Lavutslippsutvalget: No limits to Growth av Annegrete Bruvoll

advertisement

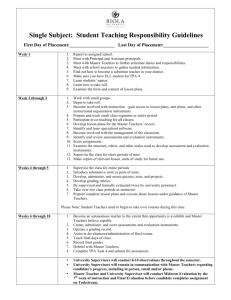

Some economic aspects of climate change Instruments and statistics by Torstein Bye Director , Economics, Energy and Environment Statistics Norway tab@ssb.no • Introduction • Instruments – basic characteristics • Instrument classification • Instruments and statistics • A Norwegian example • Summary and conclusion London Group Canberra 27-30 April 2009 1 Introduction • The Stern report (Stern, 2008) – Climate change and economic consequences Cost of mitigation, cost of adaptation, Cost efficient approach to mitigate • • • Eurostat/OECD definition of environmental related taxes Combating climate change is about instruments – classification issues. A range of instruments, – Economic instruments, technology instruments, regulatory instruments etc. – All instruments create shadow prices in the market –i.e. economic instruments – To understand effects are important when deciding upon what statistics we need • We produce a comprehensive number of consistent statistical tables – that allows us to perform consistent analyses both of driving forces, – and the impact of the instruments on emissions – Where does the statistics come from • We exemplify some interesting aspects – by combining actual figures for Norway from a set of such consistent tables. • Concludes London Group Canberra 27-30 April 2009 2 Environmental taxes - classification • (Eurostat 2001/OECD): – A tax whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific negative impact on the environment It was decided to include all taxes on energy and transport, to include resource taxes but to exclude resource taxes on the petroleum sector, and to exclude VAT. It seems random and not principal? • Pigou (1920) – The economics of welfare: – A tax that corrects for negative externalities related to economic activity (cf. the environment) • Bye and Bruvoll (2008) – Multiple instruments to change energy behaviour – the emperors new clothes? Resource rent (Ricardo, Hotelling), monopoly rent Capture Infrastructure cost – Ramsey (1927) ? Income generation – Ramsey (1927) Externalities (Pigou (1920) • Problem OECD: Value added tax, labour tax? • Example: less than 20 percent of OECD/Eurostat env.taxes for Norway are really environmental taxes – cf. Bruvoll, Næss and Smith (2009) - forthcoming London Group Canberra 27-30 April 2009 3 Taxes and subsidies Negative externality Discriminatory taxes Positive externality Discrimination D1 D1 b D0 b D0 S Da Discriminatory subsidies p1b t p0 p1a S0g S1g Sb S0 S1 p1g rent x1b x0b x0a x1a x1 x0 s p0 p1b D Bye and Bruvoll (2008):Multiple instruments to change energy behaviour – the emperor new clothes x0g x1g x1b x0b x0 x1 London Group Canberra 27-30 April 2009 4 Green and White certificates Taxes are bad – subsidies are bad – I do not want to pay GC: Free certificate on supply – purchaser obligation WC: Obligation to save – trade for supplier Green certificates -supply White certificates -demand h(p) g(p) h(p)+g(p) h(p)+g(p+pc) Db p1 Da S2 b S0 g(p+pc) p2 p1a pc p0 p1 p0 f(p) f(p+apc) x0g x1g x0 x1 x1b x0b x1b x2b x0b x2a x1a x0a x1 London Group Canberra x0 27-30 April 2009 5 Brown certificate – or carbon trade Limit the amount: Db Da p0b p* p* A shadow price occur Initial allocation Distribution of cost and benefits p0a A0a A0b A1a A1b Taxes an subsidies London Group Canberra 27-30 April 2009 6 Supplementary instruments • Regulation - shadow price – “tax” – “subsidy” • Standards - shadow price – “tax” and “subsidy” • R&D – subsidy – and a “tax” • Market concentration – regulation? – Good for the environment - Tax and subsidy Fundamentally: • All instruments are fundamentally a combination of: – a “tax” and a “subsidy” • When producing statistics: – we should remember that and treat them equally London Group Canberra 27-30 April 2009 7 Instruments and statistics - fundamentals Sector Sector Sector Agriculture Gasoline Intermediat Fuel oil Coke Coal Wood Waste Intermediates oil Coke CoalWood Wood es Gasoline Gasoline Fuel oil Fuel Coke Coal Waste WasteIntermediates Agriculture Agriculture Primary industries Fisheries Primary industries Primary industries Fisheries Fisheries Top down versus bottom up approach Forestry The fundamental bottom up approach Pulp and Pulp and paper Pulp Input – output or activity tables and paper paper Machinery A detailed sector list coefficient of compound x on the cell activity Manufacturing Manufacturing Machinery Emission Machinery Manufacturing A detailed commodity list Metals Metals Metals from table 1 Amount of emission carrier Other Other Other Amount of (fixed emissions of compound x – the product of Physical