Mehdi ARZANDEH

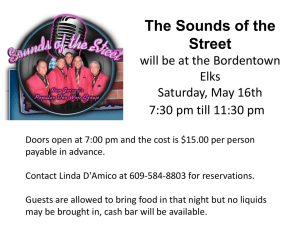

advertisement

LONG TERM DYNAMICS OF FIRM R&D INVESTMENT IN PLANT BREEDING UNDER PLANT BREEDERS RIGHTS Mehdi Arzandeh Derek G. Brewin T he 16th ICABR Conference – 128th EAAE Seminar, June 24 27, 2012, Ravello, Italy. UNDERINVESTMENT IN PLANT BREEDING The self-pollinating nature of some crops makes crop research output non-excludable. Far mer saved seed can present a serious problem in capturing the benefits of breeding which contributes to the underinvestment in breeding. (Malla et al. 2004) Therefore, innovators in plant breeding industry without a regulated market, due to this non -excludability feature, are not able to capture their innovation outcome. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 2 INTELLECTUAL PROPERTY RIGHTS International agreements on Plant Breeders Rights (PBRs) and intellectual property rights have attempted to change the nature of knowledge from non-rival to rival and provide some return to breeding investment . PBRs and patents provide the owner with exclusive commercial rights for a limited period of time. However, PBRs provide “far mer’s exemption” that allows far mers to save the seed for subsequent reproduction. (Galushko, 2008) The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 3 IS CANADA FALLING BEHIND? The United States, Australia, and most EU members acts are based on the UPOV1991. Canada’s Plant Breeder’s Act is based on the 1978 revisions to the UPOV convention. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 4 PREVIOUS MODELS A theoretical model of plant breeding was already developed by Galushko (2008). Her three-stage static model does not account for the dynamics of producing R&D innovation since in that model, she only considers a one-shot game for R&D producing. It is commonly modeled that in each stage, the private fir m decides on the optimal number of research trials used to search for the highest yielding off-spring, which creates an improved variety with a specific expected yield . This does not account for the lag between research expenditures and change in average yield nor it does for the fact that a rise in expected yield occurs as a result of a continuum process of R&D efforts. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 5 PROCESS OF CREATING A NEW VARIETY Alston et al. 1998: • involves years of effort to create varieties with commercially desirable genetic traits. Research • potential varieties undergo private and public testing and multiplication, preparing the variety for potential registration and commercial sale. Gestation • after commercial release, the varieties are adopted and grown by producers, contributing to increased productivity. Adoption • these new varieties become part of the germplasm and knowledge stock from which newer varieties are created. This fourth phase continues even after the particular variety is no longer grown. Knowledge stock The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 6 LAW OF MOTION FOR R&D INVESTMENT The lag between research expenditures and change in average yield is critical for the return on investment. Increments to the stock of knowledge occur through development and adoption of new higher-yielding varieties. (Malla et al; 2004) Capital budgeting is a crucial issue in studying the important and complex capital investment decision of R&D programs (Childs and Triantis; 1999) and thus is accounted for in our model as well. