EVM

advertisement

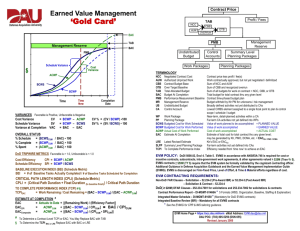

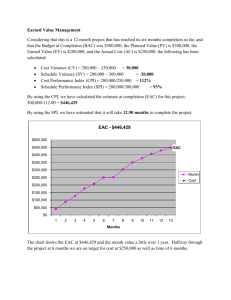

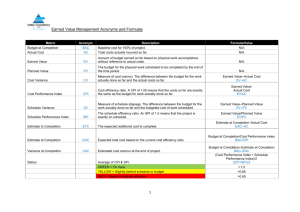

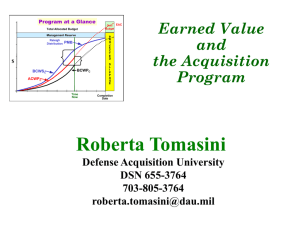

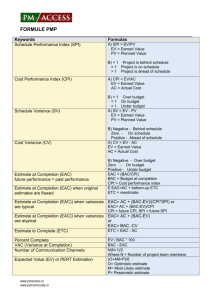

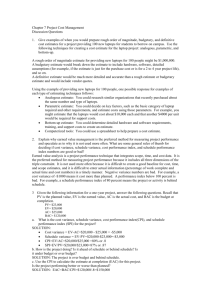

Program at a Glance Total Allocated Budget Management Reserve Raleigh Distribution P R O J E C T E D PMB $ BCWSC Over EAC Budget BCWPC ACWPC Time Now S L I P P A G E Earned Value and the Acquisition Program Completion Date Roberta Tomasini Defense Acquisition University DSN 655-3764 703-805-3764 roberta.tomasini@dau.mil What is Earned Value Management? • Definition • EV Concept and Terms • EV Policy Update (March 2005) • EV in Program Execution (Reporting, Analysis, EACs, TCPI) • Things to Look At (Analysis Tips) • Possible Actions for EVM Reporting Issues • Possible Actions for Issues Highlighted by EVM 2 Earned Value Management (EVM) Definition The use of an integrated management system that coordinates work scope, schedule, & cost goals & objectively measures progress toward these goals. 3 EARNED VALUE CONCEPT A Management Technique Emphases Disciplined Integration of Technical Performance to Associated Co$t & Schedule Objectively Measures Work Progress States Value of Work Completed in $s Provides Objective Cost & Schedule Metrics Performance Schedule Earned Value Management Enables Trend Analysis & CAIV Trades Industry Standard ANSI/EIA-748-2007 Cost DoD & Industry embrace EARNED VALUE as a Risk Management Tool 4 Earned Value Terminology Acronym Term Meaning BCWS Budget Cost of Work Scheduled Plan - Baseline - PMB BCWP Budget Cost of Work Performed Earned Value ACWP Actual Cost of Work Performed Actuals BAC Budget At Completion Planned Cost EAC Estimate At Completion Forecasted Cost SV Schedule Variance CV Cost Variance VAC Variance At Completion Accomplishment Variance EV vs Actual Cost Forecasted Overrun / Underrun 5 The Time-Phased Spend Plan $ 22 20 18 16 14 12 10 8 6 4 2 0 NEGOTIATED CONTRACT COST = Target Cost } Cumulative Budgeted Cost of Work Scheduled Management Reserve Budget at Completion Performance Measurement Baseline BAC PMB BCWS 0 2 Months 4 6 8 10 12 14 16 18 20 Completion 6 Point Earned Value Management Guidance New Policy Established in March 2005 Risk Based Decision Contract Type (EVM on FFP, LOE & T&M Contracts Discouraged) No Mandatory Requirements Acquisition Funding Cost Reimbursement & Incentive Contracts EVM System Requirements EVM Data Requirements Dollar thresholds are the same for all budget appropriation categories. Color of money is no longer an EVM discriminator. Contract Value (TY $M) 0 20 Conformance with ANSI / EIA 748 Conformance with ANSI / EIA 748 Formal EVMS validation not required Formal EVMS validation required Contract Performance Report (DI-MGMT-81466) (Tailored) Contract Performance Report (DI-MGMT-81466) (5 formats) Integrated Master Schedule (DI-MGMT-81650) (Tailored) Integrated Master Schedule (DI-MGMT- 81650) 50 7 EV in Program Execution • Data