Balance of Payment : Illustrations

advertisement

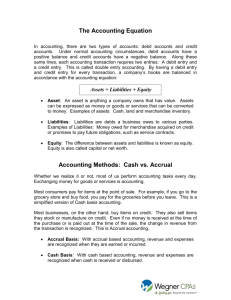

MBA (Finance specialisation) & MBA – Banking and Finance (Trimester) Term VI Module : – International Financial Management Unit I: Balance of Payment Lesson 1.2 Balance of Payment Introduction The Balance of Payments (BOP) is an accounting system that records the economic transactions between the residents and government of a particular country and the residents and governments of the rest of the world during a certain period of time, usually a year. The BOP provides valuable information for the conduct of economic policy. Balance of Payment Balance of Payments Accounting Like other accounting statements, the BOP conforms to the principle of double entry bookkeeping. This means that every international transaction should produce debit and credit entries of equal magnitude. It is important to mention here that BOP is neither an income statement nor a balance sheet. It is a sources and uses of funds statement that reflects changes in assets, liabilities and net worth during a specified period of time. Balance of Payment Debits and Credits 1. 2. Credit Transactions (+) are those that involve the receipt of payment from foreigners. The following are some of the important credit transactions a. Exports of goods or services b. Unilateral transfers (gifts) received from foreigners c. Capital inflows Debit Transactions (-) are those that involve the payment of foreign exchange i.e., transactions that expend foreign exchange. The following are some of the important debit transactions a. Import of goods and services b. Unilateral transfers (or gifts) made to foreigners c. Capital outflows Balance of Payment Balance of Payments Statement The balance of payment statement records all types of international transactions that a country consummates over a certain period of time. It is divided into three sections: I. The Current Account II. The Capital Account III. The Official Reserve Account. Balance of Payment Debit and Credit Entries The Balance of Payment of a country is classified into three well-defined categories – 1. The Current Account, 2. The Capital Account 3. The Official Reserves Account. The rules for recording a transaction as debit and credit in the current account are: Debit (Outflow) Credit (Inflow) Goods Buy Sell Services Buy Sell Investment Income Pay Receive Unilateral transfers Give Receive Cont…. The rules for doubly entry recording here are as follow: Debit (Outflow) Portfolio (short-term) Receiving a payment from a foreigner Buying a short-term asset Buying back a short-term domestic asset from its foreign owner Portfolio (long-term) Buying a long-term foreign asset (not for purpose of control Buying back a long-term domestic asset from its foreign owner (not for purpose of control) Foreign direct investment Buying a foreign asset for purpose of control Buying back from its foreign owner a domestic asset previously acquired for purposes of control Credit (Inflow) Making a payment to a foreigner Selling a domestic short-term asset to a foreigner Selling a short-term foreign asset acquired previously Selling a domestic long-term asset to a foreigner (not for purpose of control) Selling a long-term foreign asset acquired previously (not for purposes of control) Selling a long-term foreign asset acquired previously (not for purposes of control) Selling a foreign asset previously acquired for purposes of control Balance of Payment : Illustrations 1. Merchandise Trade : An Indian company sells Rs 4,00, 000 worth of machinery to a U S company. The U.S. company pays for the machinery in 30 days. Entries: Particulars Debit Liquid Short Term capital Rs 4,00,000 Exports Credit Rs 4,00,000 Balance of Payment : Illustrations 2. Services : Services represents non-merchandise transactions such as tourist expenditures. Consider, a person visits U.K. and cashes Rs 300000 worth of his Indian Traveller’s cheque at a U.K. hotel. Before coming back to India, entire amount of Rs 3,00,000 in U.K. Entries: Particulars Debit Tourist Expenditure Rs 3,00,000 Liquid Short term capital Credit Rs 3,00,000 Balance of Payment : Illustrations 3. Unilateral Transfer : This account covers gift by domestic residents to foreign residents or gift by domestic government to foreign government or vice versa. Assume that the US Red cross sends $ 10,000 worth of flood relief goods to India. Entries: ( In the US Balance of Payment) Particulars Debit Transfer Payments $ 10,000 Exports Credit $10,000 Balance of Payment : Illustrations 4. Long-Term capital : This account shows inflow and outflow of capital commitments whose maturity is longer than one year. It covers investments in financial assets without significant control of the real assets. Assume that , Indian company purchases Rs 6 crores worth of U.K. bond. Entries: ( In the India Balance of Payment) Particulars Debit Portfolio investment Rs 600,00,000 Liquid Short-term capital Credit Rs 600,00,000 Balance of Payment : Illustrations 5. Non-liquid Short-term capital : These are the flows of funds that are not normally sold. Bank loans represents non-liquid short term liabilities. Suppose U. S. bank lends $30,000 to an Indian company Entries: ( In the U.S. Balance of Payment) Particulars Debit Non-liquid short term capital $ 30,000 Liquid Short-term capital Credit $ 30,000 Balance of Payment : Illustrations Record the following transactions and prepare the Balance of Payments statement. a. A US firm export $ 1,000 worth of goods to be paid in six months. b. A US resident visits London and spends $ 400 on hotel, meal and so on. c. US Government gives a US bank balance of $200 to the government of a developing nation as part of the US aid programme. d. A US resident purchases foreign stock for $800 and pays for it by increasing the foreign bank balance in the U.S. e. A foreign investor purchase $600 of United states treasury bills and pays by drawing down his bank balance in the United states by an equal amounts. Balance of Payment : Illustrations Particulars Debit Short term capital Outflow 1000 Merchandise exports Travel Sevices purchased from foreigners 1000 400 Short term capital inflow Unilateral Transfer 400 200 Short term capital inflow Long term capital outflow 200 800 Short term capital inflow Short term capital outflow Short term capital inflow Credit 800 600 600 Balance of Payment : Illustrations Particulars Debit Merchandise 1000 Services 400 Unilateral Transfers 200 Long term capital 800 Short term capital, Net Total Credit 400 1400 1400