Subject outline - Budapest Business School

advertisement

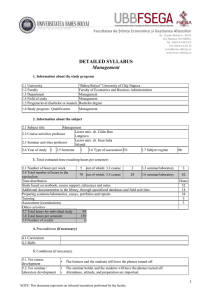

Subject outline Subject’s title: Subject’s instructor: Risk management Sági, Judit PhD, associate professor Type of subject: Level of the subject: Credit points: Language of education: Compulsory in D Module BA level year 3, semester 1. 3 English Contact hours: Lecture: Students learning hours: 1 per Practice: week 1.5 hours per week 1 per week Total: 2 per week Total: written Type of exam: Prerequisites to qualify for subject: Corporate Finance Short description of the subject: During this course, students are expected to gain definition of corporate risks and the integrated corporate risk management solutions, insight into the future trends, for example alternative risk transfer (ART). Aims: Since the risk and the risk management are integral parts of the everyday activity of companies, it is very important to be able to understand, identify, analyse, measure, manage and mitigate the most important types of risks. Accordingly, the aims of the course are to introduce the students to: - the importance of risk awareness and risk management - the most important types of financial and non-financial risks - the principles, tools and techniques of the enterprise risk measurement and management Learning outcomes: knowledge Understanding of risk, risk management in corporate context Competence in understanding the enterprise risk management framework Learning outcomes: skills Ability to calculate corporate risks Competence in develop of corporate risk management program Ability to evaluate corporate risk management processes Teaching strategies and method of delivery: The students are invited for compulsory attendance on the seminars. The attendance of the lectures is highly recommended. 2 Compulsory reading: Lam, James: Enterprise Risk Management, From Incentives to Controls, Wiley Finance, 2003. The summary of the lectures and the seminar examples, available at the homepage http://coospace.bgf.hu. Recommended reading: Merna, Tony – Al-Thani, Faisal: Corporate Risk Management. Wiley, 2008 Farkas Szilveszter – Szabó József: A vállalati kockázatkezelés kézikönyve. Dialóg Campus, Pécs – Budapest, 2005 Assessment and grading: Form of assessment: written exam. At mid-term and at the end of the course, tests should be written. Both theory and calculations are expected to be asked in the tests. Should someone fail to reach a minimum 60% of both, he (or she) has to write a composite test during the exam period. Topics of the session: Lectures/weeks: 1. week lecture Introduction to the subject. The benefits of risk management. Cautionary tales. 2. week seminar Concepts and processes. What is enterprise risk management (ERM)? Case study and exercise: Risk management function and environment 3. week lecture Components of ERM: corporate governance, line management, portfolio management, risk transfer, risk analytics, data and technology resources, stakeholder management. 4. week seminar Risk analytics: risk control, risk optimization. Case study and exercise: Investment appraisal 5. week lecture Market risk, credit risk, credit risk portfolio models. Operational risk analytics. 6. week seminar Case study and exercise: Business finance Mid-term exam 7. week lecture Risk transfer – ART. Brief history of ART, Advantages of ART, Pitfalls of ART. 8. week seminar Case study and exercise: Cost of capital 9. week lecture Credit risk management. Key credit risk concepts. Credit risk management process. Basel requirements. Best practices. 10. week seminar Case study and exercise: Credit risk management 11. week lecture Operational risk management. Definitions and scope. Operational risk management process. Business applications. Case study: Heller Financial 12. week seminar Case study and exercise: FX rate management 13. week lecture Financial institutions risk management: Industry trends. deregulation. Case study: CIBC 3 14. week seminar Energy firms and nonfinancial corporations risk management. Case studies: Enron, Microsoft 15. week Final-term exam Personally I wish all of you, students, and a useful time of period in learning this subject, Taxation and subsidies. Budapest, Sept, 2013. dr. Sági Judit