Decision-Making Tools

advertisement

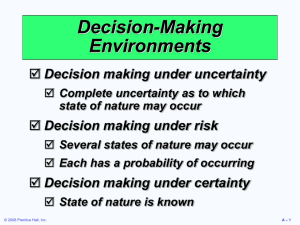

Operations Management Module A – Decision-Making Tools PowerPoint presentation for Operations Management Class Updated and extended by Prof. Dedeke © 2006 Prentice Hall, Inc. Hall, Inc. © 2006 Prentice A–1 Outline Fundamentals of Decision Making Decision Tables Types of Decision-Making Environments Decision Making Under Uncertainty Decision Making Under Risk Decision Making Under Certainty Expected Value of Perfect Information (EVPI) © 2006 Prentice Hall, Inc. A–2 Introduction Decision Making Approaches Structured Unstructured © 2006 Prentice Hall, Inc. A–3 Structured Decision Making Process 1. Clearly define the problem and the factors that influence it 2. Develop the specific goals to be achieved 3. Develop quantitative measures that relate the goals to the problem 4. Develop alternate solutions to problem 5. Compare the alternate solutions using a model or structured methodology and the quantitative measures from step 3 6. Select the best alternative 7. Implement the decision and set a timetable for completion © 2006 Prentice Hall, Inc. A–4 Decision Making Environment Level of confidence about occurrence of outcomes and consequences Total Partial Decisions under risk Decisions under certainty Decisions under uncertainty Decisions under risk Estimate-able © 2006 Prentice Hall, Inc. Known Value or Size of outcomes and consequences A–5 Decision-Making Environments Decision making under uncertainty Complete uncertainty as to which state of nature may occur Decision making under risk Several states of nature may occur Each has a probability of occurring Decision making under certainty State of nature is known © 2006 Prentice Hall, Inc. A–6 Decision Making Under Certainty States of Nature From Table A.3 Favorable Market Unfavorable Market Construct large plant (A1) $200,000 -$180,000 Construct small plant (A2) $100,000 -$90,000 Do nothing (A3) $0 $0 Probabilities 1 0 Alternatives 1. EMV(A1) = (1)($200,000) + (0)(-$180,000) = $200,000 2. EMV(A2) = (1)($100,000) + (0)(-$90,000) = $100,000 The preferable option is A1 © 2006 Prentice Hall, Inc. A–7 Decision Making Under Risk States of Nature From Table A.3 Favorable Market Unfavorable Market Construct large plant (A1) $200,000 -$180,000 Construct small plant (A2) $100,000 -$90,000 Do nothing (A3) $0 $0 Probabilities 0.3 0.7 Alternatives 1. EMV(A1) = (0.3)($200,000) + (0.7)(-$180,000) = -$66,000 2. EMV(A2) = (0.3)($100,000) + (0.7)(-$90,000) = -$33,000 3. EMV(A3) = (0.3)($0) + (0.7)($0) = $0 A3 is the option to choose. If A3 is excluded, The preferable option is A2 © 2006 Prentice Hall, Inc. A–8 Decision Making Under Risk (2) In some cases the states of nature expected are certain, however the values of each states are uncertain. States of Demand Seasonal Ticket Occasional Prob. Market Prob. Market Alternatives Sell 100 tickets now (A1) 0.7 $200,000 0.3 $50,000 Sell 100 tickets later (A2) 0.3 $150,000 0.7 $300,000 Do nothing (A3) $0 $0 1. EMV(A1) = (0.7)($200,000) + (0.3)($50,000) = $155,000 2. EMV(A2) = (0.3)($150,000) + (0.7)($300,000) = $255,000 3. EMV(A3) = (0)($0) + (0)($0) = $0 The preferable option is A2 © 2006 Prentice Hall, Inc. A–9 Risk Each possible state of nature has an assumed probability States of nature are mutually exclusive Probabilities must sum to 1 Determine the expected monetary value (EMV) for each alternative © 2006 Prentice Hall, Inc. A – 10 Expected Monetary Value EMV (Alternative i) = (Payoff of 1st state of nature) x (Probability of 1st state of nature) + (Payoff of 2nd state of nature) x (Probability of 2nd state of