US Carried Interest Tax Legislation

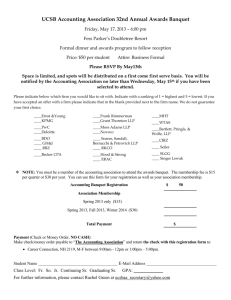

advertisement

THE CHANGING VENTURE CAPITAL LANDSCAPE: Summary of Recent U.S. and European Legislative Proposals Evolving PRC Investment Structures Best Tax Compliance Practices for Funds with U.S. Investors or Managers CVCFO November 2009 Meeting Steven R. Franklin sfranklin@gunder.com GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 1093430.1 U.S. Advisers Act Legislation GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 2 U.S. Advisers Act Legislation ♦ Private Fund Investment Advisers Registration Act of 2009 (House of Representatives) – Removes exemption from registration historically relied upon by venture capital and private equity funds – Authorizes SEC to collect additional information in the public interest/investor protection – Exempts • “Venture Capital” funds, a term to be defined later – Unclear how this will ultimately be defined. It is intended to exclude buy-out funds, which may pose problems for late-stage venture capital funds • Advisers managing SBICs • Advisers with individual funds <$150m – Includes Non-U.S. funds that have raised money from U.S. investors – Passed House Financial Services Comm. 67-1 GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 3 U.S. Advisers Act Legislation (Cont.) ♦ Private Fund Investment Advisers Registration Act of 2009 (Senate) – – Remove Adviser Act exemption from funds with less than 15 clients Limited foreign private adviser exemption • • • – Exempts • • • • – – “Venture Capital Funds,” term to be defined by SEC; exempt from registration “Private Equity Funds,” term to be defined by SEC; exempt from registration, but subject to recordkeeping and access requirements “Family Offices,” term to be defined by SEC; excepted from the definition altogether Advisers with individual funds <$150m Introduced by Sen. Chris Dodd • • • – No U.S. place of business Fewer than 15 U.S. clients Less then $25 million assets under management attributable to U.S. Clients Chairman of the Senate Committee on Banking, Housing and Urban Affairs. Likely supersedes previous legislation (including Sen. Reed’s similar proposal) Part of >1000 page legislation on financial systems reform Increases the minimum threshold from $25M to $100M for SEC registration; smaller funds must register with the states. Directs the SEC to adjust the “accredited investor” threshold under the 1933 Act every 5 years. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 4 U.S. Advisers Act Legislation (Cont.) What does Adviser Act compliance entail? ♦ Electronic registration on Form ADV – Part I – Basic information, including jurisdiction of incorporation, place of business, structure of investment adviser, states in U.S. where they operate, criminal/civil legal proceeding history – Part II – Nature of services, fees charged, investment objectives, risks, strategies, methods of analysis of prospective investments, sources of information, affiliations in financial sector including related conflicts, education and other business background ♦ Performance Fees – May only be charged if investor is a “Qualified Client” – defined as (i) a Qualified Purchaser under the Investment Company Act, (ii) if $750,000 is invested in fund, (iii) net worth in excess of $1.5 million or (iv) non-U.S. person – Result = Traditional 3(c)(1) funds (i.e, funds that want to raise money from smaller institutions and from individuals with less than $5MM of investment assets) will be more difficult to form without an exemption ♦ SEC Examinations, compliance program, code of ethics, periodic filings to clients and the SEC, appointment of Chief Compliance Officer, custodial rules, prohibitations on certain forms of advertising, no assignment of services without consent, and recordkeeping GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 5 Additional U.S. Legislation GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 6 Additional U.S. Legislation ♦ Other bills have been introduced to study the effects investment funds have had on the market and recommend further regulations. – – – – – Financial Oversight Commission Act of 2009 Financial Crisis Investigation Act of 2009 Hedge Fund Adviser Registration Act of 2009 Pension Security Act of 2009 Hedge Fund Transparency Act GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 7 Additional U.S. Legislation (Cont.) NY State Power of Attorney Statute ♦ Effective Sep. 1, 2009 all powers of attorney (“POA”) signed in NY by natural persons must comply with a new set of rules – Require disclosures, certain fonts, notarization – Any new POA revokes all previously executed POAs ♦ Major implications for funds – Changes fiduciary relationship (GP owes duty to LP) – Careful drafting of new POAs so as not to affect old POAs – “Passing through New York” problems ♦ Be careful about amending vs. amending and restating agreements so as not to extinguish existing POA GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 8 EU Legislation GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 9 EU Legislation ♦ The Directive on Alternative Investment Fund Managers was proposed on April 29, 2009 by the European Commission. ♦ Attempts to regulate investment funds that are not already covered by current EU regulations, UCITS (Undertakings for Collective Investment in Transferrable Securities). ♦ Subjects fund manager with € 500 million in assets under management with no right of redemption for 5 years (or €100 million in assets if leveraged) to various regulatory restrictions. – Aimed at both EU and Non-EU domiciled funds. – Requires disclosure requirements similar to Adviser Act of 2009. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 10 EU Legislation (Cont.) ♦ EU based fund managers would be subject to local regimes (i.e. U.K. Financial Services Authority) – LPA must be provided to regulator – Conduct of business principles, strict conflicts of interest rules, risk management, GP capital account requirement (€125,000 + 0.02% of assets > €250,000), independent valuator for portfolio valuation, custodial requirements, annual report to investors and regulator, among other items GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 11 EU Legislation (Cont.) ♦ Marketing to EU based investors – EU based manager • Must be authorized (see above) • Can only market to “professional investors” (institutions, and only limited high net worth individuals), except as provided by local law • Before marketing must provide regulator with all fund related documents – Non-EU domiciled funds → Same rules as above and must be based in OECD compliant tax jurisdiction – Non-EU fund mangers → Must elect to be subject to the financial regulatory rules of at least one EU country GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 12 EU Legislation (Cont.) Recent developments regarding these proposed EU regulations: ♦ Charles River study of compliance costs (as a % of assets under management) – VC – one-time .338%, ongoing annual.248% – PE – one-time .421%, annual .138% ♦ European Central Bank warned in October that private equity would flee Europe if adopted ♦ UK has mounted stiff opposition, though France, Spain and Germany are supportive ♦ Requires approval of EU Parliament and EU governments GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 13 U.S. Carried Interest Tax Legislation GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 14 U.S. Carried Interest Tax Legislation History of Proposals ♦ In 2007 Representative Sander Levin introduced bill to address carried interests, treating carried interests as services income ♦ Later in 2007, House of Representatives passed the “Temporary Tax Relief Act of 2007,” which included provision on carried interests ♦ Similar provision passed House in “Alternative Minimum Tax Relief Act of 2008” ♦ On April 3, 2009, Representative Levin introduced bill revising technical aspects of House legislation ♦ On May 11, 2009, Administration budget described provision to tax carried interests GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 15 U.S. Carried Interest Tax Legislation (Cont.) Recent Developments ♦ House Ways and Means Committee has announced it intends to move forward in the coming months to pass carried interest tax legislation ♦ Sen. Schumer, a past critic, is now in favor of such proposals – Any proposal will require 60 votes in the Senate ♦ Top marginal tax rate is scheduled to increase to 39.6% in 2011; self employment tax would add another 3% GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 16 U.S. Carried Interest Tax Legislation (Cont.) Who is Covered? ♦ Levin Bill covers only holders of “investment services partnership interest” ♦ Obama Administration budget proposal would expand scope so that all industries are covered by carried interest legislation – Obama Administration proposal would apply ordinary income treatment to a “services partnership interest” – Accordingly, covers a common/preferred capital structure of an operating company (including a non-U.S. company that is treated as flow-through entity) ♦ Earlier versions of the bill would have taxed even non-U.S. investment managers (not resident in the U.S.) if the Fund had any personnel inside the U.S. Current version appears to only affect managers who are U.S. citizens or residents or otherwise generally subject to U.S. tax (including Green Card holders) or who are performing services in the U.S. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 17 U.S. Carried Interest Tax Legislation (Cont.) Potential Impact ♦ What is the potential impact of the Levin bill for a party who holds a carried interest? – Net income and net loss with respect to an investment services partnership interest is treated as ordinary. – However, net losses are allowed only to the extent that aggregate net income for prior years exceeds aggregate net losses for such years. – Net income is also treated as self-employment income, subject to self-employment tax GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 18 U.S. Carried Interest Tax Legislation (Cont.) In-Kind Distributions Will Become Difficult Impossible for Funds with U.S. Managers ♦ Property distributions no longer qualify for favorable deferral available under existing law – If the partnership distributes appreciated property with respect to an investment services partnership interest • Gain will be triggered to the partnership as if it sold the property for its fair market value and that gain will be allocated to the distributee as ordinary income • The property is treated as cash with respect to the distributee partner, so that gain will be triggered to the extent that the value of the distributed property exceeds the partner’s basis in the partnership interest (determined after adjustment for gain allocated) • Distributee partner takes fair market value basis in distributed property GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 19 U.S. Carried Interest Tax Legislation (Cont.) Treatment of Capital Interests ♦ The Levin bill exempts from its coverage the portion of a service provider’s partnership interest that is acquired for invested capital. ♦ This requires that the partnership interest be acquired on account of invested capital and that allocations of distributive share to the service partner satisfy certain requirements, primarily that the allocations are no more favorable than those made to other thirdparty investors. ♦ A partner providing services will not be treated as having a qualified capital interest to the extent that contributed capital is attributable to a loan or other advance made or guaranteed, directly or indirectly, by any partner or the partnership (or a related person). ♦ Similarly, the Common “cashless contribution” technique would convert all returns on cashless contributions into ordinary income rather than capital gain. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 20 U.S. Carried Interest Tax Legislation (Cont.) Anti-Avoidance Rules ♦ Section 6662 would be amended to provide a 40% penalty where a person had an underpayment as a result of being treated as violating anti-abuse regs. – The penalty imposes “strict liability,” as it could not be avoided by showing reasonable cause. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 21 U.S. Carried Interest Tax Legislation (Cont.) Effective Date ♦ Effective date under Levin bill would apply to income with respect to carried interests in taxable years after the date of enactment – No grandfather for existing carried interests GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 22 U.S. Carried Interest Tax Legislation (Cont.) Obama Budget ♦ Other than applying to a broader class of service providers, the Obama Administration proposal appears to follow the general structure of the Levin Bill – – – – Ordinary income and self-employment tax Exception for “invested capital” No mention of 40% penalty Administration proposal would be effective for taxable years beginning after December 31, 2010 GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 23 U.S. Carried Interest Tax Legislation (Cont.) Cashless Contributions Fund Return Multiple GP Capital Contribution Taxes Paid In Year of Contribution on Fees used to Generate Cap Contribution Return on Contribution Tax on Return Opportunity Cost of Taxes Paid In Year of Contribution Based on Cost of Funds over Deferral Period Taxes Paid on Special Allocation of Income Equal to Deemed Capital Contribution Net Return (Including Taxes Paid on Fees Used to Fund Capital Contribution) BASE CASE: NO CASHLESS CONTRIBUTION 2 10,000,000 (5,000,000) 10,000,000 (2,500,000) (1,572,237) N/A 187,615 3 10,000,000 (5,000,000) 20,000,000 (5,000,000) (1,572,237) N/A 8,687,615 4 10,000,000 (5,000,000) 30,000,000 (7,500,000) (1,572,237) N/A 16,187,615 BEST CASE: CASHLESS CONTRIBUTION, CARRY TAXED AT CAPITAL GAINS RATES 2 10,000,000 - 10,000,000 (2,500,000) N/A (2,500,000) 5,000,000 3 10,000,000 - 20,000,000 (5,000,000) N/A (2,500,000) 12,500,000 4 10,000,000 - 30,000,000 (7,500,000) N/A (2,500,000) 20,000,000 WORST (?) CASE: CASHLESS CONTRIBUTION, CARRY TAXED AT ORDINARY INCOME RATES 2 10,000,000 - 10,000,000 (5,000,000) N/A (5,000,000) -- 3 10,000,000 - 20,000,000 (10,000,000) N/A (5,000,000) 5,000,000 4 10,000,000 - 30,000,000 (15,000,000) N/A (5,000,000) 10,000,000 Assumes 1) a 25% federal and state capital gains rate and 50% ordinary income rate (including state and self-employment tax); 2) a 4-year deferral period; and 3) a cost of capital of 6%, compounded annually. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 24 U.S. Carried Interest Tax Legislation (Cont.) Planning Options ♦ Front-load income to the General Partner prior to the effective date of Carried Interest bill. ♦ Change in Law provisions of the Fund limited partnership agreement theoretically can provide future flexibility, although difficult to negotiate in today’s fund-raising environment. ♦ There is no effective date specified for Carried Interest bill and it is still early in the legislative process. – Taking steps to plan for Carried Interest bill now may be premature. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 25 Other U.S.Tax Legislation GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 26 Other U.S. Tax Legislation Elimination of Disregarded Entities ♦ The Obama budget plan proposed that after December 31, 2010, certain Non-U.S. disregarded entities be classified as corporations for U.S. tax purposes. ♦ Exceptions – – An eligible entity with a single owner organized in the same jurisdiction can elect to be classified as a disregarded entity; and – An eligible entity owned by a single U.S. person can elect to be classified as a disregarded entity if it is not used for U.S. tax avoidance. • U.S. tax avoidance is so far an undefined concept. ♦ Current disregarded entities not meeting an exception will likely be converted when and if the law takes effect. – This could impact most of the common investment structures used by international funds to make PRC investments GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 27 Other U.S. Tax Legislation (Cont.) Eliminate Look-Thru on Withholding for Non-Qualified Intermediary ♦ The Obama budget plan proposed that the rules regarding withholding on Non-U.S. partnerships and other pass-thru entities be tightened up. ♦ Under the proposed rules, a Non-U.S. pass-thru entity (such as a Cayman limited partnership) would no longer be entitled to provide the withholding agent with the relevant tax information of its beneficial owners. ♦ Instead, unless the Non-U.S. pass-thru entity registered with the IRS as a “qualified” intermediary, the pass-thru entity could be treated as an “unknown foreign person,” thereby requiring the withholding agent to withhold tax at the maximum 30% rate. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 28 Other Tax Legislation (Cont.) Foreign Tax Compliance Act ♦ Introduced to both House and Senate in late October ♦ Will require U.S. LPs in Non-U.S. Venture Funds to disclose such investments – This will, in turn, increase LP information requests ♦ Similarly, direct and indirect holders of PFICs will be required to report details of such holdings ♦ May possibly require sponsors of Non-U.S. Funds to files certain reports detailing U.S. investor participation in the Fund GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 29 PRC Permanent Establishment (“PE”) Developments GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 30 PRC PE Developments Traditional Offshore Structure Cayman SPV Offshore PRC WFOE GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 31 PRC PE Developments (Cont.) More Recent Offshore Structure Cayman SPV Treaty SPV (typically Hong Kong) Offshore PRC WFOE GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 32 PRC PE Developments (Cont.) ♦ Circular 124 and Recent PRC cases (Xingjiang and Chongging) have cast doubt on the effectiveness of structures utilizing special purpose vehicles (“SPV”) in tax treaty jurisdictions where the tax treaty entity has no substance (i.e., no office, place of business, employees or activities) in its country of organization GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 33 PRC PE Developments (Cont.) Evolving Offshore Structure Typical Locations: Hong Kong Mauritius Barbados Switzerland Luxembourg Singapore Ireland Treaty Platform (Including Employees and Offices) Treaty SPV 1 Treaty SPV 2 Treaty SPV 3 Cayman 1 Cayman 2 Cayman 3 Treaty SPV A Treaty SPV B Treaty SPV C WFOE WFOE WFOE Offshore PRC GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 34 PRC PE Developments (Cont.) ♦ Query how recent U.S. international tax proposals, including the Obama administrations elimination of “check the box” rules will impact the choice of optimal structure ♦ Circular 601, released last week, also calls into question the use of intermediate SPVs GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 35 Best Tax Compliance Practices for Funds with U.S. Investors GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 36 Best Tax Compliance Practices for Funds with U.S. Investors UBTI ♦ Most funds that have raised money from U.S. tax exempt investors will have an obligation to avoid, or at least minimize, the generation of “unrelated business taxable income (commonly referred to as UBTI). GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 37 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Type of Investors Subject to UBTI ♦ U.S. private pension funds ♦ U.S. Charitable organizations ♦ U.S. Charitable Remainder Trusts ♦ U.S. Universities (including state universities) ♦ U.S. State and local pension plans if qualified under 401, but possible exception under 115 (most state and local plans take the position they are exempt under 115 and thus not subject to UBTI tax) GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 38 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Tax Treatment if There Is UBTI ♦ File 990T U.S. Tax Return ♦ Pay tax at graduated corporate or trust rates as if a taxable entity GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 39 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Non-UBTI Income Categories (“Good Income”) ♦ Assuming No Debt Financing (See UDFI discussion below): – – – – – – – – Capital gains Interest Dividends Subpart F inclusions (except insurance) PFIC distributions Royalties Some rental income from real estate Other income from routine investments (See Rev. Rul. 78-88) GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 40 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) UBTI Income Categories (“Bad Income”) ♦ Income from business activity (e.g., sales of goods/services) conducted anywhere ♦ Includes business conducted through lower-tier tax partnerships (e.g., portfolio companies not treated as corporations for U.S. tax purposes) ♦ Gains from dealer property (relevant to real estate funds) GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 41 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Fees as Potential UBTI ♦ Portfolio companies may pay fees to the Fund or its management company, e.g. – directors fees – advisory fees – transaction-related fees ♦ Issue: – Is this UBIT for the Fund? – What if the benefit to the Fund is indirect? GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 42 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Tax Treatment of Various Fees ♦ Directors Fees – services/UBTI ♦ Advisory Fees – services/UBTI ♦ Break-Up Fees – arguably lost profits/Non-UBTI ♦ Completed Transaction Fees – probably reduce basis/Non-UBTI ♦ Loan Commitment Fees, Equity Commitment Fees – loan commitment fee is not UBTI per IRC 512(b)(1) GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 43 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Debt-Financed UBTI (UDFI) ♦ Income from debt-financed property is UBTI, in ratio that “average acquisition indebtedness” bears to average adjusted basis ♦ “Debt-financed property” = financed with “acquisition indebtedness” (a broadly defined term) – “Acquisition” indebtedness may in some cases include debt incurred before the asset was acquired – “Indebtedness” may include non-traditional sources of financing such as deferral of accrued management fees – May also include deferred payments for stock (i.e., 100 shares of stock acquired for a $50 immediate payment and a $50 payment due six months later). ♦ Property is debt-financed property if there is acquisition indebtedness at any time during the taxable year in which the income is earned or, with respect to sales, the preceding 12 months ♦ Applies to borrowing by the exempt entity or by an investment partnership such as a venture capital fund GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 44 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) UDFI Solutions Borrowing is usually restricted, e.g., ♦ To short-term borrowing pending receipt of capital calls, or where borrowing is essential (e.g., to fund commitments where there are defaulting partners) ♦ If viewed as “acquisition indebtedness,” (perhaps) the debt will be “history” by the time there is significant income or gains (i..e, paid off more than 12 months prior) ♦ Borrowing incidental to the management of an investment portfolio and not increasing its size does not create UDFI (Rev. Rul. 78-88) – Application not clear to Venture Funds ♦ Occasional borrowing incident to investment, but also serving exempt