Reporting • Data Analysis – Variances – Performance Indices – Trends • Estimates at Completion (EACs) • To Complete Performance Index (TCPI) 8 Earned Value Within the Acquisition Process GOVERNMENT NEGOTIATION SOURCE SELECTION AWARD PROJECT ACQUISITION STRATEGY DEVELOP Program Execution & Performance Measurement RFP PROVIDER DEVELOP PROPOSAL STATUS REPORTS ESTABLISH Perf Meas. BASELINE MGT VOLUME ASSESS RISK TECH VOLUME DEVELOP MR COST VOLUME ASSIGN BUDGETS 9 Contract/Cost Performance Report (CPR) • Format 1: WBS • Format 2: Organizational Categories • Format 3: Baseline • Format 4: Staffing • Format 5: Explanations and Problem Analysis NOTE: CPR DID, Jul 2005, DI-MGMT-81466A new IPMR DID, 20 Jun 2012, DI-MGMT-81861 10 CPR Format 1: WBS CLASSIFICATION (When filled in) CONTRACT PERFORMANCE REPORT FORMAT 1 - WORK BREAKDOWN STRUCTURE 1. CONTRACTOR a. NAME 2. CONTRACT a. NAME b. LOCATION (Address and ZIP Code) b. NUMBER DOLLARS IN 3. PROGRAM a. NAME PROGRAM 4. REPORT PERIOD a. FROM (YYMMDD) b. TO (YYMMDD) c. TYPE 5. CONTRACT DATA a. QUANTITY b. NEGOTIATED COST d. SHARE RATIO c. EST. COST AUTHOR- d. TARGET PROFIT/ IZED UNPRICED WORK FEE 6. ESTIMATED COST AT COMPLETION MANAGEMENT ESTIMATE AT COMPLETION (1) a. b. c. 8. CONTRACT BUDGET BASE (2) e. TARGET PRICE a. WORK BREAKDOWN STRUCTURE ELEMENT f. ESTIMATED PRICE g. CONTRACT CEILING c. SIGNATURE B C W P b. c. d. e. COST OF MONEY GENERAL & ADMINISTRATIVE UNDISTRIBUTED BUDGET SUBTOTAL (Performance Measurement Baseline) f. g. 9. a. b. MANAGEMENT RESERVE TOTAL RECONCILIATION TO CONTRACT BUDGET BASE VARIANCE ADJUSTMENT TOTAL CONTRACT VARIANCE A C W P S V d. DATE SIGNED (YYMMDD) CUMULATIVE TO DATE ACTUAL VARIANCE COST WORK WORK WORK SCHEDULED PERFORMED PERFORMED SCHEDULE COST (2) (3) (5) (6) (4) BUDGETED COST B C W S h. ESTIMATED CONTRACT CEILING (3) CURRENT PERIOD (1) PRODUCTION 7. AUTHORIZED CONTRACTOR REPRESENTATIVE a. NAME (Last, First, Middle Initial) b. TITLE VARIANCE BEST CASE WORST CASE MOST LIKELY PERFORMANCE DATA ITEM b. PHASE (X one) RDT&E PHASE C V BUDGETED COST ACTUAL VARIANCE COST WORK WORK WORK SCHEDULED PERFORMED PERFORMED SCHEDULE COST (7) (8) (10) (11) (9) B C W S B C W P A C W P S V C V REPROGRAMMING ADJUSTMENTS COST VARIANCE S (12) AT COMPLETION BUDGETED ESTIMATED VARIANCE BUDGET (13) D (14) (15) (16) B A C E A C V A C 11 CLASSIFICATION (When filled in) Basic Performance Data Analysis Objectives • Determine current status -- Where are we today? • Identify trends -- Where are we headed? -- Any cost, schedule surprises ? • Forecast the future -- What is the estimated cost at completion? • Indicate areas for management action -- What should we do now? 12 Earned Value Metrics Variances Cost and schedule Current month and cumulative Performance indices Cost Performance Index (CPI) Schedule Performance Index (SPI) Percent complete Percent spent To Complete Performance Index (TCPI) 13 The Earned Value Current Status Imposed On The Spend Plan NEGOTIATED CONTRACT COST $ 22 20 18 16 14 12 10 8 6 4 2 0 } Management