Developing Trends in the US Beef Market

advertisement

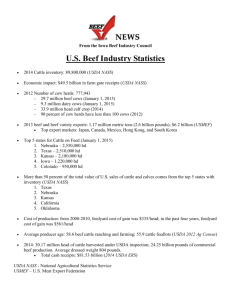

Current Situation U.S. DOLLAR INDEX Key Currencies Versus the U.S. Dollar % Change Since 2003 140% Since Jan 1, 2003 120% BRZ R, +56% 100% CAD$, +29% 80% JP ¥, +21% 60% EUR €, +20% 40% AUS$, +15% 20% SK W, -11% 0% Jan-03 Jun-03 Nov-03 Apr-04 Sep-04 Feb-05 Jul-05 Dec-05 May-06 Oct-06 Mar-07 Aug-07 Jan-08 Jun-08 Nov-08 -20% Monthly Source: Pacific Exchange Rate Service Dow Jones Average Crude Oil Cattle Industry Outlook and Strategies Florida Cattlemen’s Institute January 2009 Total Cattle Inventory 140 95.2 Million Down 1.4 Million 130 120 Mil Head 110 100 90 80 70 60 50 30 40 Source: USDA 2009 Projected 50 60 70 YEARS 80 90 00 Commercial Cow Slaughter 9,000 8,500 +9% 500,000 HEAD IN 2008 8,000 000 HEAD 7,500 7,000 6,500 6,000 5,500 5,000 4,500 4,000 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 Source: USDA Projected 2008 YEARS Down 2% (650,000) head January 1 Cattle-On-Feed 12,500 DOWN 6%, 790,000 HEAD 11,974 12,000 11,804 11,798 11,475 11,500 11,565 11,253 11,299 11,155 000 HEAD 12,097 11,307 11,000 10,558 10,500 10,631 10,658 10,346 10,000 9,500 9,000 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 YEARS U.S. Beef Trade and Forecasts Exports Source: U.S. Dept of Commerce, forecasts by CF 30 29 Beef Production and Net Beef Supply Production Net Supply 28 B I L L B S 27 26 25 24 23 22 21 20 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 YEARS Source: USDA 2008-2009 projected U.S. Dollar Index U.S. Meat Exports in 2009 Source: USDA, CattleFax Projections Per Capita Meat Consumption 100 90 2009 vs. 2008 Total Meat Consumption down 3.4 lbs 2009 vs 2008 -1.9lbs Beef 80 -1.7lbs Pounds 70 60 Pork 50 40 30 +0.4lbs Broiler -0.2lbs 20 Turkey 10 0 50 53 56 59 62 65 68 71 74 77 80 83 86 89 92 95 98 01 04 07 Source: USDA Years Recessions Length of Change in Change in Recession CH Retail Per Capita (months) Price Supply Peak Trough 2008 ??? ??? +2-4% -2-3% Mar 2001 Nov 2001 8 +10% -1% Jul 1990 Mar 1991 8 +7% -4% Jul 1981 Nov 1982 16 +1% +0% Jan 1980 Jul 1980 6 +2% -2% Nov 1973 Mar 1975 16 +2% +5% Shifts in Beef Demand Change in values 90s Trimmings +15% Chuck +10% Round +9% Rib +0% Loin -7% FEEDGRAINS Estimated Corn Production Costs in Iowa $1,000 $5.00 $4.51 Projected break-even corn price for 2009 $4.50 $800 $3.48 $735 Total Costs/Acre $700 $3.50 $600 $2.76 $2.55 $500 $400 $4.00 $344 $2.42 $363 $2.83 $2.96 $3.00 $557 $2.57 $2.50 $473 $386 $439 $414 $2.00 $300 $1.50 $200 $1.00 $100 $0.50 $0 $0.00 2002 2003 2004 Source: Adapted from Iowa State University and University of Illinois Extension 2005 2006 Years 2007 2008F 2009F Breakeven Corn Price $/bushel $900 Cattle Markets & Supply Impact on Feeding Industry ►Fewer feeding companies will finish a higher percentage of the cattle. ►Cattle ownership in feed yards will become more highly concentrated. “The feed yards will own more cattle” ►The feeding industry will remain primarily located in the 5-state area (NE, CO, KS, OK, TX). ►To much capacity, tremendous loss of equity, access to capital, capacity will be idled, some move to grow yards, others will close ►Managing cost and price risk will be an essential ingredient for a successful business model. Packing Segment ● Tighter fed supplies – excess packing capacity ● Hide & Offal value decline to squeeze margins ● Industry is vulnerable to the loss of more packing capacity in 2009-2010 2009 750lb Steer Price Projection 110 2009 est. average $98-$100 105 $CWT 100 95 90 85 80 J F M A M J J A S O N D Role of Stocker Operator Inventory shock absorber Add low cost of gain Warehouse cattle Add value and improve quality 2009 550lb Steer Calf Price Projection 120 2009 est. average $110+/115 110 105 100 95 J F M A M J J A S O N D High Return Producers Don’t Cheat When it Comes to: 1.Animal Health 2.Nutrition 3.Genetics Habits of High - Return Producers $ $ $ $ 1. Below average annual cow costs 2. Lower feed costs 3. Lower than average calf breakeven prices 4. Lower interest expense 5. Lower general operating expense 6. Higher averaging weaning weights 7. Higher conception rates 8. More pounds weaned per cow exposed (less debt) $ $ $ $ Stair Steps to Profitability Strategies for 2009 Stocker & Cow-Calf Operations ► Stocker operations must manage profits. It is the cattle feeders turn to make money. ► Narrow feeder to fed spreads. Does this present an opportunity to retain ownership? ► Narrow calf to feeder/fed spreads. Does this present an opportunity to retain ownership? Impact on Cow/Calf Producers ♦ Cost management hasn’t gone away. ♦ Value capture becomes essential (calves, bred females, open females, cull bulls, etc. ♦ Precision nutritional management when supplemental feeds are being provided. ♦ “No surprises” in terms of animal health, genetics and reproductive performance is the mantra of producers. ♦ Risk management involves long-term grass leases, supply chain contracts, and more focus on managing at least part of the calf crop through the stocker and or finishing phase. Impact on Cow/Calf Producers ♦ Optimize reproduction – rising feed and input costs will increase sensitivity to the “law” of diminishing returns”, producers are de-incentivized to maximize reproductive rates. ♦ Economies of scale become increasingly important which will force additional consolidation. ♦ Producers will only adopt technologies with very distinct financial advantages. ♦ Estate planning and inter-generational asset transfer become increasingly important. ♦ Labor availability is a limiting factor. Thank You Have a Profitable 2009