nominal GDP

advertisement

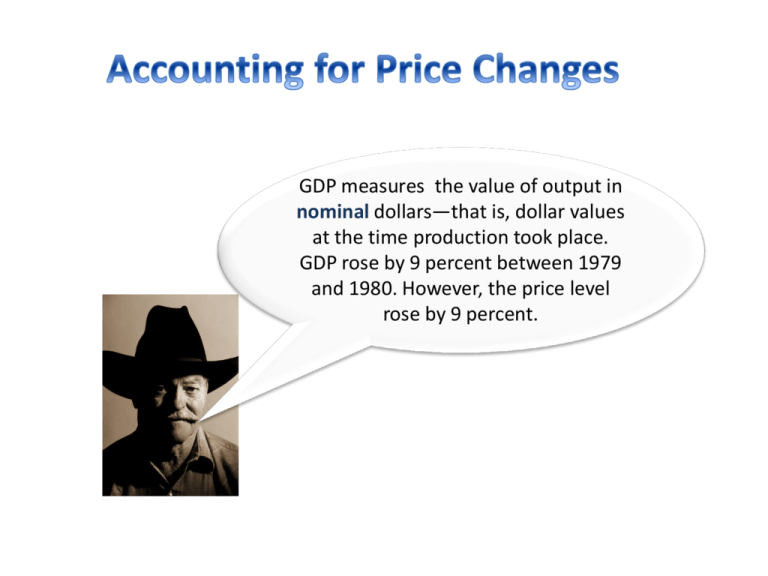

GDP measures the value of output in nominal dollars—that is, dollar values at the time production took place. GDP rose by 9 percent between 1979 and 1980. However, the price level rose by 9 percent. Real versus Nominal GDP •We use money to measure the market value of new goods and services produced in the economy. •The value (or purchasing power) of money is subject to change over time. •Hence we need to adjust nominal GDP (that is, GDP measured at current prices) for changes in the value of money. •GDP adjusted for changes in the value of money is called real GDP. Nominal GDP Calculation To calculate nominal GDP in 2006, sum the expenditures on apples and oranges in 2006 as follows: Expenditure on apples = 100 × $1 Expenditure on oranges = 200 × $0.50 Nominal GDP = $100 + $100 = $100 = $100 = $200 Now we will calculate nominal GDP for 2007 and compare Expenditure on apples = 160 × $0.50 Expenditure on oranges = 220 × $2.25 Nominal GDP = $80 + $495 Our problem is that the nominal GDP figures do not give us an accurate read of period-to-period changes in actual production. Notice that a part of the change in nominal GDP from 2006 to 2007 resulted from a change in prices. = $80 = $495 = $575 “Traditional” Real GDP calculation The traditional method converts nominal GDP to real GDP by measuring GDP in all periods at “base period prices” To correct for changes in the value of money , we will establish 2006 as our base year. That is, we will measure 2007 output at 2006 prices. Traditional method: measuring 2007 GDP at 2006 prices Expenditure on apples = 160 × $1.00 Expenditure on oranges = 220 × $0.50 Nominal GDP = $80 + $495 Thus, real GDP increased from 2006 to 2007—but not by as much as nominal GDP = $160 = $110 = $270 New Method of Calculating Real GDP To use this method, we must value 2006 output at 2007 prices and 2007 output at 2006 prices. 2007 Quantities and 2006 Prices 2006 Quantities and 2007 Prices Quantity Price Item Apples 160 $1.00 Oranges 220 $0.50 Item Quantity Price Apples 100 $0.50 Oranges 200 $2.25 •Measured at 2006 prices, Real GDP increased by 35% from 2006 to 2007 [($70/$200) × 100] •Measured at 2007 prices, real GDP increased by 15% from 2006 to 2007 [($75/$500) × 100] The next step is to average together the percentage increases for 2006 and 2007. Thus we have: 35% 15% Re alGDP 25% 2 Therefore, since real GDP in 2006 is $200, this chain-weighted method of converting nominal to real GDP gives us real GDP in 2007 of $250. US gross domestic product in nominal dollars and chained (2000) dollars 9 This is an index number used to track changes over time in the cost-of-living experienced by households The Consumer Price Index (CPI) The CPI is the “narrow” price index in that the market basket used to construct it includes items purchased by households. Bureau of Labor Statistics economic assistants check the prices of 80,000 items in 87 metropolitan areas each month. 1982-84 is the reference base period THE CONSUMER PRICE INDEX • Calculating the CPI – The CPI calculation has three steps: • Find the cost of the CPI basket at base period prices. • Find the cost of the CPI basket at current period prices. • Calculate the CPI for the base period and the current period. If man lived by bread alone Hypothetical example of a price index, base year 2006 Year (1) Price of Bread in Current Year (2) Price of Bread in Base Year (3) Price index =(1)/(2)×100 2006 2007 2008 $1.25 1.30 1.40 $1.25 1.25 1.25 100 104 112 The price index equals the price in the current year divided by the price in the base year, all multiplied by 100. 13 Hypothetical market basket used to develop the consumer price index (1) Quantity in market basket (2) Prices in base year (3) Cost of Basket in base year =(1)×(2) (4) Prices in current year (5) Cost of Basket in current year =(1)×(4) 365 packages 500 gallons 12 months $0.89/package 1.00/gallon 30.00/month $324.85 500.00 360.00 $0.79 1.50 30.00 $288.35 750.00 360.00 Product Twinkies Fuel oil Cable TV $1,184.85 $1,398.35 The cost of a market basket in the current year, shown at the bottom of column (5), sums the quantities of each item in the basket, shown in column (1), times the price of each item in the current year, shown in column (4) 14 The CPI Market Basket The BLS now revises the CPI market basket every 2 years The Consumer Price Index (1982-84 = 100) 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2007 29.8 31.8 39.8 55.5 86.3 109.3 133.8 153.5 174.5 196.4 211.68 Source: Bureau of Labor Statistics Sources of Bias in the CPI Some economists have complained that the CPI does not accurately measure changes in the cost-of-living. They cite the following problems •New goods bias •Quality change bias •Commodity substitution bias •Outlet substitution bias New Goods Bias Think of all the stuff you buy today that was not around just 20 years ago •Personal computers and software •Satellite TV •Cell phone service •High-speed internet service •Laser eye surgery •Digital music players •Serotonin reuptake inhibitors Quality Change Bias Many items have undergone qualitative improvements over time. Cars, cameras, and software are three examples