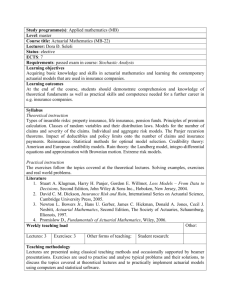

Increasing Cost Individual Cost Methods

advertisement

Unfunded Actuarial Liabilities • For a Defined Benefit Plan: UALt = ALt – Ft ”Funding Ratio” = Ft / ALt • We can calculate this Unfunded Actuarial Liability at any point in time • It is often useful to project what we think the UAL will be in a year if all assumptions play out as expected UALt+1 = ALt+1 – Ft+1 • Next year’s Asset Fund, Ft+1, can be thought of as the following pieces: • Ft+1 = Ft + I + C – P, where I = Interest earnings on the fund during the year C = Dollars contributed to the fund during the year P = Purchases of annuities for people leaving the plan during the year • ALt+1 = ALt plus the pieces that bring it forward one year (NC, interest, decrement, etc) Unfunded Actuarial Liabilities • We can use the expectations about next year’s UAL to determine what gains or losses we might have on the defined benefit plan • In general, UALt+1 = UALt (1 + i) - (Difference in interest actually earned LESS expected interest earned on Fund) - (Contributions actually made LESS Normal Costs expected in Actuarial Liability calculations) - (Reductions in liabilities due to actual terminations due to death or service LESS expected reductions for death or service) - (Reductions in liabilities due to actual retirements LESS expected retirements) • So…. If all actuarial assumptions go as planned (interest, terminations, etc) then UALt+1 = UALt (1 + i) Unfunded Actuarial Liabilities • Typically, one or more of the assumptions will not play out as expected (or “can’t” due to fractional deaths, etc) • So the plan will have an Actuarial Gain or Actuarial Loss. The Gain or Loss will comprised of the interest and liability components in the definition of UALt+1 • Actuarial Gain = (Difference in interest actually earned LESS expected interest earned on Fund) + (Reductions in liabilities due to actual terminations due to death or service LESS expected reductions for death or service) + (Reductions in liabilities due to actual retirements LESS expected retirements) • The contribution piece is not part of this since it is primarily controlled by the plan sponsor. Unfunded Actuarial Liabilities • Alternatively, in terms of Unfunded Actuarial Liabilities, • UALt+1 = UALt (1 + i) - (Contributions actually made LESS Normal Costs expected in Actuarial Liability calculations) - Actuarial Gain Actuarial Gain = UALt (1 + i) - UALt+1 - (C – NCt (1 + i) + IC) Actuarial Gain = (UALt + NCt) (1 + i) – C – IC – UALt+1 • where IC is any additional interest generated from contributions made to the fund during the year Unfunded Actuarial Liabilities • Example – SOA Course 5 Examination, Problem No. 6 • Benefit = + 1.5% • FS • YOS for 0 < YOS < 10 2.0% • FS • (YOS – 10) for 10 < YOS • i = 6%; s = 4%; No pre-retirement decrements; r = 65; Retirement Annuity Factor = 12 • • • • • Assets on 1/1/2011 = $300,000 Assets on 1/1/2012 = $320,000 Contributions on 12/31/2011 = $5,000 PUC Funding Method; Two Employees Employee A: entered plan on 1/1/2001 with e = 30; x = 40; S40 = $30,000 • Employee B: entered plan on 1/1/1981 with e = 30; x = 60; S60 = $50,000 • Actuarial Liability as of 1/1/12 = $350,000 • Determine UAL as of 1/1/2011 & Actuarial Gain during 2011 Unfunded Actuarial Liabilities • UAL as of 1/1/2011: Actuarial Liability for Employee A on 1/1/2011 = B40 • Retirement Annuity • Discount from retirement back to age 40 = [1.5% • (30,000)(1.04)24 • 10] • 12 • (1.06) -25 = $32,351.30 Actuarial Liability for Employee B on 1/1/2011 = B60 • Retirement Annuity • Discount from retirement back to age 60 = [[1.5% • (50,000)(1.04)4 • 10] + [2.0% • (50,000)(1.04)4 • 20]] • 12 • (1.06) -5 = $288,481.51 Total Plan Liability = $32,351.30 + $288,481.51 = $320,732.81 UAL as of 1/1/2011 = $320,732.81 - $300,000 = $20,732.81 Unfunded Actuarial Liabilities Actuarial Gain during 2011: Actuarial Gain = (UALt + NCt) (1 + i) – C – IC – UALt+1 Normal Cost for Employee A during 2011 = 2.0% • (30,000)(1.04)24 • 1 • 12 • (1.06) -25 = $4,300.17 Normal Cost for Employee B during 2011 = 2.0% • (50,000)(1.04)4 • 1 • 12 • (1.06) -5 = $10,490.24 Total Plan Normal Cost = $4,300.17 + $10,490.24 = $14,790.41 