orTechnology economic values prices) information Construction ConstructionConstruction table 1inand Energy account national account CO2 –and straightforward – carbon CO22 out Electricity etc Electricity etc Electricity etc Bridging table to energy balances CH4 – burning technology Banking Banking BringsBanking discipline to theSF statistical work HFC, CFC, 6 – Process technology Insurance Insurance Analyses of driving forces Insurance Private Services Private Services Private Services Transport Transport Analysis of the effects of instruments Transport Other The role of UN Other Forestry Forestry Other Public services Public services Public services Residential Residential Residential London Group Canberra 27-30 April 2009 8 Instruments and statistics – “technologies” Sector Gasoline P Agriculture Manufacturing Services Households T S Fuel P T Coke S P T Coal S P T Wood S P T Intermedia tes Waste S P T S P T S Table 3 - split into processes (P) - Transport (T) and Stationary (S) end uses – Why; - discriminatory or - different environmental impact - tax rates per unit - subsidies vary - allowances vary? - certificates vary? - regulation vary? Tax rates for each emission activity Same principle for all instruments OECD data base of environmental taxes, exemptions, reimbursement, caps etc http://www.oecd.org/env/policies/database - cf the criticism above London Group Canberra 27-30 April 2009 9 Instruments and statistics • Taxes – Table 4x-x (taxes and discrimination – accounts) – Tax rate on volumes of proven environmental impact Ex. emissions of carbon dioxide. – Data collection and definition – are tax rates split ?: Simple in theory – difficult in practice ? cf. Eurostat (2001) – Ramsey, environmental, energy, resource, transportation infrastructure, – Bye and Bruvoll (2008b) Harmonize with the total collected taxes measured in public accounts – (i.e. a tax account matrix). • – Steinbach et al. (2008a) Environmental taxes in the context of the SEEA Subsidies – table 5x-x (complexity versus registers) – Measure keeps prices below their market value for consumers and above market value for producers – In practice - direct transfers or tax credits (foregone income) – In UNEP (2004) direct transfers, public R&D, preferential tax treatments, price controls and loanslower than market interest rate – Our paper has a much broader definition of subsidies - only possible to calculate indirectly –cf. market responses – relevant data for analysis – make analysis possible – Data collection Subsidies are normally launched to investment projects in terms of a specific amount or a lump sum to producing facilities based on a production basis (for instance a feed in tariff – i.e. a unit subsidy) for facilities that want to save the use of input (energy efficiency projects) on the demand side, either lump sum or per unit. Lump sum subsidies are normally linked to some kind of volume measures, i.e. they may be transformed to a unit measure. In practice this measure is complex and some data transformation processes are needed to make the measures comparable in units. Subsidies are normally directed towards detailed projects, i.e. these data are on matrix form, cfr. table 3. The bright side - government will normally establish some kind of a register – Steinbach et al. (2008b) discusses Environmental subsidies in the context of the SEEA manual. London Group Canberra 27-30 April 2009 10 • • Instruments and statistics Carbon market – table 6x-x – cf create 50 percent reduction in 2050? – Shadow price of regulation – equals the ”tax” Two sets of additional statistical tables – Initial assignment of free allowances in volumes (implies also a value transfer – volume times the market price) – Economic and volume capturing the trading of emission permits – Aggregates over the columns in table 3: • normally directed towards sectors and not activities – but who knows what happens Data source – The assigned amount of allowances may be collected from public registers grandfathered, i.e. based on historic emissions, other free emissions (for instance for new facilities). Surrendered emission, The “verified” emissions follow from table 3. – Trade of permits – both volumes and values (some may not be tradable) Allowances – public registers CDM trade –public registers JI trade –public registers Verified emissions – table 3 Net trade on exchange – accounting principle – The permit market in the context of the SEEA manual and the SNA - Olsen (2008). London Group Canberra 27-30 April 2009 11 Instruments and statistics • Green certificates – table 7x-x – cf at least 20 percent of EU market in 2020 – Approval - delivery of the number of certificates by technology choice and firms in