News Letter - Knowledge Enclave

advertisement

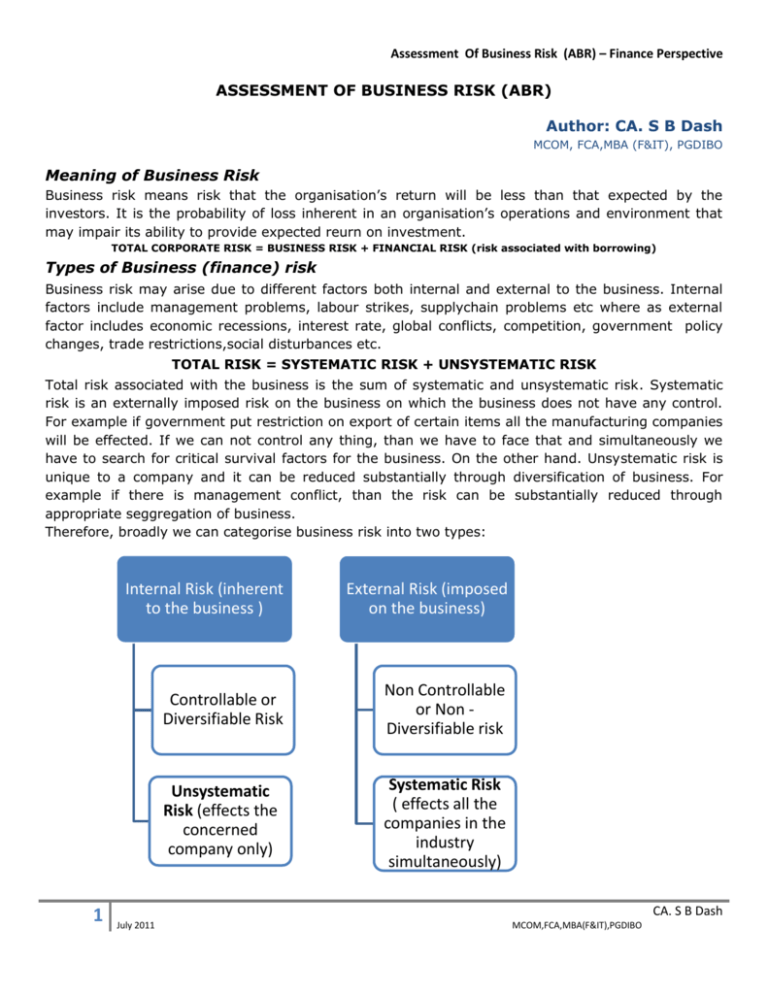

Assessment Of Business Risk (ABR) – Finance Perspective ASSESSMENT OF BUSINESS RISK (ABR) Author: CA. S B Dash MCOM, FCA,MBA (F&IT), PGDIBO Meaning of Business Risk Business risk means risk that the organisation’s return will be less than that expected by the investors. It is the probability of loss inherent in an organisation’s operations and environment that may impair its ability to provide expected reurn on investment. TOTAL CORPORATE RISK = BUSINESS RISK + FINANCIAL RISK (risk associated with borrowing) Types of Business (finance) risk Business risk may arise due to different factors both internal and external to the business. Internal factors include management problems, labour strikes, supplychain problems etc where as external factor includes economic recessions, interest rate, global conflicts, competition, government policy changes, trade restrictions,social disturbances etc. TOTAL RISK = SYSTEMATIC RISK + UNSYSTEMATIC RISK Total risk associated with the business is the sum of systematic and unsystematic risk. Systematic risk is an externally imposed risk on the business on which the business does not have any control. For example if government put restriction on export of certain items all the manufacturing companies will be effected. If we can not control any thing, than we have to face that and simultaneously we have to search for critical survival factors for the business. On the other hand. Unsystematic risk is unique to a company and it can be reduced substantially through diversification of business. For example if there is management conflict, than the risk can be substantially reduced through appropriate seggregation of business. Therefore, broadly we can categorise business risk into two types: 1 Internal Risk (inherent to the business ) External Risk (imposed on the business) Controllable or Diversifiable Risk Non Controllable or Non Diversifiable risk Unsystematic Risk (effects the concerned company only) Systematic Risk ( effects all the companies in the industry simultaneously) CA. S B Dash July 2011 MCOM,FCA,MBA(F&IT),PGDIBO Assessment Of Business Risk (ABR) – Finance Perspective Assessment of Business risk (ABR): Risk is a subjective matter. BRA involves giving quantitative measures to the subjective aspect of risk. It is difficult to give a quantitative measure to risk. However, we can apply cardinal approach to give a quantitative measure to risk associated with the business. Advantages of ABR: 1. Works as a measure of volatility associated with buisness; 2. A tool of project appraisal and financing decisions (for project financing banks also look into the risk aspect of business on the basis of which they decide the risk adjusted rate of interest); 3. Helpful in diversification decisions; 4. A tool for inter company analysis; 5. Helpful for cross sectional analysis and time series analysis; 6. Helpful for investing decisions by the prospective investors; 7. Hedging of risk is possible only after its quantifiaction; 8. Helpful in monitoring the effciency and effectiveness of internal control system of any organisation. ABR Process: Business risk can be assessed through its return on investemnt. It can be either return on total capital employed or return on equity capital employed. If we identify the both, than we can understand the impact of borrowing on the overall risk of the business. Risk and return are directly related to each other. With increase in risk associated with business, the investors expectation of interest increases and vice-versa. Unless company meets the expectation of the investors, there will be pressure on its market capitalization. Therefore assessment of risk must start from the return on investment itself and investors’ expectation (return) must be assessed through the risk associated with the business. Therefore, in ABR process return and risk are complementary and supplementary to each other. For ABR, therefore, we have to first identify the returns of the business, either ex-Ante or ex-Post. Ex-ante figures are suggested in situations like business extension, new projects, mergers and acquisitions and business diversifications, i.e, where there is substantial increase in capital. Ex-post figures are suggested in case of continuing business without any substantial restructure in the capital of the business. The basic steps involved in ABR process are as follows: 1. Calculate the total risk associated with the business which is represented by standard deviation; 2. Bifurcate the total risk into systematic risk and unsystematic risk; After ABR, the following steps are applied as a part of management of business risk (MBR) process: 3. Identify the reasons for unsystematic risk; 4. Apply diversification strategy for minimizing unsystematic risk’ 5. Apply hedging methodology for hedging the systematic risk. Nomally, it is assumed that internal risk can be reduced to nil through diversification and therefore the risk that counts is the