Unfunded Actuarial Liabilities Actuarial Gain during 2011: Actuarial Gain = (UALt + NCt) (1 + i) – C – IC – UALt+1 Actuarial Gain = ($20,732.81 + $14,790.41)(1.06) – 5000 - 0 - ($350,000 - $320,000)a Actuarial Gain = $2,654.61 Actuarial Gains and Losses For a Defined Benefit Plan: Total Experience Gain = Investment Gain + Liability Gain = Earning more than assumed/expected on asset fund + Having better than expected experience on mortality, salary, withdrawal assumptions, etc Actuarial Gains and Losses Investment Gain = Actual Asset Fund at End of Year – Expected Asset Fund at End of Year = Act F – Exp F Liability Gain = Expected Actuarial Liability at End of Year – Actual Actuarial Liability at End of Year = Exp AL – Act AL Total Experience Gain = (Act F – Exp F) + (Exp AL – Act AL) Actuarial Gains and Losses • • • • Example: Annual Retirement Benefit = $600 per Year of Service Funding Method = TUC Actual fund performance = 10% versus 5% expected in Commutation Function Sheet • 2 employees with e = 25 and x = 60; r = 65 • 1 dies during the year • Asset Fund at BOY = $80,000; Normal Cost paid at BOY = $6,000 • Calculate Total Experience Gain • = (Act F – Exp F) + (Exp AL – Act AL) Actuarial Gains and Losses • Total Act AL under TUC at x = 60 is 2*(600)(35)(7.94)(.5393) = $179,845.76 • Expected AL under TUC at x = 61 is $179,845.76 increased for interest, survival and next payment of Normal Cost = $208,863.33 Actual AL under TUC at x = 61 is 1*(600)(36)(7.94)(.6088) = $104,411.63 Liability Gain = $208,863.33 - $104,411.63 = $104,451.70 Actuarial Gains and Losses • Act F is (80,000 + 6,000) * 1.10 = $94,600 • Exp F is (80,000 + 6,000) * 1.05 = $90,300 • Investment Gain = $94,600 - $90,300 = $4,300 • Total Experience Gain • = $4,300 + $104,451.70 • = $108,751.70 Individual Level Premium • We have been talking over the last classes about people entering a defined benefit pension plan that already exists • However, sometimes employees are already in service when a plan is introduced • Two ways to handle this: – Create a initial Supplemental Liability and calculate normal costs from the entry date (like under EANLD) – Start with no initial liability and fund at a more rapid pace from the inception date forward Individual Level Premium • The ILP cost method is commonly used for the second of the two methods • Normal costs are derived from plan inception through retirement, and account for already accrued service • PVFNC = PVFB • NC (ä(T)a:r-a|) = Br • (D(T)r / D(T)a) • är(12) • Rearrange and solve for NC • NC [(N(T)a - N(T)r) / D(T)a] = Br • (D(T)r / D(T)a) • är(12) Individual Level Premium • The ILP cost method is commonly used for the second of the two methods • Normal costs are derived from plan inception through retirement, and account for already accrued service • ALx = PVFBx - PVFNCx • ALx = [Br • (D(T)r / D(T)x) • är(12)] - NC (ä(T)x:r-x|) • ALx = [Br • (D(T)r / D(T)x) • är(12)] - NC • (N(T)x - N(T)r) / D(T)x Aggregate Cost Methods • As we discussed early in this section of the class, funding can be done on an individual basis or on an aggregate basis • All that we’ve discussed so far has been individual methods: • TUC • PUC • EANLD • EANLP • ILP • We’ll take a quick look at a couple aggregate methods Individual Aggregate • IA method (an oxymoron?) has components that are both individual and aggregate in nature • Individual: Normal Cost for entire plan is still the sum of normal costs of each individual • Aggregate: Normal Cost for each individual is affected by the amount of excess funding that exists in the plan as a whole Individual Aggregate • Back to our “Entrepreneurial Company” exercise: • We all begin as new employees 10 years ago, now we are established enough to create a defined benefit plan • New DB plan recognizes past service credits • What are different ways to fund the plan? Individual Aggregate • Use a purely Individual Method, calculate current Actuarial Liability, and gather assets of that amount – Good funding, but expensive at first • Use the Individual Level Premium method, and cram the funding in the shorter time to retirement – Normal costs can be very high • Determine how much you can afford to post as