Treatment 2.0

advertisement

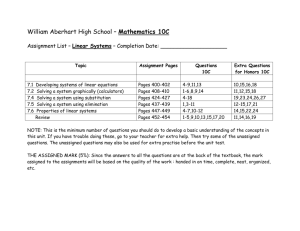

Funding Universal Access through a “Global Health Charge” on alcohol and tobacco: feasibility in the 20 countries with the largest HIV epidemics Dr Andrew Hill, Pharmacology and Therapeutics, Liverpool University, UK Dr Will Sawyer, MetaVirology Ltd, London, UK World AIDS Conference, Washington, USA, July 2012 [Abstract MOAE0306] Thanks to: Joep Lange University of Amsterdam Elly Katabira International AIDS Society, Kampala Ceppy Merry Infectious Diseases Institute, Kampala Praphan Phanuphak Thai Red Cross AIDS Society, Bangkok Marco Vittoria World Health Organization, Geneva Dave Ripin Clinton Foundation Andrew Levin Clinton Foundation Chris Duncombe Bill and Melinda Gates Foundation Ben Plumley Pangaea AIDS Foundation Nathan Ford Medecins Sans Frontieres, Geneva The HIV epidemic in 2011: 34.2 million infected 2.5 million new infections per year 8 million treated 19 million: will need ARVs in future In future, 19 million more people will need treatment 7 million need treatment, but have no access 1.7 million deaths per year Source: UNAIDS 2012: “Together we will end AIDS” $7 billion per year shortfall in funding for Universal Access 1. International funding for HIV: $8.6 billion in 2011 2. Funding from low / middle-income countries: $8.2 billion in 2011 3. Additional funding required: $7 billion per year Source: UNAIDS 2012: “Together we will End AIDS” Global Financial Crisis How can we afford to treat 15-30 million people with HIV in the future? Alcohol, tobacco, HIV/AIDS, malaria and TB as causes of death worldwide Annual deaths in 2010, worldwide: Alcohol abuse: 2.5 million Tobacco: 6 million (->8 million) could be prevented by cutting consumption HIV/AIDS: 1.8 million TB: 1.1 million Malaria: 0.7-1.1 million could be prevented by better treatment and care Alcohol and tobacco are under-taxed in low and middle income countries; consumption is growing. Increasing tax on alcohol and tobacco is known to improve public health. UNAIDS Epidemiology Reports 2011, WHO smoking and alcohol statistics, UN population reports Taxes on tobacco and alcohol are low in many African countries World Health Organization standard: taxes should be at least 70% of the retail price of a packet of cigarettes1 High income countries: 38/48 (79%) have a tax rate of at least 50% Low-income countries: 11/36 (31%) have a tax rate of at least 50% Packet of 20 cigarettes in UK and Kenya: in UK = $11 Excise Tax + VAT = $9 80% in Kenya2 = $1 Excise Tax + VAT = $0.47 47% Ref 1: WHO report on global tobacco epidemic 2011 Ref 2: http://allafrica.com/stories/201106130136.html Global Health Charge Middle and low income countries introduce a small extra “Global Health Charge” on alcohol and tobacco: 1 US cent per 10mL unit of unit of alcohol 10 US cents per packet of 20 cigarettes Global Health Charge – how would it work? Global Health Charge is collected by National Governments, from the main alcohol and tobacco suppliers, when supplies are sent out from their breweries and factories. This money is collected and spent only at the National level, to fund access to HIV, TB and malaria treatment and care. Money can be used in partnership with Global Fund, PEPFAR and NGOs to jointly fund treatment access programmes. Global Health Charge: calculations by country Take the 20 countries with the largest HIV epidemics Annual alcohol and tobacco consumption: commercial (recorded) supplies Adult population size Number of patients who need antiretroviral treatment by country? Cost of Universal Access calculated assuming 2011 costs of treatment, medical care and diagnostics ($861 per patient/year of treatment). In each country, could the “Global Health Charge” fund Universal Access, and what money could be left over to pay for TB, Malaria and other health priorities? UNAIDS Epidemiology Reports 2011, WHO smoking and alcohol statistics, UN population reports Global Health Charge: calculations by country Costs per person-year on antiretroviral treatment: $861 Antiretroviral treatment: $416 (73% 1st line, 20% 2nd line, 7% 3rd line) Including importation and transport / storage. Diagnostics: $145 (2 x HIV RNA, 2 x CD4, 5% with genotype) Medical care: $300 UNAIDS Epidemiology Reports 2011, WHO smoking and alcohol statistics, UN population reports Results – example of Kenya Adult population size / HIV: 26 million adults 1.5 to 1.6 million people HIV+, 430,000 people already on ARVs (2010 data) Alcohol consumption per person-year: 1.6 litres recorded, 2.5 