180000 Chinese Trust Companies • China has heavily regulated deposit rates. • Rich people seek higher yields. WMP direct funds to trust companies – specialized lenders that finance projects that cannot access traditional banks. Shadow Banking and the GFC Mar-09 Mar-08 Mar-07 Mar-06 Mar-05 Mar-04 Mar-03 Mar-02 Mar-01 Mar-00 Mar-99 Mar-98 Mar-97 Mar-96 Mar-95 Billion Growth in I-Banking Assets of Broker Dealers 3,500 3,000 2,500 2,000 1,500 1,000 500 0 Financing of Investment Banks October 2004 – SEC lifts capitalization rules for large broker-dealers M. Brunnermeier, Princeton U. Slides. I-Banks switched to more S-T financing. Broker Dealers Source of Financing Ex. In 2000, Equity to Assets at Morgan Stanley was 4.6%, in May 2008 was 1.1% 45.00% 40.00% 35.00% 25.00% 20.00% 15.00% 10.00% 5.00% ST CP Equity Mar-09 Mar-08 Mar-07 Mar-06 Mar-05 Mar-04 Mar-03 Mar-02 Mar-01 Mar-00 Mar-99 Mar-98 Mar-97 Mar-96 0.00% Mar-95 % 30.00% CMO: Collateralized Mortgage Obligations Sample • An SPV is set up to purchase mortgages and issue bonds which pay out in tranches. Tranches are orderings of payments in terms of seniority. Each tranche is has itsM. Brunnermeier, Princeton U. Slides. Commercial and Investment Banks own credit rating. often set up SPV Special purpose vehicle: Quasiindependent company set up to manage asset. Vanilla Mortgage Backed Security • A bond that raises funds to buy a bundle of mortgages and uses income to repay bondholders. • Usually sold or guaranteed by GSE (Govt. Natl Mortgage Assoc., Fed. Natl Mortgage Association, Federal Home Loan Mortgage Corp.) Mortgages MBS Bondholders Mortgages Mortgages Single Tranche Collataralized Mortgage Obligations • A special purpose vehicle that buys mortgages and structures payments into tranches. • Usually private label, SPV/SPE , in order to expand base of allowable mortgages. Special purpose vehicle/entity: Quasi-independent company set up to manage asset. Senior Tranche AAA Mortgages CMO Mortgages Mortgages Junior Tranche Structured Securities • Securitized bonds w/o GSE guarantees are risky because in a slump not all mortgage borrowers will repay their debts. But income is highly diversified. • CMO’s structure payments according to seniority. Most senior tranches have first call on income, so only lose money if a large fraction of borrowers fail to repay. • CMO’s concentrate risk among most junior tranches, synthetically creating safe senior securities. Collateralized Debt Obligations • A special purpose vehicle that buys quantities of debt securities (often MBS or CMO tranches) that might be low rated and turn it into tranches some of which might be better rated. Senior Tranche AAA BBB Securities SPV Junior Tranche BBB Securities BBB Securities AAA tranches may have paid higher returns than typical AAA securities. Attractive to institutions restricted to AAA Sub-prime Lenders • An industry of financial intermediaries that specialized in making mortgage loans pre-packaged for securitization arose. • Many of these specialized in the sub-prime market. • Typically, these were sold to SPV’s rather than GSE’s. • Investors in CMO’s and CDO’s financed their purchases with short-term borrowing and issuing commercial paper often sold to MMMF’s. • Shadow banking reduced maturity mismatch in traditional banking sector but only shifted it to investment banks and mutual funds. End of Housing Bubble • In 2005, housing prices reached a peak. • However, by reducing lending standards and increasing reliance on sub-prime lending, mortgage lending continued to grow. • By 2007, housing prices began to fall. Jan, 2000 Apr, 2000 Jul, 2000 Oct, 2000 Jan, 2001 Apr, 2001 Jul, 2001 Oct, 2001 Jan, 2002 Apr, 2002 Jul, 2002 Oct, 2002 Jan, 2003 Apr, 2003 Jul, 2003 Oct, 2003 Jan, 2004 Apr, 2004 Jul, 2004 Oct, 2004 Jan, 2005 Apr, 2005 Jul, 2005 Oct, 2005 Jan, 2006 Apr, 2006 Jul, 2006 Oct, 2006 Jan, 2007 Apr, 2007 Jul, 2007 Oct, 2007 Jan, 2008 Apr, 2008 Jul, 2008 Oct, 2008 Jan, 2009 Apr, 2009 Jul, 2009 Oct, 2009 Jan, 2010 Apr, 2010 Jul, 2010 Oct, 2010 Jan, 2011 Apr, 2011 Jul, 2011 Oct, 2011 House Price Index: FHFA: Purchase Only: US: Jan1991=100 235 225 215 205 195 185 175 165 155 145 135 10 8 1985Q1 1985Q3 1986Q1 1986Q3 1987Q1 1987Q3 1988Q1 1988Q3 1989Q1 1989Q3 1990Q1 1990Q3 1991Q1 1991Q3 1992Q1 1992Q3 1993Q1 1993Q3 1994Q1 1994Q3 1995Q1 1995Q3 1996Q1 1996Q3 1997Q1 1997Q3 1998Q1 1998Q3 1999Q1 1999Q3 2000Q1 2000Q3 2001Q1 2001Q3 2002Q1 2002Q3 2003Q1 2003Q3 2004Q1 2004Q3 2005Q1 2005Q3 2006Q1 2006Q3 2007Q1 2007Q3 2008Q1 2008Q3 2009Q1 2009Q3 2010Q1 2010Q3 2011Q1 2011Q3 2012Q1 2012Q3 2013Q1 2013Q3 2014Q1 12 Mortgage losses estimated at $1.4 trilion by IMF Credit performance worse at subprime lenders. 