acct2 - Homework Market

advertisement

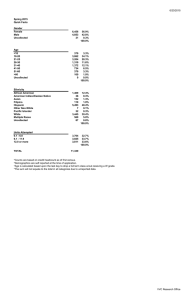

Triple Company's accountant made an entry that included the following items: debit postage expense $12.50; debit office supplies expense $27.41, debit to cash over/short $2.27. If the original amount in petty cash is $320.00, how much is in petty cash before the reimbursement? $320.00 $282.36 $37.64 $275.55 $277.82 A company had net sales of $32,500 and ending accounts receivable of $2,100 for the current period. Its days' sales uncollected equals (rounded): 24 days 25 days 6 days 89 days 1 days In year 1 a company had net sales of $20,000 and ending accounts receivable of $2,200. In year 2 this company had net sales of $60,000 and ending accounts receivable of $4,200. Use days' sales uncollected to determine which of the following statements is true. Days' sales uncollected in year 1 is 40 days and in year 2 is 26 days. This measure indica Days' sales uncollected in year 1 is 40 days and in year 2 is 26 days. This measure indica Days' sales uncollected in year 1 is 28 days and in year 2 is 13 days. This measure indica Days' sales uncollected in year 1 is 13 days and in year 2 is 28 days. This measure indica Days' sales uncollected in year 1 is 28 days and in year 2 is 42 days. This measure indica A company had $55 missing from petty cash and that was not accounted for by petty cash receipts. The correct procedure is to: Debit Cash Over and Short for $55 Credit Cash for $55 Credit Cash Over and Short for $55 Debit Petty Cash for $55 Credit Petty Cash for $55 Fluffy Pet Grooming deposits all cash receipts on the day when they are received and all cash payments are made by check. At the close of business on June 30, its Cash account shows a $14,821, debit balance. Fluffy Pet Grooming's June 30 bank statement shows $14,581 on deposit in the bank. Prepare a bank reconciliation: for Fluffy Pet Grooming using the following information a . b . c . Outstanding checks as of June 30 total $2,271. The June 30 bank statement included a $80 debit memorandum for bank services. Check No. 919, listed with the canceled checks, was correctly drawn for $234 in paymen bill on June 15. Fluffy Pet grooming mistakenly recorded it with a debit to utilities expens credit to cash in the amount of $342. d The June 30 cash receipt of $2,539 were placed in the bank's night depository after bank . and were not recorded on the June 30 bank statement. What is the adjusted bank balance? $14,285 $14,849 $14,593 $14,553 $14,793 On November 15, 2010, Betty Corporation accepted a note receivable in place of an outstanding accounts receivable in the amount of $138,610. The note is due in 90 days and has an interest rate of 6.25%. What is the appropriate journal entry to record at maturity? A company receives a 7.50%, 6-month note for $8,200. The total interest due on the maturity date is (Use a 360-day year): $45.56 $49,200 $1,230 $615.00 $307.50 Eastern Company sold $640,000 of its accounts receivable and was charged a 4% factoring fee. How should Eastern Company record this transaction in the journal? On August 1, 2010, Ace Corporation accepted a note receivable in place of an outstanding accounts receivable in the amount of $125,665. The note is due in 75 days and has an interest rate of 10%. What would be the total amount collected at the maturity date? $125,665.00 $2,618.02 $128,283.02 $123,046.98 $138,231.50 The interest accrued on $3,500 at 7% for 45 days is: $62 $31 $245 $78 $21