unrecorded Tobacco consumption per person-year: 8.4 packs of 20 cigarettes Annual revenue from Global Health Charge (1c / 10c): $63 million Number of people needing antiretrovirals (2010): 277,000 Cost of Universal Access (100%): $239 million ($861 per patient) Number of people who could be treated from GHC (1c / 10c): 73,000 Global Health Charge of 5c / unit alcohol and 25c / packet of cigarettes in Kenya would fund 100% Universal Access ($260 million / year revenue) 10 countries could afford 100% Universal Access to ARVs with “Global Health Charge” Annual charges and funds available in ten countries (1c / 10c rate): ___________________________________________________________________________________ Country Patients needing ARV access Global health charges: value ARV access TB/malaria extra costs* funds 1c / 10c charge ___________________________________________________________________________________ Nigeria 1,040,000 $ 1120 m $ 896 m $ 223 m Uganda 281,000 $ 259 m $ 243 m $ 16 m Botswana 35,000 $ 10 m $ 8m $ 2m Thailand 113,000 $ 446 m $ 97 m $ 348 m Vietnam 47,000 $ 81 m $ 40 m $ 41 m India 825,000 $ 887 m $ 710 m $ 177 m Brazil 89,000 $ 1170 m $ 76 m $ 1,094 m Russia 250,000 $ 2165 m $ 216 m $ 1,949 m Ukraine 147,000 $ 634 m $ 126 m $ 507 m China 184,000 $11,002 m $ 158 m $10,844 m ___________________________________________________________________________________ Total: All 3,011,000 eligible patients put on ARV treatment (total cost: $2.57 billion/year) Substantial additional funding available for HIV prevention, TB, Malaria, other diseases ___________________________________________________________________________________ *assumes $861/year cost for treatment and care, per person-year References: UNAIDS Epidemiology Reports 2011, WHO smoking and alcohol statistics, UN population reports 10 countries could help to pay for Universal Access with “Global Health Charge” Annual charges and funds available in ten countries (1c alcohol / 10c tobacco rate): ___________________________________________________________________________________ Country Patients needing ARV access Global health Extra patients Tax for charges: value on ARV’s 100% UA 1c / 10c charge 1c / 10c charge ___________________________________________________________________________________ Cameroun 140,000 $ 74 m 86,000 2c / 10c Cote d’Ivoire 125,000 $ 79 m 91,000 2c / 10c DR Congo 256,000 $ 121 m 140,000 2c / 10c Tanzania 351,000 $ 154 m 179,000 2c / 15c South Africa 1,110,000 $ 323 m 375,000 3c / 25c Kenya 277,000 $ 63 m 73,000 5c / 20c Zambia 136,000 $ 24 m 28,000 5c / 25c Zimbabwe 234,000 $ 39 m 45,000 5c / 25c Mozambique 331,000 $ 41 m 48,000 10c / 30c Malawi 189,000 $ 14 m 16,000 14c / 50c ___________________________________________________________________________________ Total: 1.08/3.1million (35%) eligible patients put on ARV treatment (total cost: $931 million/year) ___________________________________________________________________________________ *assumes $861/year cost for treatment and care, per person-year References: UNAIDS Epidemiology Reports 2011, WHO smoking and alcohol statistics, UN population reports Limitations of the analysis 1. Calculations are based on average $861 cost per person-year for antiretroviral treatment, diagnostics and care. Analyses could be re-run with lower costs. 2. Antiretroviral drugs need to be accessible at minimum prices (CHAI/MSF) 3. Analyses based on 2010 estimates of HIV prevalence – updating needed 4. Could increased taxation of alcohol and tobacco lead to cross-border smuggling and/or increased use of non-commercial supplies? 5. Enforcement of taxation is required, including small-scale suppliers and brewers. 6. Other “sin taxes” could be planned, to cover other public health priorities – e.g. vaccination, cardiovascular disease. Conclusions A “Global Health Charge” of US 1c per 10mL unit of alcohol and US 10c per packet of 20 cigarettes, collected and spent at the National level, could fund 100% Universal access to ARV treatment in 10 of the 20 countries with the largest HIV epidemics (3 million additional people on ARV treatment). In these countries, substantial additional funds would be available to treat malaria, TB and other health priorities. In the other 10 countries, 1.1 million people could be put on ARV treatment with a 1c / 10c Global Health Charge. Higher charges could allow 100% Universal Access in these countries (e.g. 5c / 20c in Kenya). Increased taxation could lower consumption of alcohol and tobacco, with associated public health benefits