function, and not increasing the overall portfolio size, does not create UDFI (PLRs 8721104; 8721107) – Application not clear to Venture Funds GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 45 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Management Fee Offsets and UBTI Risk ♦ Offset is a reduction in the periodic management fee otherwise payable by the Fund to its manager on account of fees payable by portfolio companies or other parties to the manager ♦ Offset typically range from 50% to 100%, and unused offsets carry forward to reduce the management fee in future periods ♦ Sometimes fee amounts not offset against management fee prior to the end of the Fund’s term will be payable to the investors upon the liquidation of the Fund GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 46 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Guarantees Of Portfolio Company Debt and UDFI ♦ UDFI could be created as a result of fund’s guarantee of portfolio company debt if the fund, rather than the portfolio company, is the true borrower (Plantation Patterns). Should turn on portfolio company’s ability to service the debt based on its own assets/anticipated revenues. ♦ GP may be contractually obligated not to allow fund to provide a guarantee unless GP first determines that there is not a material risk of UBTI GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 47 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Fees (such as cash or warrants) For Guaranteeing Portfolio Company Debt as Potential UBTI ♦ Guarantee Fee should not be UBTI if the guarantee activity was isolated and not regularly carried on. ♦ This could be helpful, but as fund size increases, perhaps multiple guarantees will be given and multiple fees will be charged. ♦ Unclear whether recurring guarantee fees will be treated as services income and thus UBTI GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 48 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Critical Portfolio Company Information Rights and Covenants GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 49 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Summary of Portfolio Company Information Rights and Covenants: ♦ In general, in connection with each investment in a Non-U.S. portfolio company, a Fund with U.S. taxable and tax-exempt investors should: – Corporate Status: confirm that the Non-U.S. portfolio company will be classified as a corporation for U.S. income tax purposes, and not as a partnership or other pass-through entity. For those entities that are eligible to elect to be treated as a pass-through entity, obtain a representation that the entity will not elect to be treated as a partnership for U.S. income tax purposes; GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 50 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Summary of Portfolio Company Information Rights and Covenants (Cont): – CFC: obtain protective provisions addressing CFC issues; – PFIC: Negotiate to obtain the information necessary for the Fund’s investors to make a QEF election or protective statement for U.S. income tax purposes, and obtain protective provisions facilitating this election; and » Misc: obtain other miscellaneous information reporting provisions. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 51 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Representations and Warranties Regarding Classification as a Corporation for U.S. Tax Purposes GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 52 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Classification of Portfolio Company as a Corporation ♦ Generally, investment in an entity treated as a corporation for U.S. income tax purposes will not result in either UBTI or effectively connected trade or business income. ♦ Investment in a business organized as a partnership or other pass-through entity, however, will give rise to UBTI and trade or business income, both of which are prohibited under most Fund agreements. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 53 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Classification of Portfolio Company as a Corporation (Cont.) ♦ A Non-U.S. portfolio company will be classified as a corporation or a partnership under the entity classification regulations (the “Regulations”). The Regulations provide that certain Non-U.S. entities will always be treated as corporations for U.S. income tax purposes. ♦ If the corporate form of a prospective Non-U.S. portfolio company is not mandatory under the Regulations, then the Non-U.S. portfolio company should represent that it will either elect to be treated as a corporation for U.S. income tax purposes or refrain from making an election to be treated as a partnership if it would otherwise be taxed as a corporation. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 54 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) ♦ Sample Entity Classification Representation: – The Company shall take such actions, including making an election to be treated as a corporation or refraining from making an election to be treated as a partnership, as may be required to ensure that at all times the company is classified as corporation for United States federal income tax purposes GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 55 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Representatons and Warranties from Portfolio Companies Regarding Controlled Foreign Corporation (CFC) Status and Subpart F Income GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 56 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Controlled Foreign Corporation ♦ If a Non-U.S. corporation is a Controlled Foreign Corporation (“CFC”) for an uninterrupted period of 30 days during any taxable year, then certain income of the CFC, whether or not distributed, will be currently taxed to certain U.S. shareholders (“U.S. Shareholders,” as defined below) who are shareholders of the CFC on the last day of the CFC’s taxable year. ♦ In addition, disposition of CFC shares in a merger may result in tax in what would otherwise be a nontaxable transaction for U.S. income tax purposes. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 57 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Determination of U.S. Shareholder Status ♦ Three requirements must be met before the Fund or its investors could be subjected to tax on undistributed income from a CFC. – First, the Fund or its investors must be “U.S. Shareholders” (generally U.S. persons that own, directly or indirectly 10% or more of the voting power of the stock of the Non-U.S. portfolio company). Note that the General Partner of a Fund is arguably deemed to own ALL of the Voting Power of the stock owned by the Fund. – Second, the Non-U.S. portfolio company must be a CFC (generally a Non-U.S. corporation in which “U.S. Shareholders” own or control, directly or indirectly, 50% of the voting power or value of the stock). Note that a Fund formed under the laws of the United States (e.g. Delaware) will itself be a U.S. Shareholder if it owns more than 10% of the Portfolio Company. – Finally, either the CFC must earn certain types of income or the CFC must be acquired in a transaction that would otherwise be nontaxable under U.S. income tax law. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 58 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Sample CFC Representations to be Obtained from Non-U.S. Portfolio Companies ♦ Minimum Representation: – Immediately after the Effective Time, the Company [will] [will not] be a “Controlled Foreign Corporation” (“CFC”) as defined in the U.S. Internal Revenue Code of 1986, as amended (or any successor thereto). The Company shall make due inquiry with its tax advisors on at least an annual basis regarding the Company’s status as a “Controlled Foreign Corporation” (“CFC”) as defined in the United States Internal Revenue Code of 1986, as amended (or any successor thereto) (the “Code”) and regarding whether any portion of the Company’s income is “subpart F income” (as defined in Section 952 of the Code) (“Subpart F Income”). Each Investor shall reasonably cooperate with the Company to provide information about such Investor and such Investor’s Partners in order to enable the Company’s tax advisor’s to determine the status of such Investor and/or any of such Investor’s Partners as a “United States Shareholder” within the meaning of Section 951(b) of the Code. No later than two (2) months following the end of each Company taxable year, the Company shall provide the following information to the Investors: (i) the Company’s capitalization table as of the end of the last day of such taxable year and (ii) a report regarding the Company’s status as a CFC. In addition, the Company shall provide the Investors with access to such other Company information as may be necessary for the Investors to determine the Company’s status as a CFC and to determine whether Investor or any of Investor’s Partners is required to report its pro rata portion of the Company’s Subpart F Income on its United States federal income tax return (and if so, what such portion is), or to allow such Investor or such Investor’s Partners to otherwise comply with applicable United States federal income tax laws. For purposes of the foregoing as well as the representations contained in Sections ___ [Note: insert section references for all CFC/PFIC representations], (i) the term “Investor’s Partners” shall mean each of the Investor’s partners and any direct or indirect equity owners of such partners and (ii) the “Company” shall mean the Company and any of its subsidiaries. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 59 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Sample CFC Representation to be Obtained from Non-U.S. Portfolio Companies (Cont.) ♦ In addition to the foregoing representation, in the event that the Company is a CFC and any of the Investor’s Partners are “United States Shareholders” with respect to such CFC, then if possible one or more of the following additional representations should be obtained: – – – – #1: The Company and the shareholders of the Company shall not, without the written consent of Investor, issue or transfer stock in the Company to any investor if following such issuance or transfer the Company, in the determination of counsel or accountants for Investor, would be a CFC. #2: In the event that the Company is determined by the Company’s tax advisors or by counsel or accountants for the Investor to be a CFC, the Company agrees to use commercially reasonable efforts to avoid generating Subpart F Income. #3: In the event that the Company is determined by the Company’s tax advisors or by counsel or accountants for the Investors to be a CFC, the Company agrees to use commercially reasonable efforts to annually make dividend distributions to the Investors, to the extent permitted by law, in an amount equal to 50% of any income of the Company that would have been deemed distributed to the Investor pursuant to Section 951(a) of the Code had the Investor been a “United States person” as such term is defined in Section 7701(a)(30) of the Code. #4: (If the company is or ever was a CFC): The Company will not be required to determine its Subpart F Income for any taxable period (or portion thereof) ending after the Closing Date by taking into account the recharacterization provisions of Section 952(c)(2) of the Code. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 60 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Portfolio Company Representations and Warranties Regarding Passive Foreign Investment Company (“PFIC”) Status GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 61 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Passive Foreign Investment Companies ♦ In general, the “Passive Foreign Investment Company” or “PFIC” rules are broader in scope than the CFC rules discussed above since they are not dependent upon control by U.S. shareholders. ♦ Any Non-U.S. portfolio company may be a PFIC regardless of the size or number of U.S. shareholders if (i) 75% or more of its gross income is passive income or (ii) if 50% or more of the company’s assets generate passive income.1 1 This determination is made based on the adjusted bases (as determined for the purposes of computing earnings and profits) of the company’s assets if (a) the company is not a public company and (b) either the company is a CFC or it elects to have this method of determination apply. Otherwise, the determination is made on the basis of the value of the company’s assets. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 62 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Passive Foreign Investment Companies (Cont.) ♦ Subject to certain exceptions, if a Non-U.S. portfolio company meets either the passive income test or the passive asset test during the shareholder’s holding period for such company’s stock, the PFIC rules will apply in all subsequent years, including those during which the company ceases to earn significant passive income and/or ceases to own a majority of passive assets. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 63 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Passive Foreign Investment Companies (Cont.) ♦ If (i) a Non-U.S. corporation is a PFIC and (ii) the Fund (or, in the case of a Non-U.S. fund, its U.S. LPs) has not elected to be taxed under the Qualified Electing Fund rules described below, then the Fund and its investors would be taxed currently on all actual dividend distributions from the PFIC, such dividends being ineligible for the preferential rate applicable to “qualified dividends.” ♦ In addition, to the extent that any distributions, including gains from the disposition of PFIC stock, constitute “excess distributions,” such distributions will be deemed distributed ratably throughout the Fund’s ownership of the PFIC, with an annual interest charge applied to amounts deemed allocable to past taxable years. ♦ The annual interest charge and taxation of excess distributions is intended to eliminate any benefit to a shareholder of retaining assets in a PFIC rather than distributing all available assets on an annual basis. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 64 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Passive Foreign Investment Companies (Cont.) ♦ To avoid being subjected to tax upon a return of capital, the special interest charge, and loss of ability to engage in tax-free transactions, the Fund (if it is formed in the U.S.) or its U.S. investors (if the fund is formed outside the U.S.), may make a Qualifying Electing Fund (“QEF”) election to pay tax on its proportionate share of a PFIC’s earnings and profits annually, as if such earnings and profits had been distributed to shareholders. ♦ This election may not be particularly costly, since many Non-U.S. portfolio companies will not generate any earnings and profits (notwithstanding earning passive interest income on the proceeds of financings) during the early years of their operations, as earnings and profits are determined in the aggregate, and passive interest income will likely be offset by losses related to business operations. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 65 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Passive Foreign Investment Companies (Cont.) ♦ In a year in which the PFIC ceases to receive 75% “passive income” and ceases to have at least 50% “passive assets,” those U.S. shareholders that have previously made the QEF election avoid both the deemed distribution of company’s current income to the shareholder and the application of the special interest charge to any gains realized on the disposition of the PFIC’s stock, while those shareholders that failed to make a timely QEF election would continue to be taxed as discussed above. ♦ If the Investor has a “reasonable belief” that a Non-U.S. portfolio company does not exceed the PFIC passive activity limits before the Fund has made a valid QEF election for its interest in the company, the Fund may make a “protective statement” to preserve its right to make a retroactive QEF election if the company is ever determined to be a PFIC. ♦ The “cost” of making the protective statement is the elimination of the statute of limitations for the IRS to raise PFIC issues on tax returns filed after the protective statement is made. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 66 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Sample PFIC Representation to be Obtained from NonU.S. Portfolio Companies ♦ Minimum PFIC Representation. The Company has never been, and, to the best of its knowledge after consultation with its tax advisors, will not be with respect to its taxable year during which the Effective Date occurs, a “passive foreign investment company” within the meaning of Section 1297 of the Internal Revenue Code of 1986, as amended (or any successor thereto). The Company shall use its [commercially reasonable] [best] efforts to avoid being a “passive foreign investment company” within the meaning of Section 1297 of the Internal Revenue Code of 1986, as amended (or any successor thereto). In connection with a “Qualified Electing Fund” election made by any of Investor’s Partners pursuant to Section 1295 of the Internal Revenue Code of 1986 or a “Protective Statement” filed by any of Investor’s Partners pursuant to Treasury Regulation Section 1.1295-3, as amended (or any successor thereto), the Company shall provide annual financial information to Investor in the form provided in the attached PFIC Exhibit (or in such other form as may be required to reflect changes in applicable law) as soon as reasonably practicable following the end of each taxable year of the Company (but in no event later than 90 days following the end of each such taxable year), and shall provide Investor with access to such other Company information as may be required for purposes of filing U.S. federal income tax returns of Investor’s Partners in connection with any such Qualified Electing Fund election or Protective Statement. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 67 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Sample PFIC Representation to be Obtained from Non-U.S. Portfolio Companies (Cont.) Additional PFIC Representation. Depending upon the circumstances, it may be possible to negotiate this additional representation as well: – In the event that an Investor’s Partner who has made a “Qualified Electing Fund” election must include in its gross income for a particular taxable year its pro rata share of the Company’s earnings and profits pursuant to Section 1293 of the United States Internal Code of 1986, as amended (or any successor thereto), the Company agrees to make a dividend distribution to the Investor (no later than 90 days following the end of the Company’s taxable year or, if later, 90 days after the Company is informed by Investor that such Investor’s Partner has been required to recognize such an income inclusion) in an amount equal to 50% of the amount that would be included by Investor if Investor were a “United States person” as such term is defined in Section 7701(a)(30) of the Code and had Investor made a valid and timely “Qualified Electing Fund” election which was applicable to such taxable year. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 68 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Representations and Warranties from Portfolio Companies with Respect to Miscellaneous U.S. Reporting Requirements GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 69 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Miscellaneous Information Reporting Requirements ♦ Certain information reporting requirements apply to owners of control positions in Non-U.S. corporations and persons making transfers of property to Non-U.S. business entities that would be tax-free transfers if undertaken between U.S. parties. Failure to comply with these requirements may result in the imposition of monetary penalties by the IRS. ♦ The IRS requires a U.S. person who owns a control position (more than 50% of voting power or more than 50% of total value) in a Non-U.S. corporation, along with U.S. residents or citizens who are officers or directors of a Non-U.S. corporation in which a U.S. person has acquired at least 10% of such corporation’s stock (vote or value), to file an informational return. For the purposes of determining stock ownership, certain constructive ownership rules apply. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 70 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Miscellaneous Information Reporting Requirements (Cont.) ♦ Generally, the Fund will be considered to own not only the stock it holds directly, but also any stock owned by its U.S. partners as well as a proportionate share of the holdings of most entities in which the Fund has interests. If the Fund is determined to hold a control position in a Non-U.S. corporation, it will need to attach an informational return (on Form 5471) to its tax return for each year in which it held the control position. The information required on the return is basic financial information (assets, liabilities and stock structure) of the controlled foreign corporation as well as information about any transactions between the Fund and the Non-U.S. corporation. ♦ The IRS generally requires a U.S. person who transfers cash or property to a NonU.S. business entity, in a transaction that would be tax-free if the transfer occurred between two U.S. persons, to file an informational statement. The contents of the statement can vary based on the type of transfer, but will normally include general information about both parties as well as a description of the property transferred, the property received and the transaction as a whole. An additional information statement may be required in certain transfers of intangible property. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 71 Best Tax Compliance Practices for Funds with U.S. Investors (Cont.) Sample Representation to be Obtained from Non-U.S. Portfolio Companies with respect to Miscellaneous Information Requirements The Company shall make due inquiry with its tax advisors (and shall cooperate with Investor’s tax advisors with respect to such inquiry) on at least an annual basis regarding whether Investor’s or any Investor’s Partner’s direct or indirect interest in the Company is subject to the reporting requirements of either or both of Sections 6038 and 6038B of the Code (and the Company shall duly inform the Investor of the results of such determination), and in the event that Investor’s or any Investor’s Partner’s direct or indirect interest in Company is determined by the Company’s tax advisors or the Investor’s tax advisors to be subject to the reporting requirements of either or both of Sections 6038 and 6038B Company agrees, upon a request from Investor, to provide such information to Investor as may be necessary to fulfill Investor’s or Investor’s Partner’s obligations thereunder. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 72 Thank You GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 73 IRS Circular 230 Disclosure ♦ This presentation was not intended or written to be used, and it cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. Federal tax law. GUNDERSON DETTMER STOUGH VILLENEUVE FRANKLIN & HACHIGIAN, LLP 74