6 4 2 0 Delinquency rate on all loans; All commercial banks (Seasonally adjusted) Delinquency rate on loans secured by real estate; All commercial banks (Seasonally adjusted) Liquidity of CMO’s and CDO’s • There is much uncertainty and asymmetric info in CMO’s. Difficult for a potential investor to evaluate quality of the mortgage loan bundle while bundler/seller may have better idea. • Increased risk has generated lemon’s problem. • Wide bid/ask spreads makes it difficult to reasonably implement M2M accounting. Issues • Capitalization: Banks and other holders of mortgage backed securities are likely to take large losses on defaults. • Liquidity: MMMF are supposed to be safe investments; once risk becomes known MMMF‘s pull out of commercial paper market go into treasuries. • Complexity: CDO’s and CMO’s are complicated instruments; difficult to tell good from bad. In hard times, adverse selection may make selling them w/o huge discount problematic. • Business cycle issue. Large contraction in consumption and investment likely to make default rates rise. Liquidity Runs • Logic of the Diamond & Dybvig model 2 Equilibria OFI CMO’s Basel III – Link • International regulations change following the crisis. • Requirements for simple leverage ratios, not just risk- weighted CAR. • Capital requirements for SIFI’s (systematically important financial institutions) not just banks. • Liquidity Requirements 1. 2. Liquidity Coverage Ratio – Enough liquid assets to cover withdrawals under stress scenarios Net Stable Funding Ratio – Incentives to maintain a minimum level of stable or long-term financing . 39 A. Conventional View • Asset Price Indicators should only influence monetary policy as they impact aggregate demand and inflation over the medium term. • Price stability is the only focus. • Monetary policy should make no effort to affect the speculative component of asset prices. “The central bank should respond to movements of stock prices, house values, and other asset prices only insofar as they affect future output and inflation over the medium term. That is, policy tightening might be called for to contain the incipient inflation caused by an asset–market boom, but not to arrest the boom per se.” Bernanke (2002) 39 40 B. Leaning Against the Wind/ Extra Action • ECB 2005 “The central bank would adopt a somewhat tighter policy stance in the face of an inflating asset market than it would otherwise allow if confronted with a similar macroeconomic outlook under more normal market conditions” • Respond to speculative boom with tight monetary policy. • Trade certainty of worse near-term economic performance for possibility of better future performance 40 41 C. Post-Crisis View 1. Risk Taking Channel of Monetary Policy 2. Dealing with Credit Booms 41 42 1. Bank Risk Taking Channel • Economic studies suggest that banks respond to persistent periods of low interest rates by taking more risk. • Yield chasing – Banks may implicitly promise yields to investors, need to earn yields that match those promises. Only by taking on more risk can they do so. • Evidence suggests that yield chasing is less prevalent in well-regulated banking markets. 43 Bank Risk Taking and Interest Rates Dell'Ariccia, G., 2010, “Monetary Policy and Bank Risk-Taking,” IMF Staff Position Note No. 10/09 Link Challenges to Monetary Policy Effectiveness 44 IT and Bank Risk Taking BIS View (Borio and Wheelock, 2004; Borio and White, 2004) • Inflation targeting monetary policy passively allows bank credit to expand to fuel the asset price boom general price inflation • Unless policymakers act to defuse a boom, a crash will follow. 