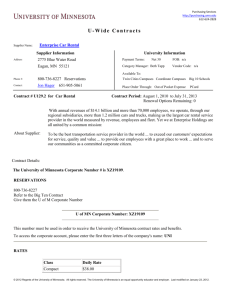

Conferencing and Collaboration Subscription

advertisement

North American Power Generation Rentals Market Rental Prices Continue to Slide while Revenues Begin to Recover after Sharp Downturn “With the power rental products at a fairly high stage of maturity and new technologies far away from commercialization, it is the service offering that is likely to differentiate the winner from the looser. Pre- and post- rental services ranging from engineering assistance to maintenance support is emerging as a key distinguishing factor.” Energy and Power Generation Analyst Team Frost & Sullivan Industry Trends • Cessation of Y2K and utility demand has seriously affected the rental market revenues • Political and economic uncertainties has further impacted market potential • Electric reliability concerns and waning capital investment culture to drive the rental market • Tightening emission regulations spurs the demand for non-diesel rentals • U.S. Northeast power rental market set to grow at a faster pace • Increasing trend toward use of large sized generators • Rental rates expected to reduce steadily, even though revenues would recover Key Features Frost & Sullivan provides: • Drivers, restraints, challenges, and strategic recommendations • Market sizing and competitive analysis • Revenue and unit shipment forecasts • Output analysis and trends for rental generators • End user analysis within each regional segment • Pricing and Distribution analysis • Market trends for gas turbine and gas fired generators • Overview of other emerging technologies What We Offer • In-depth regional coverage: Four U.S. Census regions and Canada • Proven methodology encompassing extensive primary and secondary data and research • Focused information and strategies that cover business and technology issues • Credible data and analysis highlighting industry dynamics • Winning strategies to help you create precise business plans Who Will Benefit? Current Market Participants • • • • • Find out how large is the North American and regional power rental markets Find out how you compare to the competition Assess current and future drivers and restraints Determine and exploit new market opportunities Understand the growth prospects across each end-user segment New Entrants • • Analyze challenges associated with the industry Look out for possible alliance or acquisition targets Who Will Benefit? (Cont’d) Gen-set and Turbine OEMs • • • • • Find out which competitors are getting involved in the rental market Assess the levels of current and future equipment demand Understand the size ranges that are becoming increasingly popular Determine to what extent rentals will affect new generator sales Find out whether it is worth to enter the rental market Investment Community • • Determine which participants will outperform the competition Assess what investment is justified into the rentals sector What’s Included • • • • • • Diesel Generator Rentals Gas Fired Generator Rentals Gas Turbine Rentals Regional Analysis Application Analysis Strategic recommendations for different functions Key Market Participants Aggreko, Inc. Alstom Power Rentals Atlantic Rentals Atlas Copco (RSC/Prime) Caterpillar, Inc. (CAT Rental Power) Detroit Diesel Allison Canada Est., Inc. GE Energy Rentals/ GE International, Inc. Generac Power Systems, Inc. Hertz Equipment Rental Corp. Holt Power Systems Kohler Rentals Power/ KOHLER Co. Multiquip Nations Rent West, Inc. Penn Power Systems Standby Power/ Cummins Michigan Power, Inc. Stewart and Stevenson Services, Inc. Sunbelt Rentals Corp. Toran Power and Equipment Ltd. United Rentals, Inc. For More Information • Call toll free 877 GO FROST (877.463.7876) • Fax toll free 888.690.3329 • Email myfrost@frost.com • Visit www.frost.com