systematic risk only. However, practically it may not be possible to bring internal risk to zero level due to the existence 2 CA. S B Dash July 2011 MCOM,FCA,MBA(F&IT),PGDIBO Assessment Of Business Risk (ABR) – Finance Perspective of inherent problems associated with the business. Therefore. In ABR process we should first estmate the total risk and thereafter we may decompose it into systematic and unsystematic risk. Assessment of Total Risk: Calculation of Total Risk (σ ) Ex-Post (in case of runninig business, on the basis of statistical data) Ex-Ante (In Case of new projects or business expansions on the basis of probabilities of future return) Ex-Post Measurement: 1. This method is applied in case of running business without having any future enhancement prgram; 2. Here total risk is calculated on the basis of return of past several periods. The periods may be monthly,quarterly, halfyearly or annual basis; 3. Here we take average of the return of past several periods and than we find deviation of periodic return from the average return 4. Thereafter we calculate the sum of the square of the deviations; 5. Sum of the square of the deviations as divided by (n-1) reflects the variance of the project; (where n is number of period counts); 6. The root over of the variance reflects the standard deviation ( σ ) of the business which infact is the measure of total risk of the business; 7. This can be compared with the industry average standard deviation to understand the riskiness of the business; 8. We, infact, can calculate the coefficient of variation of the business which is (σ/average return).It reflects risk of the project per unit of return given by it. For comparing among businesses in the same industry it can have a great help. Ex-Ante Measurement: 1) It is applicabe in case of expansion of business with additional introduction of capital or mobilisation of retained earnings or introduction of new projects; 2) Here past data can not be taken as a representative for future performance of business since investments may have a magnetic effect on the future returns; 3) Thus under this method we assign probability to future expected returns; 3 CA. S B Dash July 2011 MCOM,FCA,MBA(F&IT),PGDIBO Assessment Of Business Risk (ABR) – Finance Perspective 4) While assigning probability we should take into consideration the different states of market expected in the future, e.g, boom, recession, normal, recovery or slowgrowth etc., 5) The average(estimated) return is calculated by taking the sum of multiplications of prbabilities with the expected return; 6) There after we calculate deviations of expecetd return from the estimated return and we calculate the square of them; 7) Varaiance is the sum of square of deviations as multiplied with the probabilities and the square of variance is the standard deviation (σ); 8) Since life of project is more than one year, the standard deviation of the project will be calculated by applying the following additional steps: a) Find out the present value of the standard deviation; b) Take the square of present value of standard deviation, which reflects the variance; c) The √ of variance will reflect the standard deviation of the business. 9) We can proceed to calculate coefficient of variation (σ/average return) which can be used to compare the performance of the business vis – a – vis performance of the industry. Decompostion of total risk into systematic and Unsystematic risk 1) Systematic risk means the risk that the return of the business may be adversely effected due to external factors relating to the business; 2) Therefore it can be calculated by identifying the sensitiveness of the company’s return to all those external factors; 3) The external factors may include GDP rate, inflation, rate of change in interest rate, yield of capital market etc., 4) In case of listed companies, we may regress the return of the company’s security with that of the index, to find out the rate of sensitiveness (popularly known as β ). But here the following are the underlying assumptions: a) The security has a place in the index (may be sensex, nifty or any other index); b) All external forces effect the capital market. 5) In case of non-listed companies we have two options: a) Take the industry average β and adjust for the debt-equity ratio (technically calculate the relevered β); b) Create a block of companies with diversified business including the company concerned and regress the company’s return with the return of the block of the companiies to findout the β. 6) β can be calculated by applying either regression formula or through covariance analysis; 7) In fact β represents the movement of the security and the market per unit of movement of the market. Therefore it is covariance of the security and market per unit of the variance of the market. Mathematically, β = COVi,m/variance m 8) Adjustment to β: After assessment of β through the above regression analysis, β must be adjusted for the financial levarage impact of the business. When there is no debt