Reserve BCWS ACWP }CV Budget at Completion (BAC) } SV BCWP 0 2 Months 4 6 8 10 12 Time Now 14 16 18 20 Completion Point 14 Cumulative Dollar Variance Cost and Schedule Trends $ in Millions 1.0 0 (1.0) (2.0) CV (3.0) (4.0) SV 15 Performance Metrics • Cost Variance = BCWP - ACWP = 10-13 = -3M • Schedule Variance = BCWP - BCWS = 10 - 14 = -4M • Cost Performance Index = BCWP/ACWP = 10/13 = .77 Percent Complete = BCWP/BAC = 10/20 = 50% Percent Spent = ACWP/BAC = 13/20 = 65% Schedule Performance Index = BCWP/BCWS = 10/14 = .71 Estimate at Completion BAC/CPI = 20/.77 = $26M 16 Gold Card 17 Estimate at Completion (EAC) EAC = Actual Costs accumulated to date + Estimated Cost of the Work Remaining Budget at Completion = $20M BCWS = $14M (Planned to date) ACWP = $13M BCWP = $10M (EV) Work Remaining 18 EAC Concept EAC = ACWP + Estimate to Complete EAC = ACWP + Work Remaining Performance Factor EAC = ACWP + (BAC - BCWP ) CPIc EAC = BAC CPIc Note: This EAC assumes that future performance will be the same as that represented by CPIc. 19 EAC Methods METHOD FORMULA 1. Cumulative CPI BAC - BCWPC ACWPC + CPIC 2. Composite BAC - BCWPC ACWPC + CPI X SPI C C 3. 3-Month CPI BAC - BCWPC ACWPC + (BCWP) (ACWP) 3 MO 4. Weighted BAC - BCWPC ACWPC + .8 CPI + .2SPI C C Note: data c Indicates cumulative 20 To Complete Performance Index (TCPI) TCPIEAC = Work Remaining Budget Required for EAC (or cost remaining) = BAC-Cumulative BCWP EAC- Cumulative ACWP The CPI from today until contract completion required to achieve the EAC. Or, The level of efficiency required from today to completion to achieve the EAC. Note: Compare TCPI EAC to cum CPI for “believability” check 21 Things to Look At (Analysis Tips) • Look at CPI in latest CPR - What is CPI cum now? • Look at CPI trend - Rate of change? CPI cum drop of 1% per month, not green • Look at SPI trend – Rate of change? Chasing schedule? • Compare CV and use of Management Reserve – MR vs Work Remaining? • Compare govt EAC to ktr LRE – Which is higher? • Calculate TCPI for each (govt Most Likely EAC and ktr ML LRE) • Compare percent complete to percent spent – greater than 10%, not green • Look at trend charts for rebaselinings – How many? When was last one? • Look at trend charts relative to +/- 10% (OSD) and +/- 5% (DCMA tripwires) • Take govt EAC to price and compare to budget (contract total on the R-3) 22 • When was the last IBR? How did it go? – How many findings? CARs? Possible Actions for EVM Reporting Issues • • • • • • • • • • • PMO discussions with contractor PMO engages DCMA for assistance Discussions with contractor at levels above PM PCO letter Award/Incentive fee impact CPAR input CARs (Correction Action Request)-Levels 1-4 – DCMA initiated Conduct an IBR Conduct a compliance review Withhold payment up to 5% Pull contractor’s EVM validation 23 Possible Actions for Issues Highlighted by EVM Question: What do you do? Answer: 1. Find the root cause…..talk to the contractor - Does it relate to a KPP or KSA? - If yes… - Is there any trade space? - Discuss options with the contractor - Discuss options with the user - If no… - Discuss options with the contractor - Discuss options within Acquisition community 2. Take action to help resolve/mitigate the problem 24 Any Questions? 