public registers – The value of the certificate on the pool /exchange – Energy balance (residential) or the energy account (territorial) framework depends upon national or international framework? • White certificate - table 8x-x – cf. at least 20 percent of EU market in 2020 – Public register of how much each firm/sector is supposed to save – The principal agent assumption eases the data collection. Each agent (for instance a distribution company for electricity) has to verify the savings and the cost for each principal (consumer) • Regulation table – table9x-x – Regulations are normally set up by public firms on a firm specific regime. – Public sector should follow up on their own regulation both the regulated and the verified outcome is registered – consistency check to table 3 – The information needed then should be based on these registers. London Group Canberra 27-30 April 2009 12 A Norwegian example (table 3,4,6) – CO2 “taxes” NOK/tonne CO2 350,00 Extraction of oil and gas Households 300,00 250,00 Land transport ex/cabs, railw ay and bus transport Domestic sea transport 200,00 oct 2008: 25 €/tonne CO2 Average CO2-tax in Norw ay: 184 NOK/tonne CO2 dec 2008: 15 €/tonne CO2 Plastic, rubber production Iron and steel Cement, lime and gypsum Fishing 50,00 Aluminum Gas terminals 100,00 Production of refined oil products 150,00 0,00 0 5 10 15 20 25 30 35 40 45 mill. tonnes CO2 London Group Canberra 27-30 April 2009 13 A Norwegian example–who pays how much? NOK/tonne CO2 Landfills 850 800 750 700 650 600 550 500 450 400 EU/ETS oct 2008: 25 €/tonne CO2 Extraction of oil and gas 350 Households 300 250 ~0.3 bill. € Sea- and land transport 200 ~0.4 bill.€ 150 100 ~0.8 bill. € ”Processing emissions 50 0 0 5 10 15 20 25 30 35 40 45 mill. tonnes CO2 London Group Canberra 27-30 April 2009 14 Summary and conclusion • Mitigation is about instruments • What is an environmental tax? • Complex instruments introduced • All instruments are combinations of “taxes and subsidies” • Statistics for just one instrument is “a lie”? • Statistics for all instruments on the same principle • Input/output matrix • Tax rates • Registers • Accounting • Analyses made possible – Driving forces – Effect of instruments – partially/bilaterally/trilaterally/multilaterally London Group Canberra 27-30 April 2009 15 Some questions raised: • • • • • • • • The paper advocates that all instruments in climate policy reduce to a combination of taxes and subsidies. Does the London Group agree? The paper advocates that it is important that statistics gather information on instruments in climate policy in a detailed manner, which makes it possible to study the market and technology effects of instruments. Does the LG agree? To follow the impact of climate policy it is important that as many instruments as possible are included in the statistics. For some instruments it seem easy, for others it is more complex. However, research on how to include complex instruments should be emphasised? The paper advocates that the statistical detailed setup for instruments should follow the statistical setup for emissions (i.e. the national and energy account setup). Does the LG agree? – For statistical purposes this eases the data gathering as values may be based on tax rates and emission accounts. – Consistency may be checked by aggregation of these tax rates emission accounts calculations and total public tax accounts. Emission permits should be included in the statistical system on the same basis? – This includes tradable permits in the markets, which may be calculated indirectly, see below – This includes JI – which may be found in national registers – This includes CDM – which may be found in national registers – This includes free allowances –which may be found in national registers We should include new instruments as green and white certificates? Statistics for regulations should be gathered – how to include them should be studied further? Important lessons are to be learned from the OECD-database – However the DEFINITIONS of environmental taxes ARE disputed? London Group Canberra 27-30 April 2009 16 Norwegian environmental taxes as share of ”environmentally related taxes” reported to Eurostat CO2 taxes Other environmental taxes Other Electricity consumption tax (taxes on other climate gas emissions, NOx, SO2 and waste) Diesel tax, envir. elements excepted Petrol tax, environm. elements excepted Motor vehicle registration tax Annual motor vehicle tax Total reported taxes: 8.2 bill Euro Environmental taxes: 1.4 bill Euro (<20%) Sources: Bruvoll, Næss and Smith (2009) (forthcoming) Ministry of Finance (2007): An evaluation of Norwegian excise taxes, NOU 2007:8 London Group Canberra 27-30 April 2009 17