plan assets now (call it “F”), and fund the difference going forward – Potentially a balance of current and future funding Individual Aggregate • Basics of IA method: • F = amount of excess funding that exists in the plan • FP = amount of the excess funding that is allocated to participant P • This amount of excess funding helps to reduce the amount of liability that must be funded, so normal costs are reduced • For each individual: • PVFNC = PVFB - FP Individual Aggregate • Key question: How do you take F and divide it up in to pieces in order to figure out FP for each individual?? • Common ways to do this: • Divide the fund equally among all participants: FP = F / n • Prorate F by the present value of the projected retirement benefit • Prorate F by the present value of the accrued benefit • Prorate F by the current AL for each participant • Make up your own creative way…. Individual Aggregate • Let’s work through an example with 2 participants • F = $1,000 • Retirement benefit = 1.65% of final salary times Years of Service • r = 65, s = .03 • Participant 1: e = 25, x = 35, Sx = $80,000 • Participant 2: e = 35, x = 45, Sx = $120,000 • How do we cost the plan? Individual Aggregate • Let’s work through an example with 2 participants • Determing FP by using Present Value of Projected Retirement Benefit • F = $1,000 • Retirement benefit = 1.65% of final salary times Years of Service • r = 65, s = .03 • Participant 1: e = 25, x = 35, Sx = $80,000 • Participant 2: e = 35, x = 45, Sx = $120,000 • How do we cost the plan? Individual Aggregate • Let’s work through an example with 2 participants • Determing FP by dividing evenly between participants • F = $1,000 • Retirement benefit = 1.65% of final salary times Years of Service • r = 65, s = .03 • Participant 1: e = 25, x = 35, Sx = $80,000 • Participant 2: e = 35, x = 45, Sx = $120,000 • How do we cost the plan? Aggregate Cost Method • Now let’s look at a cost method that truly is totally aggregate in nature • The exercise, while incorporating individual information, is really geared towards figuring out the Normal Cost for the entire plan, rather than each person individually • It incorporates the concept of the “average working-life annuity” Aggregate Cost Method • • • • • Average working-life annuity = ä(T) = Σ [(sN(T)x - sN(T)r) / sD(T)x] • Sx Σ Sx = Present Value of all Future Salaries Paid • Total Current Salaries Aggregate Cost Method • Using the average working-life annuity notation, we then have: • TNC • ä(T) = Σ PVFB – F • Read this as “The total normal cost for the plan paid under the assumption of the average working-life annuity, equals the total present value of future benefits for the plan less any excess funding” Aggregate Cost Method • Of course, sometimes we want TNC to be a level percent of total salary so we use TNC = U • Σ Sx • Special note: We can express level dollar as a subset of level percent of salary… • What adjustments need to be made? • What happens if we set s = 0, and Sx = 1? Other Funding Methods • For Defined Benefit Plans implemented after employees already have accrued service: • Individual Level Premium showed a way to do fast funding with no initial cash outlay • Could also immediately fund an amount to pick up EANLD at the point in scale • But other “in-between” alternatives exist Frozen Initial Liability (EAN) • FIL (EAN) method calculates for each individual what the current Actuarial Liability would be under EANLD • But instead of picking up point in scale, we choose a time period over which to amortize this liability – called the “Frozen Initial Liability” (FIL) • This amortization cost of FIL is called the “Supplement Cost” (SC) • Meanwhile, we are using the EANLD Normal Cost to do the remaining funding • Total Cost in a year = NC + SC Frozen Initial Liability using TUC • Method calculates for each individual what the current Actuarial Liability would be under TUC • Again, we choose a time period over which to amortize this liability – called the “Frozen Initial Liability” (FIL) • This amortization cost of FIL is called the “Supplement Cost” (SC) • Meanwhile, we are using the TUC method to do the remaining funding • Total Cost in a year = NC + SC