25 BACKUP CHARTS for the Integrated Baseline Review (IBR) 26 Integrated Baseline Review (IBR) Goal Joint PM mutual understanding of the PMB content and the risk 27 IBR – PMB Evaluation • Assess the following: – Technical scope of work is captured – Work flow and scope ties to contract schedule key milestones – Resources (budgets, facilities, personnel, skills, etc.) are adequate – Performance data will reflect project progress – Work measurement is objectively planned – Assumptions underlying the plan are reasonable SO WHAT DOES THIS MEAN? 28 PMB Budget Allocation Top Down Version 3 Contract Price Total Allocated Budget Fee/Profit NCC AUW CBB Overrun Performance Measurement Baseline OTB Management Reserve - Withheld for Unknowns - No Scope or Schedule Summary Level Planning Packages - Specific Scope @ higher WBS level - Time-phased budget - Strict Controls Control Accounts Work Packages Planning Packages Undistributed Budget - Temporary Holding - Work Authorized but no detailed Budget or Schedule - Integrated Scope, - Integrated Scope, Schedule & Budget Schedule & Budget - No Detailed Plans - Detailed Plans 29 Developing the PMB 1. Scope 2. Schedule 3. Budget 100 40 60 1. Decompose SOW 2. Extend WBS to control account work package 1. Arrange work packages in order 2. Sequence over time 1. Budget the work packages 2. Classify the work and select an EV technique 3. Calculate cumulative BCWS Reports Negotiated Contract Cost MR $ PMB Time 30 Control Account A Key Management Control Point WORK BREAKDOWN STRUCTURE SYSTEM LEVEL 1 ENGINE LEVEL 2 C O M P A N Y T E S T E N G M F G D A T A LEVEL 3 FAN LEVEL 4 FAN ASSEMBLY LEVEL 5 MECHANICAL DESIGN D E SI G N CASE ASSY COMPRESSOR ROTOR ASSY FULL SCALE RIG STATOR ASSY CONTROL ACCOUNT CONTROL ACCOUNT ANALYTICAL DESIGN DRAFTING/ CHECKING TRAINING 40 100 CONTROL ACCOUNT CONTROL ACCOUNT 60 Work Packages Work Packages 31 EARNED VALUE TECHNIQUES METHOD LENGTH 0 / 100 % 1 Mth 50 / 50 % 2-3 Mths % Complete Varies Variant Milestone 3 or More Mths Level of Effort Varies Apportioned Effort Varies BCWP CALCULATION 30 0 15 15 35% 5 10 15 10 10 10 5%WP3 5%WP3 32 BACKUP CHARTS 33 How to Tailor the CPR • Can tailor content and/or frequency • Format 1: WBS – Default WBS level 3 – Consider Level 4/5 for high risk/dollar areas – No more than 2 pages • Format 2: Organizational Categories – This should be useful for your program – Consider aligning to IPTs • Format 3: Baseline • Format 4: Staffing – This will be in the same breakout as Format 2 • Format 5: Explanations and Problem Analysis – Thresholds for variance analysis reporting should support management by exception concept – Review thresholds periodically NOTE: Smaller programs may only need Formats 1 or 342 and Format 5 Primary Trip Wires • EVM Center