in the capital structure of the company, equity shareholders feel less risky. Hoeevr when debt is introduced in the capital structure they feel risky due to the fact that, a part of the profit will park in the pocket of the debt providers in the name of interest. Therefore, to the extent of additional debt-equity ratio of the company over and above the industry average, the beta of the equity shareholders of the company will increase. This is known as levered β. The β of a debt free company is known as unlevered β. Levered β can be calculated as below (after giving tax shield impact on debt): Levered β =unlevered β (1+D(1-t)/E) 4 CA. S B Dash July 2011 MCOM,FCA,MBA(F&IT),PGDIBO Assessment Of Business Risk (ABR) – Finance Perspective CALCULATION OF β Listed Companies Unlisted companies (regression of security's return with any index of the market in which the company has a place) (regression of the security's return with the industry's return or return of block of companies in which security has a place. Methods of Calculation of β Regression formula Covariance methodology nΣxy-ΣxΣy/nΣx2-(Σx)2 (ρσiσm)/σm2 x=return of market ρ=correlation coefficient between the security and the market σi and σm=standard deviation of security and market respectively. y=return of security n=number of period counts 5 CA. S B Dash July 2011 MCOM,FCA,MBA(F&IT),PGDIBO Assessment Of Business Risk (ABR) – Finance Perspective 9) Security characteristic line (SCL) is a regression line plotting performance of a particular security or portfolio against that of the market portfolio at every point in time. The SCL is plotted on a graph where the Y-axis is the excess return on a security over the risk-free return and the X-axis is the excess return of the market in general. The slope of the SCL is the security's beta and the intercept is its alpha. 1. (The risk and return characterstic of a security can be represented by means of the above graph, which is popularly known as security characterstic line (SCL)) 10) Applying time series regression to the characterstic line, the risk return relationship between security and market return can be calculated as below: y=α+βx+e where, y= risk premium on the security (ri-rf); x=risk premium on the market (rm-rf); α=intercept which can be further elaborated as below: Positive abnormal return (α): Above-average returns that cannot be explained as compensation for added risk. Negative abnormal returns (α): Below-average returns that cannot be explained by below-market risk. e=error factor (risk premium attributable to diversifiable or idiosyncratic risk). Note: The above is the heart of capital asset pricing model as per which: E(r)=rf +β(rm-rf) Where, rf=risk free rate of return, rm=market rate of return, E(r)=expected rate of return from the security. 11) Therefore, the equation of the characterstic line can be restated as below: E(r)-rf =α +β(rm-rf)+e 6 CA. S B Dash July 2011 MCOM,FCA,MBA(F&IT),PGDIBO Assessment Of Business Risk (ABR) – Finance Perspective 12) Total risk associated with the security reflects that, its risk premium will vary significantly from the expected risk premium. This can be measured by means of variance. Therefore, Var (y) = Var (α+βx+e) Therefore, σi2 = β2σm2 + Var e Or, Total Risk of the security = Systematic Risk + Unsystematic Risk Systematic Risk = β2σm2 Since, β = ρσi/σm , Proportion of systematic risk in total risk = (ρσi/σm)2 σm2/ σi2 =ρ2 Proportion of unsystematic risk in total risk = 1- ρ2 13) This is all about assessment of business risk. After assessment, the management of business risk begins (MBR). There are several ways of management of business risk. But they are not the part of this discussion. A brief outline of MBR is as follows: a) Unsystematic risk can be reduced by means of diversification. Diversification into new business line may bring additional risk depending on two factors: i. Correlation coefficient (ρ) of new business with the existing business; ii. Weight of the new business in the total business. Total risk after diversification (σi2) will be: w12σ12+w22 σ22+2 w1 w2ρ σ1 σ2 Where, w1,σ1 are weight and risk associated with existing business, W2,σ2 are weight and risk associated with new business. (Weight of individual business to be maintained is a subject matter of MBR need be discussed separately.) b) Though systematic risk can not be reduced, different performance measures may be taken into consideration to meet the expectation of the shareholders. This needs some additional mathematical models need to be discussed in a sepate chapter of MBR. We may apply probability distribution methodology, differentiation, mathematical exponential and logarithm functions for such MBR process which will be discussed subsequently under MBR. Infact, Systematic risk can be reduced through various hedging methodologies using derivative and non- derivative financial instruments like forward rate agreements (FRAs), futures, options,swaptions, currency and interest rate swaps etc. 7 CA. S B Dash July 2011 MCOM,FCA,MBA(F&IT),PGDIBO