44 45 IMF WEO Sustaining the Recovery October 2009 Figure 3.3. Selected Macroeconomic Variables before and during House Price Busts 4 3 Panel 1: Credit/GDP Growth 2 1 0 -12 -11 -10 -9 -8 -7 -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 6 7 8 -1 % Deviation -2 -3 From 8 quarter trend -4 -5 -6 -7 pre-1985 post-1985 45 46 Policies for Macrofinancial Stability: How to Deal with Credit Booms Giovanni Dell'Ariccia, Deniz Igan, Luc Laeven, and Hui Tong,with Bas Bakker and Jérôme Vandenbussche IMF Staff Policy Note May 2012 Dealing with Credit Booms • Credit Booms: Credit grows 10-20% faster than GDP Good or Bad? Often follow domestic or international financial liberalization. 47 Policies for Credit Booms Leaning against the Wind • Monetary Policy: Raise Interest Rates. • Fiscal Policy: Counter-cyclical fiscal policy • Monetary and fiscal policies are important for general macro overheating that may accompany credit boom. But evidence for their effectiveness beyond that is limited and could have significant negative impacts on growth. “Both the objective of keeping consumer price inflation close to 2.5% and the objective of sustaining capacity utilization in the years ahead could in isolation imply a somewhat lower key policy rate forecast.… On the other hand, a lower key policy rate may increase the risk of a further buildup of financial imbalances” (Norges Bank 2014, p. 16). Leaning 2014 Challenges to Monetary Policy Effectiveness LINK Link 48 49 Macro-prudential Measures (MPM) Loan Eligibility Criteria. 2. Capital and Liquidity Requirements. 3. Asset concentration and growth limits. 1. 49 50 Monitoring Credit Risk: HK Link Final Exam • Thursday, December 11th, LTB 12:30-3:30. • Cumulative. Similar to mid-term and practice exams. • Bring writing instruments and a calculator. • Semi-open book – Bring 1 A4 size paper with handwritten notes on both sides. • Office Hours: Standard TR 4:30-5:30 and MW 2-3:30. Currency Internationalization • China creating an offshore Renminbi market by allowing Hong Kong residents to keep quota of RMB deposits . MacCauley Renminbi internationalisation and China’s financial Development BIS Quarterly Review, December 2011 http://www.bis.org/publ/qtrpdf/r_qt1112f.pdf Offshore RMB FX Market RMB Daily Turnover, April 2013 20 18 16 Billions US$ 14 12 Delivarable Forward 10 Spot 8 6 4 2 0 Onshore Hong Kong Other Offshore Shu, He, and Cheng, 2013 Advantages • Chinese (and other!) companies can settle and invoice in Renminbi. • In 2010, 2% of China’s trade was settled in RMB. In 2011, nearly 7% • Create more balanced international portfolio of assets. • Questions: Can China have international currency without capital account convertibility. Dec, 1980 Oct, 1981 Aug, 1982 Jun, 1983 Apr, 1984 Feb, 1985 Dec, 1985 Oct, 1986 Aug, 1987 Jun, 1988 Apr, 1989 Feb, 1990 Dec, 1990 Oct, 1991 Aug, 1992 Jun, 1993 Apr, 1994 Feb, 1995 Dec, 1995 Oct, 1996 Aug, 1997 Jun, 1998 Apr, 1999 Feb, 2000 Dec, 2000 Oct, 2001 Aug, 2002 Jun, 2003 Apr, 2004 Feb, 2005 Dec, 2005 Oct, 2006 Aug, 2007 Jun, 2008 Apr, 2009 Feb, 2010 Dec, 2010 Oct, 2011 Aug, 2012 Jun, 2013 Apr, 2014 Hong Kong Deposits Deposits: HK$ Deposits: US Dollar: Exclude Foreign$ Swap Deposits: Renminbi: Total Outstandings Other 12000000 10000000 8000000 6000000 4000000 2000000 0 Dec, 1980 Oct, 1981 Aug, 1982 Jun, 1983 Apr, 1984 Feb, 1985 Dec, 1985 Oct, 1986 Aug, 1987 Jun, 1988 Apr, 1989 Feb, 1990 Dec, 1990 Oct, 1991 Aug, 1992 Jun, 1993 Apr, 1994 Feb, 1995 Dec, 1995 Oct, 1996 Aug, 1997 Jun, 1998 Apr, 1999 Feb, 2000 Dec, 2000 Oct, 2001 Aug, 2002 Jun, 2003 Apr, 2004 Feb, 2005 Dec, 2005 Oct, 2006 Aug, 2007 Jun, 2008 Apr, 2009 Feb, 2010 Dec, 2010 Oct, 2011 Aug, 2012 Jun, 2013 Apr, 2014 Millions HK$ 8000000 7000000 6000000 5000000 4000000 3000000 2000000 1000000 0 To Finance Imports to and Exports & Re-exports from HK To Finance Merchandising Trade Not Touching HK Other Loans for Use in HK Other Loans for Use outside HK Other Loans where the Place of Use is Not Known