nature) +…+ (Payoff of last state of nature) x (Probability of last state of nature) © 2006 Prentice Hall, Inc. A – 11 Decision Making Under Uncertainty States of Nature Alternatives Favorable Market Unfavorable Market Construct large plant $200,000 -$180,000 Construct small plant $100,000 $0 Do nothing Maximum in Row Minimum in Row Row Average $200,000 -$180,000 $10,000 -$20,000 $100,000 -$20,000 $40,000 $0 $0 $0 $0 Maximax Maximin Equally likely 1. Maximax choice is to construct a large plant 2. Maximin choice is to do nothing 3. Equally likely choice is to construct a small plant © 2006 Prentice Hall, Inc. A – 12 Using Decision Trees to Solve Decision Making Under Risk 2. Symbols used in a decision tree: a. —decision node from which one of several alternatives may be selected b. —a state-of-nature node out of which one state of nature will occur © 2006 Prentice Hall, Inc. A – 13 Decision Tree Example A decision node A state of nature node Favorable market Unfavorable market Construct small plant Favorable market Unfavorable market Figure A.1 © 2006 Prentice Hall, Inc. A – 14 Decision Table Example Alternatives Construct large plant Construct small plant Do nothing State of Nature Favorable Market Unfavorable Market $200,000 –$180,000 $100,000 –$ 20,000 $ 0 $ 0 Table A.1 © 2006 Prentice Hall, Inc. A – 15 Decision Tree Example EMV for node 1 = $10,000 = (.5)($200,000) + (.5)(-$180,000) Payoffs Favorable market (.5) 1 Unfavorable market (.5) Favorable market (.5) Construct small plant 2 EMV for node 2 = $40,000 Figure A.2 © 2006 Prentice Hall, Inc. Unfavorable market (.5) $200,000 -$180,000 $100,000 -$20,000 = (.5)($100,000) + (.5)(-$20,000) $0 A – 16 Complex Decision Tree Example Figure A.3 © 2006 Prentice Hall, Inc. A – 17 Decision Trees in Ethical Decision Making Maximize shareholder value and behave ethically Technique can be applied to any action a company contemplates © 2006 Prentice Hall, Inc. A – 18 Decision Trees in Ethical Decision Making Yes Does action maximize company returns? Yes Is action legal? No No Figure A.4 © 2006 Prentice Hall, Inc. Is it ethical? (Weigh the affect on employees, customers, suppliers, community against shareholder benefit) Is it ethical not to take action? (Weigh the harm to shareholders vs. the benefits to other stakeholders) Yes Do it No Don’t do it Yes Don’t do it No Do it, but notify appropriate parties Don’t do it A – 19 Qualitative Decision Making: Factoring Priorities • Operations decisions often involve selection of suppliers, vendors, markets, products and so on. In most of these cases, one has to define priorities. • Steps – Identify attributes to rank or compare, skill, age – Have a scale to use for ranking, e.g. 1, 2, 3, 4, 5 – Choose a scale for priorities, e.g. 0.1, 0.3, 0.9… – Use system to compare alternatives © 2006 Prentice Hall, Inc. A – 20 Example: Priorities and Decision Making Employee A Employee A Employee B Employee B Weight (W) Score (S1 ) W x S1 Score (S2 ) W x S2 Language 0.1 10 6 Analytical 0.25 6 8 Technical 0.30 7 9 Salary Expect. 0.20 5 6 Degree 0.15 10 5 TOTAL © 2006 Prentice Hall, Inc. A – 21 Example: Priorities and Decision Making Employee A Employee A Employee B Employee B Weight (W) Score (S1 ) W x S1 Score (S2 ) W x S2 Language 0.1 10 1 6 0.6 Analytical 0.25 6 1.5 8 2 Technical 0.30 7 2.1 9 2.7 Salary Expect. 0.20 5 1 6 1.2 Degree 0.15 10 1.5 5 0.75 TOTAL 1.0 © 2006 Prentice Hall, Inc. 7.1 7.25 A – 22 Qualitative Decision Making: Location Strategies • Review Chapter 8, Example 1, page 253-254 & 258 Solved problem 8.1, page 263 See problem 8.1 in Excel spreadsheet © 2006 Prentice Hall, Inc. A – 23