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 7 PRODUCT AND PROCESS INNOVATION We also distinguish between two types of innovation so called innovation in process and innovation in product and try to account for dynamics of each type and their effect on the R&D outcome of the breeding fir m. The theoretical basis for a complementary relationship between innovation in the product and process dimensions has been espoused by other researchers (Athey and Schmutzler, 1995; Mantovani, 2006) with some empirical support (Brewin et al. 2009). The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 8 THE STUDY’S AIM Trying to develop a model for BPR’s regime proposing a dynamic version of a model first introduced in a static framework by Galushko (2008) to incorporate the effect of stock of knowledge on the rise in yield as well as accounting for the complementary relationship between process and product innovations. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 9 THE MODEL SET UP A Deter ministic Optimization Problem. At the beginning of each period, the R&D fir m decides to how much invest in the process and in the product innovation research which together improve its ability to develop new varieties with lower cost in next periods. At the end of each period, the fir m introduces a new seed that improves the productivity of planting the crop and the portion of the heterogeneous far mers who are assumed to be unifor mly distributed in the range [0, 1], buy it at price w n or continue using the existing generic seed at price w e . The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 10 FARMERS’ PROFIT FUNCTION Far mer’s profit function planting the existing variety at time t: (1) 𝜋 𝑡𝑒 = 𝑌 − 𝑤 𝑒 Far mer’s profit function planting new varieties at time t: (2) 𝜋 𝑡𝑛 = 𝑌 + 𝑍 𝑡 − 𝑤 𝑛 − λ𝑎 The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 11 NEW VARIETY DEMAND Comparing the two profits, demand for development of a new variety is given by: 𝑎𝑡 = 𝑍𝑡 −(𝑤 𝑛 −𝑤 𝑒 ) λ (3) Under PBR’s, once far mers buy the new seed, they use their own seed for replanting. It is assumed that they do not upgrade their seed to the Fir m’s newer biotechnolog y variety. It implies that the R&D fir m will not have the part of the market in the next periods, once it sells the new variety to it. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 12 DYNAMIC OPTIMIZATION PROBLEM The general for m of the dynamic programing problem, the refor mulated Bellman equation and the constraints facing by the fir m at time t can be written as 𝑇−1 𝑉𝑡 𝑍 𝑡 , 𝐶𝑡 = 𝑓 𝜋 𝑡 𝑍 𝑡 , 𝐶𝑡 , 𝐸𝑡𝐷 , 𝐸𝑡𝐶 + 𝜌 𝑡 𝑉 𝑍 𝑇 , 𝐶 𝑇 max 𝐷 𝐶 𝐸0𝐷 ,𝐸0𝐶 ,…,𝐸𝑇−1 ,𝐸𝑇−1 ∈Ω 𝑡=0 𝑍 𝑡+1 = 𝑓 (𝑍 𝑡 , 𝐸𝑡𝐷 , 𝐸𝑡𝐶 ) 𝐶𝑡+1 = 𝑔(𝐶𝑡 , 𝐸𝑡𝐷 , 𝐸𝑡𝐶 ) 𝑠. 𝑡. 𝛼 𝐸𝑡𝐷 + 𝛽 𝐸𝑡𝐶 ≤ 𝐾 0 ≤ 𝑎 𝑡 ≤ 1 𝑓𝑜𝑟 𝑎𝑙𝑙 𝑡, 𝑍 0 𝑎𝑛𝑑 𝐶0 𝑎𝑟𝑒 𝑔𝑖𝑣𝑒𝑛. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. (4) 13 MODELING COMPLEMENTARITIES Brewin et al. (2009) assumed that the ex post realization of product ( 𝐷 ∗ ) and process innovations ( 𝑆 ∗ ) depend on both types of ex ante research: 𝐷 ∗ = ℎ 𝐷, 𝑆; 𝑍 + 𝑣 𝑆 ∗ = 𝑗 𝐷, 𝑆; 𝑍 + 𝜀 • If process and product innovation research are complementary, then h S > 0 and j D > 0, where subscripts represent partial derivatives with respect to that argument. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 14 MODELING COMPLEMENTARITIES profit function of the fir m for time t 𝑓 𝜋 𝑡 𝑍 𝑡 , 𝐶𝑡 , 𝐸𝑡𝐷 , 𝐸𝑡𝐶 = (𝑎 𝑡 −𝑎 𝑡−1 ). (𝑤 𝑛 − 𝑐) − 𝐸𝑡𝐷 − 𝐸𝑡𝐶 (5) equations of law of motion for Z and C • 𝑍 𝑡+1 = 𝑍 𝑡 + 𝐸𝑡𝐷 + 𝐸𝑡𝐶 • 𝐶𝑡+1 = 𝐶𝑡 − 𝐸𝑡𝐷 − 𝐸𝑡𝐶 The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. (6) (7) 15 DYNAMIC OPTIMIZATION PROBLEM the problem in the second period (t=1) 𝑉1 𝑍1 , 𝐶1 = 𝑛 − 𝑐) − 𝐸𝐷 − 𝐸𝐶 max (𝑎 −𝑎 ). (𝑤 1 0 1 1 𝐷 𝐶 𝐸1 ,𝐸1 ∈Ω + 𝜌. 𝑠. 𝑡. 𝑎 2 − 𝑎 1 . (𝑍 2 − 𝐶2 ) 𝑍 2 = 𝑍1 + 𝐸1𝐷 + 𝐸1𝐶 𝐶2 = 𝐶1 − 𝐸1𝐷 − 𝐸1𝐶 𝛼 𝐸1𝐷 + 𝛽 𝐸1𝐶 ≤ 𝐾 0 ≤ 𝑎1 ≤ 1 𝑍1 𝑎𝑛𝑑 𝐶1 𝑎𝑟𝑒 𝑔𝑖𝑣𝑒𝑛. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. (8) 16 OPTIMAL POLICY FUNCTIONS The optimal policy functions for period 1 • 𝐸𝐷 = 1 −𝛽 𝜌+4𝐾+𝛽 (𝑍1 −𝐶1 ) 4(𝛼−𝛽 ) • −𝛼 𝜌+4𝐾+𝛼 (𝑍1 −𝐶1 ) 4(𝛽−𝛼 ) 𝐸1𝐶 = = −𝛽 𝜌+4𝐾+𝛽 (−𝐶 +2(𝐸0𝐷 +𝐸0𝐶 )) 4(𝛼−𝛽 ) (9) = −𝛼 𝜌+4𝐾+𝛼(−𝐶 +2(𝐸0𝐷 +𝐸0𝐶 )) 4(𝛽−𝛼 ) (10) The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 17 DYNAMIC OPTIMIZATION PROBLEM The problem in the first period (t=0) 𝑉0 𝑍 0 , 𝐶0 = 𝑛 − 𝑐 ) − 𝐸 𝐷 − 𝐸 𝐶 + 𝜌. 𝑉 𝑍 , 𝐶 max (𝑎 ). (𝑤 0 1 1 1 0 0 𝐷 𝐶 𝐸0 ,𝐸0 ∈Ω 𝑍1 = 𝑍 0 + 𝐸0𝐷 + 𝐸0𝐶 𝐶1 = 𝐶0 − 𝐸0𝐷 − 𝐸0𝐶 𝑠. 𝑡. 𝛼 𝐸0𝐷 + 𝛽 𝐸0𝐶 ≤ 𝐾 𝑍0 = 0 , 𝑎 0 = 0 𝑎𝑛𝑑 𝐶0 = 𝐶 The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. (12) 18 OPTIMAL POLICY FUNCTIONS the optimal policy functions for period zero 𝐸0𝐷 = 2(𝑤 𝑛 −𝑐) −2𝐶 + 4𝐾 𝛽+1+ ρλ 𝛼 4( 𝛽 −1) (13) 𝐸0𝐶 = 2(𝑤 𝑛 −𝑐) −2𝐶 + 4𝐾 𝛼+1+ ρλ 𝛽 4( 𝛼 −1) (14) The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 19 PROPOSITIONS Proposition1. A decrease in the unit cost of innovation in product and in process or/and an increase in the amount of capital accessible for the R&D fir m increases both R&D investment on innovation in process and in product which further increases the profitability of producing the new biotechnology seed for the R&D fir m and planting it for the far mers. Corollar y1. A government policy that reduces the fir m's unit cost of R&D research, such as a government subsidy on the cost of innovation, and a policy to increase the capital availability for the fir m will enhance R&D fir ms' research activity. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 20 PROPOSITIONS Proposition2. An increase in the difference between the prices of biotechnolog y seed and that of the existing generic seed will reduce the demand for the new variety. Corollar y2. Since increase in the new variety seed price raises the optimal amount of innovation in product and in process, the overall effect of an increase in the biotechnolog y variety price on the R&D profits and the level of investment on R&D depends on the elasticity of demand of the growers. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 21 PROPOSITIONS Proposition3. Increase in the number of heterogeneous far mers increases the demand for the new variety and consequently stimulates investment on R&D in plant breeding. Corollar y3. Increase in the planted area of a crop (or size of the final product industry) raises the R&D investment. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 22 PROPOSITIONS Proposition4. Increase in the costs of adopting a new variety decreases the demand for the biotechnolog y seed and decreases the benefits of R&D and investment on research. Corollar y4. A government policy such as a subsidy on the costs that reduces the far mers’ costs of adopting the new variety will enhance R&D fir ms' research activity. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 23 PROPOSITIONS Proposition5. Increase in the unit cost of capital used in producing innovation in process or in product decreases the investment in the same innovation but the effect of it on the other type of innovation is ambiguous. Corollar y5. Over time, the type of innovation with more efficiency in using limited resources of the R&D fir m will receive more investment. This might cause overinvestment on one type and under-investment on the other one. If so, a government policy such as a subsidy on the costs of the type of innovation with a lower efficiency might enhance the outcome of R&D investment. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 24 WHAT NEXT… o A dynamic model of R&D investment has a lot of other advantages besides those pointed out in this study. o Once we upgrade this simple two period model to a model with infinite horizon, we can answer some other very important issues raised in the literature. o Some of these concerns that can be addressed by such a dynamic models are: • Falling in the IRR to investment in R&D • Overcapitalization of investment in R&D • Optimal amount of investment in R&D • And so on. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 25 DYNAMIC OPTIMIZATION PROBLEM Plug ging the far mers’ demand for the new seed and the constraints into value function, it will be equivalent to 𝑉1 𝑍1 , 𝐶1 𝐶 𝐸0𝐷 − 𝐸0𝐶 𝐾 − 𝛽 𝐸 1 𝐶 𝑛 − 𝑐 − = max . 𝑤 − 𝐸 1 λ 𝛼 𝐸1𝐶 ∈Ω +𝜌. 𝐾−𝛽 𝐸1𝐶 𝛼 + 𝐸1𝐶 . 𝑍1 − 𝐶1 + 𝐾−𝛽 𝐸1𝐶 2( 𝛼 The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. + 𝐸1𝐶 ) 26 VALUE FUNCTION The value function for period 1 𝑉1 𝑍1 , 𝐶1 = 1−𝜌 𝑍1 −𝐶1 4𝜌 . 𝑤 𝑛 −𝑐 λ − 1−𝜌 𝑍1 −𝐶1 2 The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. (11) 27 DYNAMIC OPTIMIZATION PROBLEM This problem is equivalent to 𝐾 − 𝛽 𝐸 0𝐶 𝑉0 𝐶0 = max −( + 𝐸 0𝐶 ) 𝐶 𝛼 𝐸 1 ∈Ω 𝐾 − 𝛽 𝐸 0𝐶 𝐶 1 − 𝜌 −𝐶 + 2(𝐸 0 + ) 𝛼 + 4 𝑤𝑛 − 𝑐 . − λ 1 − 𝜌 −𝐶 + The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 2(𝐸 0𝐶 𝐾 − 𝛽 𝐸 0𝐶 + ) 𝛼 2 28 PROPOSITION 5 PROOF The effect of change in alpha and beta on the process innovation expenditure will be shown in this section as an example. The same argument holds for their effect on the product innovation. 𝑑 𝐸0𝐶 𝑑𝛼 = 4𝛽 (2𝐶 + 4𝐾 𝛼 +1+ 2 𝑤 𝑛 −𝑐 ρλ ) 4𝛽 𝛼 2 ( 𝛼 −4) 2 − 4𝐾 4𝛽 𝛼 2 ( 𝛼 −4) • Thus the effect of a change in the coefficient of innovation in product on the process innovation is ambiguous. 𝑑 𝐸0𝐶 𝑑𝛽 =− 4 2𝐶 + 4𝐾 𝛼 +1+ 𝛼 4𝛽 −4 𝛼 2 𝑤 𝑛 −𝑐 ρλ 2 ≤0 • Therefore, the effect of a change in the coefficient of innovation in process on the amount of expenditure in process innovation is negative. The 16th ICABR Conference - 128th EAAE Seminar, June 24-27, 2012, Ravello, Italy. 29