Contractor EVMS confidence rating – Corrective Action Requests (CAR Levels 1-4) – EVM System maturity levels • Integrated Baseline Review (IBR) – Initial review conducted within 180 days – Ongoing reviews triggered by Mods and/or OTBs – Outcome of the review •Cost •Schedule •Technical •Resources •Processes Baseline Risk 35 Secondary: Trip Wire Metrics • Baseline Execution Index (BEI) – IMS – Cum index less than .95 • Schedule Performance Index (SPI) – CPR – Cum index less than .95 • Critical Path Length Index (CPLI) – IMS – Cum index less than .95 • Cost Performance Index (CPI) – CPR – Cum index less than .95 • To Complete Performance Index (TCPI) – CPR – CPI to TCPI delta of 10% • Contract Mods – ACO, PCO – Contract Mods to Original Base value of 10% • PMB Revisions – CPR, CFSR – Changes to Monthly Time-Phased PMB value of 5% 36 wInsight Current Period Date Jul 09 Aug 09 BCWS BCWP ACWP SCH VAR $ SCH VAR % SPI COST VAR $ COST VAR % CPI 11,245 10,425 11,772 -820 -7% 0.93 -1,347 -13% 0.89 9,898 9,371 10,659 -527 -5% 0.95 -1,288 -14% 0.88 Sep 09 Current 9,898 9,605 10,601 -293 -3% 0.97 -996 -10% 0.91 Oct 09 Nov 09 Dec 09 6,325 6,208 7,028 -117 -2% 0.98 -820 -13% 0.88 5,974 6,032 6,560 59 1% 1.01 -527 -9% 0.92 4,568 4,744 5,388 176 4% 1.04 -644 -14% 0.88 Entries in Black are Input data Entries in Red are Calculated 37 wInsight Cumulative Date Jul 09 Aug 09 BCWS BCWP ACWP SCH VAR $ SCH VAR % SPI COST VAR $ COST VAR % CPI 3 MONTH CPI 6 MONTH CPI 66,649 63,276 68,945 -3,373 -5% 0.95 -5,669 -9% 0.92 0.90 0.92 76,547 72,647 79,604 -3,901 -5% 0.95 -6,958 -10% 0.91 0.89 0.91 Sep 09 Cumulative 86,445 82,252 90,205 -4,193 -5% 0.95 -7,953 -10% 0.91 0.88 0.90 Oct 09 Nov 09 Dec 09 92,770 88,460 97,233 -4,311 -5% 0.95 -8,773 -10% 0.91 0.89 0.89 98,744 94,492 103,793 -4,252 -4% 0.96 -9,300 -10% 0.91 0.89 0.89 103,312 99,236 109,181 -4,076 -4% 0.96 -9,945 -10% 0.91 0.90 0.89 38 wInsight At Completion TCPI - BAC 1.09 1.14 TCPI - EAC 1.34 1.42 CBB / TAB 130,149 130,149 EAC (Kr) 119,000 120,000 VAC $ 11,149 10,149 VAC % 8.6% 7.8% % SCHED - BAC 51% 59% % COMP - BAC 49% 56% % SPENT - BAC 53% 61% SLIP IN WEEKS - At Completion 1.20 1.27 1.35 1.47 1.61 1.83 2.07 2.62 130,149 130,149 130,149 130,149 120,000 120,000 121,000 121,000 10,149 10,149 9,149 9,149 7.8% 7.8% 7.0% 7.0% 66% 71% 76% 79% 63% 68% 73% 76% 69% 75% 80% 84% - 39 wInsight EAC Forecasts Date 3 MO AVG 6 MO AVG CUM CPI CUR CPI CPI*SPI Jul 09 140,646 138,815 141,810 146,966 145,695 Aug 09 141,735 139,871 142,614 148,045 145,997 Sep 09 Oct 09 EAC Forecasts 142,385 142,802 140,871 141,716 142,734 143,057 143,640 147,339 145,412 145,290 Nov 09 142,917 142,324 142,959 141,521 144,722 Dec 09 143,069 142,726 143,192 147,824 144,589 40 OSD Position on EACs: • When a contract is more than 20% complete: – 1. The overrun at completion will be more than the overrun incurred to date – 2. The percent overrun at completion will be greater than percent overrun incurred to date • Based on OSD database of more than 500 major DOD contracts since 1977 41